[DK Goel] Q. 20 Accounts from Incomplete Records Solutions Class 11 CBSE (2025-26)

Solutions of Question number 20 of Chapter 22 Accounts from Incomplete Records DK Goel class 11 CBSE (2025-26)

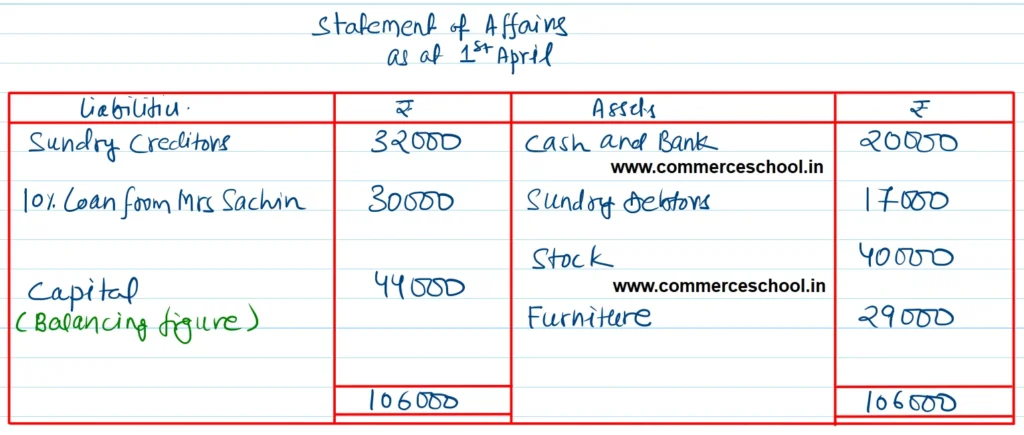

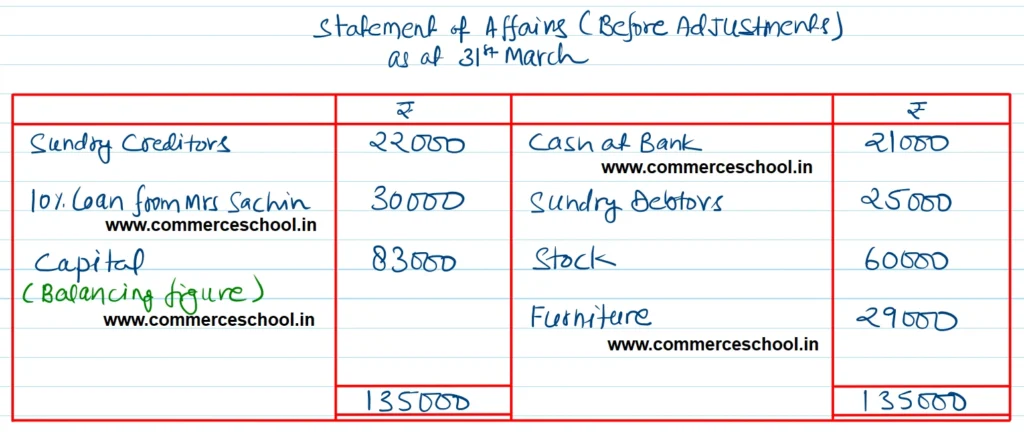

The following information is available from Sachin, who maintains books of accounts on single entry system:

| 1st Apirl, 2022 (₹) | 31st March, 2023 (₹) | |

| Cash at Bank | 20,000 | 21,000 |

| Sundry Debtors | 17,000 | 25,000 |

| Stock | 40,000 | 60,000 |

| Furniture | 29,000 | 29,000 |

| Sundry Creditors | 32,000 | 22,000 |

| 10% Loan from Mrs Sachin | 30,000 | 30,000 |

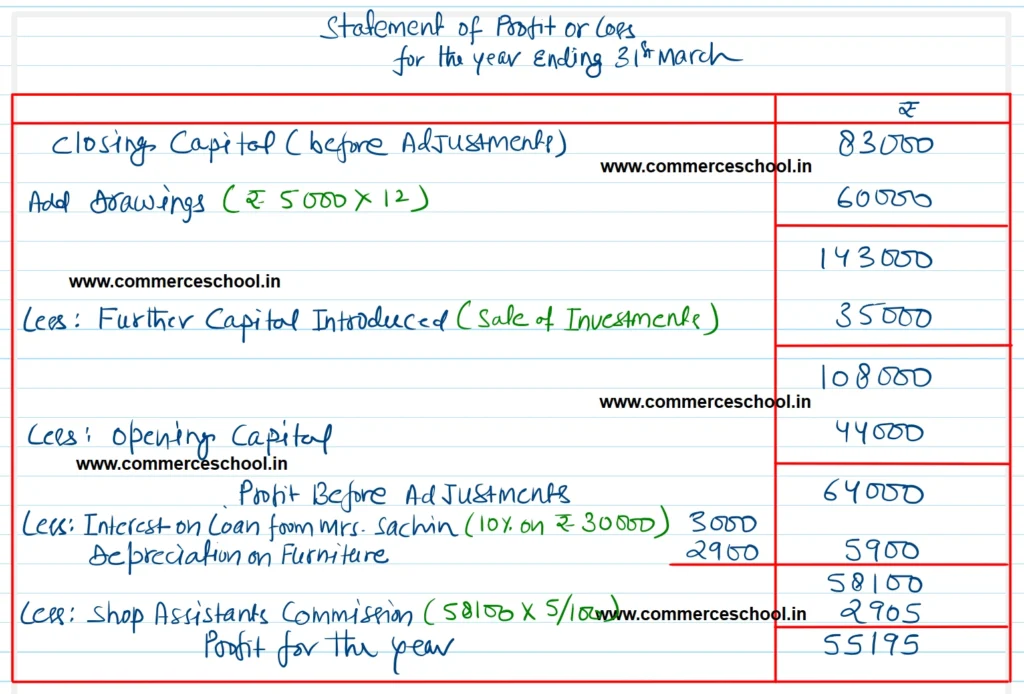

Sachin withdrew ₹ 5,000 from the business every month for meeting his household expenses. During the year, he sold investments held by him privately for ₹ 35,000 and invested the amount in his business.

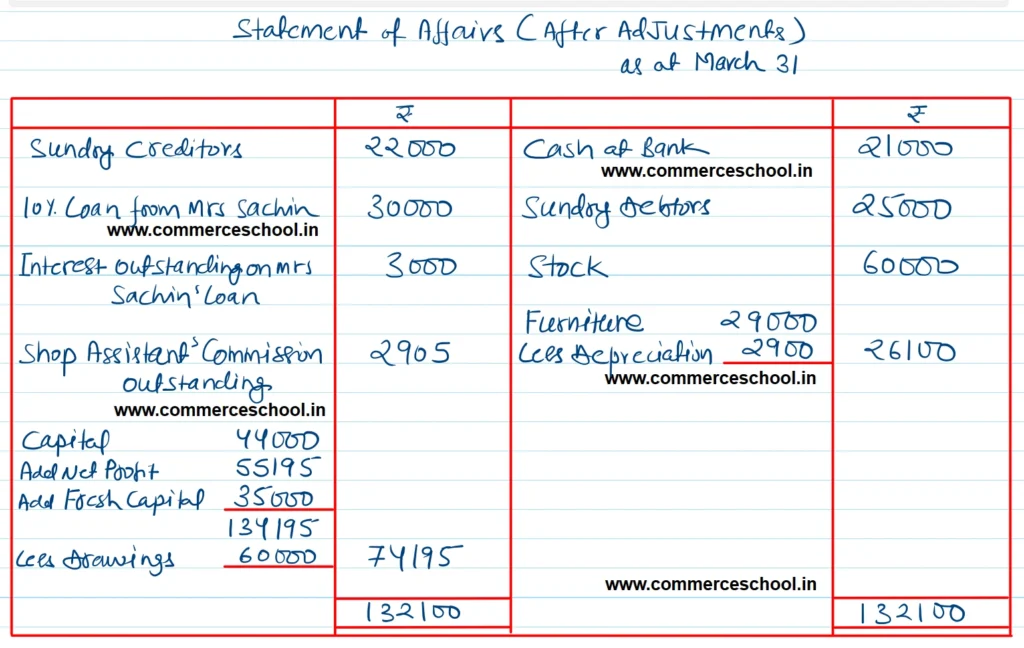

At the end of the year 2022-23, it was found that full year’s interest on loan from Mrs. Sachin had not been paid. Depreciation @ 10% per annum was to be provided on furniture for the full year. Shop assistant was to be given a share of 5% on the profits ascertained before charging such share.

Calculate profit earned during the year ended 31st March, 2023 by Sachin.

[Ans. Opening Capital ₹ 44,000; closing Capital ₹ 83,000; Net Profit ₹ 55,195; Total of Final Statement of Affairs ₹ 1,32,100.]

Hint: Shop Assistant’s Share will be 5/100 of 58,100.

Solution:-