[CBSE] Q. 94 Solution of Accounting for Share Capital TS Grewal Class 12 (2022-23)

Are you looking for the solution to Question number 94 of the Accounting for Share Capital chapter of TS Grewal Book 2022-23 Edition CBSE Board?

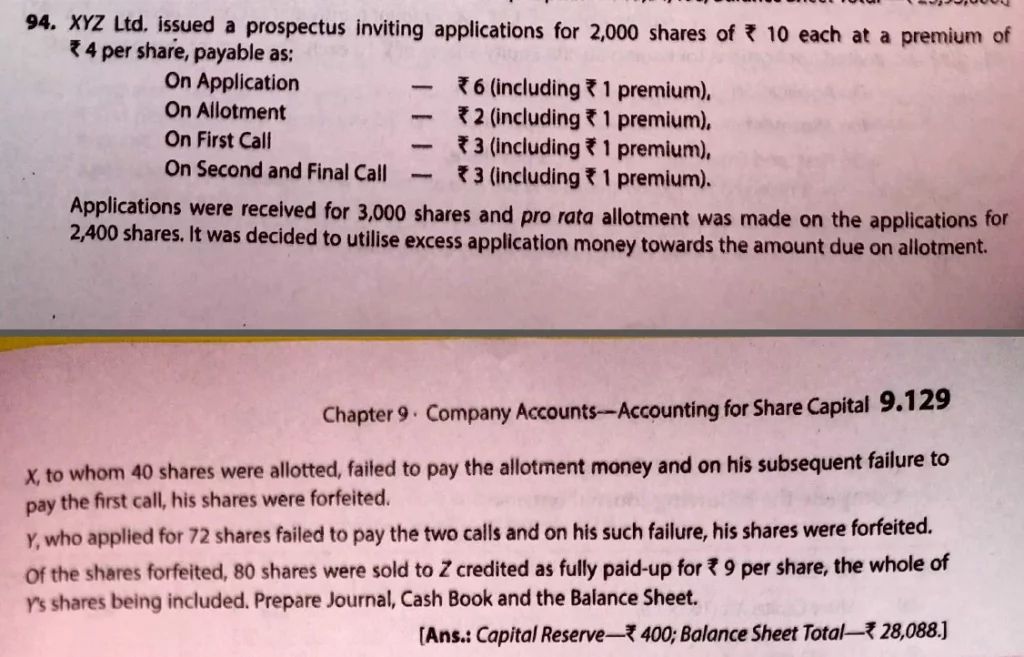

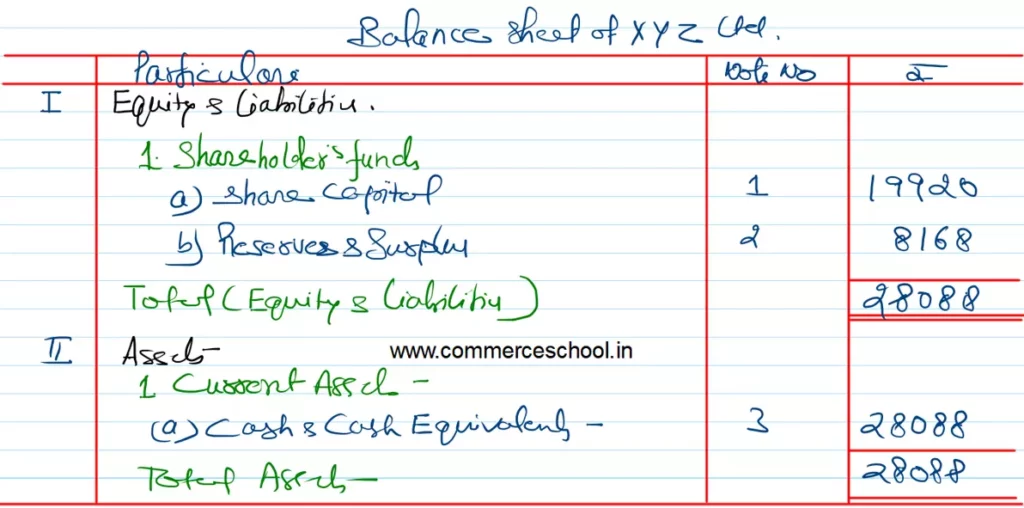

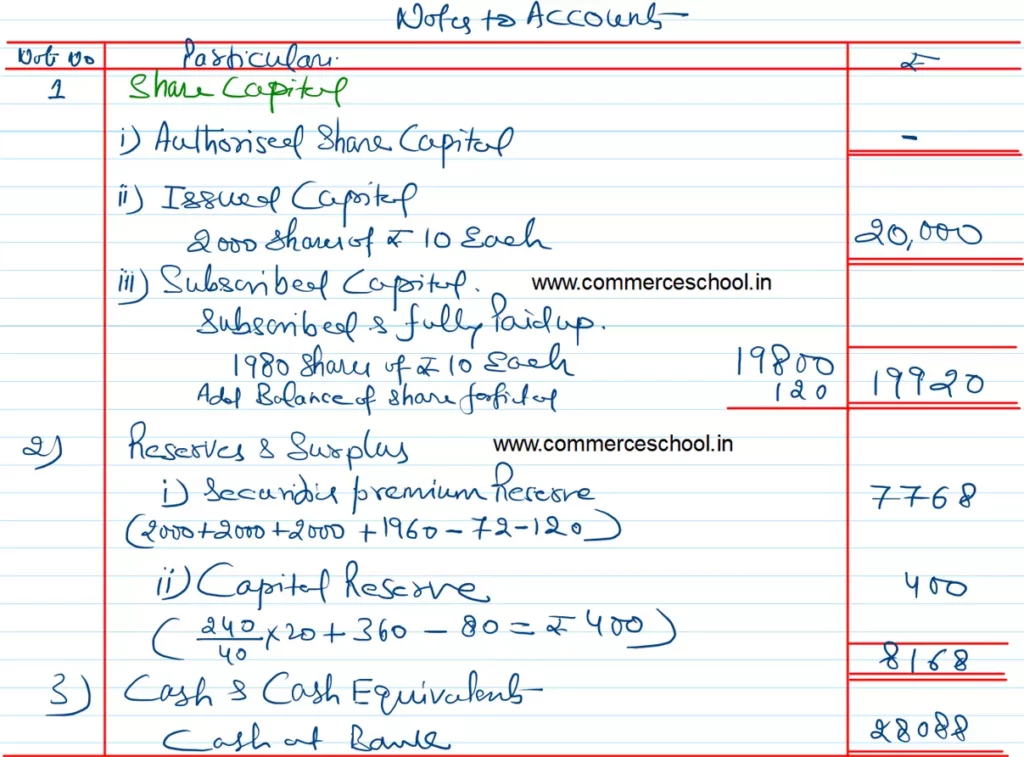

XYZ Ltd. issued a prospectus inviting applications for 2,000 shares of ₹ 10 each at a premium of ₹ 4 per share, payable as:

| On Application | ₹ 6 (including ₹ 1 premium) |

| On Allotment | ₹ 2 (including ₹ 1 premium) |

| On First Call | ₹ 3 (including ₹ 1 premium) |

| On Second and Final Call | ₹ 3 (including ₹ 1 premium) |

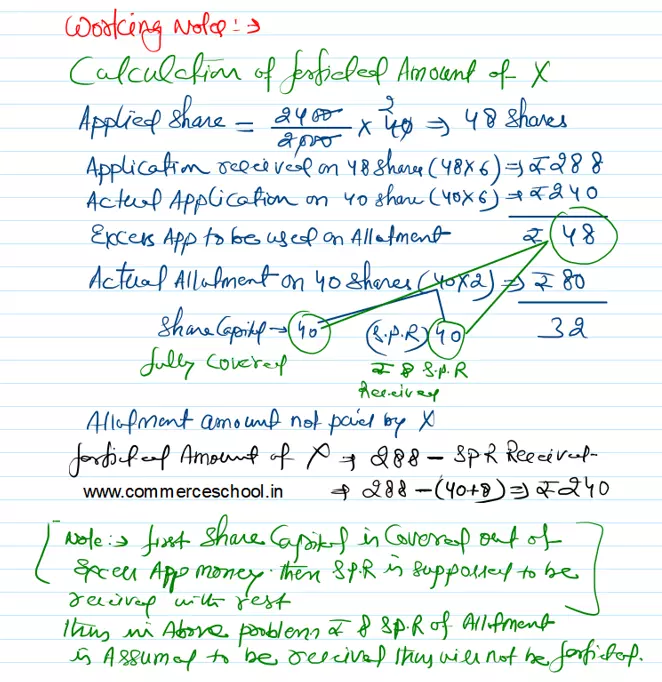

Applications were received for 3,000 shares and pro rata allotment was made on the applications for 2,400 shares. It was decided to utilize excess application money towards the amount due on allotment.

X, to whom 40 shares were allotted, failed to pay the allotment money and on his subsequent failure to pay the first call, his shares were forfeited.

Y, who applied for 72 shares failed to pay the two calls and on his such failure, his shares were forfeited.

of the shares forfeited, 80 shares were sold to Z and credited as fully paid up for ₹ 9 per share, the whole of Y’s shares being included.

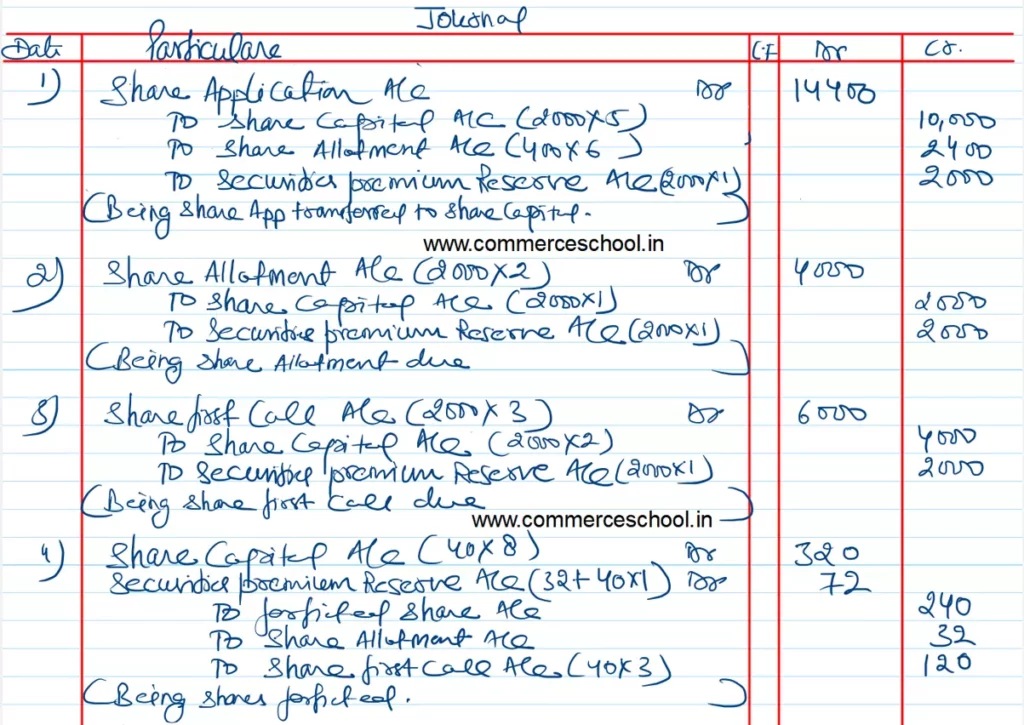

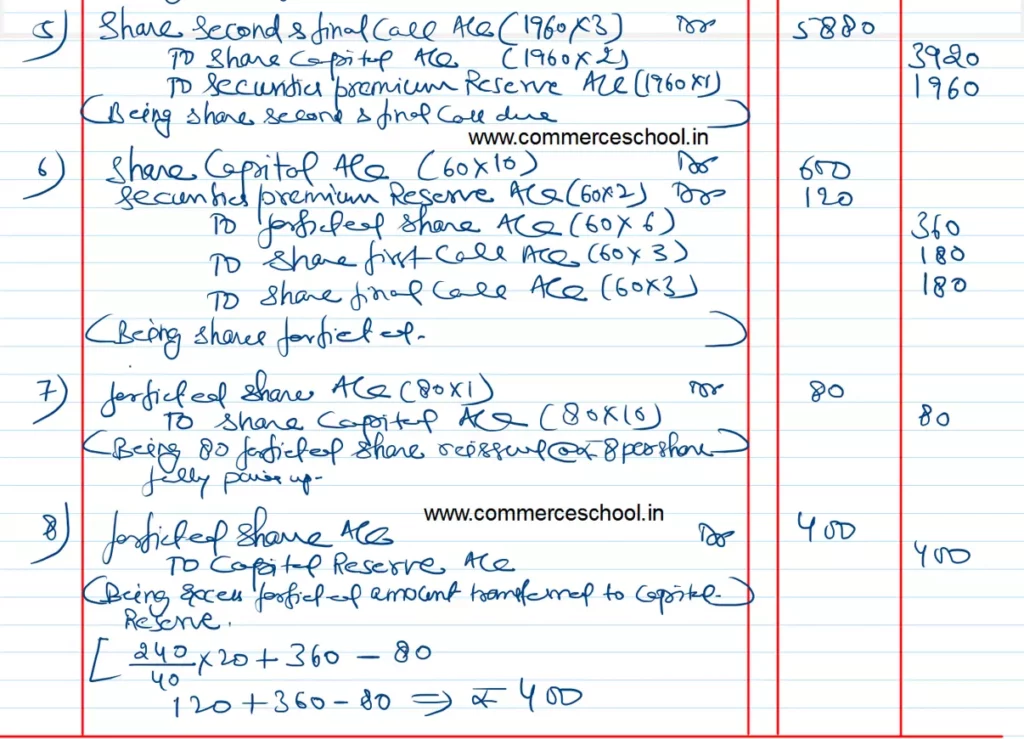

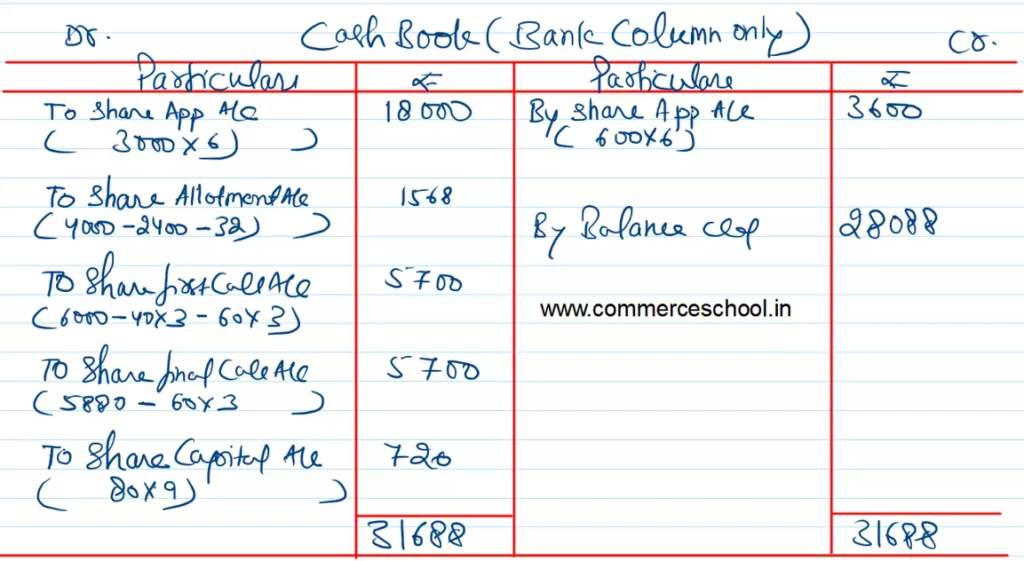

Prepare Journal, Cash Book, and the Balance Sheet.

Solution:-

Issue of Share chapter Solutions of TS Grewal Class 12 Accountancy CBSE 2022-23

Let’s Practice

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Solutions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Solutions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Solutions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |