[DK Goel] Q. 15 Depreciation Solutions Class 11 CBSE (2025-26)

Solutions of Question number 15 of Depreciation chapter DK Goel class 11 CBSE (2025-26)

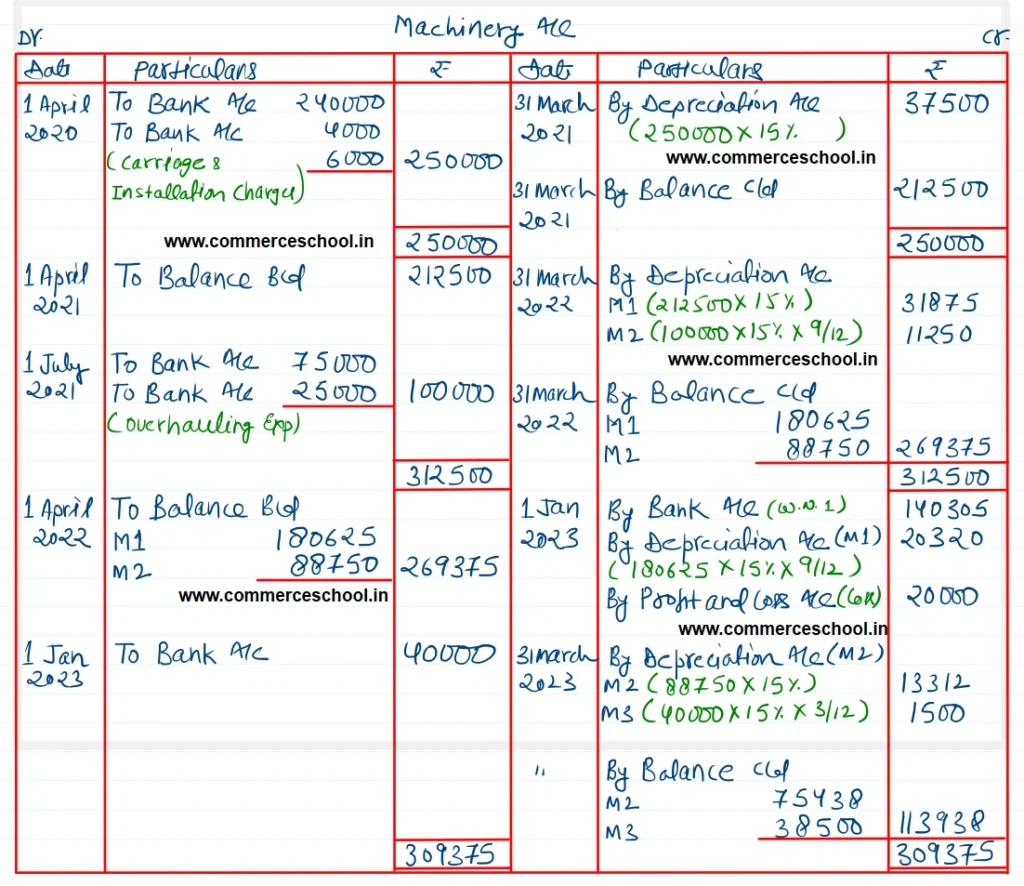

Ashoka Ltd. bought a machine on 1st April, 2020 for ₹ 2,40,000 and spent ₹ 4,000 on its carriage and ₹ 6,000 towards installation cost. On 1st July, 2021 it purchased a second hand machinery for ₹ 75,000 and spent ₹ 25,000 on its overhauling. ON 1st January, 2023 it decided to sell the machinery bought on 1st April, 2020 at a loss of ₹ 20,000. It bought another machine on the same date for ₹ 40,000. Company decided to charge depreciation @ 15% p.a. on written down value method. Prepare machinery account for 3 years. Books are closed each year on 31st March.

[Ans. Sale price of Machine ₹ 1,40,305; Balance of Machine A/c on 31st March, 2023 ₹ 1,13,938]

Solution:-

Below is the list of all solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |