[DK Goel] Q. 10 Financial Statements (with Adjustments) Solutions Class 11 CBSE (2025-26)

Solutions of Question number 10 of Chapter 20 Financial Statements (with Adjustments) DK Goel class 11 CBSE (2025-26)

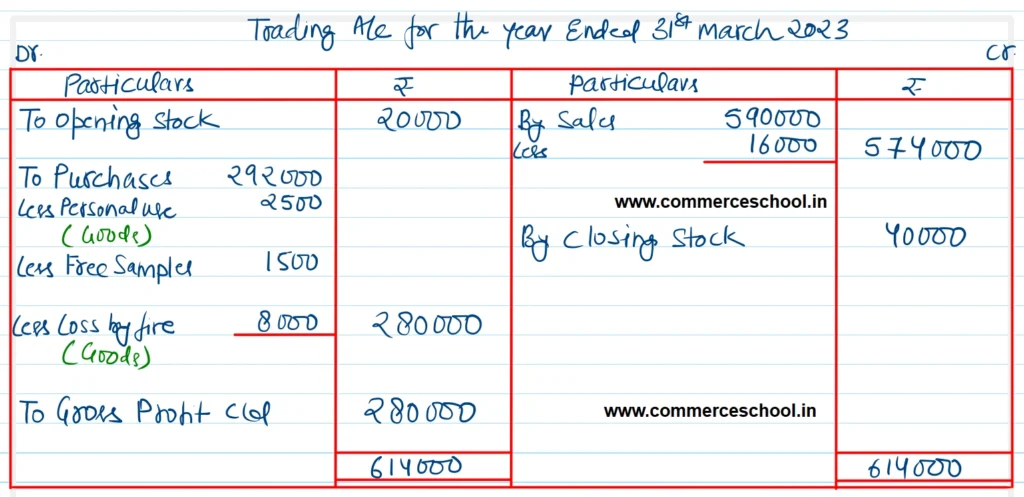

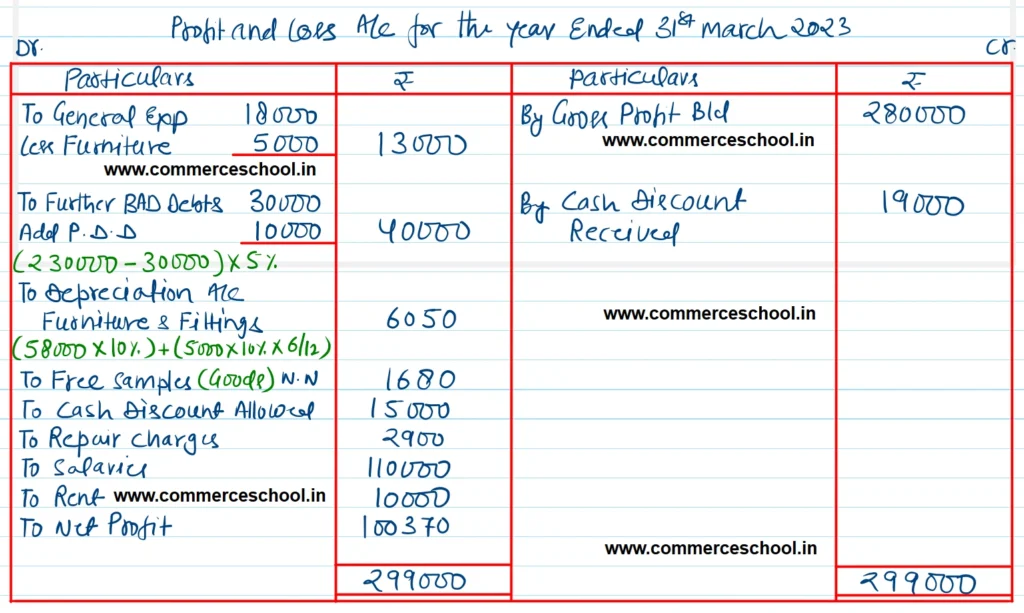

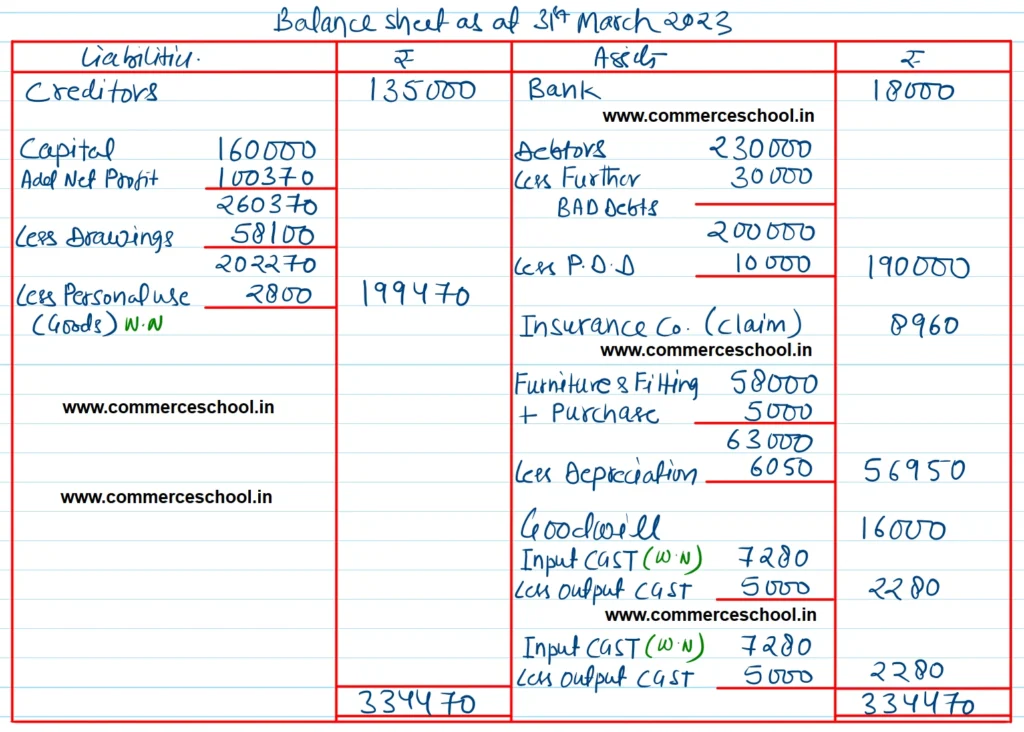

Q. 10 (a) From the following balances, prepare Trading, Profit and Loss A/c and a Balance Sheet as at 31st March, 2023:-

| Particulars | ₹ | Particulars | ₹ |

| Opening Stock | 20,000 | Goodwill | 16,000 |

| Purchases | 2,92,000 | Furniture and Fittings | 58,000 |

| Fuel and Power | 34,000 | Repair Charges | 2,900 |

| Capital | 1,60,000 | Bank | 18,000 |

| Sales | 5,90,000 | Salaries | 1,10,000 |

| Rent | 10,000 | General Expenses | 18,000 |

| Returns Inwards | 16,000 | Debtors | 2,30,000 |

| Cash Discount allowed | 15,000 | Creditors | 1,35,000 |

| Cash Discount received | 19,000 | Output CGST | 5,000 |

| Drawings | 58,100 | Output SGST | 5,000 |

| Input CGST | 8,000 | ||

| Input SGST | 8,000 |

Take the following adjustments into account:

(a) General expenses include ₹ 5,000 chargeable to Furniture purchased on 1st October 2022.

(b) Create a provision of 5% on debtors for Bad and Doubtful Debts after treating ₹ 30,000 as a Bad-debt.

(c) Depreciation on Furniture and Fittings for the year is to be at the rate of 10% per annum.

(d) Closing Stock was ₹ 40,000, but there was a loss by fire on 20th March to the extent of ₹ 8,000. Insurance Company admitted the claim in full.

(d) (I) Goods costing ₹ 2,500 were used by the proprietor.

(II) Goods costing ₹ 1,500 were distributed as free samples.

Goods were purchased paying CGST and SGST @ 6% each.

[Ans. G.P. ₹ 2,80,000; N.P. ₹ 1,00,370; B/s Total ₹ 3,34,470.]

Solution:-

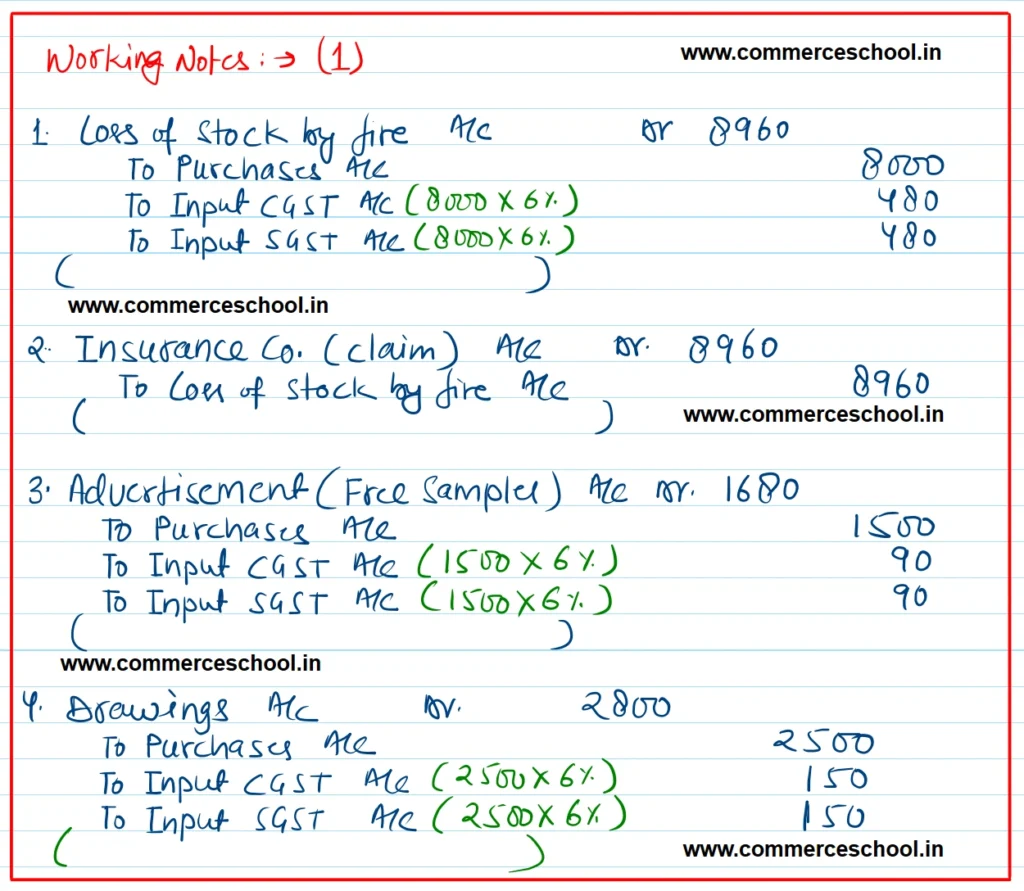

Hints:

(1) Depreciation on Furniture will be calculated as follows:- on ₹ 58,000 for one year, and on ₹ 5,000 for six moths.

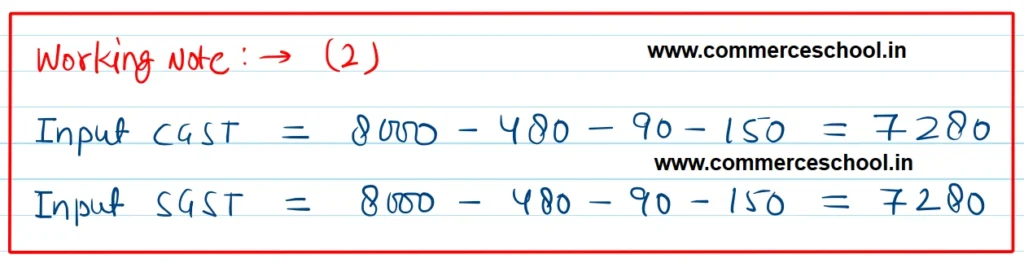

(2) GST will be calculated on Loss by Fire, goods used by Proprietor and goods distributed as free samples.

(3) Net amount of Input CGST and Input SGST shown on assets side ₹ 2,280 each.

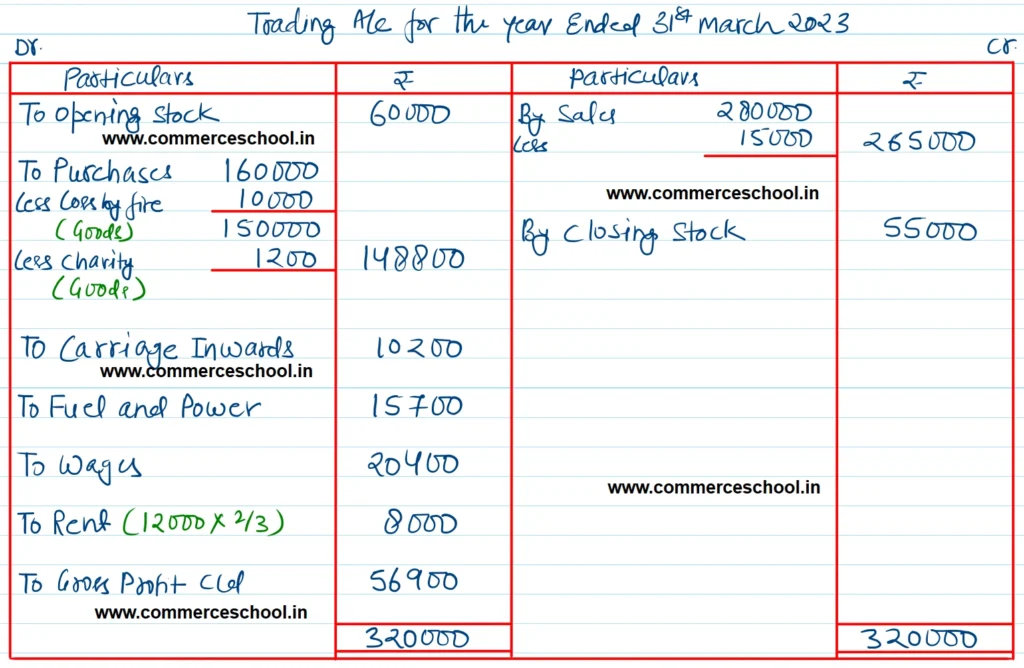

Q. 10 (B). From the following particulars taken out from the books of Subhash General Store, prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and Balance Sheet as at that date:-

| Particulars | ₹ | Particualrs | ₹ |

| Plant & Machinery on 1-4-2022 | 80,000 | Rent | 12,000 |

| Plant & Machinery Purchased on 1-7-2022 | 20,000 | Insurance Premium paid from 1-1-2023 to 31-12-2023 | 1,200 |

| Sundry Debtors | 1,20,000 | Cash at Bank | 5,400 |

| Creditors | 32,000 | Wages | 20,400 |

| Furniture | 5,000 | Advertising | 4,800 |

| Motor Car | 70,000 | Carriage Inwards | 10,200 |

| Purchases | 1,60,000 | Carriage Outwards | 2,000 |

| Sales | 2,80,000 | Fuel and Power | 15,700 |

| Sales Returns | 15,000 | Manoj’s Capital | 3,50,000 |

| Salaries | 36,000 | Manoj’s Drawings | 12,000 |

| Opening Stock | 60,000 | Brokerage | 700 |

| Motor Car Expenses | 6,000 | Donation | 5,100 |

| Stationery | 500 |

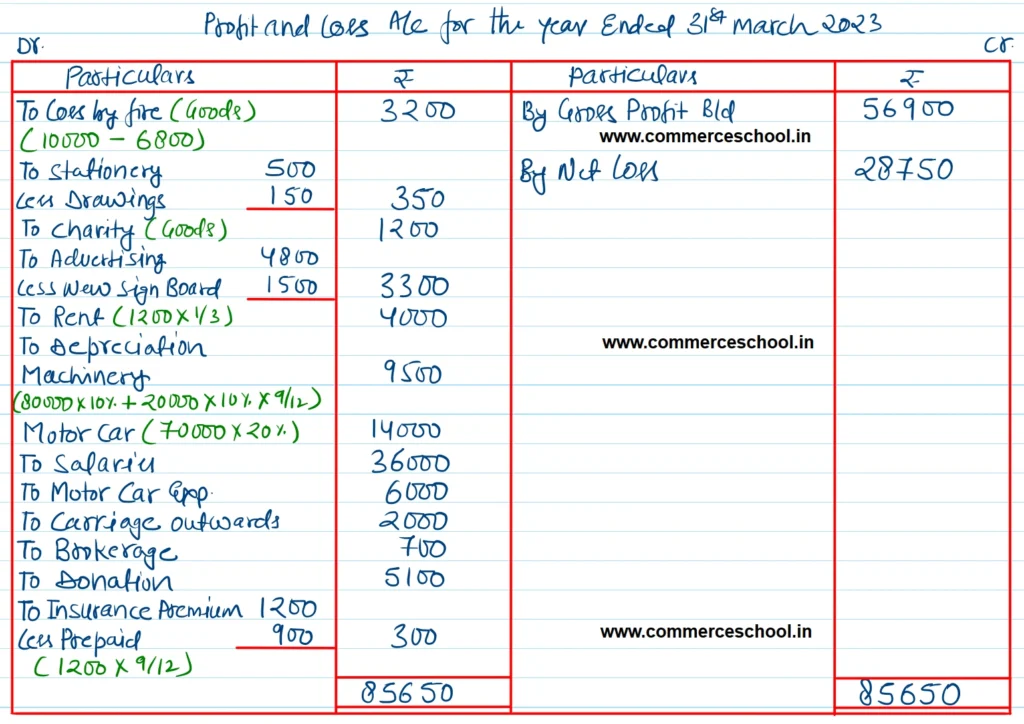

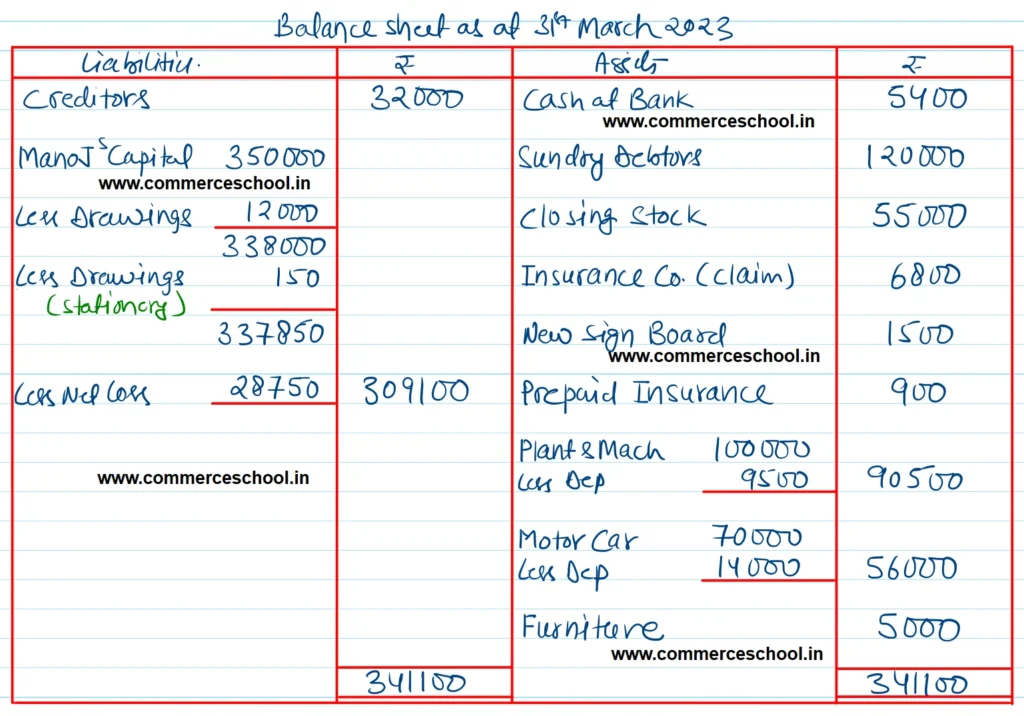

The following inforamtion is relevant:-

(1) Closing Stock ₹ 55,000. Stock valued at ₹ 10,000 was destroyed by fire on 18th March, 2023 but the Insurance Company admitted a claim of ₹ 6,800 only which was received in April, 2023.

(2) Stationery for ₹ 150 was consumed by the Proprietor.

(3) Goods costing ₹ 1,200 were given away as charity.

(4) A new Signboard costing ₹ 1,500 is included in Advertising.

(5) Rent is to be allocated 2/3rd to Factory and 1/3rd to Office.

(6) Depreciate machinery by 10% p.a. and Motor Car by 20% p.a.

[Ans. G.P. ₹ 56,900; Net Loss ₹ 28,750; B/S Total ₹ 3,41,100.]

Hint: Prepaid Insurance ₹ 900.

Solution:-

Below is the list of all solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |