[DK Goel] Q. 12 Accounts from Incomplete Records Solutions Class 11 CBSE (2025-26)

Solutions of Question number 12 of Chapter 22 Accounts from Incomplete Records DK Goel class 11 CBSE (2025-26)

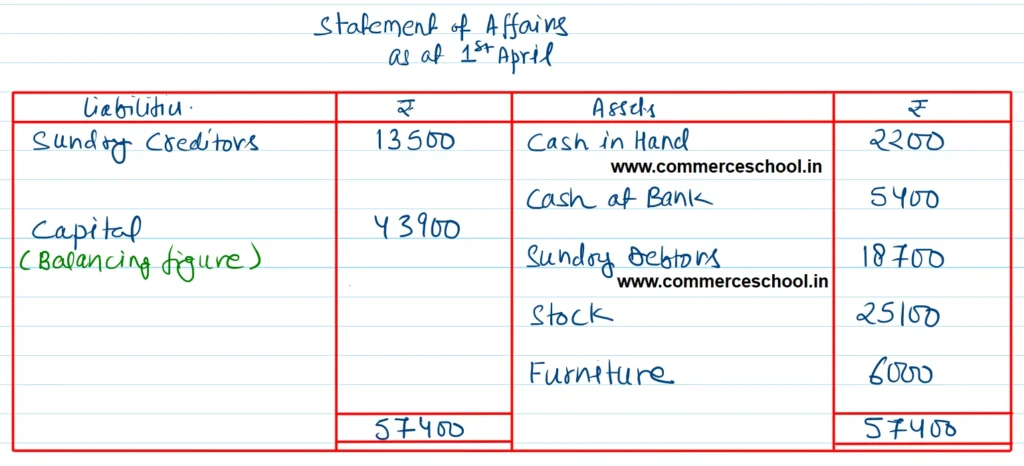

Ashok keeps incomplete records. The position of his business on 1st April, 2022 was as follows:

Cash in Hand ₹ 2,200; Cash at Bank ₹ 5,400; Stock ₹ 25,100; Sundry Debtors ₹ 18,700; Furniture ₹ 6,000; Sundry Creditors ₹ 13,500.

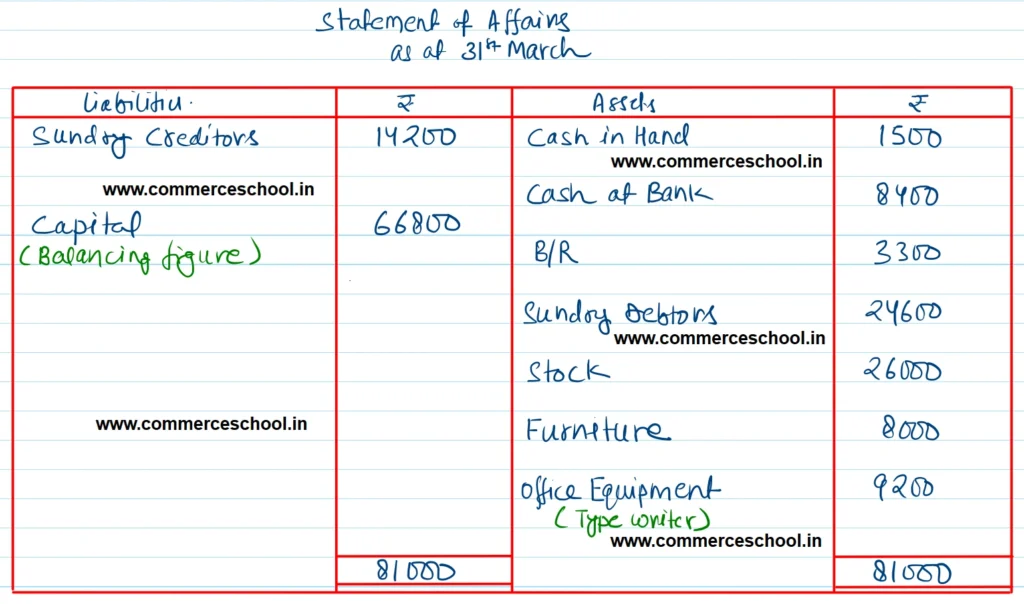

His position on 31st March, 2023 was as follows:

Cash in Hand ₹ 1,500; Cash at Bank ₹ 8,400; B/R ₹ 3,300; Stock ₹ 26,000; Sundry Debtors ₹ 24,600; Furniture ₹ 8,000; Sundry Creditors ₹ 14,200.

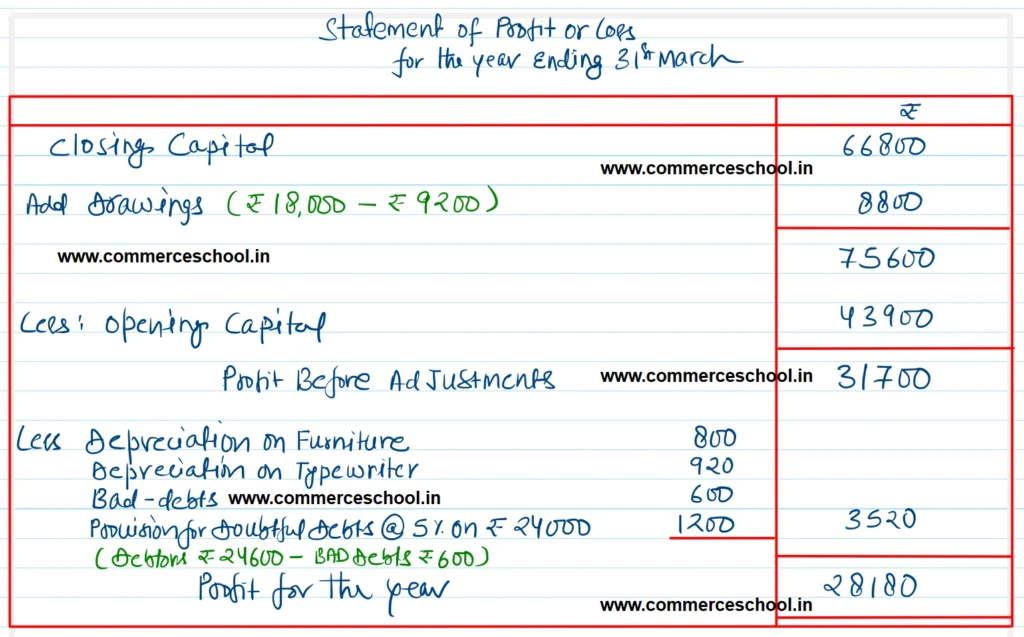

During the year he had withdrawn from the business ₹ 18,000, of which ₹ 9,200 were spent in purchasing a Typewrite for the business.

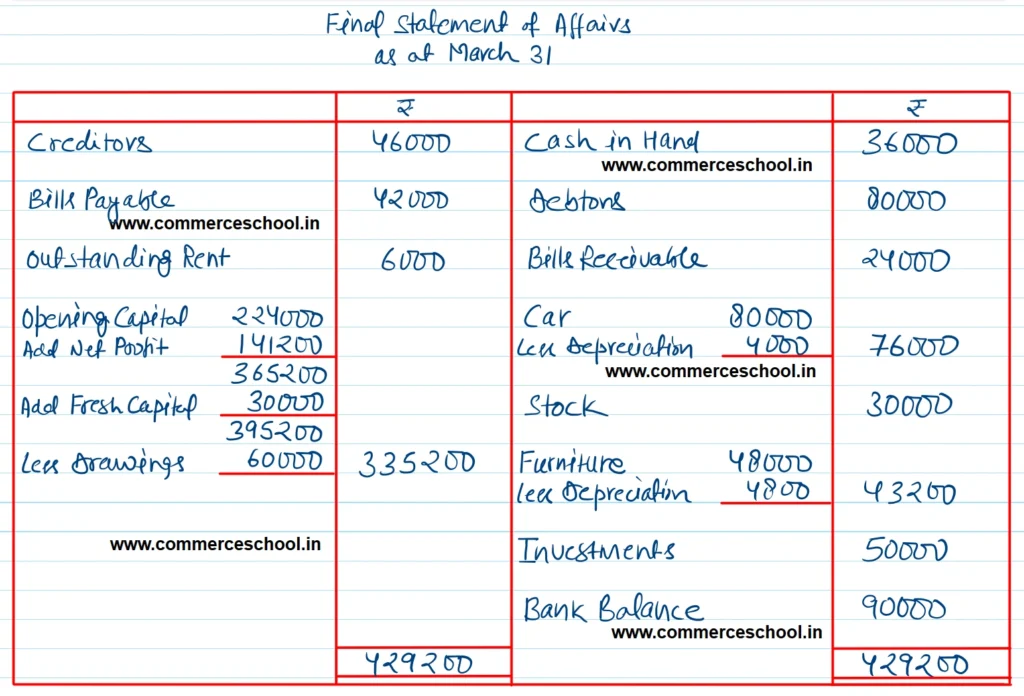

(a) Depreciate furniture and typewriter by 10%.

(b) Write off ₹ 600 as Bad-Debts.

(c) Make a provision of 5% on Debtors for doubtful debts.

Calculate the profit or loss of his business for the year ended 31st March, 2023 and prepare a final statement of affairs, after the above adjustments.

[Ans. Opening Capital ₹ 43,900; Closing Capital ₹ 66,800; Net Profit ₹ 28,180; Total of final statement of affairs ₹ 77,480.]

Solution:-