[CBSE] Q 8 DK Goel Dissolution of a Partnership Firm Solutions Class 12 (2024-25)

Solution of Question number 8 of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

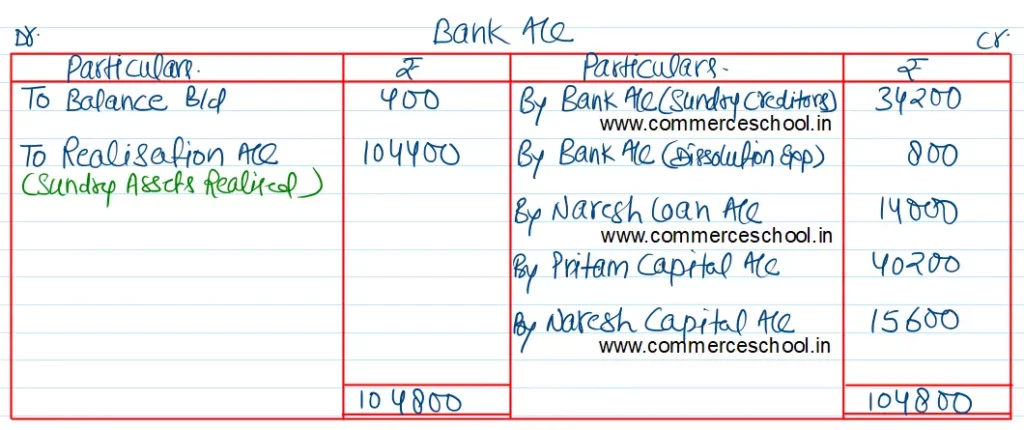

Q. 8 (A) Pritam and Naresh decided to dissolve their firm on September 30, 2023, when their Balance Sheet stood as follows:

| Liabilities | ₹ | Assets | ₹ |

| Capital Accounts: Pritam Naresh | 40,000 20,000 | Cash at Bank | 400 |

| Loan Accounts: Naresh Mrs. Pritam | 14,000 10,000 | Stock-in-Trade | 21,500 |

| Sundry Creditors | 36,000 | Bills Receivable | 8,800 |

| Outstanding Rent | 500 | Sundry Debtors 45,000 Less: Provision for Bad Debts 1,500 | 43,500 |

| Furniture | 3,000 | ||

| Plant & Machinery | 23,000 | ||

| Goodwill | 20,000 | ||

| Prepaid Insurance | 300 | ||

| 1,20,500 | 1,20,500 |

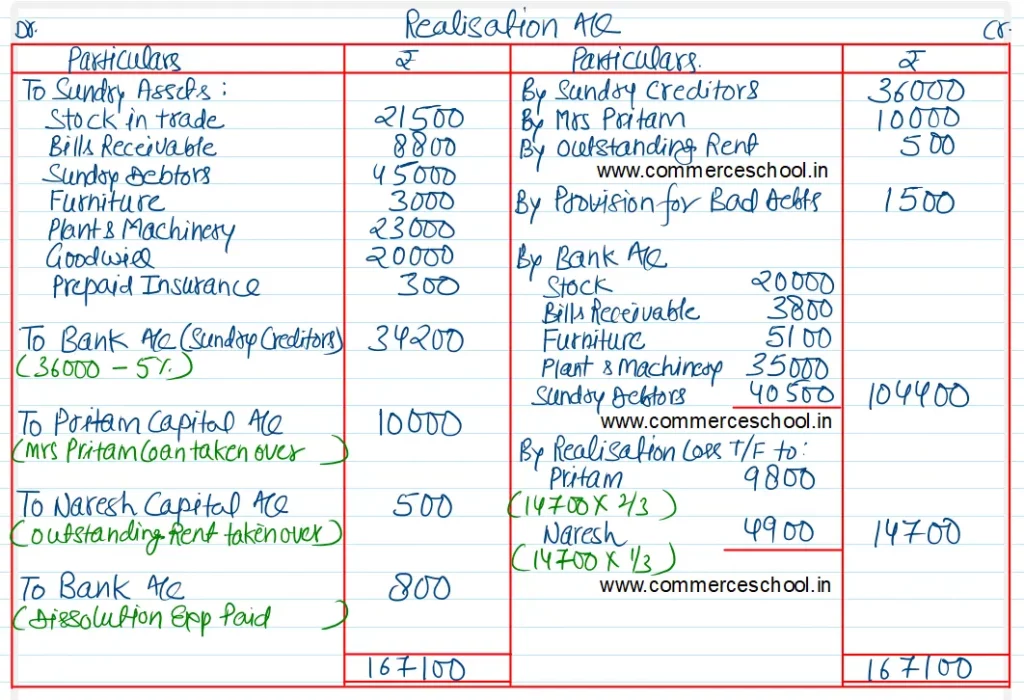

The assets were realised as follows: Stock ₹ 20,000; Bills Receivable ₹ 3,800; Furniture ₹ 5,100; Plant & Machinery ₹ 35,000; Sundry Debtors at 10% less than book value.

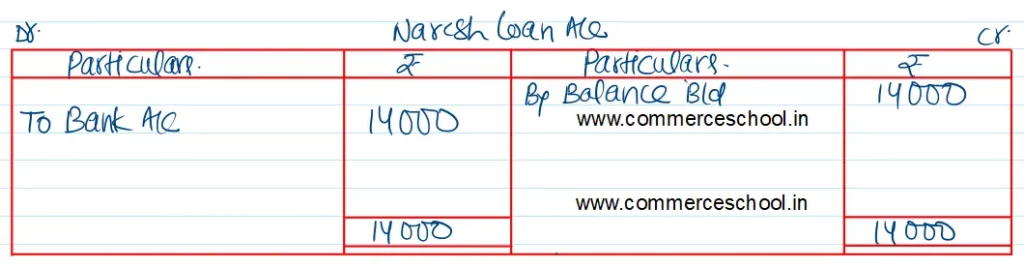

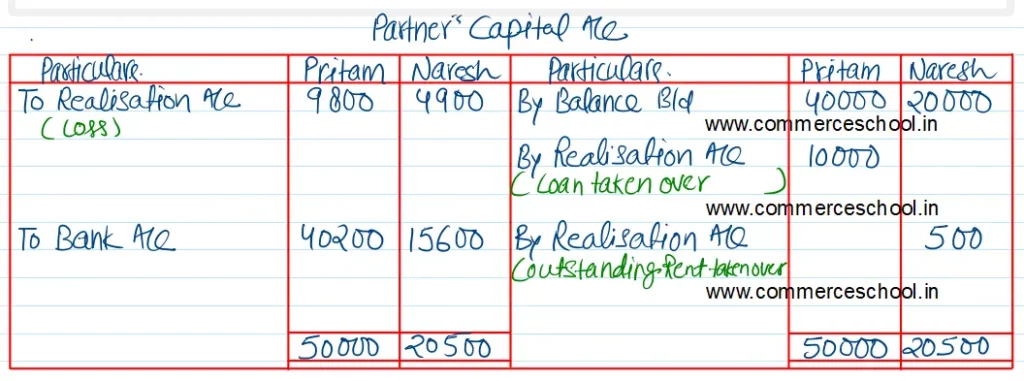

Sundry Creditors allowed a discount of 5%. Pritam agreed to pay his wife’s loan. Naresh agreed to pay outstanding rent. Expenses on dissolution came to ₹ 800.

Pritam and Naresh shared profits and losses in the ratio of their capitals. Accounts were finally settled.

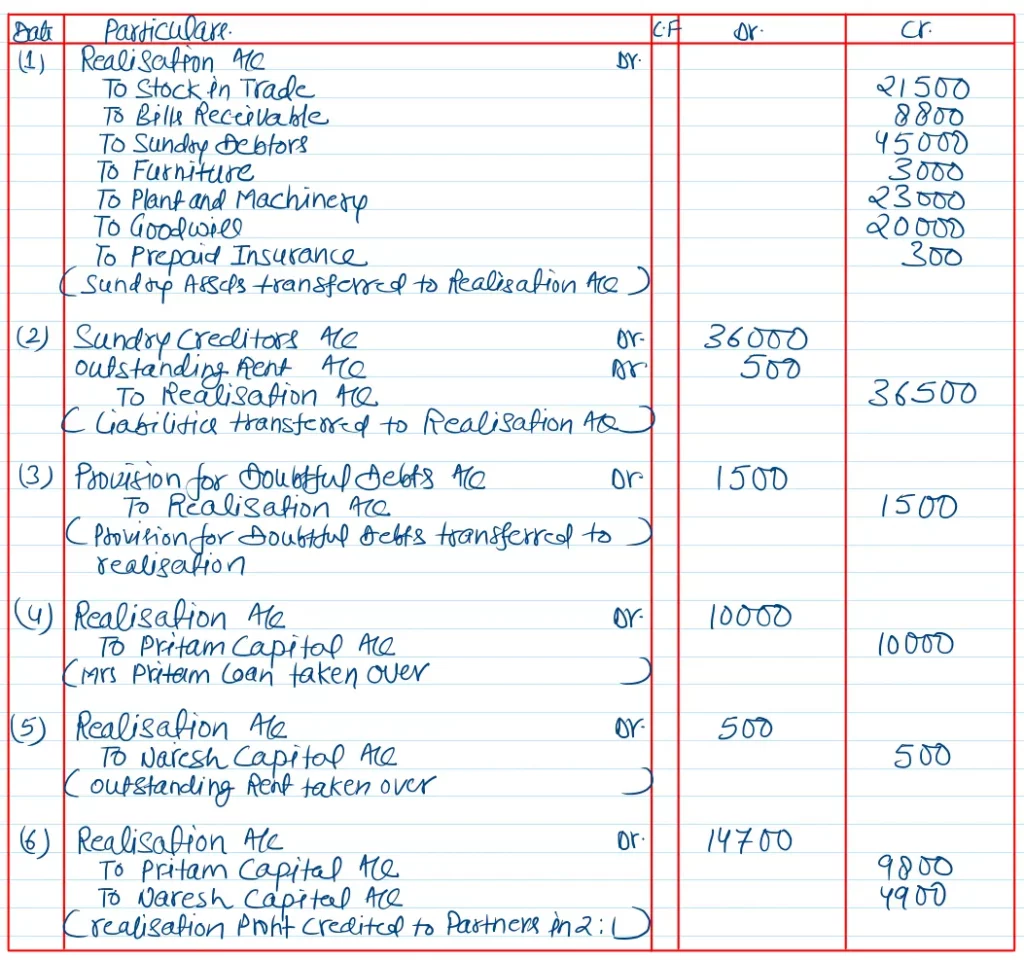

Prepare Journal Realisation Account, Capital Accounts and Bank Account.

[Ans. Loss on Realisation ₹ 14,700; Cash paid to Pritam ₹ 40,200 and Naresh ₹ 15,600; Total of Bank A/c ₹ 1,04,800.]

Solution:-

Hint: Goodwill and Prepaid Insurance will be debited to Realisation A/c and no further entry will be made in respect of these items.

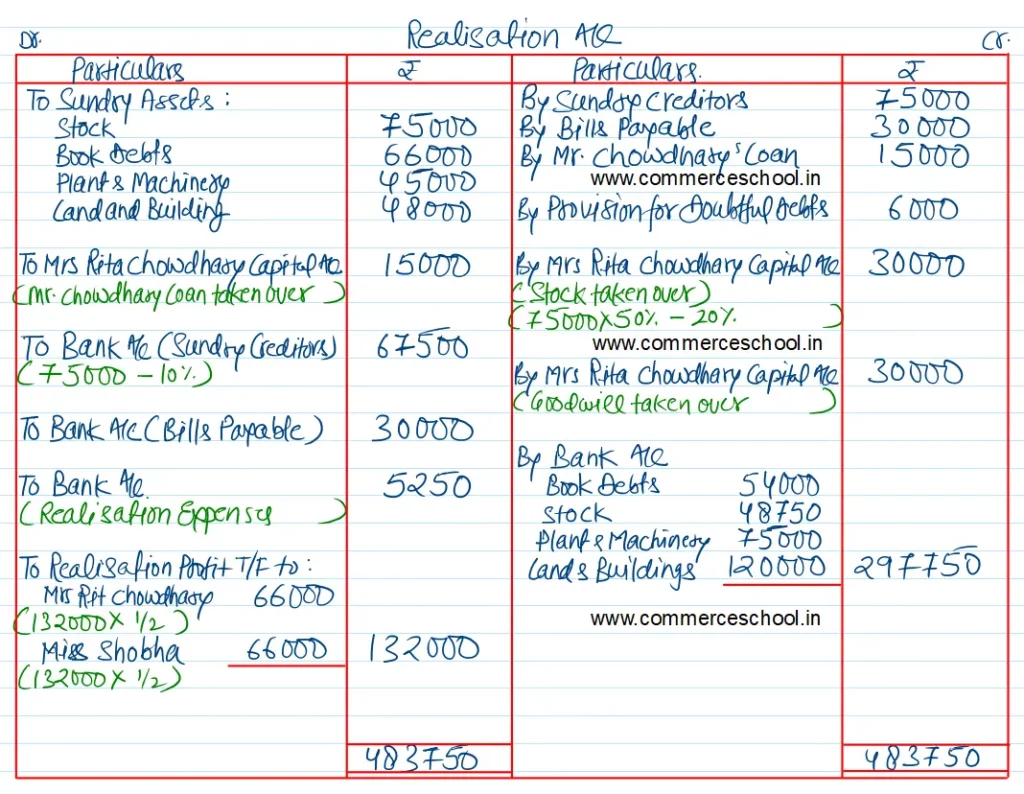

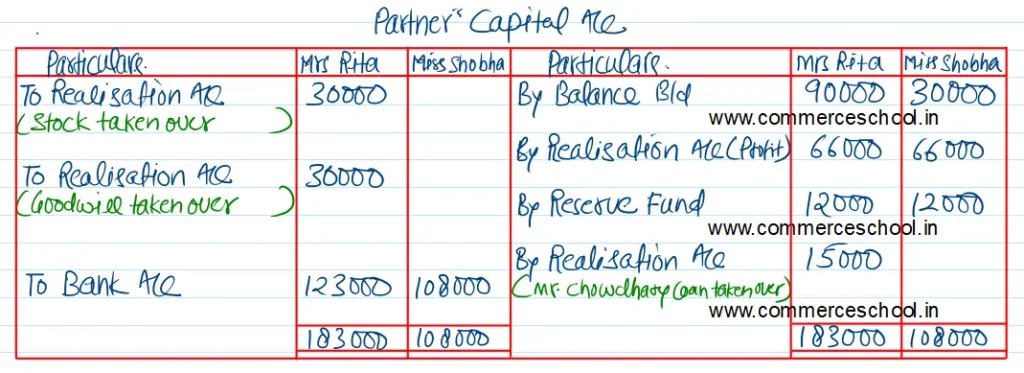

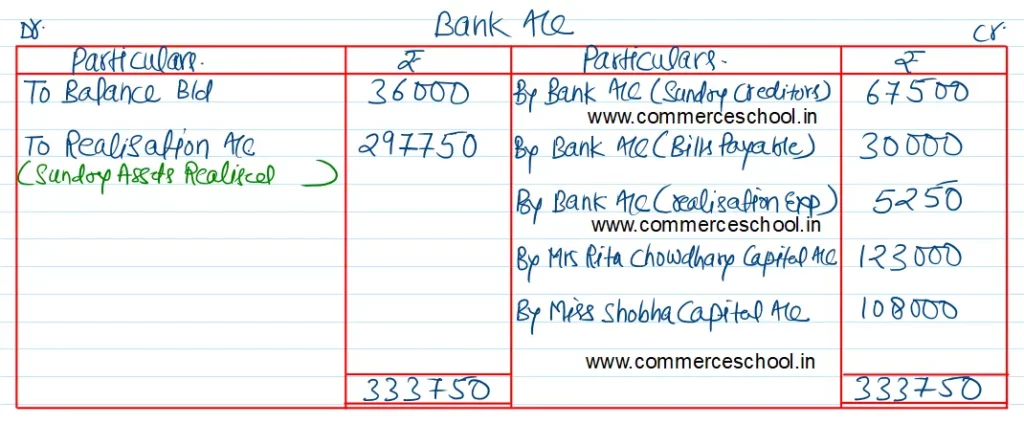

Q. 8 (B). Mrs. Rita Chowdhary and Miss Shobha are partners in a firm, ‘Fancy Garments Exports’ sharing profits and losses equally. On 1st April, 2024, the Balance Sheet of the firm was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | 75,000 | Bank | 36,000 |

| Bills Payable | 30,000 | Stock | 75,000 |

| Mr. Chowdhary’s Loan | 15,000 | Book Debts 66,000 Less: Provision for Doubtful Debts 6,000 | 60,000 |

| Reserve Fund | 24,000 | Plant & Machinery | 45,000 |

| Mrs. Rita Chowdhary’s Capital | 90,000 | Land & Buildings | 48,000 |

| Miss Shobha’s Capital | 30,000 | ||

| 2,64,000 | 2,64,000 |

The firm was dissolved on the date given above. The following transactions took place:

(i) Mrs. Rita Chowdhary undertook to pay Mr. Chowdhary’s Loan and took over 50 percent of stock at a discount of 20 percent.

(ii) Book-debts realised ₹ 54,000; balance of the stock was sold off at a profit of 30 percent on cost.

(iii) Sundry Creditors were paid out at a discount of 10 percent. Bills Payable were paid in full.

(iv) Plant and Machinery realised ₹ 75,000 and Land and Buildings ₹ 1,20,000.

(v) Mrs. Rita Chowdhary took over the goodwill of the firm at a valuation of ₹ 30,000.

(vi) Realisation expenses were ₹ 5,250.

Show the Realisation Account, Bank Account and Partner’s Capital Accounts in the books of the firm.

[Ans. Gain on Realisation ₹ 1,32,000; Final Payments :- Rita ₹ 1,23,000 and Shobha ₹ 1,08,000, Total of Bank A/c ₹ 3,33,750.]

Solution:-

Here are the solutions of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

| S.N | Questions | |

| 1 | Question – 1 | |

| 2 | Question – 2 | |

| 3 | Question – 3 | |

| 4 | Question – 4 | |

| 5 | Question – 5 | |

| 6 | Question – 6 | |

| 7 | Question – 7 | |

| 8 | Question – 8 | |

| 9 | Question – 9 | |

| 10 | Question – 10 |

| S.N | Questions | |

| 11 | Question – 11 | |

| 12 | Question – 12 | |

| 13 | Question – 13 | |

| 14 | Question – 14 | |

| 15 | Question – 15 | |

| 16 | Question – 16 | |

| 17 | Question – 17 | |

| 18 | Question – 18 | |

| 19 | Question – 19 | |

| 20 | Question – 20 |

| S.N | Questions | |

| 21 | Question – 21 | |

| 22 | Question – 22 | |

| 23 | Question – 23 | |

| 24 | Question – 24 | |

| 25 | Question – 25 | |

| 26 | Question – 26 | |

| 27 | Question – 27 | |

| 28 | Question – 28 | |

| 29 | Question – 29 | |

| 30 | Question – 30 |

| S.N | Questions | |

| 31 | Question – 31 | |

| 32 | Question – 32 | |

| 33 | Question – 33 | |

| 34 | Question – 34 | |

| 35 | Question – 35 | |

| 36 | Question – 36 | |

| 37 | Question – 37 | |

| 38 | Question – 38 | |

| 39 | Question – 39 | |

| 40 | Question – 40 |

excellent

excellent