[DK Goel] Q. 21 Financial Statements (with Adjustments) Solutions Class 11 CBSE (2025-26)

Solutions of Question number 21 of Chapter 20 Financial Statements (with Adjustments) DK Goel class 11 CBSE (2025-26)

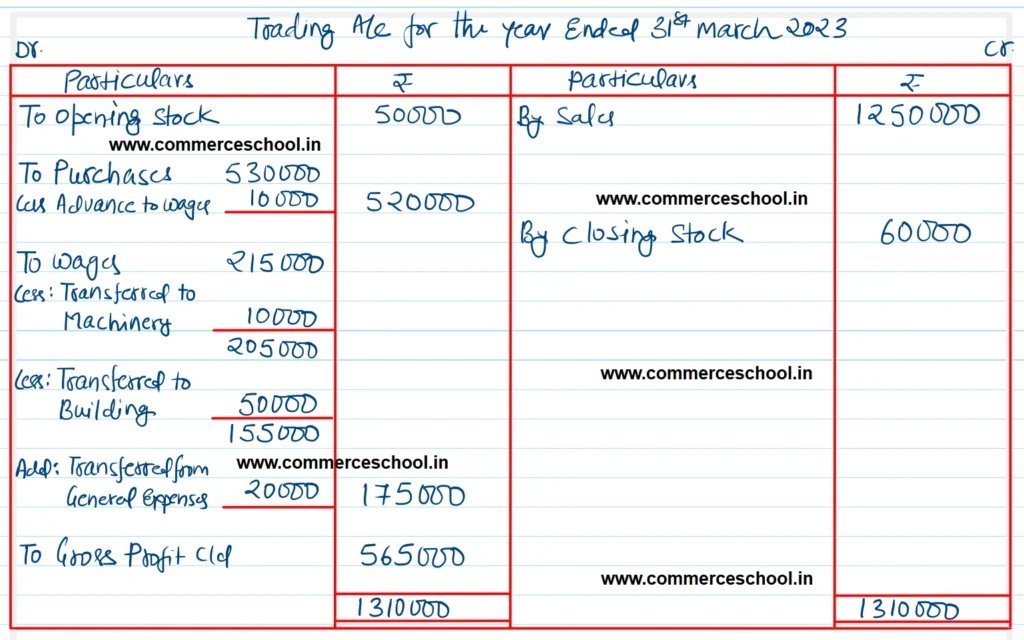

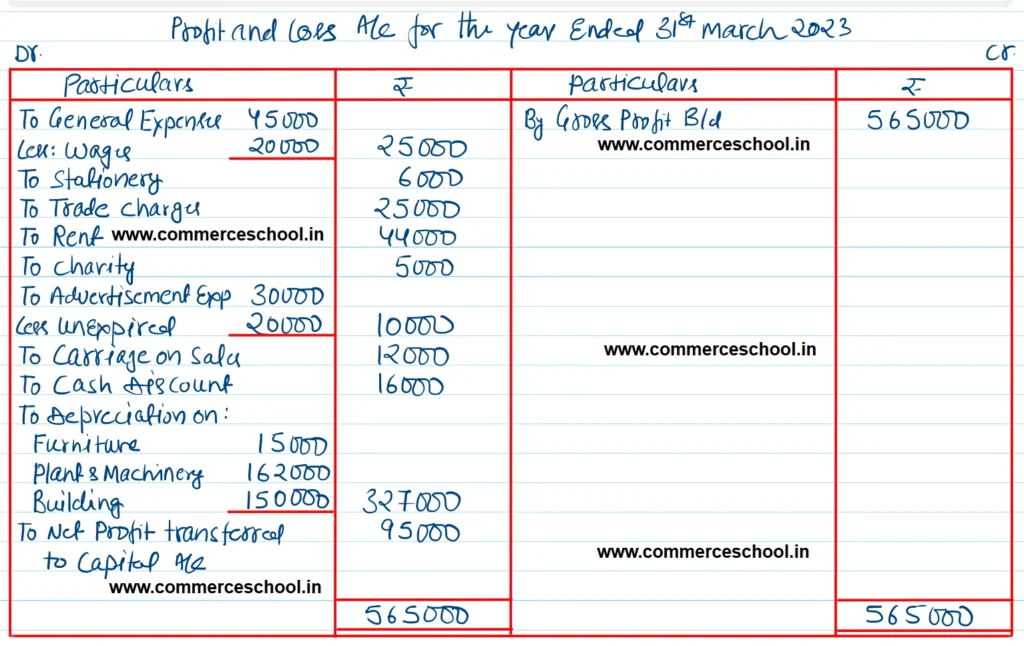

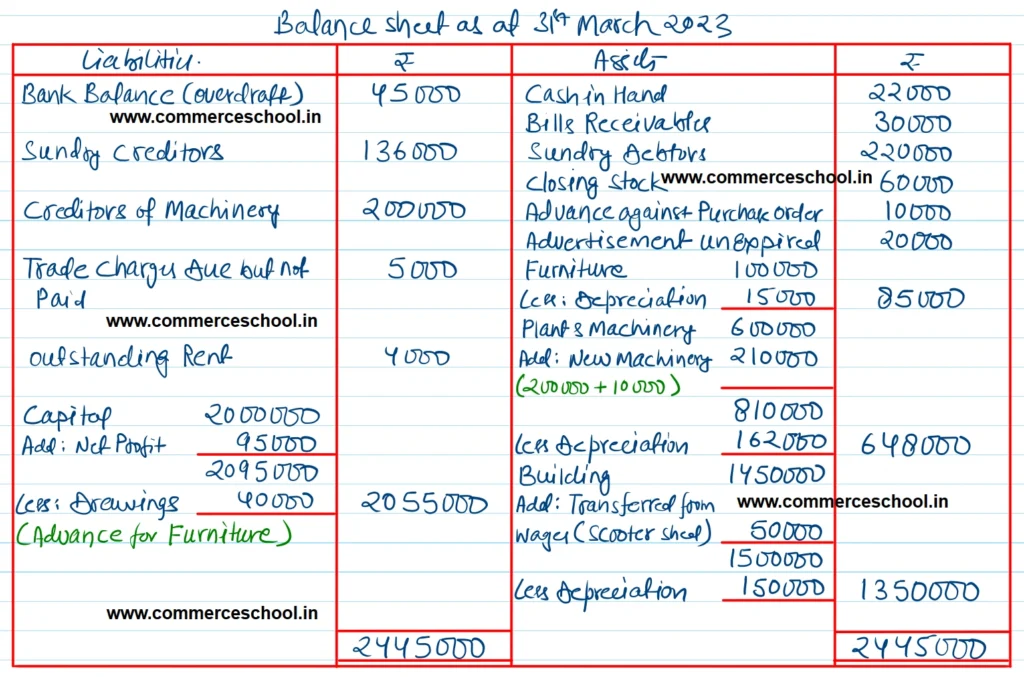

From the following Trial Balance of Sh. Swamy Narain, prepare Trading and Profit and Loss Account for the year ended 31st March 2023 and a Balance Sheet as at that date:

| Dr. Balances | ₹ | Cr. Balances | ₹ |

| Opening Stock | 50,000 | Capital | 20,00,000 |

| Purchases | 5,30,000 | Sales | 12,50,000 |

| General Expenses | 45,000 | Sundry Creditors | 1,36,000 |

| Stationery | 6,000 | Trade Charges due but not paid | 5,000 |

| Wages | 2,15,000 | Outstanding Rent | 4,000 |

| Trade Charges | 25,000 | Bank Balance | 45,000 |

| Rent | 44,000 | ||

| Charity | 5,000 | ||

| Advertisement Expenses | 30,000 | ||

| Carriage on Sales | 12,000 | ||

| Bills Receivables | 30,000 | ||

| Sundry Debtors | 2,20,000 | ||

| Cash Discount | 16,000 | ||

| Cash in Hand | 22,000 | ||

| Furniture | 1,00,000 | ||

| Advance for Furniture | 40,000 | ||

| Plant & Machinery | 6,00,000 | ||

| Building | 14,50,000 | ||

| 34,40,000 | 34,40,000 |

Adjustments:

(i) Stock on 31st March, 2023 was valued at ₹ 60,000.

(ii) A new machine was installed during the year costing ₹ 2,00,000 but it was not recorded in the books. Wages paid for its installation ₹ 10,000 have been debited to Wages Account.

(iii) An advance of ₹ 10,000 given alongwith purchase order was wrongly recorded in purchases.

(iv) General expenses include ₹ 20,000 paid for Wages.

(v) Wages include a sum of ₹ 50,000 spent on the erection of a Scooter Stand for employees.

(vi) Advance for Furniture is for furniture at proprietor’s residence.

(vii) Depreciate Furniture at 15% , Plant & Machinery at 20% and Building at 10%.

(viii) Carry forward 2/3 of Advertisement Expenses as unexpired.

(ix) A B/R of ₹ 20,000 was discounted with bank on 15 Nov. 2022, but not yet matured.

[Ans. Gross Profit ₹ 5,65,000; Net Profit ₹ 95,000; Balance Sheet Total ₹ 24,45,000.]

Solution:-

Hints:

(i) Creditors for Machinery ₹ 2,00,000 will be shown in Liabilities. Depreciation on Plant & Machinery ₹ 1,62,000.

(ii) ₹ 50,000 spent on scooter stand will be added to Building. Depreciation on Building ₹ 1,50,000.

(iii) Advance for ₹ 10,000 alongwith purchase order will be shown on asset side.

(iv) B/R discounted will not be recorded since it is contingent liability. As contingent Liability of ₹ 20,000 in respect of B/R discounted with bank, not yet matured.

Below is the list of all solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |