[CBSE] Q 74 DK Goel Admission of a Partner Solutions Class 12 (2024-25)

The solution of Question number 74 of Admission of a Partner chapter 3 of DK Goel Class 12 CBSE (2024-25)

Q. 74. X and Y were partners sharing profits in the ratio of 1 : 2. Their Balance Sheet as at 31st March, 2024 was as follows:

Balance Sheet

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 36,000 | Cash | 20,000 |

| Outstanding Expenses | 4,000 | Debtors 40,000 Less: Provision 500 | 39,500 |

| Capitals X Y | 1,50,000 3,00,000 | Stock | 1,20,000 |

| Furniture | 30,000 | ||

| Plant | 2,72,500 | ||

| Patents | 8,000 | ||

| 4,90,000 | 4,90,000 |

They agreed to admit Z for 1/5th share from 1st April, 2024 on the following terms:

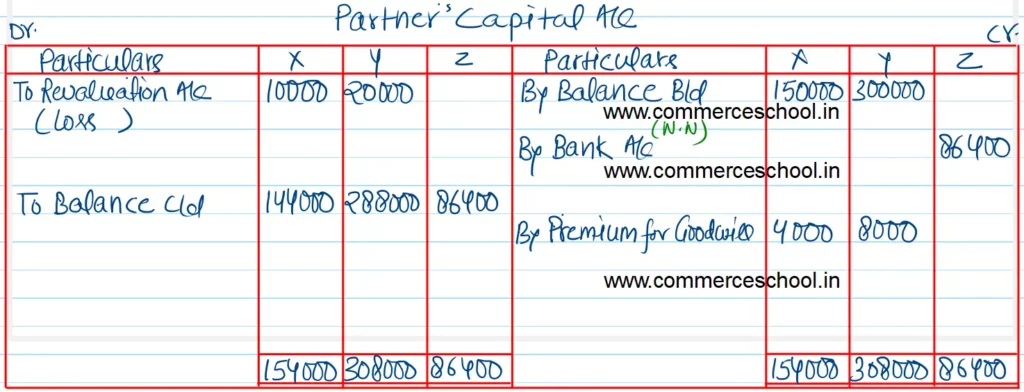

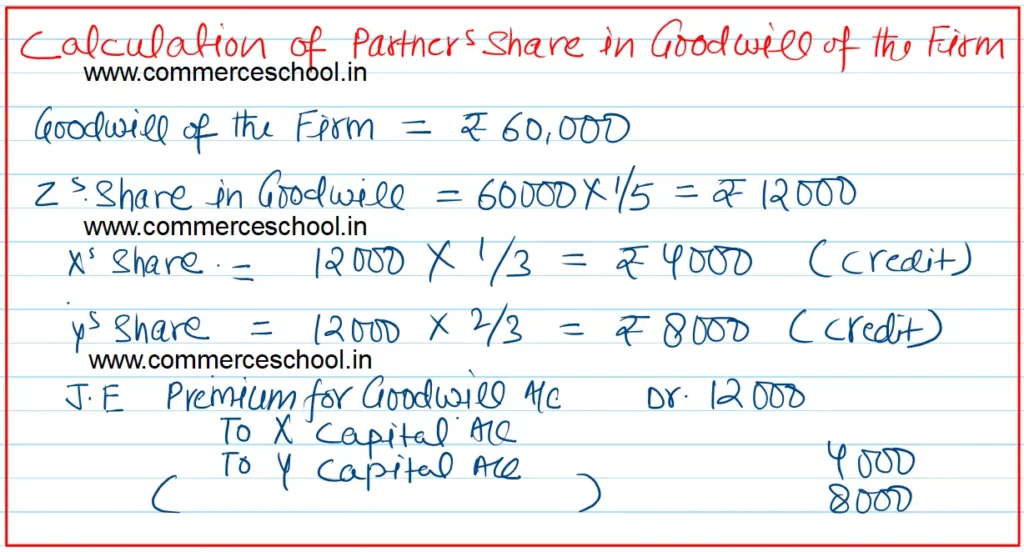

(i) Goodwill of the firm was valued at ₹ 60,000 and Z to bring in his share of premium for goodwill in cash.

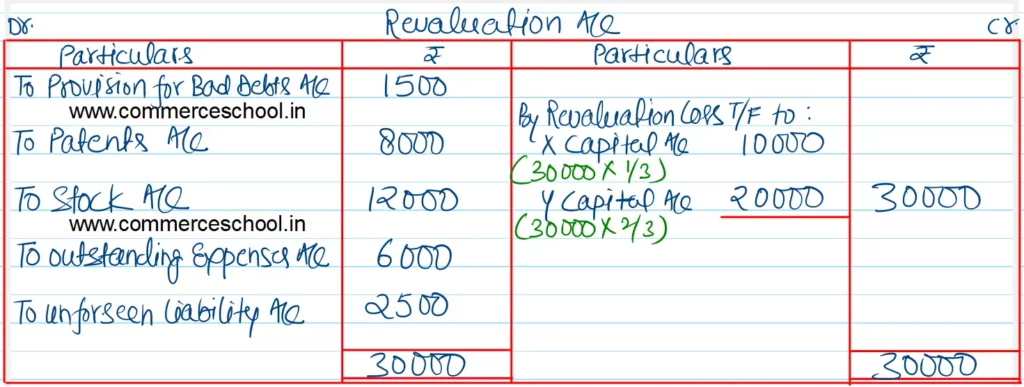

(ii) Provision for bad debts be raised by ₹ 1,500.

(iii) Patents are valueless.

(iv) Stock be reduced by 10%.

(v) Outstanding expenses be increased by ₹ 6,000.

(vi) ₹ 2,500 be provided for an unforeseen liability.

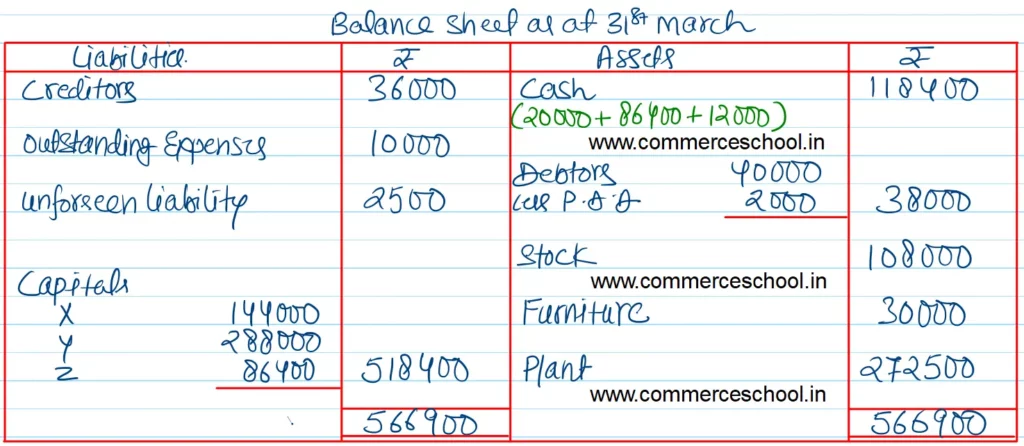

Prepare Revaluation Account, Partner’s Capital Accounts and the Opening Balance Sheet.

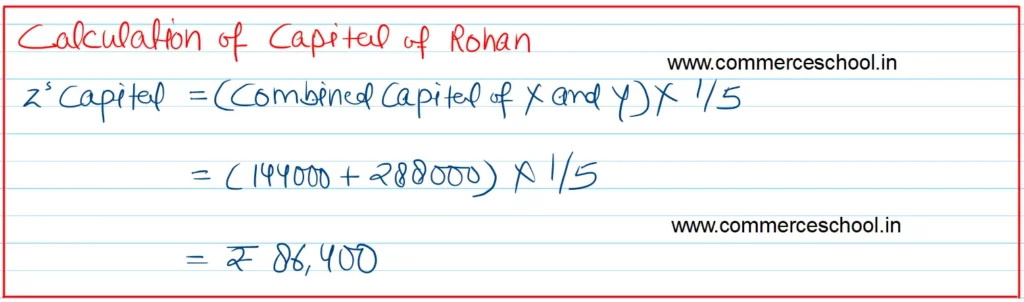

[Ans. Loss on Revaluation ₹ 30,000; Capital A/cs : X ₹ 1,44,000; Y ₹ 2,88,000 and Z ₹ 86,400. Cash Balance ₹ 1,18,400; B/S Total ₹ 5,66,900.]

Solution:-