[CBSE] Q 9, Q 10 Depreciation Solutions TS Grewal Class 11 (2025-26)

Solution of Question number 9 and 10 of the Depreciation chapter TS Grewal Class 11 CBSE Board for 2025-26 Session.

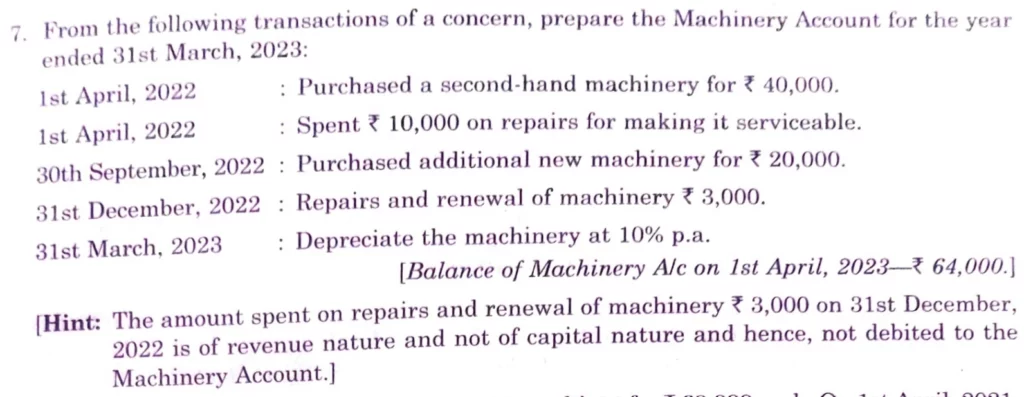

Q. 9. From the following transactions of a concern, prepare the Machinery Account for the year ended 31st March, 2025:

| 1st April, 2022 | Purchased a second-hand machinery for ₹ 40,000. |

| 1st April, 2022 | Spent ₹ 10,000 on repairs for making it serviceabale. |

| 30th September, 2022 | Purchased additional new machinery for ₹ 20,000. |

| 31st Decemeber, 2022 | Repairs and renewal of machinery ₹ 3,000. |

| 31st March, 2023 | Depreciate the machinery at 10% p.a. |

[Balance of Machinery A/c on 1st April, 2023 – ₹ 64,000.]

[Hint: The amount spent on repairs and renewal of machinery ₹ 3,000 on 31st December, 2022 is of revenue nature and not of capital nature and hence, not debited to the Machinery Account.]

Solution:-

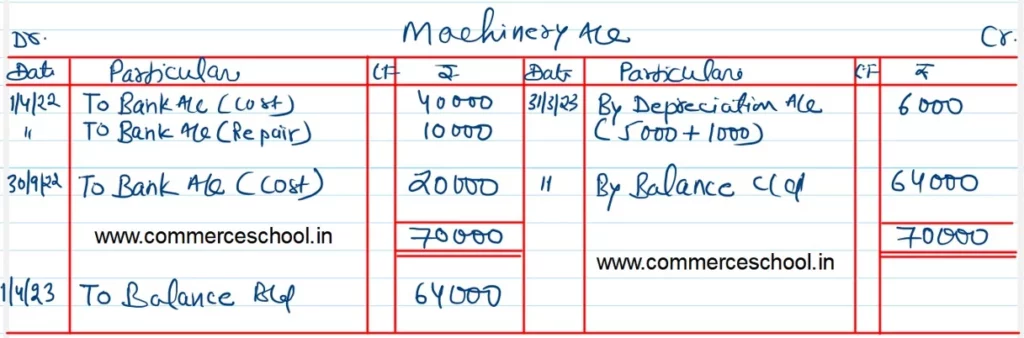

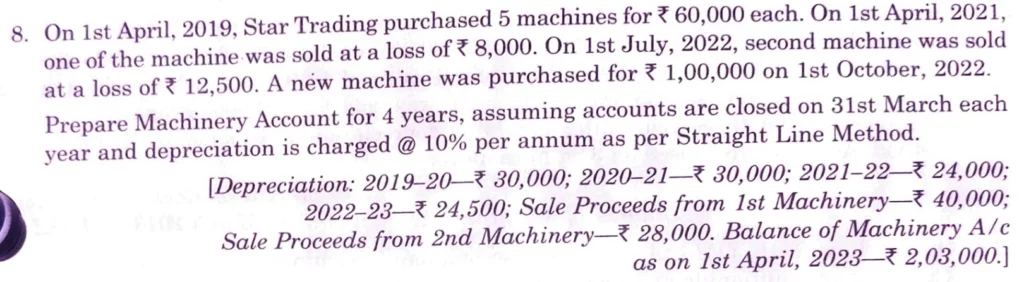

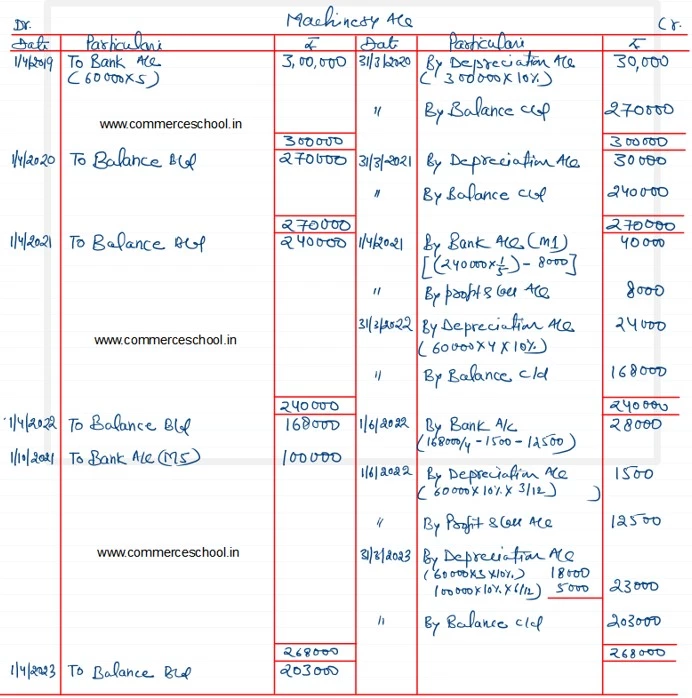

Q. 10. On 1st April, 2021, Harish Traders purchased 5 Machines for ₹ 60,000 each. On 1st April, 2023, one of the machine was sold at a loss of ₹ 8,000.

On 1st July, 2024, second machine was sold at a loss of ₹ 12,500. A new machine was purchased for ₹ 1,00,000 on 1st October, 2024.

Prepare Machinery Account for 4 years, assuming accounts are closed on 31st March 2025, each year and depreciation is charged @ 10% per annum as per Straight Line Method.

[Depreciation: 2019 – 20 – ₹ 30,000; 2020 – 21 – ₹ 30,000; 2021-22 – ₹ 24,000; 2022-23 – ₹ 24,500; Sale Proceeds from 1st Machinery – ₹ 40,000; Sale Proceeds from 2nd Machinery – ₹ 28,000. Balance of Machinery A/c as on 1st April, 2023 – ₹ 2,03,000.]

Solution:-

Following is the list of all solutions of the depreciation chapter of ts Grewal CBSE for the (2025-26) session.