[CBSE] Q 9, Q 10 Accounting for Goods and Services Tax (GST) TS Grewal class 11 (2025-26)

Solutions of Question number 9 and 10 of Accounting for Goods and Services Tax (GST) of TS Grewal class 11 CBSE Board 2025-26

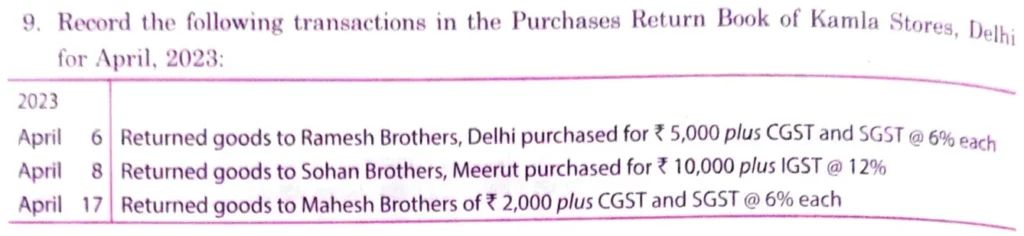

Q. 9. Record the following transactions in the Purchases Return Book of Kamla Stores,Delhi for April, 2025:

| 2022 April 6 | Returned goods to Ramesh Brothers, Delhi purchased for ₹ 5,000 plus CGST and SGST @ 6% each |

| April 8 | Returned goods to Sohan Brothers, Meerut purchased for ₹ 10,000 plus IGST @ 12% |

| April 17 | Returned good to Mahesh Brothers of ₹ 2,000 plus CGST and SGST @ 6% each |

Solution:-

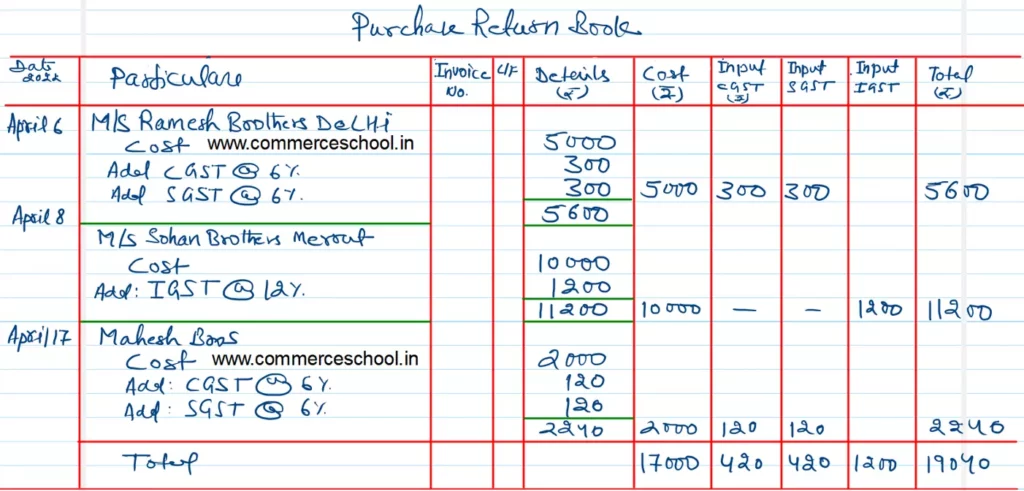

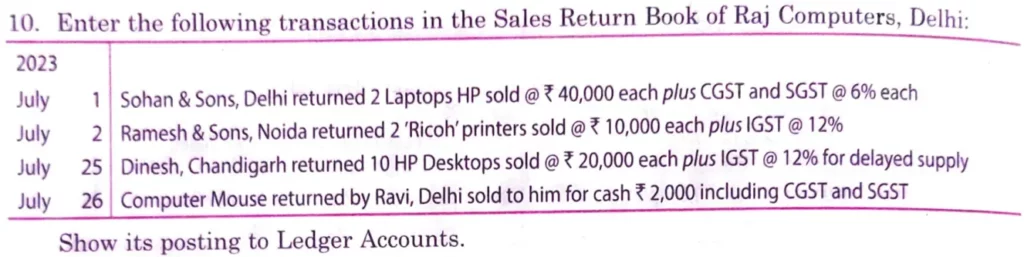

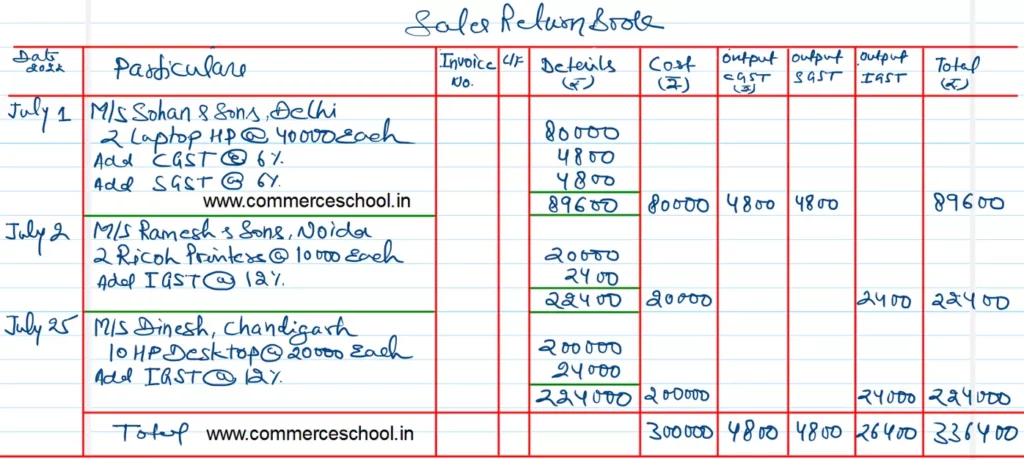

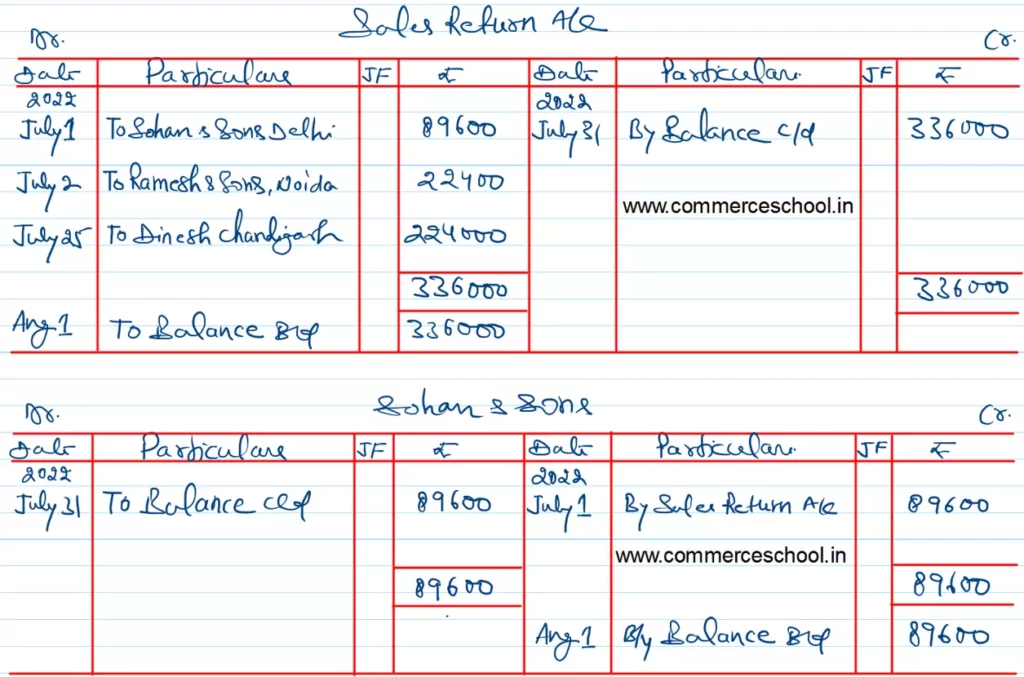

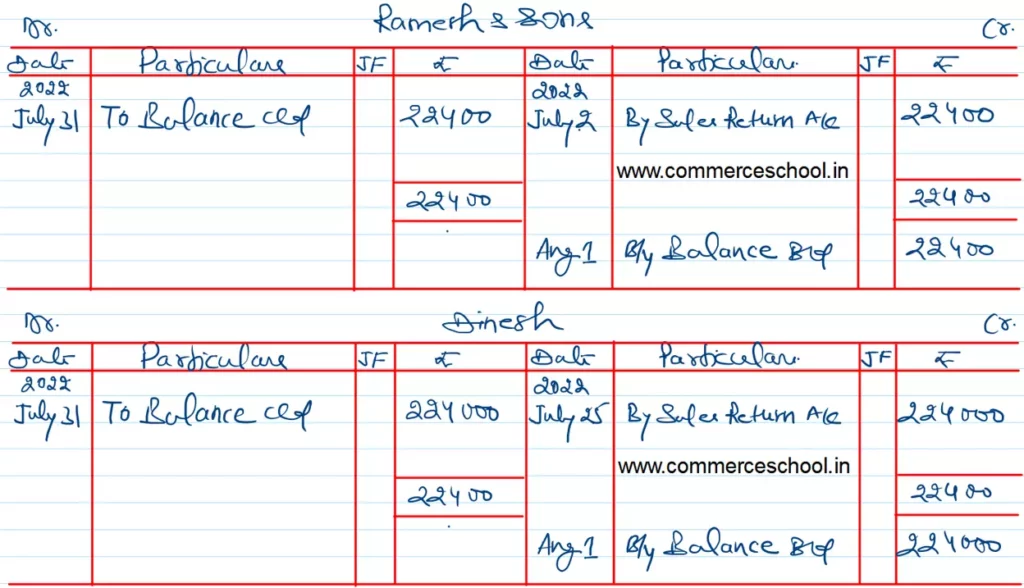

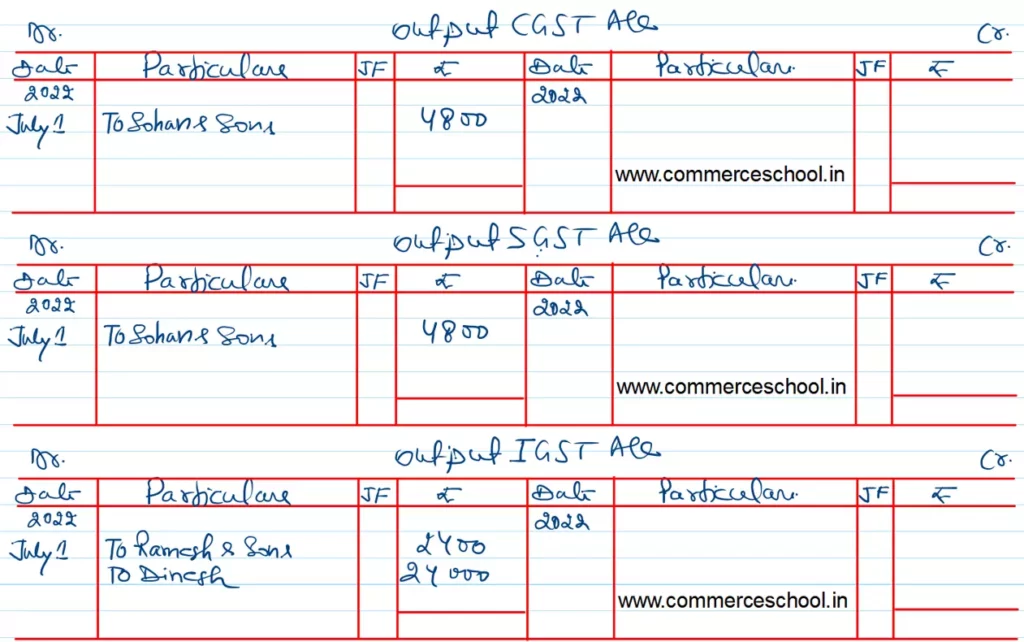

Q. 10. Enter the following transactions in the Sales Return Book of Raj Computers, Delhi:

| 2022 July 1 | Sohan & Sons, Delhi returned 2 Laptops HP sold @ ₹ 40,000 each plus CGST and SGST @ 6% each |

| July 2 | Ramesh & Sons, Noida returned 2 ‘Ricoh’ printers sold @ ₹ 10,000 each plus IGST @ 12% |

| July 25 | Dinesh, Chandigarh returned 10 HP Desktopts sold @ ₹ 20,000 each plus IGST @ 12% for delayed supply |

| July 26 | Computer Mouse returned by Ravi, Delhi sold to him for cash ₹ 2,000 including CGST and SGST |

Show its posting to Ledger Accounts.

Solution:-

Solution:-

Below is the list of all solutions of chapter 12 Goods and Services Tax (GST) TS Grewal class 11 CBSE