[DK Goel] Q. 16 Special Purpose Subsidiary Book Solutions Class 11 CBSE (2025-26)

Solutions of Question number 16 of Chapter 12 Special Purpose Subsidiary Book DK Goel class 11 CBSE (2025-26)

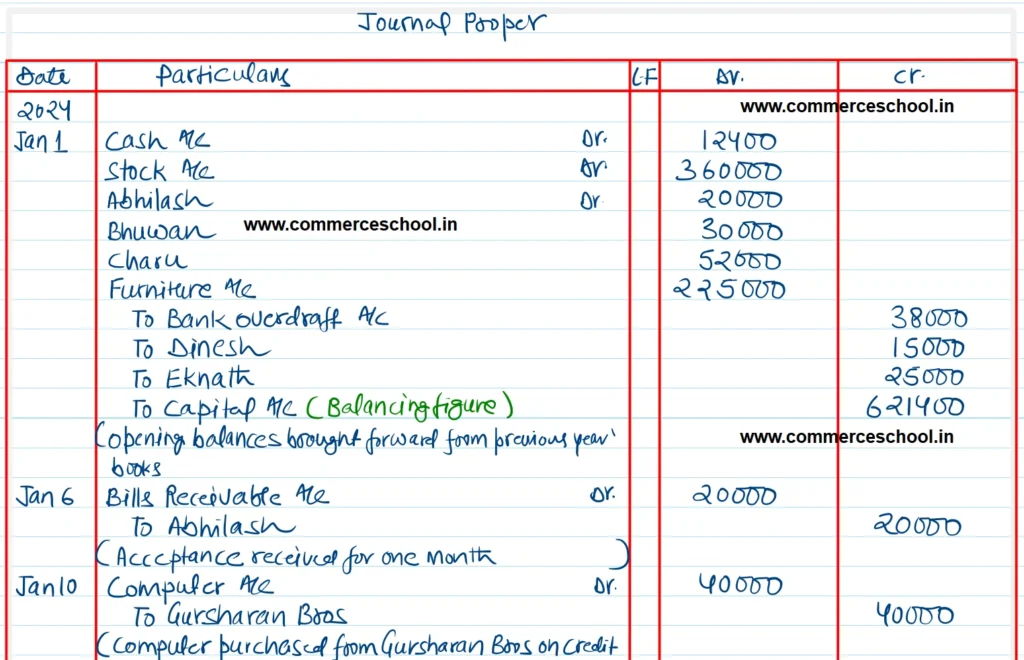

Enter the following transactions of a dealer in electrical goods in the appropriate subsidiary books:

| 2023 | ||

| Jan 1 | Assets: Cash in hand ₹ 12,400; Stock ₹ 3,60,000; Debtors: Abhilash ₹ 20,000; Bhuwan ₹ 30,000, Charu ₹ 52,000; Furniture ₹ 2,25,000. | |

| Liabilities: Bank Overdraft ₹ 38,000; Creditors : Dinesh ₹ 15,000, Eknath ₹ 25,000. | ||

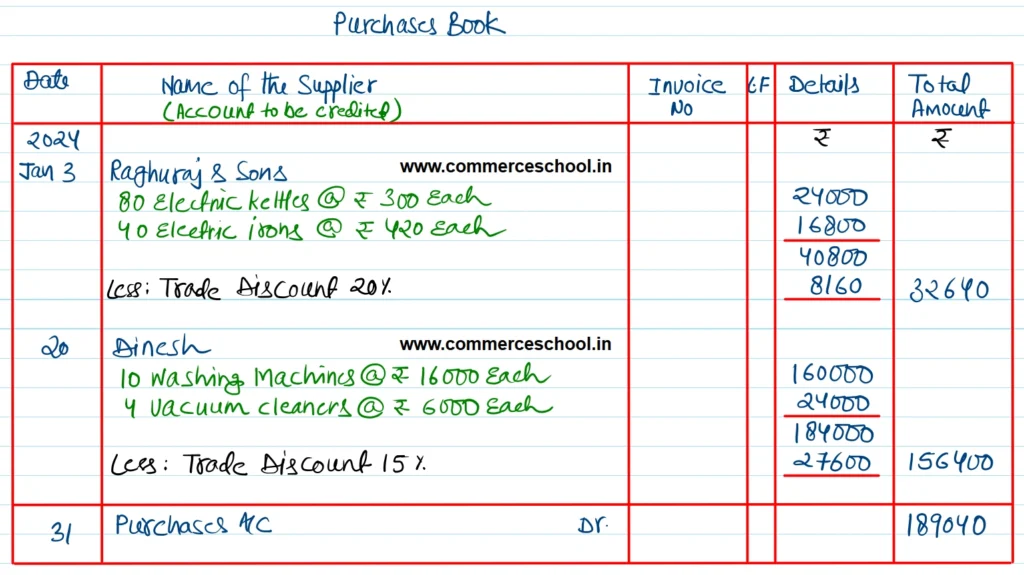

| 3 | Purchased from Raghuraj & Sons: 80 electric kettles @ ₹ 300 each 40 electric irons @ ₹ 420 each 20% Trade Discount | |

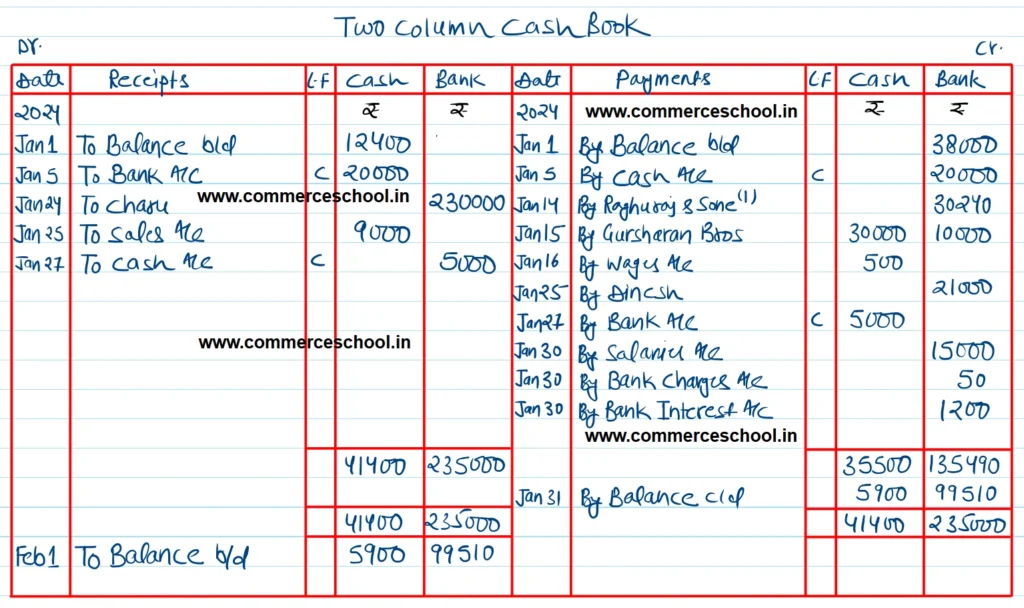

| 5 | Withdrew from Bank | 20,000 |

| 6 | Acceptance received from Abhilash at one month for the amount due from him. | |

| 10 | Purchased a computer from Gursharan Bros. on credit for office use | 40,000 |

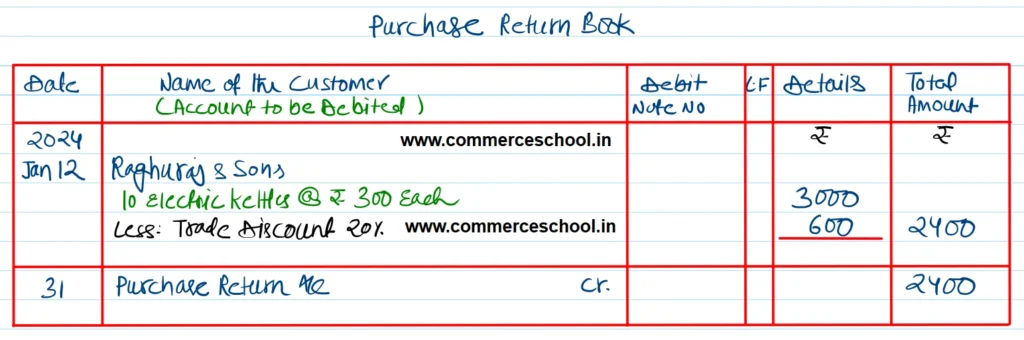

| 12 | Returned 10 electric kettles to Raghuraj & Sons. | |

| 14 | Paid Raghuraj & Sons by cheque the balance due to them. | |

| 15 | Paid to Gursharan Bros. ₹ 30,000 in cash and the balance by a cheque. | |

| 16 | Paid wages in cash | 500 |

| 20 | Purchased from Dinesh: 10 Washing Machines @ ₹ 16,000 each 4 Vacuum Cleaners @ ₹ 6,000 each 15% Trade Discount | |

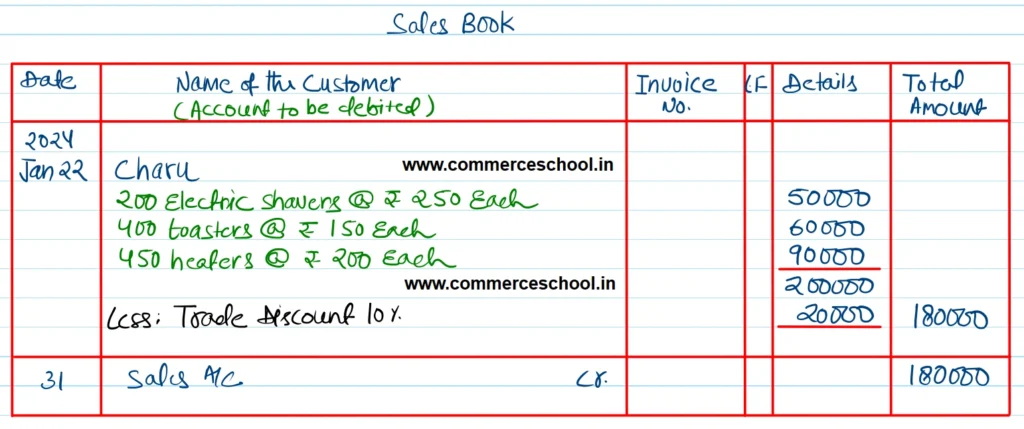

| 22 | Sold to Charu 200 electric shavers @ ₹ 250 each 400 toasters @ ₹ 150 each 450 heaters @ ₹ 200 each 10% Trade Discount | |

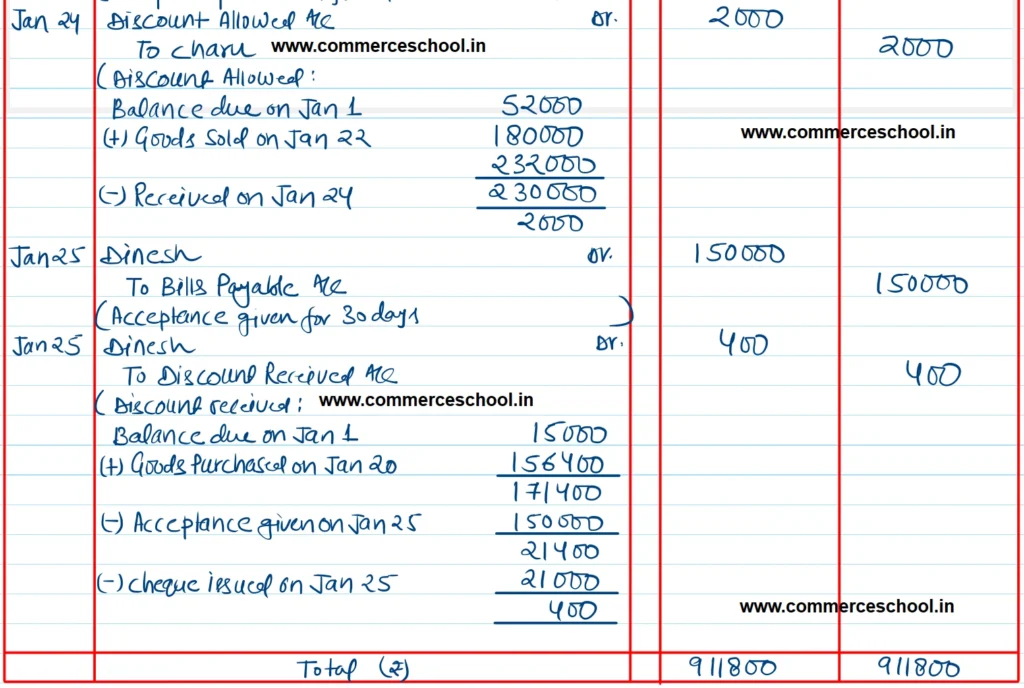

| 24 | Received from Charu a cheque in full settlement of his account. The cheque is paid into bank | 2,30,000 |

| 25 | Acceptance given to Dinesh for 30 days | 1,50,000 |

| 25 | Cheque issued to Dinesh in full settlement of his account | 21,000 |

| 25 | Sold for Cash 20 electric irons | 9,000 |

| 27 | Deposited into bank | 5,000 |

| 30 | Paid staff salaries by cheque | 15,000 |

| 30 | Bank charged incidental expenses ₹ 50 and charged interest ₹ 1,200 |

[Ans. Cash in hand ₹ 5,900; Cash at Bank ₹ 99,510; Total of Purchase Book ₹ 1,89,040; Sales Book ₹ 1,80,000; Purchase Return Book ₹ 2,400; Total of Journal Proper ₹ 9,11,800.]

Solution:-

Note:- Entries for discount allowed and discount received will be recorded in Journal Proper.

Below is the list of all solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |