[DK Goel] Q. 17 Financial Statements (without Adjustments) Solutions Class 11 CBSE (2025-26)

Solutions of Question number 17 of Chapter 20 Financial Statements (without Adjustments) DK Goel class 11 CBSE (2025-26)

From the following balances of the Ledger of Sh. Akhileshwar Singh, prepare Trading and Profit & Loss Account and Balance Sheet:-

| Particulars | Dr. (₹) | Cr. (₹) |

| Stock on 1-4-2022 | 30,000 | |

| Stock on 31-3-2023 | 46,200 | |

| Purchases and Sales | 2,30,000 | 3,45,800 |

| Returns | 12,500 | 15,200 |

| Commission on Purchases | 1,200 | |

| Freight and Carriage | 26,000 | |

| Wages and Salary | 10,800 | |

| Fire Insurance Premium | 820 | |

| Business Premises | 40,000 | |

| Sundry Debtors | 26,100 | |

| Sundry Creditors | 26,700 | |

| Goodwill | 8,000 | |

| Patents | 8,400 | |

| Coal, Gas and Power | 12,100 | |

| Printing and Stationery | 2,100 | |

| Postage | 710 | |

| Travelling Expenses | 4,250 | |

| Drawings | 7,200 | |

| Depreciation | 1,000 | |

| General Expenses | 8,350 | |

| Capital | 89,760 | |

| Investments | 8,000 | |

| Interest on Investments | 800 | |

| Cash in Hand | 2,570 | |

| Banker’s Account | 5,200 | |

| Commission | 4,600 | 4,400 |

| Loan on Mortgage | 30,000 | |

| Interest on Loan | 3,000 | |

| B/P | 2,280 | |

| B/R | 4,540 | |

| Income Tax | 3,000 | |

| Horses and Carts | 20,300 | |

| Discount on Purchases | 1,600 | |

| 5,21,740 | 5,21,740 |

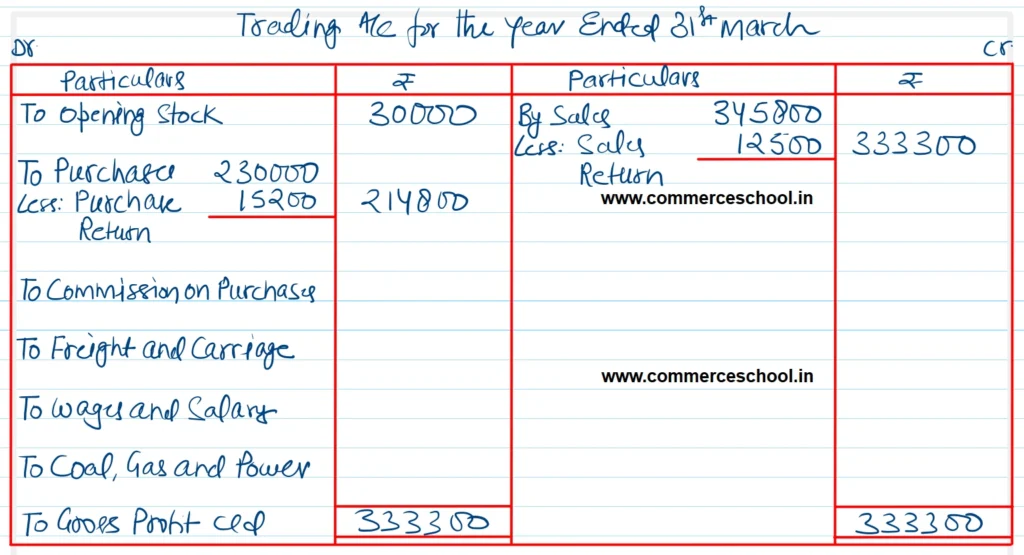

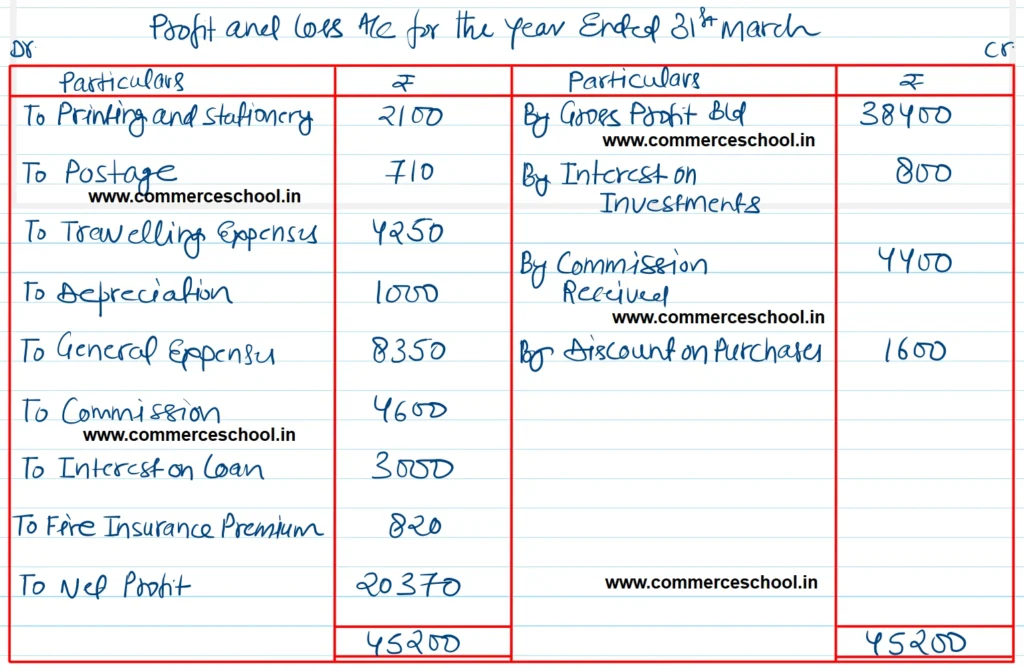

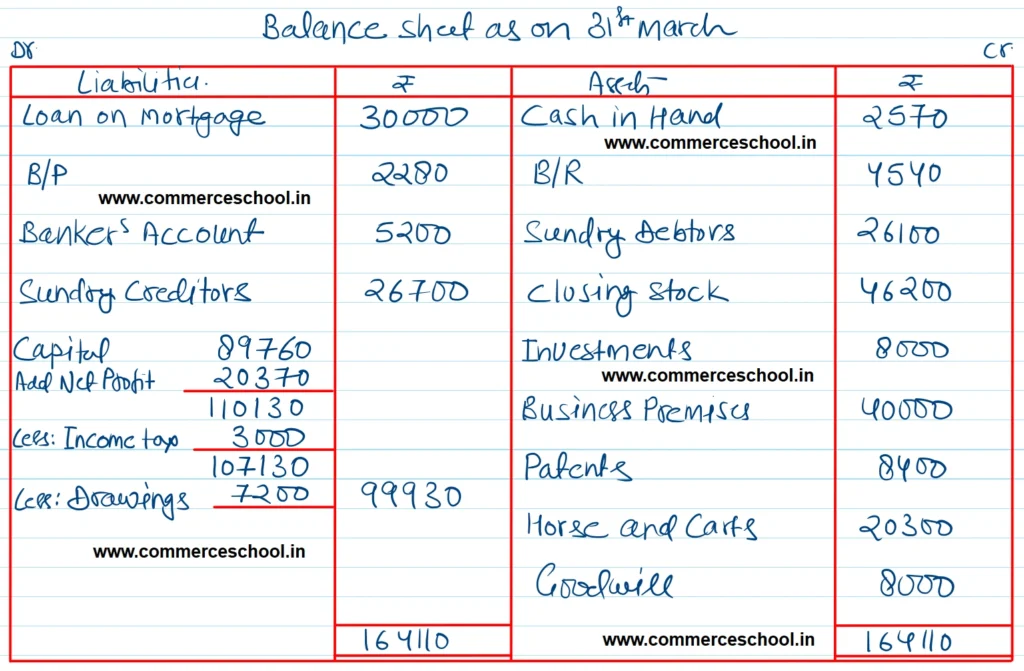

[Ans. Gross Profit ₹ 38,400; Net Profit ₹ 20,370 and Balance Sheet Total ₹ 1,64,110.]

Solution:-

Hints:-

- Closing stock appears inside the Trial Balance. As such, it will be shown only on the Assets side.

- ‘Investments’ will be shown on the Assets side and ‘Interest and Investments’ on the credit side of Profit & Loss Account.

- ‘Loan on Mortgage’ will be shown on the Liabilities side and ‘Interest on Loan’ on the debit side of Profit & Loss Account.

- Income Tax will be treated as Drawings.

- Commission on Purchases will be shown on the debit side of Trading Account.

Below is the list of all solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |