[DK Goel] Q. 21, Q. 22 Bank Reconciliation Statements Solutions Class 11 CBSE (2025-26)

Solutions of Question number 21 and 22 of Chapter 16 Bank Reconciliation Statements DK Goel class 11 CBSE (2025-26)

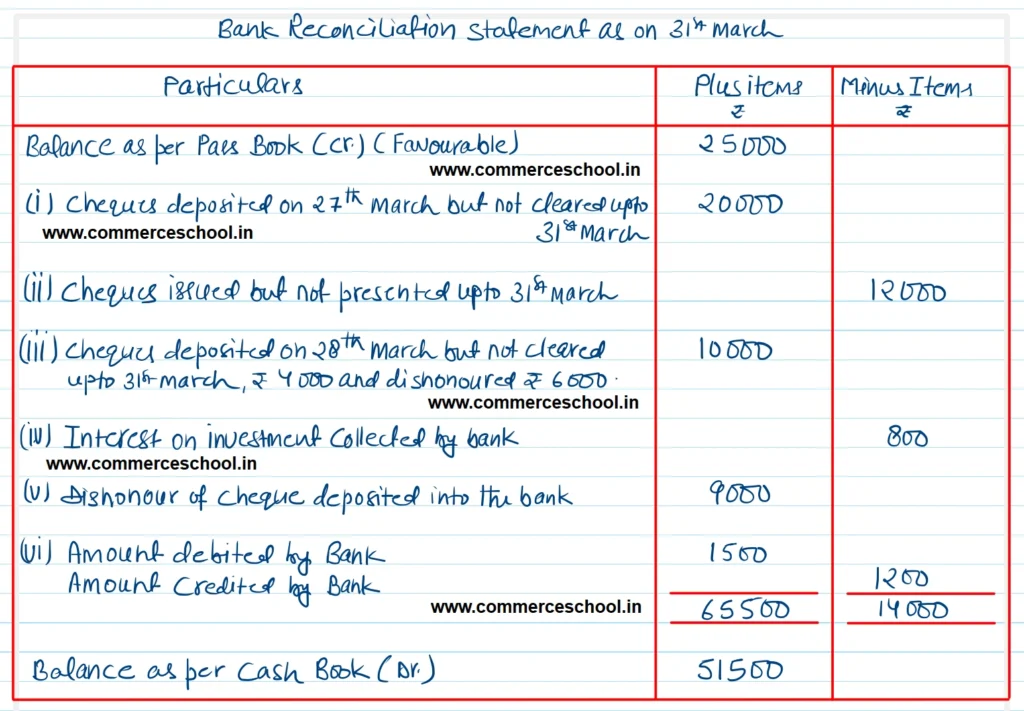

Q. 21. On 31st March, 2023, Pass Book showed a balance of ₹ 25,000. Prepare a Bank Reconciliation Statement from the following particulars:

(i) Cheques of ₹ 20,000 were deposited in Bank on 27th March, 2023, out of which cheques of ₹ 5,000 were cleared on 1st April, 2023. Rest are not cleared.

(ii) On 29th March, 2023, cheques were issued amounting to ₹ 15,000, out of which cheques of ₹ 3,000 were presented in March, ₹ 4,000 on 2nd April and rest were not presented.

(iii) Cheques of ₹ 10,000 were deposited in Bank on 28th March, 2023, out of which cheques of ₹ 4,000 were cleared on 2nd April, 2023 and rest are dishonoured.

(iv) Interest on investment collected by bank does not appear in the Cash Book ₹ 800.

(v) A cheque of ₹ 9,000 deposited into bank was dishonoured on 30th March, 2023 but no intimation was received from the bank till 31st March.

(vi) Bank has debited ₹ 1,500 and credited ₹ 1,200 in our account.

[Ans. Dr. Balance as per Cash Book ₹ 51,500.]

Solution:-

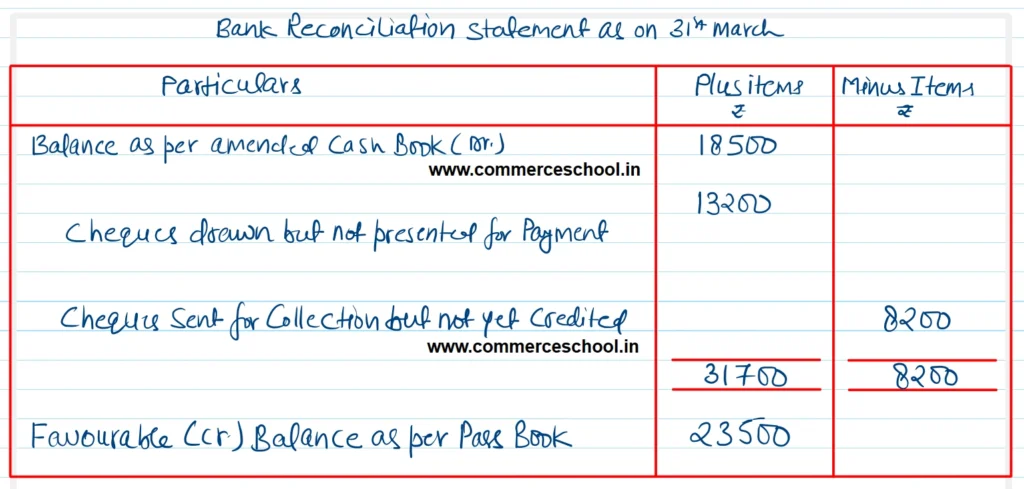

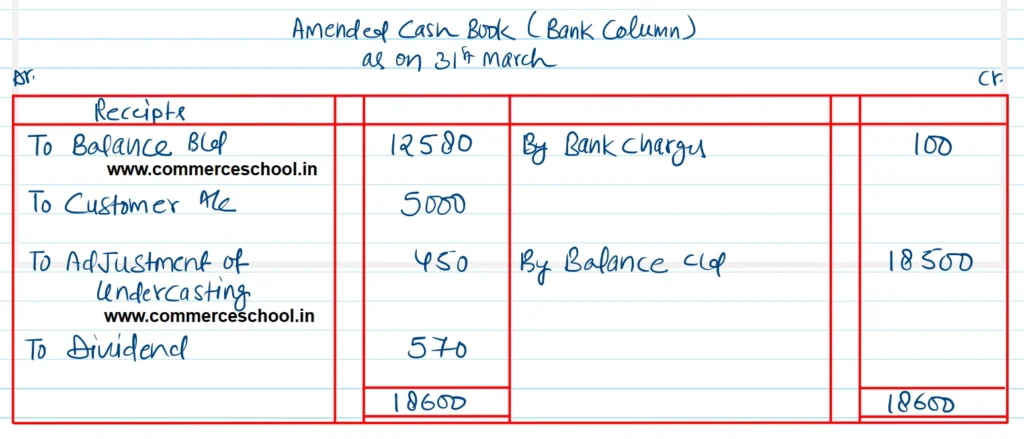

Q. 22. On 31st March, 2023 the Cash Book of Gopal disclosed a balance of ₹ 12,580. On checking entries in the Cash Book with the bank statement, it was ascertained that:

(i) Cheques amounting to ₹ 18,000 were drawn on 25th March, of which cheques of ₹ 4,800 were cashed before 31st March.

(ii) Cheques for ₹ 18,000 were sent for collection out of which cheques fro ₹ 8,200 were credited by bank after 31st March.

(iii) An amount of ₹ 5,000 paid directly into the merchant’s account by a customer was not entered in the Cash Book.

(iv) On 31st March, cash was deposited into the bank ₹ 12,720 but the cashier debited the bank account with ₹ 12,270 by mistake.

(v) Dividend collected by bank on our behalf ₹ 570 does not appear in the Cash Book.

(vi) ₹ 300 is entered in the bank statement as bank charges. This was recorded as ₹ 200 in the cash book.

You are required:

(i) to prepare the Amended Cash Book, and

(ii) then prepare a Bank Reconciliation Statement.

[Ans. (i) Amended balance as per Cash Book ₹ 18,500; (ii) Bank balance as per Pass Book ₹ 23,500.]

Solution:-

Hint: In item no. (iv), ₹ 450 will be recorded on the Debit Side of amended cash book.

Below is the list of all solutions