[DK Goel] Q. 19 Financial Statements (with Adjustments) Solutions Class 11 CBSE (2025-26)

Solutions of Question number 19 of Chapter 20 Financial Statements (with Adjustments) DK Goel class 11 CBSE (2025-26)

From the following Trial Balance of Geeta, you are required to prepare:

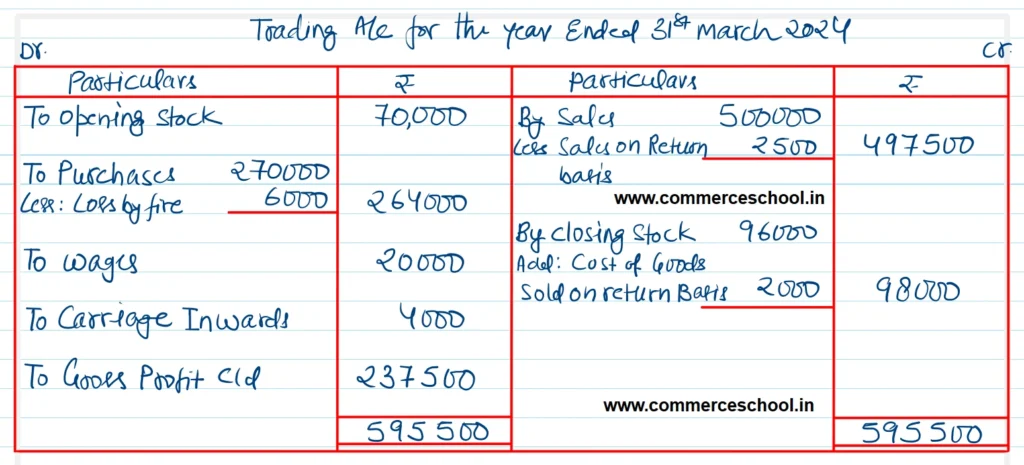

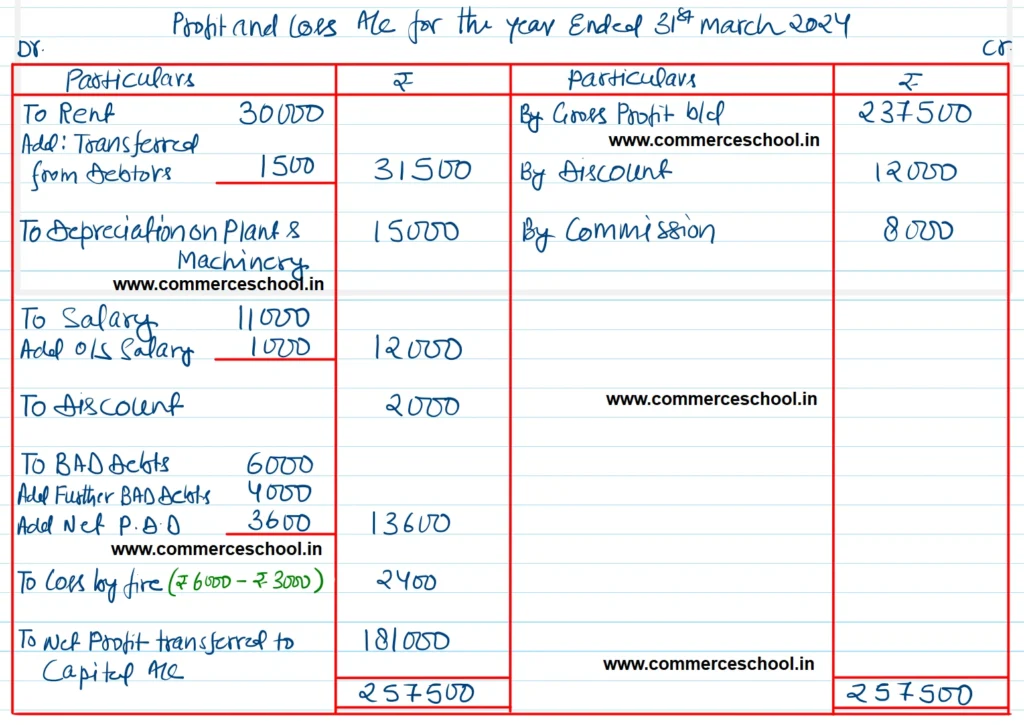

(i) Trading and Profit and Loss Account for the year ended on 31st March, 2019, and

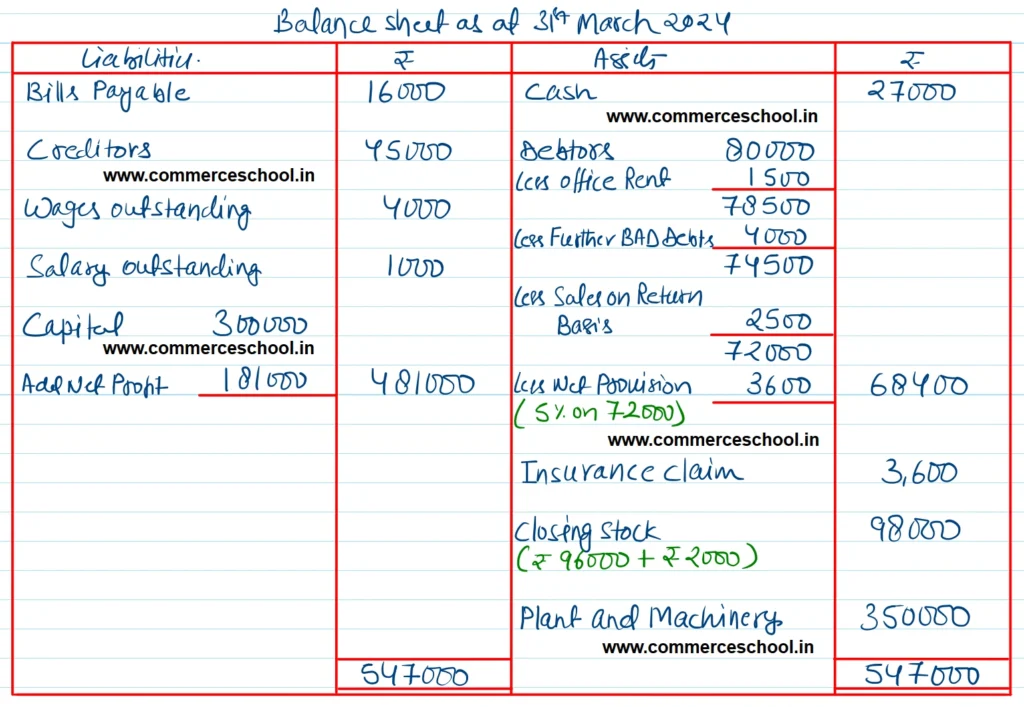

(ii) Balance Sheet as at that date.

| Debit Balances | ₹ | Credit Balances | ₹ |

| Stock on 01.04.2018 | 70,000 | Capital | 3,00,000 |

| Plant and Machinery | 3,50,000 | Wages Outstanding | 4,000 |

| Rent | 30,000 | Sales | 5,00,000 |

| Depreciation on Plant and Machinery | 15,000 | Creditors | 45,000 |

| Wages | 20,000 | Bills Payables | 16,000 |

| Salary for 11 months | 11,000 | Discount | 12,000 |

| Cash | 27,000 | Commission | 8,000 |

| Purchases | 2,70,000 | ||

| Debtors | 80,000 | ||

| Discount | 2,000 | ||

| Carriage Inwards | 4,000 | ||

| Bad Debts | 6,000 | ||

| 8,85,000 | 8,85,000 |

Adjustments:

(i) Stock on 31st March, 2019 was ₹ 96,000.

(ii) Stock destroyed by fire was ₹ 6,000 and the Insurance Company accepted a claim for ₹ 3,600.

(iii) ₹ 1,500 paid as rent of the office was debited to Landlord’s account (included in Debtors).

(iv) Write off further bad debts ₹ 4,000.

(v) Sales include sales on return basis. Approval for sale of ₹ 2,500 has not been received till 31.03.2019. The rate of gross profit on this sale was 25% on cost.

(vi) Create a provision for Doubtful Debts on Debtors 5%.

[Ans. Gross Profit ₹ 2,37,500; Net Profit ₹ 1,81,000; Balance Sheet total ₹ 5,47,000.]

Solution:-

Hints:

(i) ₹ 2,500 will be deducted from Sales and Debtors for cancellation of sales on a return basis. Also, the cost of such goods i.e., ₹ 2,000 will be added to Closing Stock.

(2) New Provision will be 5% on ₹ 72,000.

Below is the list of all solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |