[DK Goel] Q. 11, Q. 12 Bank Reconciliation Statements Solutions Class 11 CBSE (2025-26)

Solutions of Question number 11 and 12 of Chapter 16 Bank Reconciliation Statements DK Goel class 11 CBSE (2025-26)

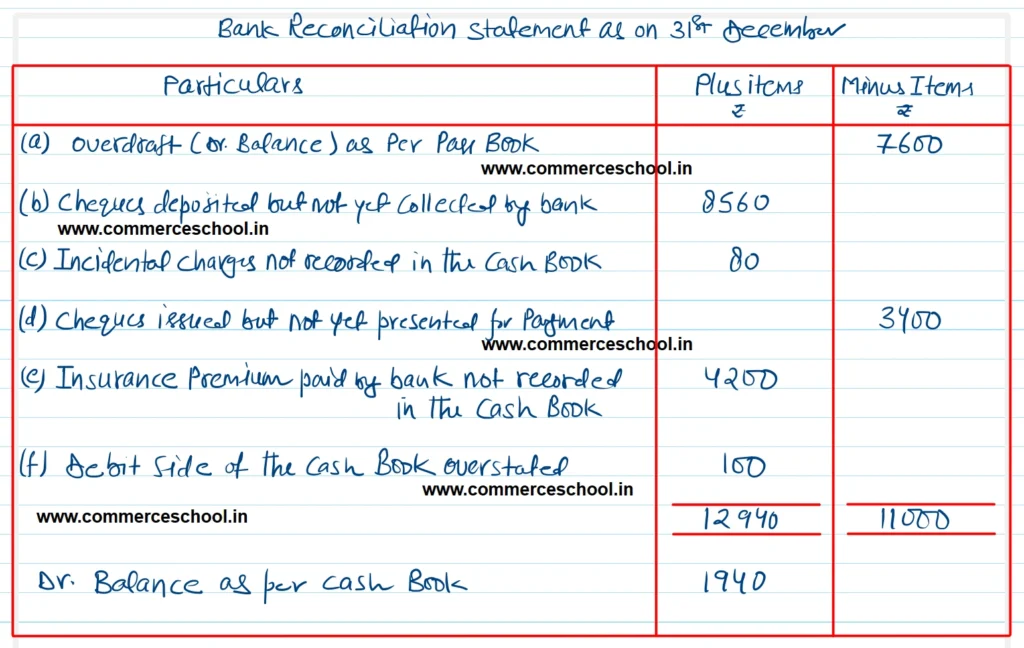

Q. 11. Prepare the Bank Reconciliation Statement from the following particulars for the period ending 31st December, 2024.

(a) Overdraft as per Pass Book on 31-12-2024 ₹ 7,600.

(b) Cheques deposited but not collected by the bank ₹ 8,560.

(c) Incidental charges not recorded in Cash Book ₹ 80.

(d) Cheques were issued for ₹ 7,800 but only ₹ 4,400 were presented for payment.

(e) Insurance premium paid by bank not recorded in the Cash Book ₹ 4,200.

(f) On 31st December, 2024 cash was deposited in bank ₹ 385 but the cashier debited the bank column with ₹ 485 by mistake.

[Ans. Dr. Balance as per Cash Book ₹ 1,940.]

Solution:-

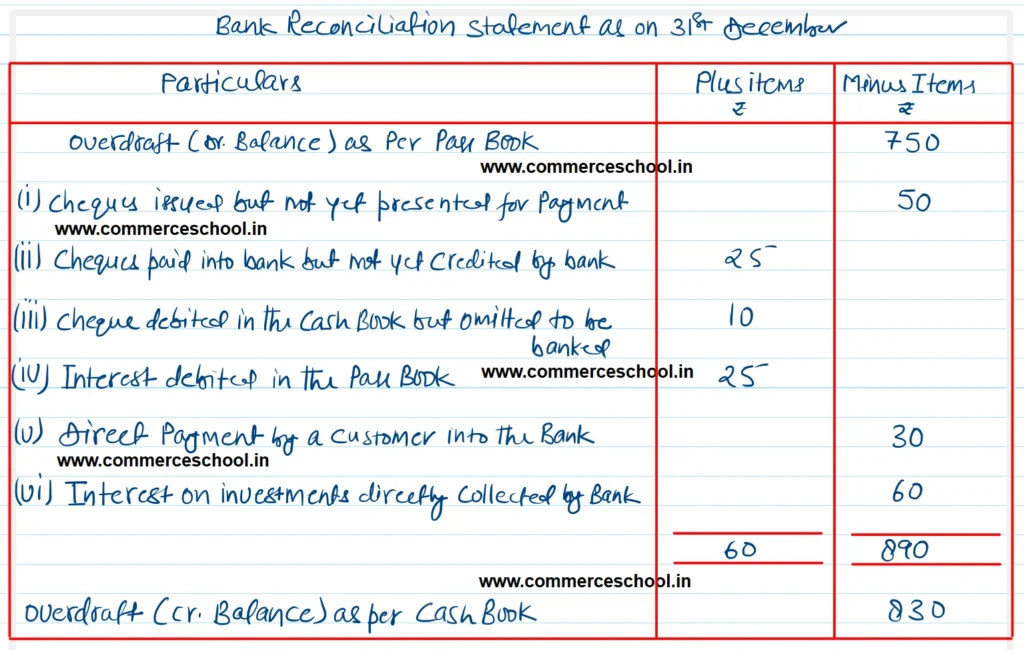

Q. 12. Prepare a Bank Reconciliation Statement from the following particulars:-

On 31st December 2024, I had an overdraft of ₹ 750 as shown by my Pass Book. I had issued cheques amounting to ₹ 250 of which ₹ 200 worth only seem to have been presented for payment. Cheques amounting to ₹ 100 had been paid in by my on 30th December, but of these only ₹ 75 were credited in the Pass Book. I also find that a cheque for ₹ 10 which I had debited to bank account in my books has been omitted to be banked. There is a debit of ₹ 25 in my Pass Book for interest.

An entry of ₹ 30 of a payment by a customer direct into the bank appears in the Pass Book. My Pass Book also shows a credit of ₹ 60 to my account for interest on investments directly collected by my bankers.

[Ans. Overdraft as per Cash Book ₹ 830.]

Solution:-

Below is the list of all solutions

| S.N | Solutions |

| 1 | Question – 1, 2 |

| 2 | Question – 3, 4 |

| 3 | Question – 5, 6 |

| 4 | Question – 7, 8 |

| 5 | Question – 9, 10 |

| 6 | Question – 11, 12 |

| 7 | Question – 13, 14 |

| 8 | Question – 15, 16 |

| 9 | Question – 17, 18 |

| 10 | Question – 19, 20 |