[CBSE] Q 9, Q 10 Accounts for Incomplete Records Solutions (2025-26)

Solution of Question number 9 and 10 Accounts for Incomplete Records (Single Entry System) CBSE Board (2025-26)

Q. 9. Sarvesh maintains her books of account from Incomplete Records. Her books provide the following information:

| 1st April, 2024 (₹) | 31st March, 2025 (₹) | |

| Cash | 1,200 | 4,000 |

| Debtors | 16,800 | 27,200 |

| Stock | 22,400 | 24,400 |

| Investments | – | 8,000 |

| Furniture | 7,500 | 8,000 |

| Creditors | 14,900 | 11,600 |

She withdrew ₹ 500 per month for personal expenses. She sold her Investments of ₹ 16,000 at a 5% premium and introduced the amount into business.

You are required to prepare a Statement of Profit or Loss for the year ending 31st March 2016.

[Capital as at 1st April 2015 – ₹ 33,000; Capital as at 31st March 2016 – ₹ 60,000; Profit – ₹ 16,200.]

Solution:-

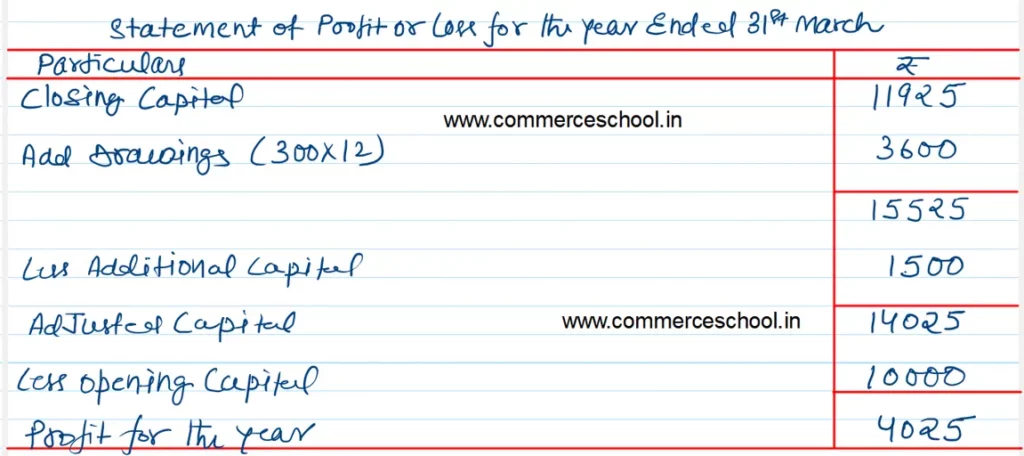

Q. 10. Mahesh commenced business on 1st April 2022 with a capital of ₹ 10,000. He immediately bought furniture and fixtures for ₹ 2,000.

On 1st October 2022, he borrowed ₹ 5,000 from his wife @ 9% p.a. (interest not yet paid) and also introduced further capital of his own of ₹ 1,500. He drew @ ₹ 300 per month at the end of each month for household expenses. On 31st March 2023 his position was as follows:

Cash in Hand ₹ 2,800; Sundry Debtors ₹ 6,400; Stock ₹ 6,800; Sundry Creditors ₹ 500 and owing for Rent ₹ 150.

Furniture and Fixtures to be depreciated by 10%.

Ascertain the profit earned or loss incurred by Mahesh during the year ended 31st March 2023.

[Capital at the end – ₹ 11,925; Profit – ₹ 4,025.]

Solution:-

Following is the list