[CBSE] Q 72 DK Goel Admission of a Partner Solutions Class 12 (2024-25)

The solution of Question number 72 of Admission of a Partner chapter 3 of DK Goel Class 12 CBSE (2024-25)

Q. 72. A and B are partners sharing profits in the ratio of 3 : 1. Their Balance sheet as at 31st March, 2023, was as under:

Balance Sheet as at 31st March, 2023

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | Plant and Machinery | 3,80,000 | |

| Capital Accounts: A B | 6,00,000 4,00,000 | Building | 4,20,000 |

| Stock | 84,000 | ||

| Debtors 1,40,000 Less PDD 10,000 | 1,30,000 | ||

| Cash | 26,000 | ||

| 10,40,000 | 10,40,000 |

On 1st April, 2023, C is admitted as a new partner on the following terms:

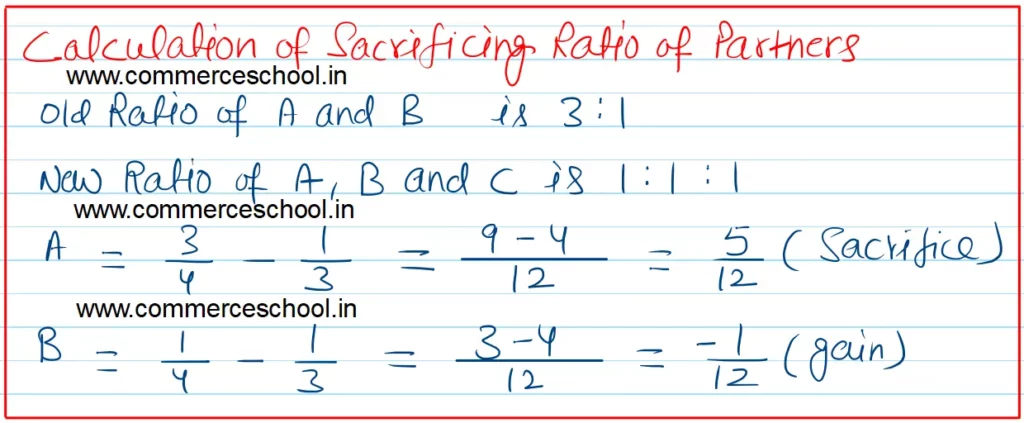

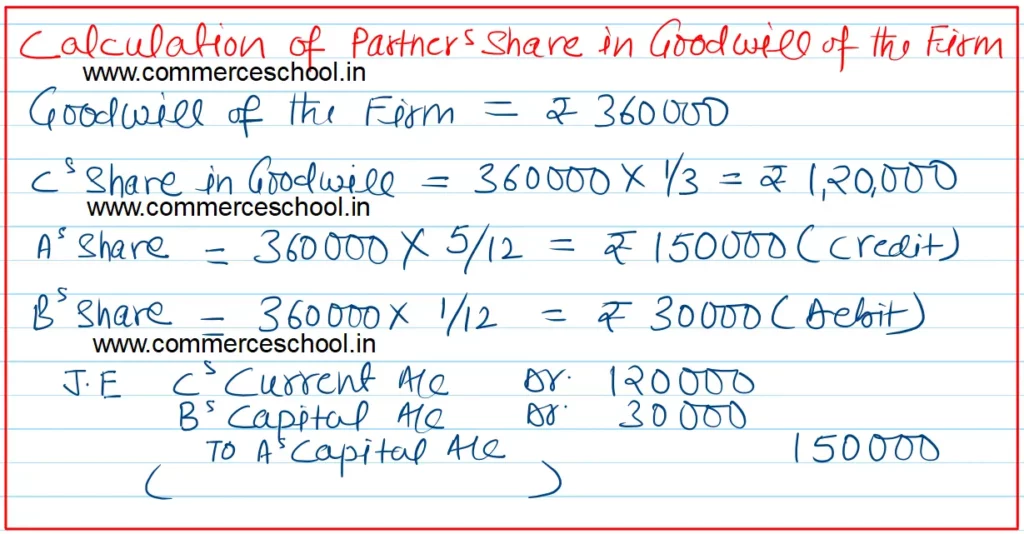

(I) Partners will share the profits in equal proportion.

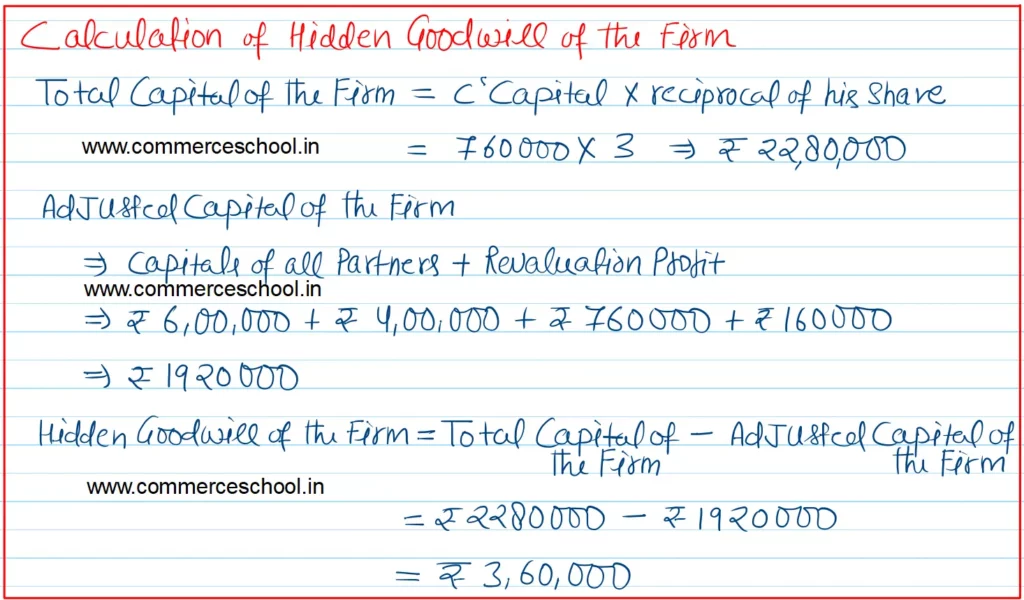

(ii) C to bring in ₹ 7,60,000 as his capital but would be unable to bring his share of goodwill in cash.

(iii) The value of the goodwill of the firm to be calculated on the basis of C’s share in the profits and the capital contributed by him.

(iv) Building is undervalued by 30% and Stock is overvalued by 20%.

(v) There were outstanding expenses amounting to ₹ 6,000.

You are required to prepare:

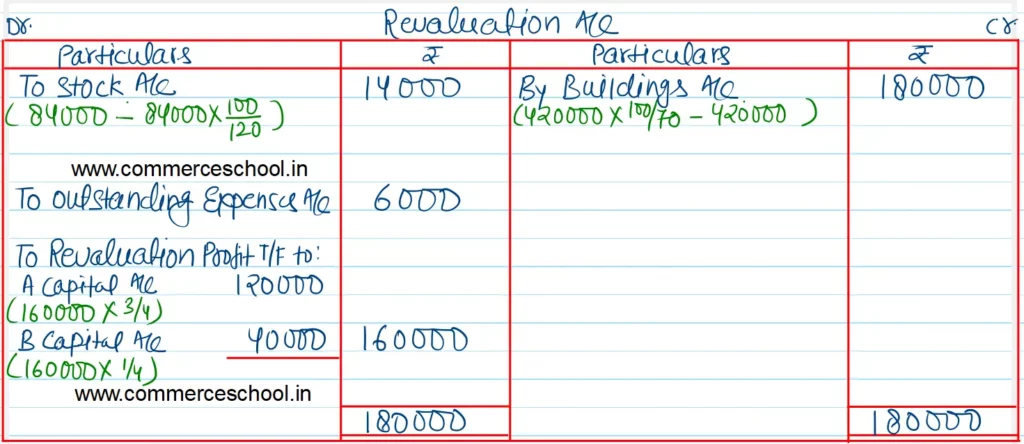

(I) Revaluation Account

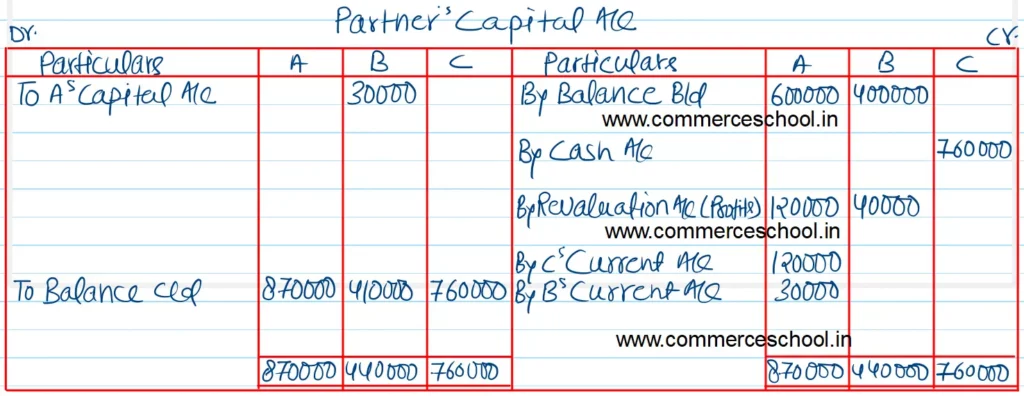

(ii) Partner’s Capital Accounts.

[Ans. Gain on Revaluation ₹ 1,60,000; Hidden Goodwill ₹ 3,60,000; Capital Accounts: A ₹ 8,70,000; B ₹ 4,10,000 and C ₹ 7,60,000.]

Solution:-