[DK Goel] Q. 14 Financial Statements (with Adjustments) Solutions Class 11 CBSE (2025-26)

Solutions of Question number 14 of Chapter 20 Financial Statements (with Adjustments) DK Goel class 11 CBSE (2025-26)

Following is the Trial Balance of Mr. Gautam as at 31st March, 2023:

| Particulars | ₹ | Particulars | ₹ |

| Goodwill | 30,000 | Purchase Returns | 2,650 |

| Land & Buildings | 60,000 | Capital A/c | 2,03,000 |

| Plant & Machinery | 40,000 | Bills Payable | 13,800 |

| Loose Tools | 3,000 | Sundry Creditors | 30,000 |

| Bills Receivable | 2,000 | Sales | 1,15,000 |

| Opening Stock | 40,000 | ||

| Purchases | 51,000 | ||

| Wages | 20,000 | ||

| Carriage Inwards | 1,200 | ||

| Coal & Gas | 5,600 | ||

| Salaries | 4,000 | ||

| Rent | 2,700 | ||

| Discount allowed | 1,500 | ||

| Cash at Bank | 25,000 | ||

| Cash in Hand | 1,400 | ||

| Sundry Debtors | 45,000 | ||

| Repairs | 1,800 | ||

| Printing & Stationery | 600 | ||

| Bad-debts | 1,200 | ||

| Advertisements | 3,500 | ||

| Furniture and Fixtures | 1,200 | ||

| General Expenses | 250 | ||

| Investments | 5,000 | ||

| Drawings | 15,000 | ||

| Carriage Outwards | 1,500 | ||

| Sales Returns | 2,000 | ||

| 3,64,450 | 3,64,450 |

You are required to prepare Final Accounts after taking into account the following adjustments:

(a) Closing Stock on 31st March, 2023 was ₹ 60,000.

(b) Depreciate Plant and Machinery at 5%, Loose Tools at 15% and Furniture and fixtures at 5%.

(c) Provide 21/2% for discount on Sundry Debtors and also provide 5% for Bad and Doubtful Debts on Sundry Debtors.

(d) Only three quarter’s rent has been paid, the last quarter’s rent being outstanding.

(e) Interest earned but not received ₹ 600.

(f) Write off 1/4th of Advertisement expenses.

[Ans. Gross Profit ₹ 57,850; Net Profit ₹ 37,296; Total of B/S ₹ 2,69,996.]

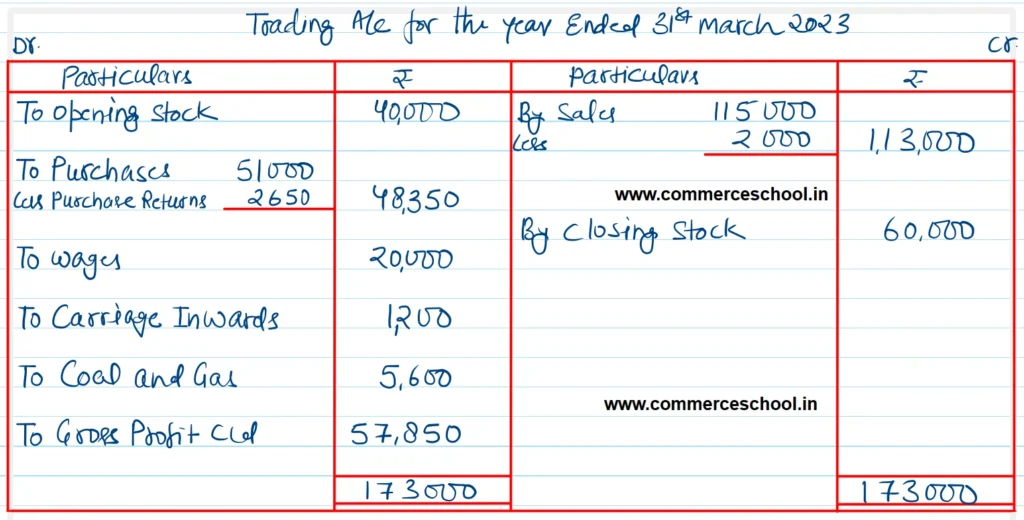

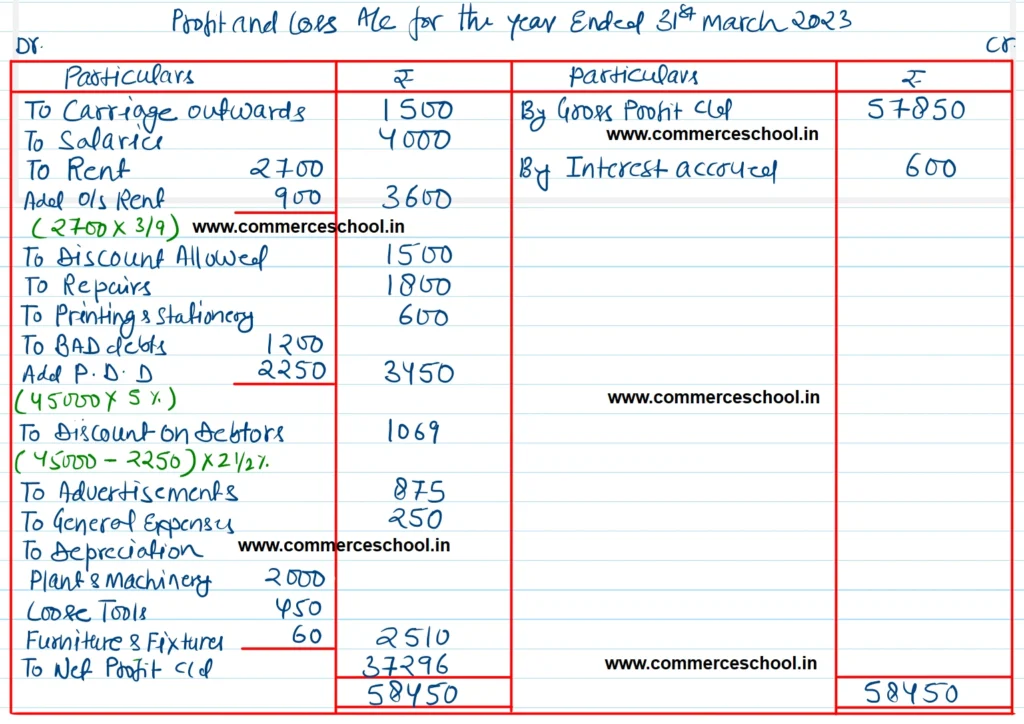

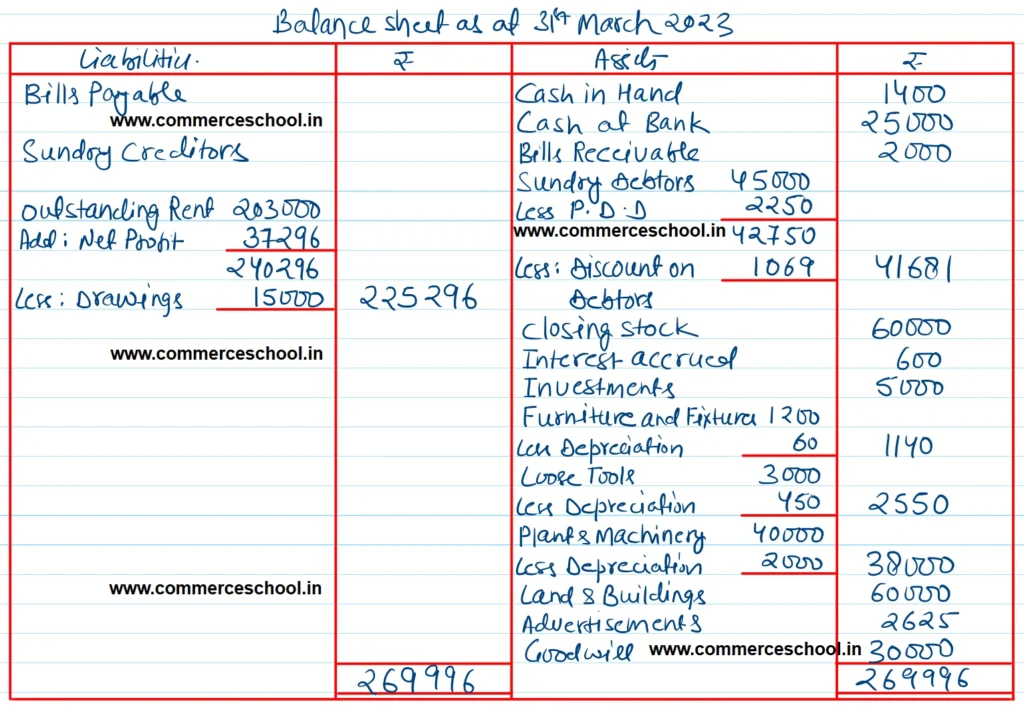

Solution:-

Hints:

(1) Rent shown in the Trial Balance is for 3 quarters or for 9 months. As such Rent Outstanding for the remaining 3 months will be 2,700/9 x 3 = ₹ 900.

(2) First, provision for Doubtful Debts will be created on debtors and then provision for discount will be calculated on debtors remaining after deducting the provision for Doubtful Debts.

Below is the list of all solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |