[CBSE] Q. 74 Solution of Fundamentals of Partnership Firms TS Grewal Book (2023-24)

Solution of Question number 74 of the Fundamentals of partnership firm chapter TS Grewal Book CBSE 2023-24 Edition.

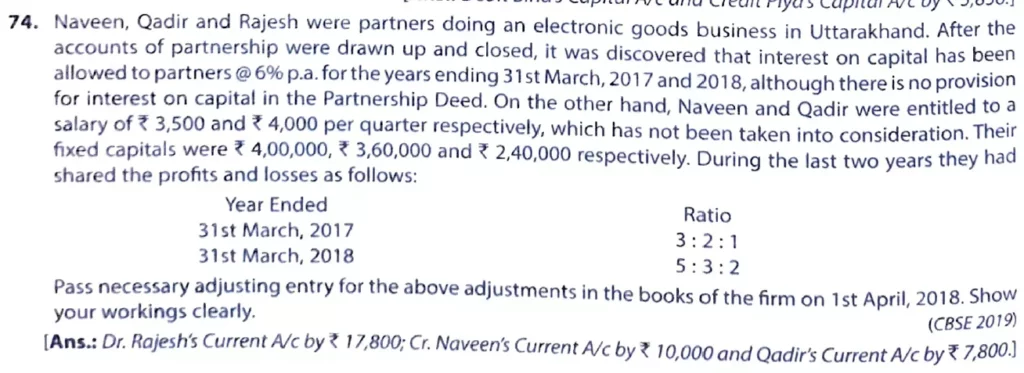

Naveen, Qadir, and Rajesh were partners doing an electronic goods business in Uttarakhand. After the accounts of the partnership were drawn up and closed, it was discovered that interest on capital has been allowed to partners @ 6% p.a. for the years ending 31st March 2017 and 2018, although there is no provision for interest on capital in the Partnership Deed. On the other hand, Naveen and Qadir were entitled to a salary of ₹ 3,500 and ₹ 4,000 per quarter respectively, which has not been taken into consideration. Their fixed capitals were ₹ 4,00,000, ₹ 3,60,000 and ₹ 2,40,000 respectively. During the last two years, they had shared the profits and losses as follows:

| Year Ended | Ratio |

| 31st March 2018 | 3 : 2 : 1 |

| 31st March, 2018 | 31st March 2017 |

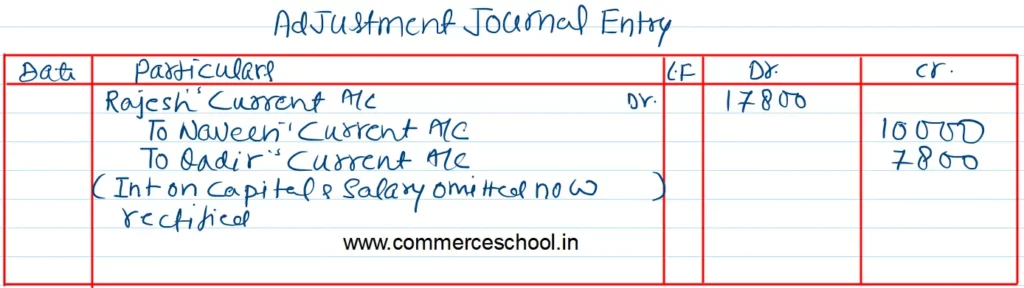

Pass necessary adjusting entries for the above adjustments in the books of the firm on 1st April 2018. Show your workings clearly.

[Ans.: Dr. Rajesh’s Current A/c by ₹ 17,800; Cr Naveens’s Current A/c by ₹ 10,000 and Qadir’s Current A/c by ₹ 7,800.]

Solution:-

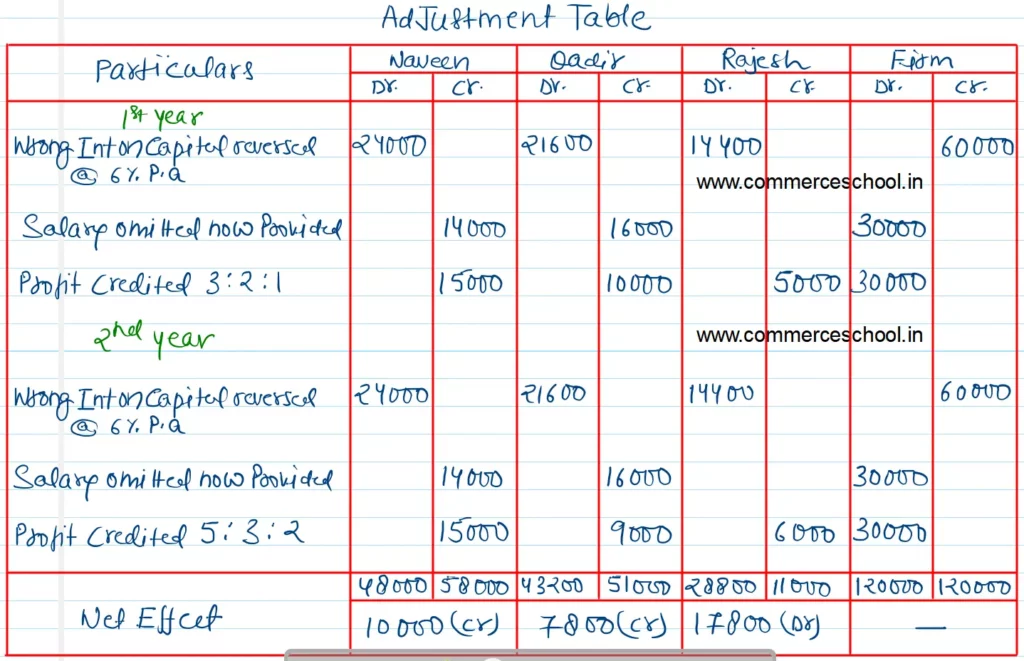

Working Notes:-

Interest on Capital

Naveen

4,00,000 × 6% = ₹ 24,000

Qadir

3,60,000 × 6% = ₹ 21,600

Rajesh

2,40,000 × 6% = ₹ 14,400

Salary

Naveen

3,500 × 4 = ₹ 14,000

Qadir

4,000 × 4 = ₹ 16,000

Here is the list of all Solutions.

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Questions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Questions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |

| 78 | Question – 78 |

| 79 | Question – 79 |

| 80 | Question – 80 |

| S.N | Questions |

| 81 | Question – 81 |

| 82 | Question – 82 |

| 83 | Question – 83 |

| 84 | Question – 84 |

| 85 | Question – 85 |

| 86 | Question – 86 |

| 87 | Question – 87 |

| 88 | Question – 88 |

| 89 | Question – 89 |

| 90 | Question – 90 |

| S.N | Questions |

| 91 | Question – 91 |

| 92 | Question – 92 |

| 93 | Question – 93 |

| 94 | Question – 94 |

| 95 | Question – 95 |