[CBSE] Q 9 Solutions Adjustments in Preparation of Financial Statements TS Grewal Class 11 (2022-23)

Solution of Question number 9 of the Adjustments in Preparation of Financial Statements of TS Grewal Book class 11, 2022-23?

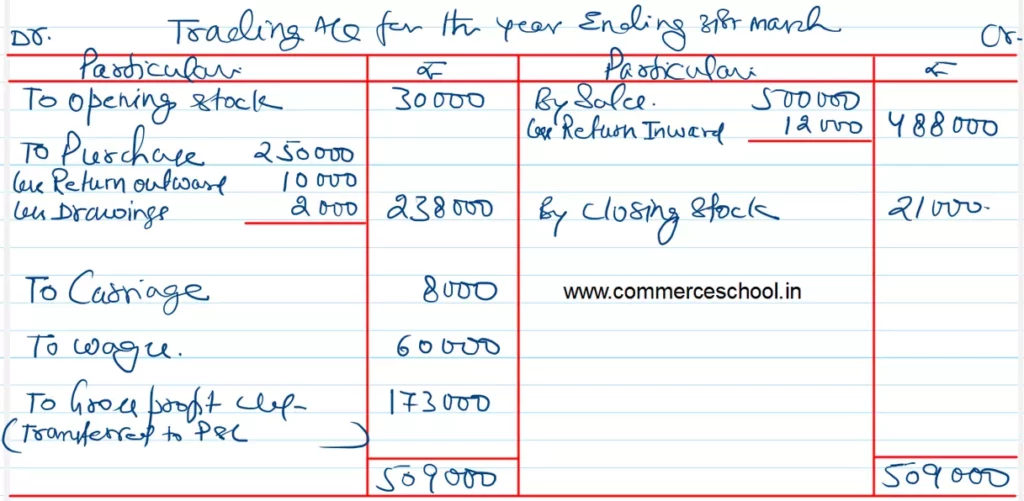

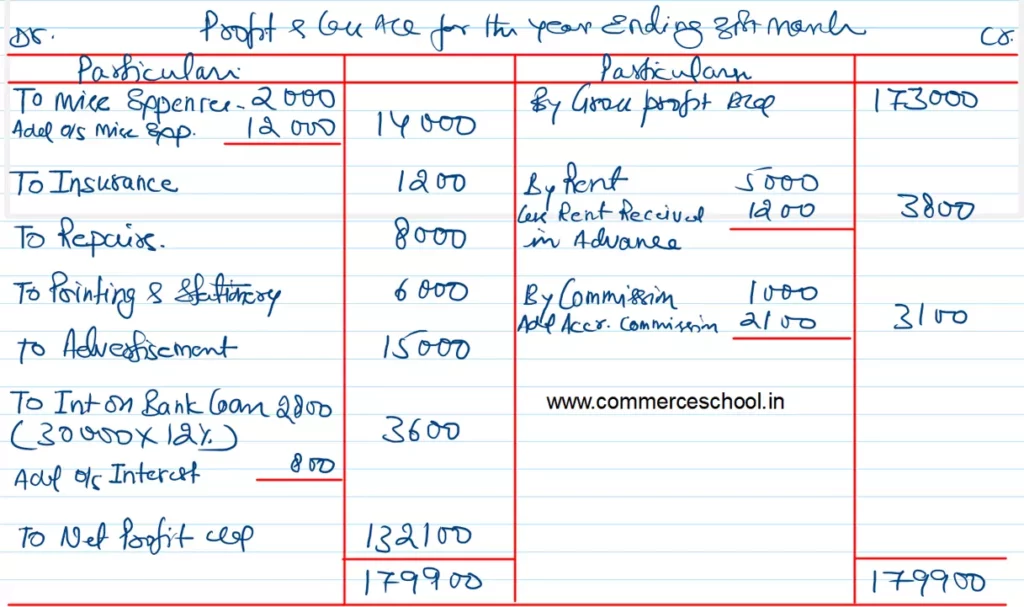

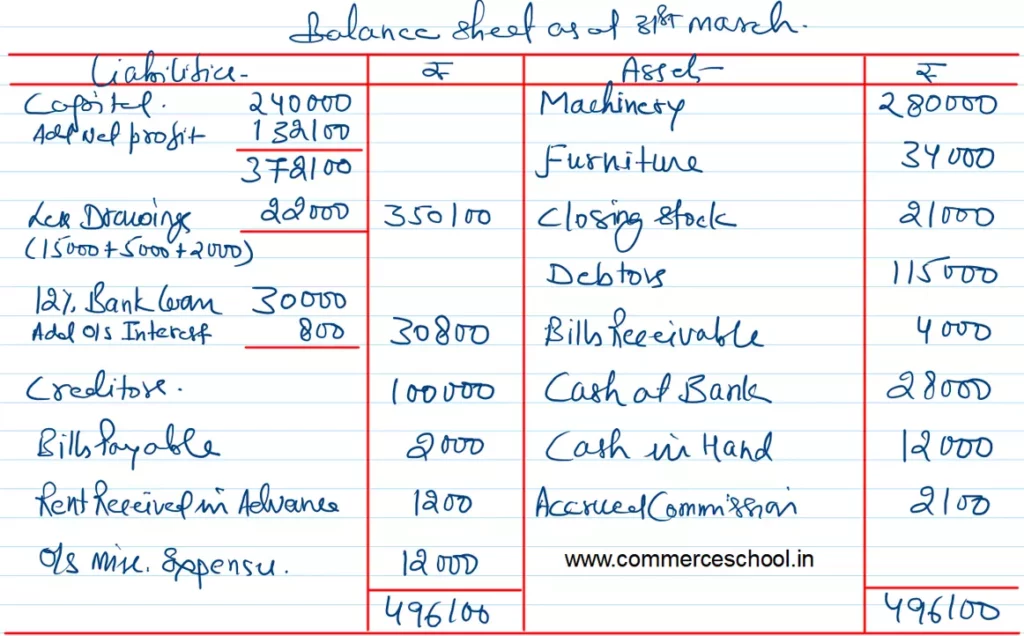

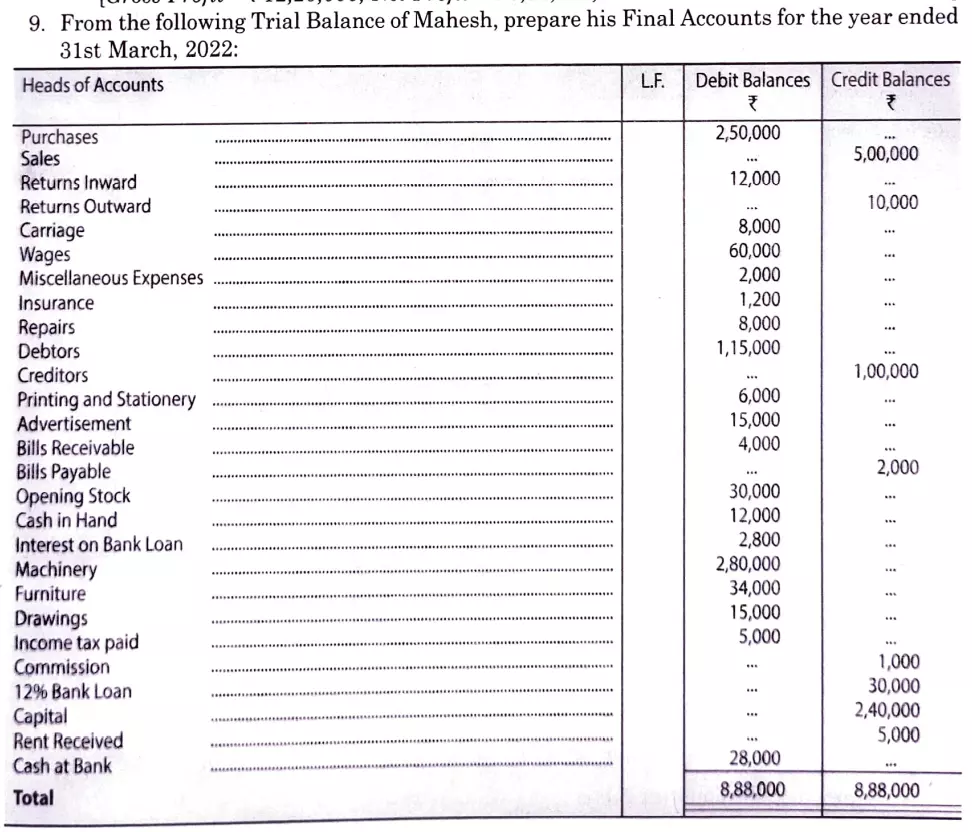

From the following Trial Balance of Mahesh, prepare his Final Accounts for the year ended 31st March, 2022:

| Heads of Accounts | L.F. | Debit Balances ₹ | Credit Balances ₹ |

| Purchases Sales Returns Inward Returns Outward Carriage Wages Miscellaneous Expenses Insurance Repairs Debtors Creditors Printing and Stationery Advertisement Bills Receivable Bills Payable Opening Stock Cash in Hand Interest on Bank Loan Machinery Furniture Drawings Income tax paid Commission 12% Bank Loan Capital Rent Received Cash at Bank | 2,50,000 – 12,000 – 8,000 60,000 2,000 1,200 8,000 1,15,000 – 6,000 15,000 4,000 – 30,000 12,000 2,800 2,80,000 34,000 15,000 5,000 – – – – 28,000 | – 5,00,000 – 10,000 – – – – – – 1,00,000 – – – 2,000 – – – – – – – 1,000 30,000 2,40,000 5,000 – | |

| 8,88,000 | 8,88,000 |

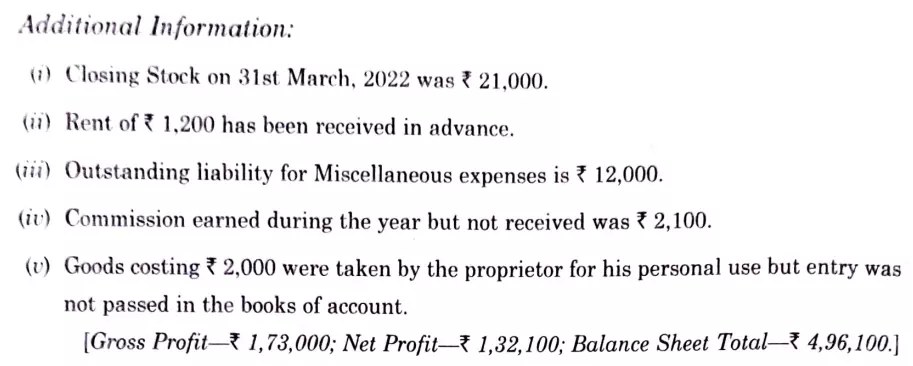

Additional Information:

(i) Closing Stock on 31st March, 2022 was ₹ 21,000.

(ii) Rent of ₹ 1,200 has been received in advance.

(iii) Outstanding liability for Miscellaneous expenses is ₹ 12,000.

(iv) Commission earned during the year but not received was ₹ 2,100.

(v) Goods costing ₹ 2,000 were taken by the proprietor for his personal use but entry was not passed in the books of account.

[Gross Profit – ₹ 1,73,000; Net Profit – ₹ 1,32,100; Balance Sheet – ₹ 4,96,100.]

Solution:-