[DK Goel] Q 14 Accounting Equations Solutions CBSE (2025-26) Class 11

Solution of Question number 14 Accounting Equations DK Goel class 11 CBSE (2025-26).

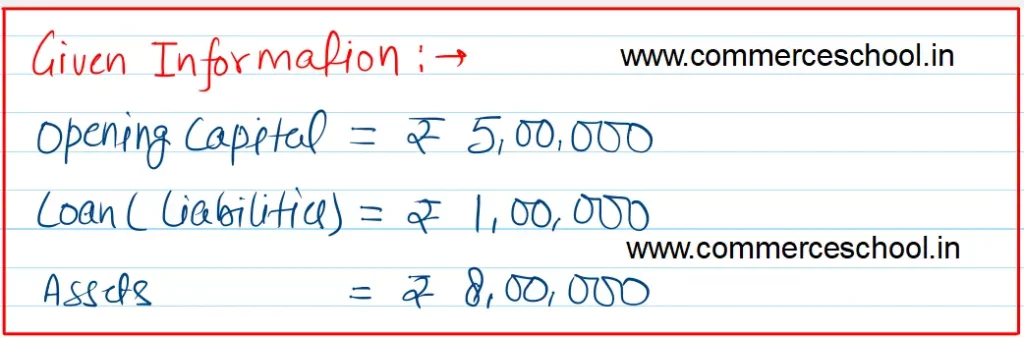

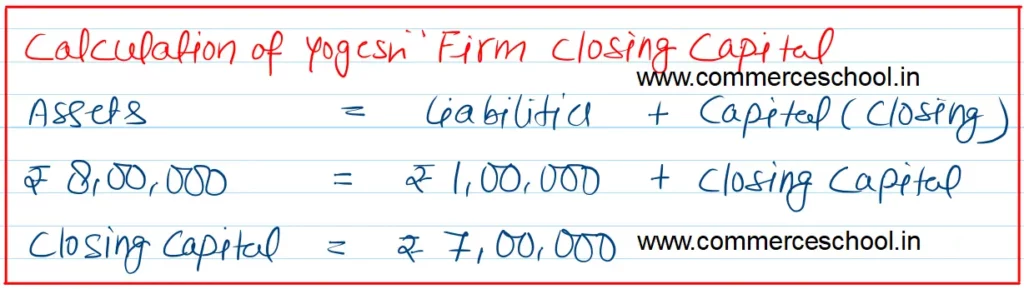

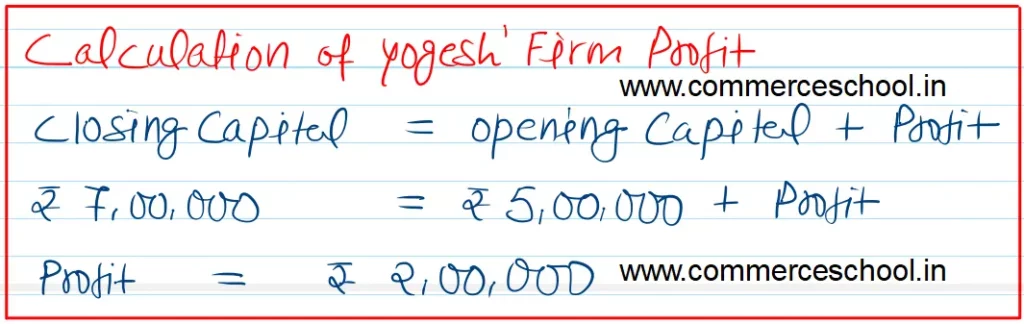

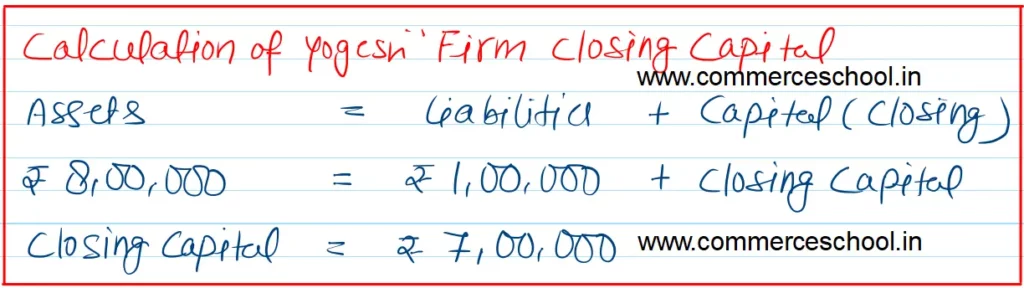

Q. 14 (a) Yogesh commenced business on 1st April, 2017 with a Capital of ₹ 5,00,000 and a loan of ₹ 1,00,000 borrowed from Citi Bank. On 31st March, 2018, his assets were ₹ 8,00,000. Calculate his closing capital and profits earned during the year.

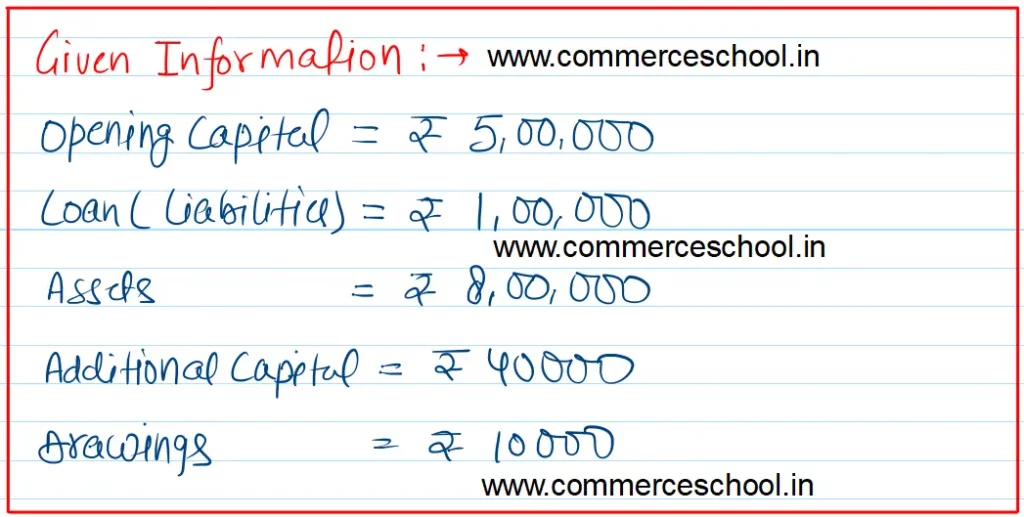

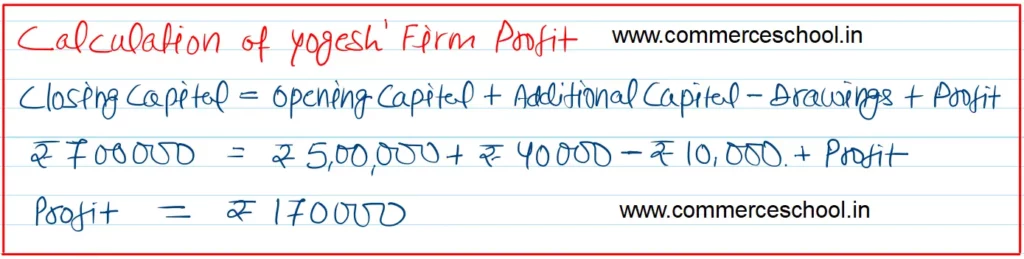

(b) If in the above case, the proprietor had introduced fresh capital of ₹ 40,000 and had withdrawn ₹ 10,000 for personal purposes, calculate his profits.

[Ans. (a) Closing Capital ₹ 7,00,000; Profit ₹ 2,00,000. (b) Profit ₹ 1,70,000.]

Solution – 14 (a)

Solution – 14 (b)

Below is the list of all solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |