[DK Goel] Q. 13 Cash Book Solutions Class 11 CBSE (2025-26)

Solutions of Question number 13 Chapter 11 Books of Original Entry – Cash Book DK Goel class 11 CBSE (2025-26)

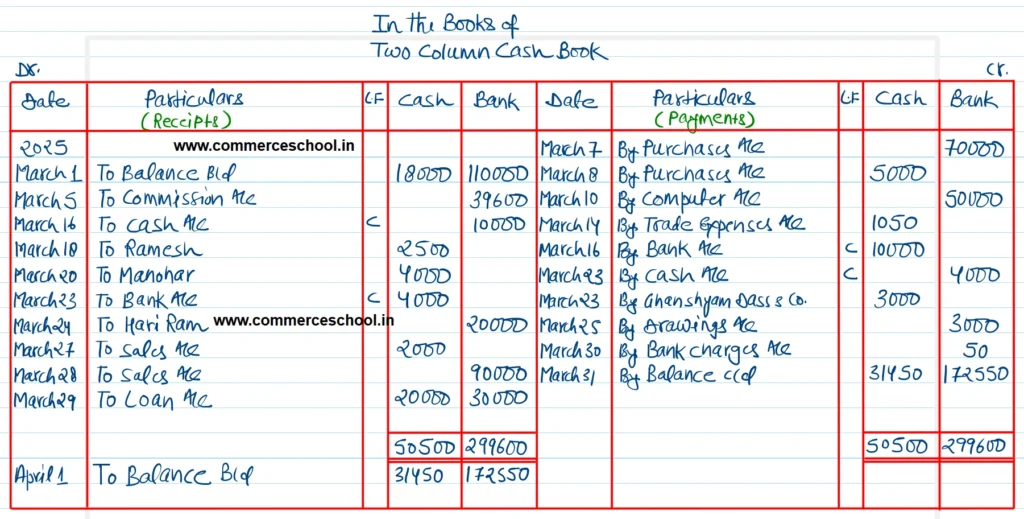

Q. 13 (A). Prepare a Cash Book with Cash and Bank Column from the following transactions:-

| 2025 | |

| March 1 | Cash in hand ₹ 18,000 and at Bank ₹ 1,10,000. |

| 5 | Received a cheque for commission ₹ 39,600. Cheque was immediately deposited into bank |

| 7 | Bought goods for cheque ₹ 70,000 |

| 8 | Bought goods for cash ₹ 5,000 |

| 10 | Purchased a Computer and payment made by cheque of ₹ 50,000. |

| 14 | Paid Trade Expenses ₹ 1,050 |

| 16 | Paid into Bank ₹ 10,000 |

| 18 | Ramesh who owed us ₹ 5,000became bankrupt and paid us 50 paise in a ₹ |

| 20 | Received ₹ 4,000 from Manohar and allowed him discount ₹ 100. |

| 23 | Paid ₹ 3,000 to Ghanshyam Dass & Co. They allowed us discount ₹ 100. |

| 24 | Received ₹ 20,000 from Hari Ram and deposited the same into Bank. |

| 25 | Withdrew from Bank for private expenses ₹ 3,000. |

| 27 | Sold goods for cash ₹ 2,000. |

| 28 | Received cheque for goods sold ₹ 90,000 |

| 29 | Received repayment of a loan of ₹ 50,000 and deposited ₹ 30,000 out of it into Bank |

| 30 | Bank charges as per Pass Book ₹ 50. |

[Ans. Cash in Hand ₹ 31,450; Bank Balance ₹ 1,72,550.]

Solution:-

Hint: On 18th March: the amount of bad debts will not be recorded in the Cash Book. On 28th March: It will be assumed that the cheque has been deposited into the bank on the same dahy.

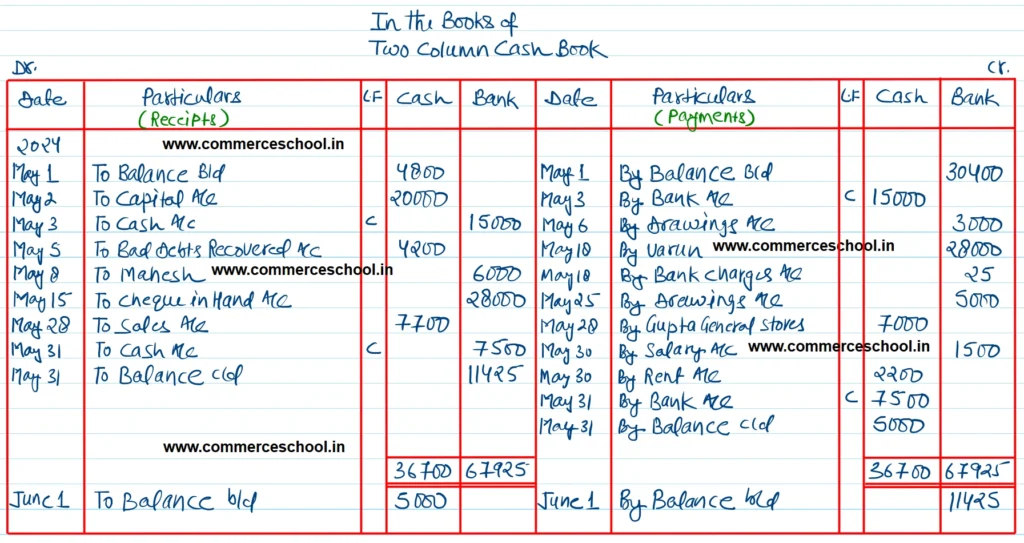

Q. 13 (B). From the following transactions, prepare Cash Book with Cash and Bank Columns:-

| 2024 | ₹ | |

| May 1 | Cash in hand Bank Overdraft | 4,800 30,400 |

| 2 | Fresh Capital introduced | 20,000 |

| 3 | Deposited into Bank | 15,000 |

| 4 | Sold goods to Mahesh on Credit | 6,200 |

| 5 | An amount of ₹ 4,200 due from Ashok written off as bad debts in the previous year, now recovered. | |

| 6 | Withdrew from bank for the payment of Life Insurance Premium | 3,000 |

| 8 | Received a cheque from Mahesh for ₹ 6,000 in full settlement of his account and deposited the same into the Bank. | |

| 10 | Sold goods to Varun on Credit. | 30,000 |

| 12 | Received a cheque for ₹ 28,000 from Varun in full settlement. | |

| 15 | Cheque received from Varun sent to Bank | |

| 18 | Varun’s cheque returned by Bank dishonoured. Bank charged ₹ 25 on this cheque | |

| 20 | Received a cheque of ₹ 6,800 from Vijay which was endoresed to Amrit Raj on 23rd May. | |

| 25 | Withdrew cash from Bank ₹ 5,000 for paying gift to his daughter on her birthday. | |

| 26 | Bought goods from Gupta General Store for ₹ 10,000 on credit and they allowed us trade discount of 25% | |

| 28 | Paid to Gupta General Stores in cash in full settlement | 7,000 |

| 28 | Sale of old machinery, payment received in cash ₹ 7,700 | |

| 30 | Paid Salary by cheque ₹ 1,500. Paid Rent in cash ₹ 2,200 | |

| 31 | Paid into Current Account the entire balance after retaining ₹ 5,000 at office. |

[Ans. Cash Balance (Dr.) ₹ 5,000; Bank Overdraft ₹ 11,425; Excess Cash deposited into Bank on 31st May ₹ 7,500.]

Solution:-

Hints:

May 6th: Life Insurance Premium is treated as Drawings.

May 12th: Entry for receipt of Cheque will be recorded in Journal Proper.

May 15th: To Cheques in Hand A/c (₹ 28,000 in Bank Column)

May 18th: By Varun (₹ 28,025) in Bank Column); Entry for discount withdrawn ₹ 2,000 will be passed through Journal Proper.

Below is the list of all solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |