[DK Goel] Q. 18 Financial Statements (with Adjustments) Solutions Class 11 CBSE (2025-26)

Solutions of Question number 18 of Chapter 20 Financial Statements (with Adjustments) DK Goel class 11 CBSE (2025-26)

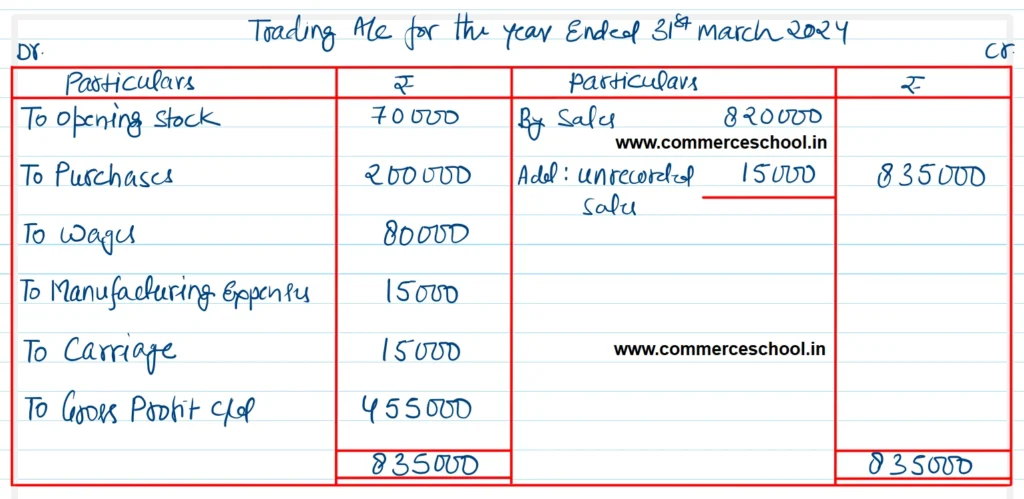

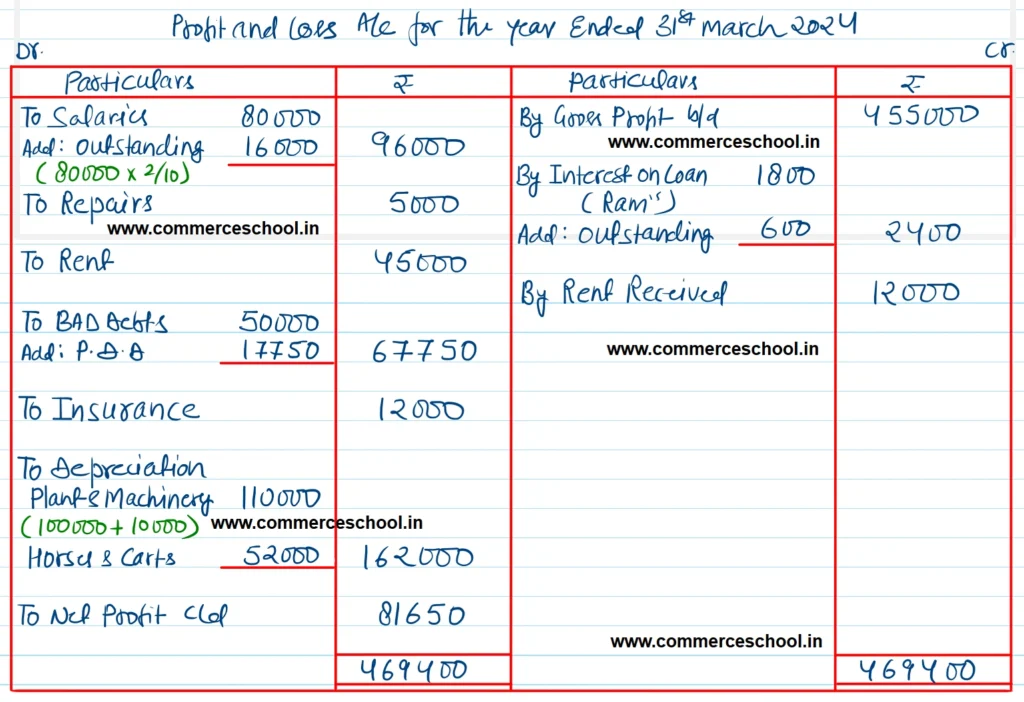

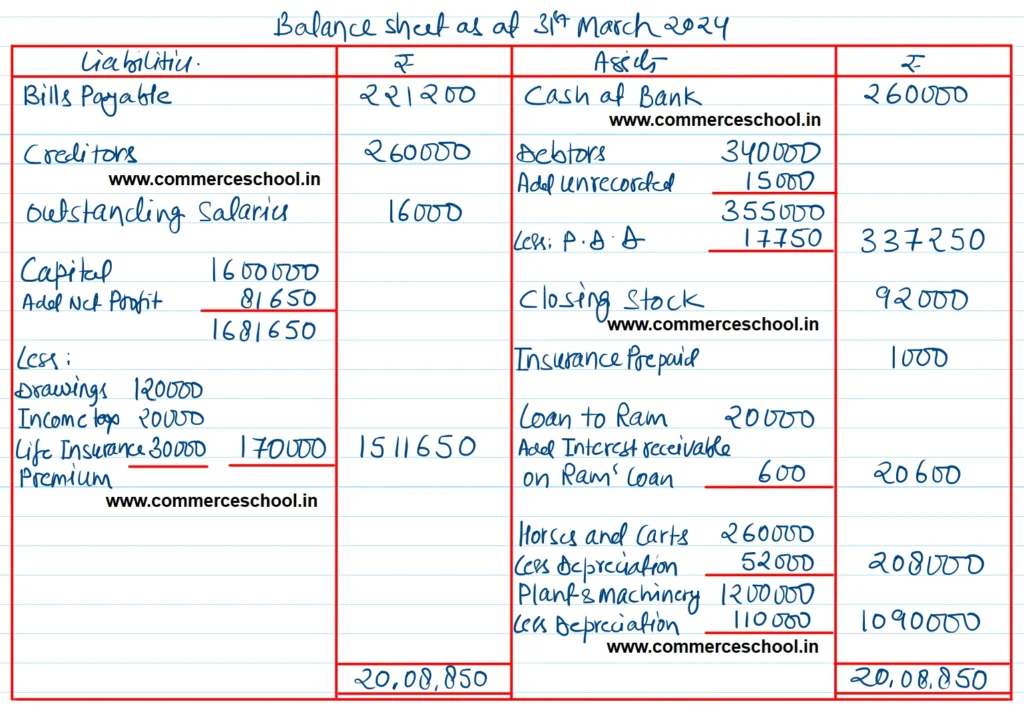

From the following Trial Balance extracted from the books of Sh. Pawan Kumar, prepare a Trading Account, Profit & Loss Account for the year ended 31st March, 2024 and a Balance Sheet a at that date:

| Dr. Balances | ₹ | Cr. Balances | ₹ |

| Drawings | 1,20,000 | Capital | 16,00,000 |

| Plant and Machinery | 12,00,000 | Creditors | 2,60,000 |

| Horses and Carts | 2,60,000 | Sales | 8,20,000 |

| Debtors | 3,40,000 | Bills Payable | 2,21,200 |

| Purchases | 2,00,000 | Interest on Ram’s Loan | 1,800 |

| Wages | 80,000 | Rent Received | 12,000 |

| Cash at Bank | 2,60,000 | ||

| Salaries | 80,000 | ||

| Repairs | 5,000 | ||

| Stock (1.4.2023) | 70,000 | ||

| Stock (31.3.2024) | 92,000 | ||

| Rent | 45,000 | ||

| Manufacturing expenses | 15,000 | ||

| Bad-Debts | 50,000 | ||

| Carriage | 15,000 | ||

| Income Tax | 20,000 | ||

| Life Insurance Premium | 30,000 | ||

| Loan to Ram at 12% p.a. | 20,000 | ||

| Insurance | 12,000 | ||

| Insurance Prepaid | 1,000 | ||

| 29,15,000 | 29,15,000 |

Adjustments:-

(1) Plant and Machinery includes a new machinery purchased on 1st October, 2023 for ₹ 2,00,000.

(2) Depreciate Plant and Machinery by 10% p.a. and Horses and Carts by 20% p.a.

(3) Salaries for the month of February and March 2024 are outstanding.

(4) Goods worth ₹ 15,000 were sold and depatched on 27th March but no entry was passed to this effect.

(5) Make a provision for Doubtful Debts at 5% on Debtors.

[Ans. G.P. ₹ 4,55,000; Net Profit ₹ 81,650; B/S Total ₹ 20,08,850.]

Solution:-

Hints:-

(1) In adjustment no. 1 no recording will be made of ₹ 2,00,000. However, depreciation will be charged as:

On ₹ 10,00,000 @ 10% for one year = ₹ 1,00,000

On ₹ 2,00,000 @ 10% for half year = ₹ 10,000

(2) Closing Stock and Prepaid Insurance are given inside the Trial Balance. As such, these will be recorded on the Assets side only.

(3) Total Drawings = ₹ 1,20,000 + ₹ 20,000 + ₹ 30,000 = ₹ 1,70,000.

(4) Sales of ₹ 15,000 will be added in sales as well as in debtors.

Below is the list of all solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |