[CBSE] Q. 93 Solution of Accounting for Share Capital TS Grewal Class 12 (2022-23)

Are you looking for the solution to Question number 93 of the Accounting for Share Capital chapter of TS Grewal Book 2022-23 Edition CBSE Board?

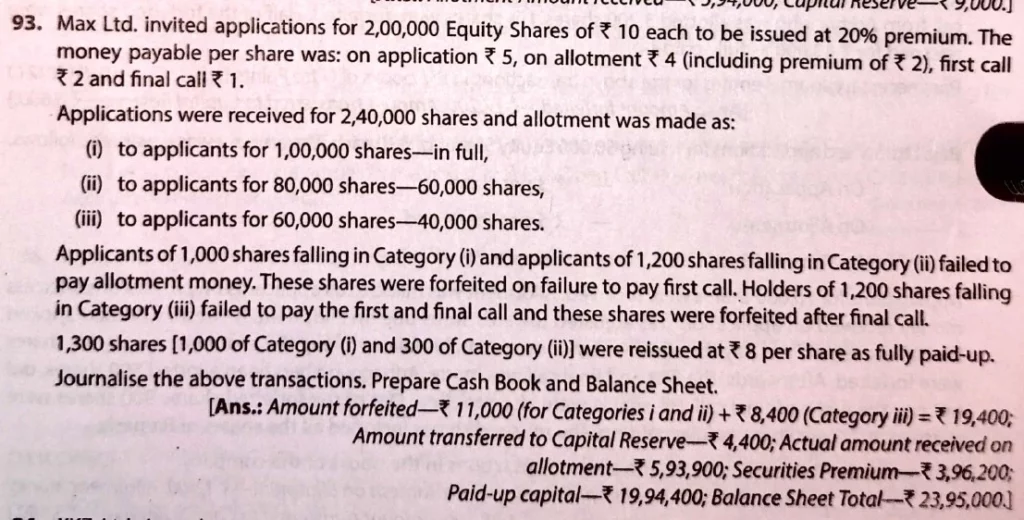

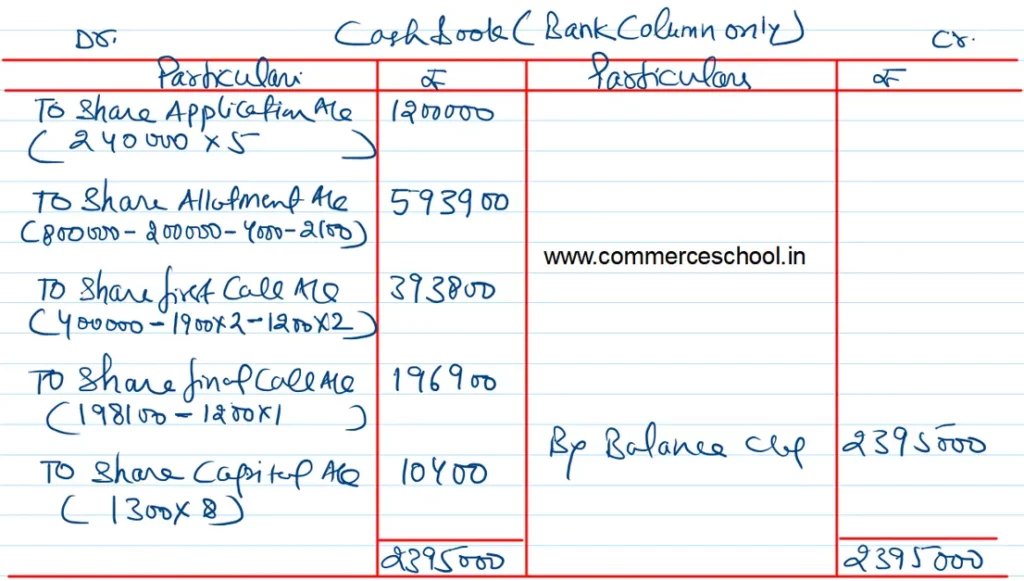

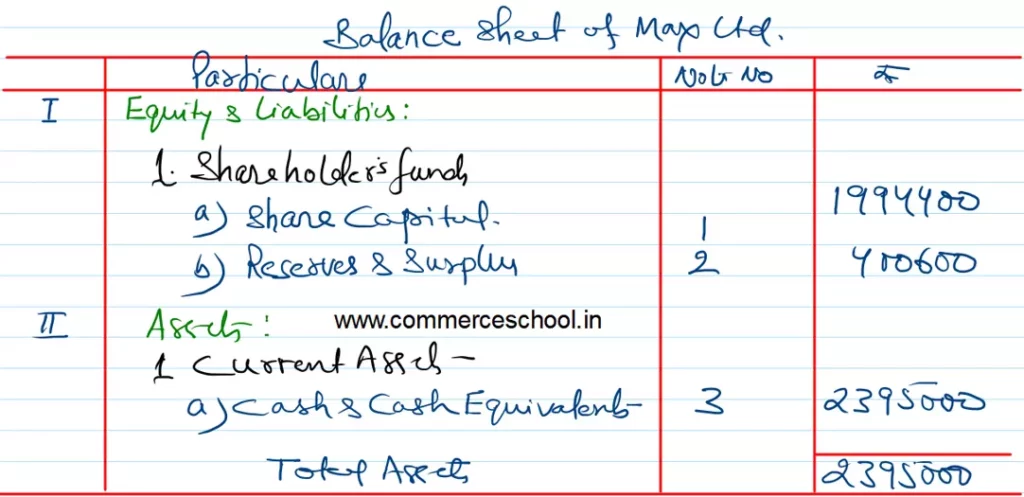

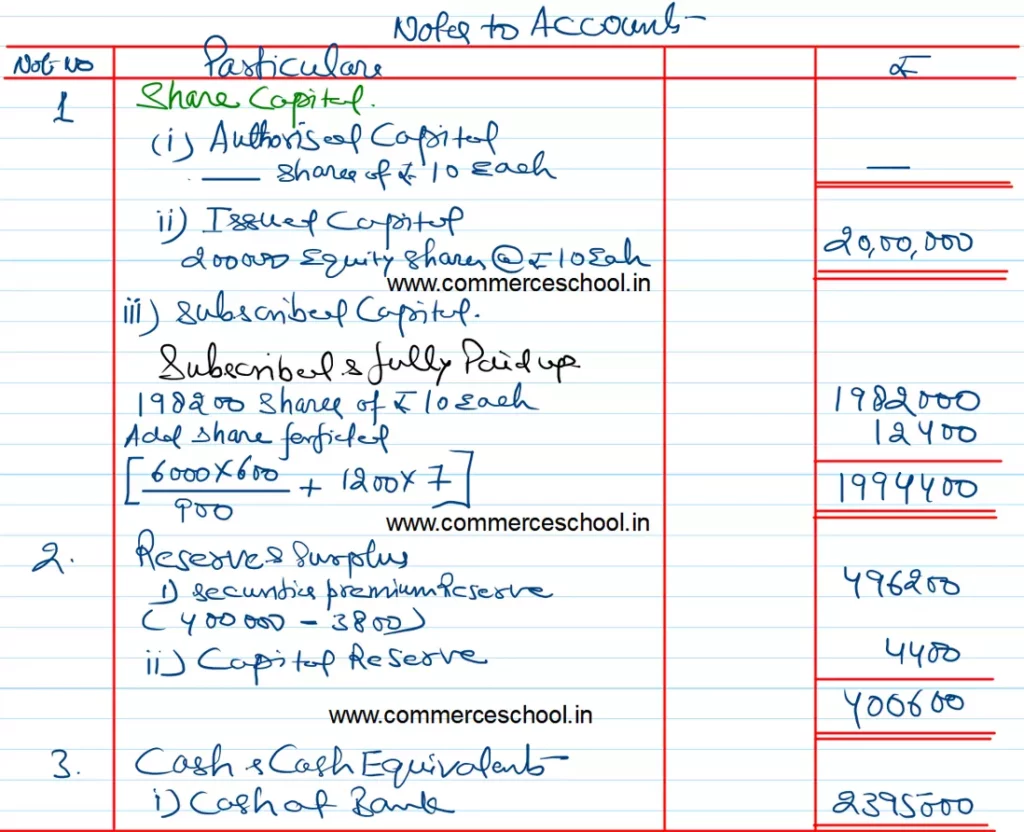

Max Ltd. invited applications for 2,00,000 Equity Shares of ₹ 10 each to be issued at a 20% premium. The money payable per share was: on application ₹ 5, on allotment ₹ 4 (including premium of ₹ 2), first call ₹ 2, and final call ₹ 1.

Applications were received for 2,40,000 Shares and allotment was made as:

(I) to applications for 1,00,000 shares – in full,

(ii) to applicants for 80,000 shares – 60,000 shares

(iii) to applicants for 60,000 shares – 40,000 shares

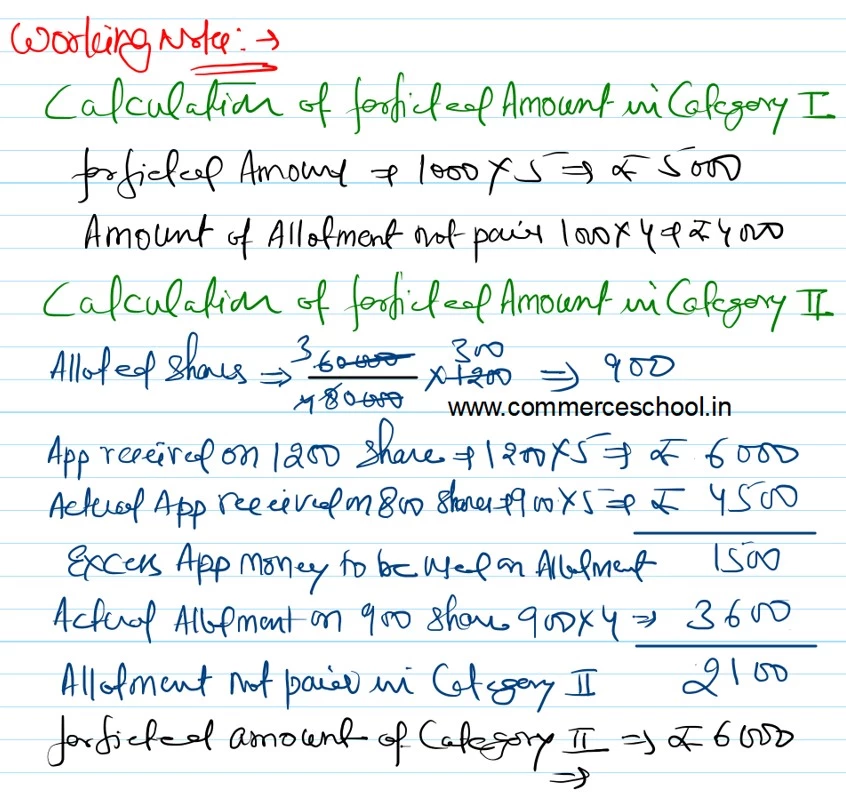

Applicants of 1,000 shares falling in category I) and applicants of 1,200 shares falling in Category ii) failed to pay allotment money. These shares were forfeited on failure to pay the first call. Holders of 1,200 shares falling in Category iii) failed to pay the first and final call and these shares were forfeited after the final call.

1,300 shares [1,000 of Category (I) and 300 of Category (iii) were reissued at ₹ 8 per share as fully paid up.

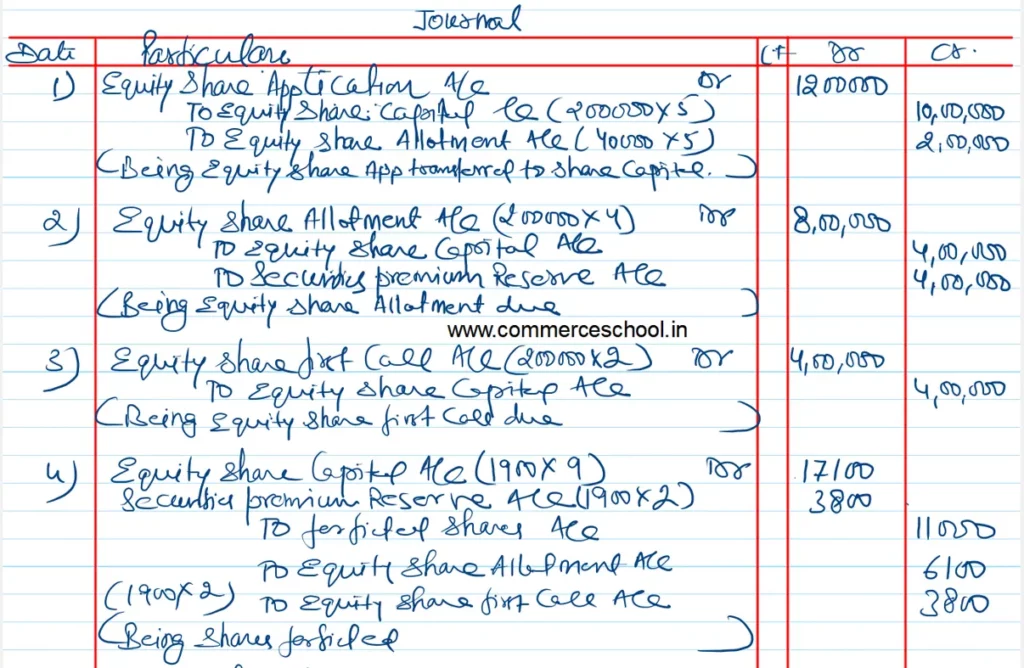

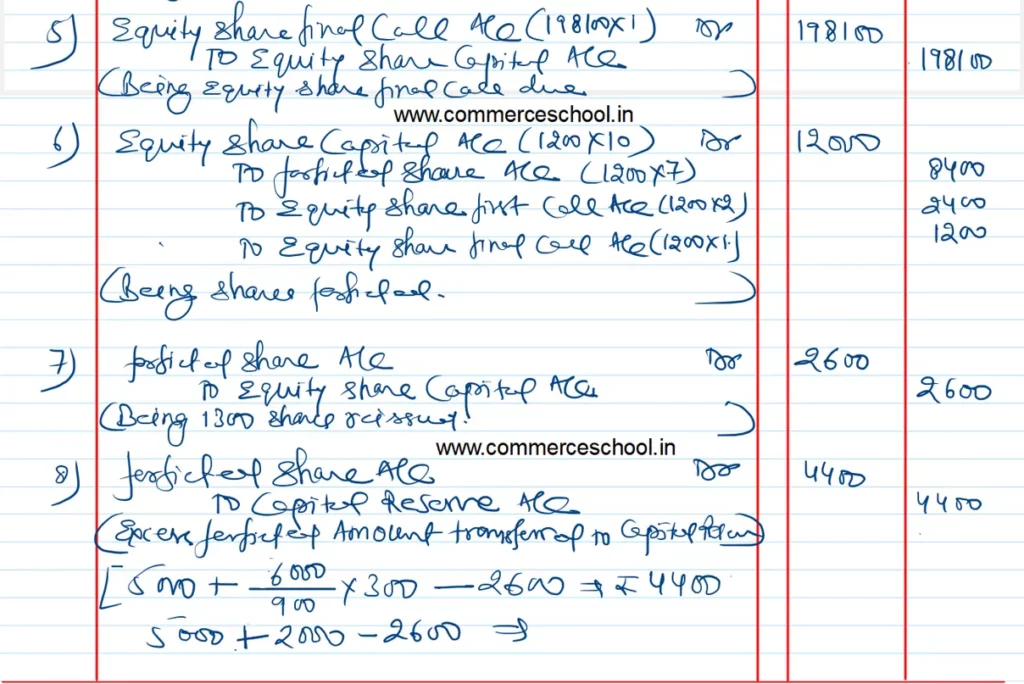

Journalize the above transactions, and Prepare Cash Book and Balance Sheet.

Solution:-

Issue of Share chapter Solutions of TS Grewal Class 12 Accountancy CBSE 2022-23

Let’s Practice

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Solutions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Solutions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Solutions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |