[DK Goel] Q. 21 Accounts from Incomplete Records Solutions Class 11 CBSE (2025-26)

Solutions of Question number 21 of Chapter 22 Accounts from Incomplete Records DK Goel class 11 CBSE (2025-26)

A retail Trader has not kept proper books of accounts. Ascertain his profit or loss for the year ending 31st March, 2023, and prepare a final statement of affairs from the following information:

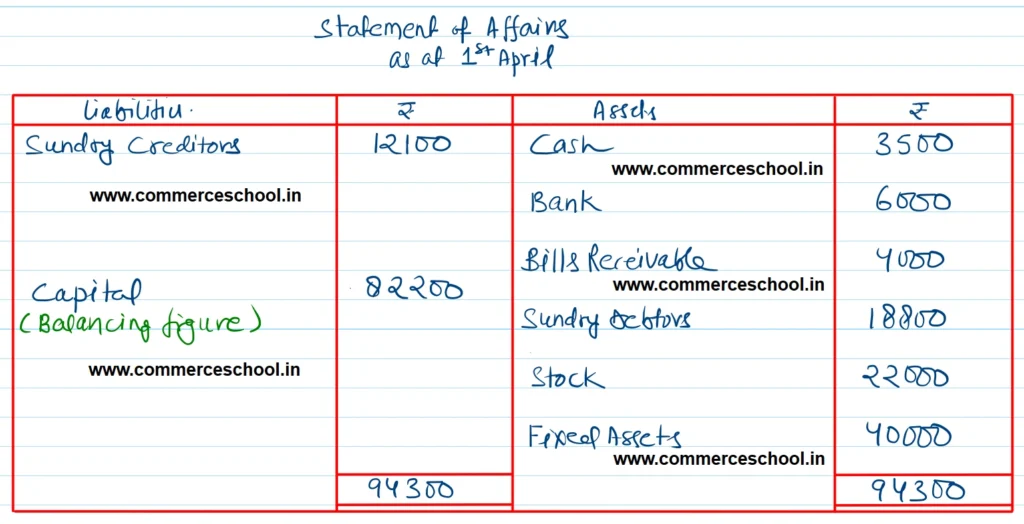

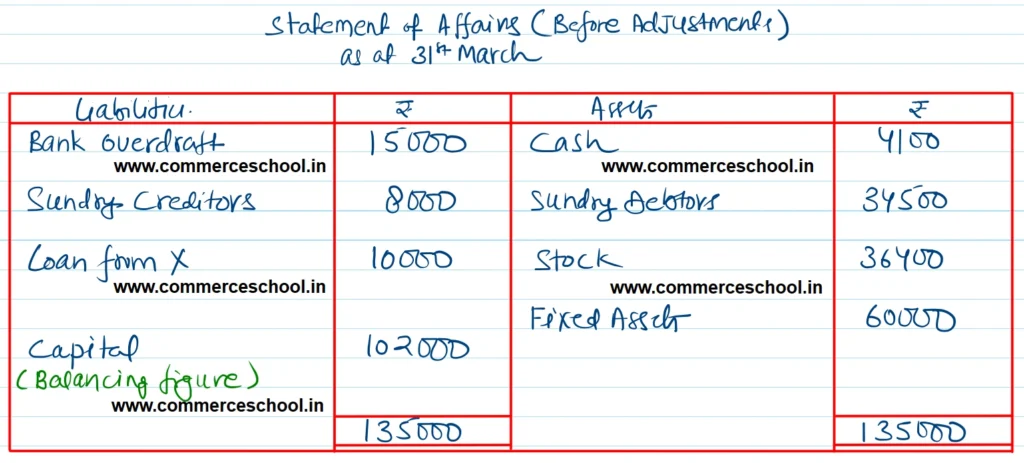

| 1st April, 2022 (₹) | 31st March, 2023 (₹) | |

| Cash Balance | 3,500 | 4,100 |

| Bank Balance | Dr. 6,000 | Cr. 15,000 |

| Stock | 22,000 | 36,400 |

| Sundry Debtors | 18,800 | 34,500 |

| Sundry Creditors | 12,100 | 8,000 |

| Loan from X | – | 10,000 |

| Bills Receivable | 4,000 | – |

| Fixed Assets | 40,000 | 60,000 |

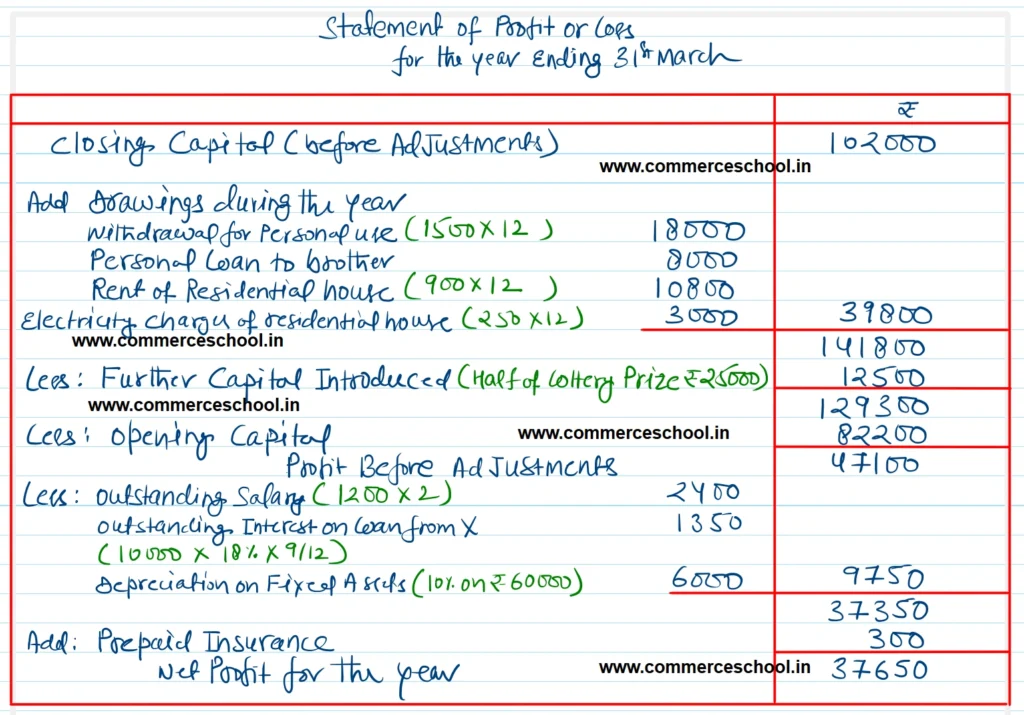

He withdrew from the business ₹ 1,500 per month for his personal use and ₹ 8,000 for giving a personal loan to his brother. He also used a house for his personal purposes, the rent of which at the rate of ₹ 900 per month and electricity charges at an average rate of ₹ 250 per month were paid from the business account.

He had received a lottery prize of ₹ 25,000, out of which he invested half the amount in business.

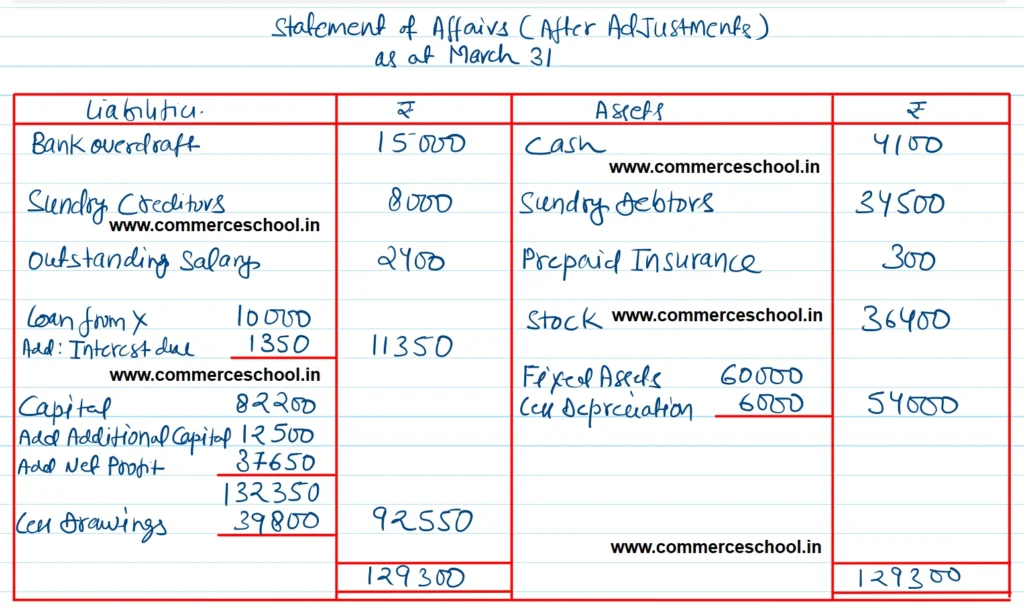

He has not paid two months’ salary to his clerk @ ₹ 1,200 per month, but insurance premium @ ₹ 600 per annum was paid on 1st October, 2022 to run for one year.

Loan from X was taken on 1st July, 2022 on which interest was unpaid @ 18% p.a. Fixed assets are to be depreciated @ 10% p.a.

[Ans. Opening Capital ₹ 82,200; Closing Capital ₹ 1,02,000. Net Profit ₹ 37,650; Total of Final Statement of Affairs ₹ 1,29,300.]

Solution:-

Hint: Personal loan given to the brother will be treated as Drawings.