[DK Goel] Q. 24 Financial Statements (with Adjustments) Solutions Class 11 CBSE (2025-26)

Solutions of Question number 24 of Chapter 20 Financial Statements (with Adjustments) DK Goel class 11 CBSE (2025-26)

Following are balances from the trial balance of Ritesh Traders as at 31st March 2023:

| Particulars | ₹ | Particulars | ₹ |

| Opening Stock | 5,620 | Interest on Securities | 6,400 |

| Purchases | 1,54,200 | Land and Building | 10,00,000 |

| Sales | 3,74,800 | Securites | 6,00,000 |

| Wages | 1,26,000 | Cash in Hand | 25,600 |

| Carriage Inward | 900 | Bank Overdraft | 3,40,000 |

| Freight on Purchase | 4,900 | Discount Allowed | 1,500 |

| Salaries | 8,000 | Discount Received | 420 |

| Insurance | 2,800 | Bills Payable | 4,000 |

| Repair to Machinery | 1,400 | Loan (Cr.) | 11,000 |

| Drawings | 5,600 | Bills Receivable | 7,000 |

| Customer’s A/c | 15,800 | Capital Account | 13,47,600 |

| Postage | 500 | Suppliers A/c | 40,000 |

| Trade Expenses | 1,000 | X’s Loan (Cr.) | 18,600 |

| Plant and Machinery | 1,82,000 |

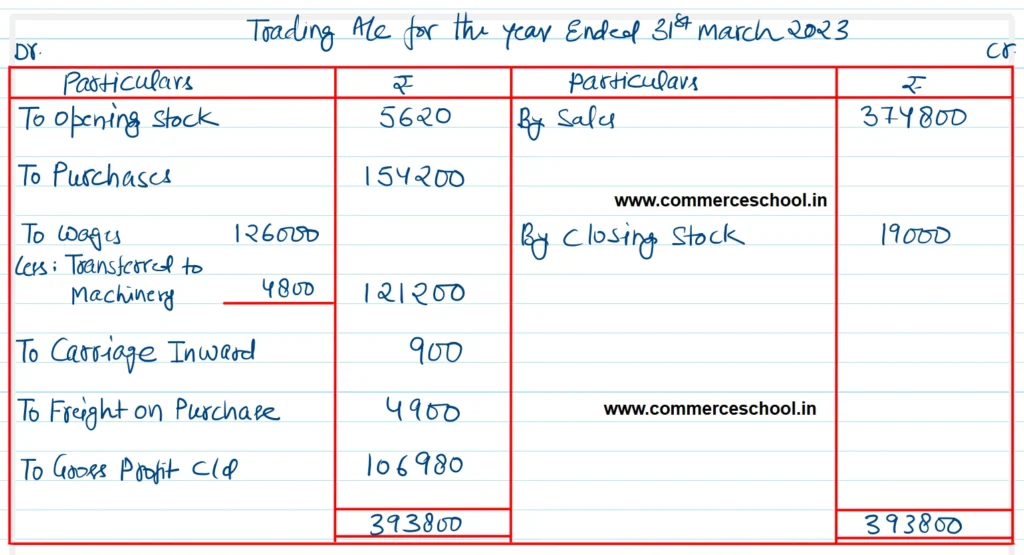

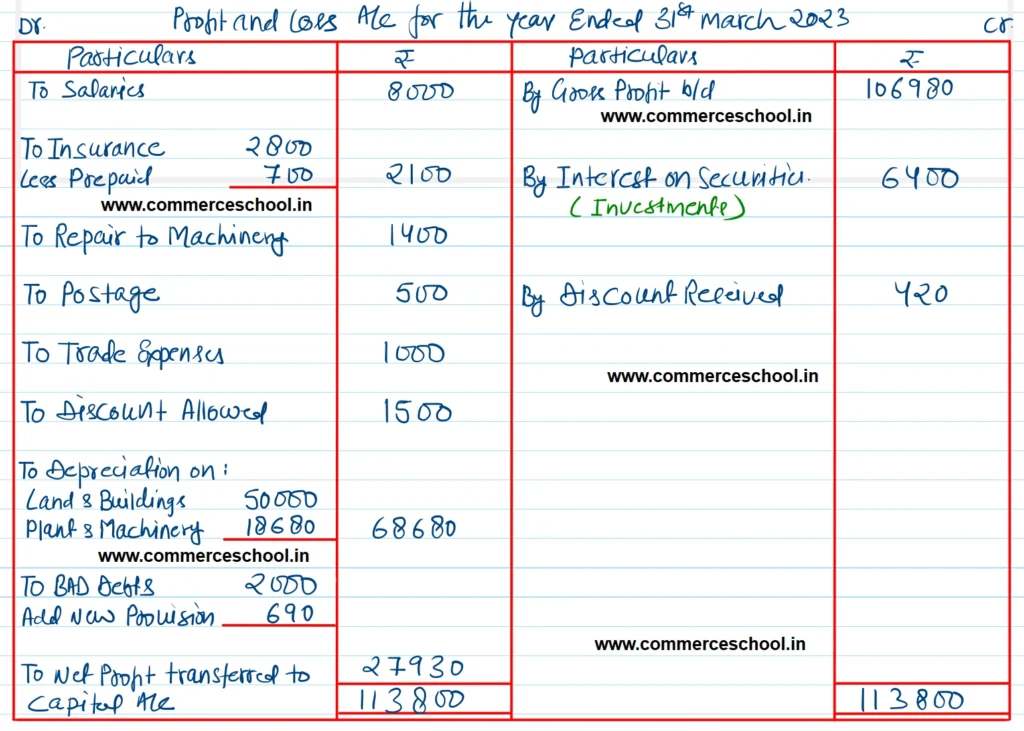

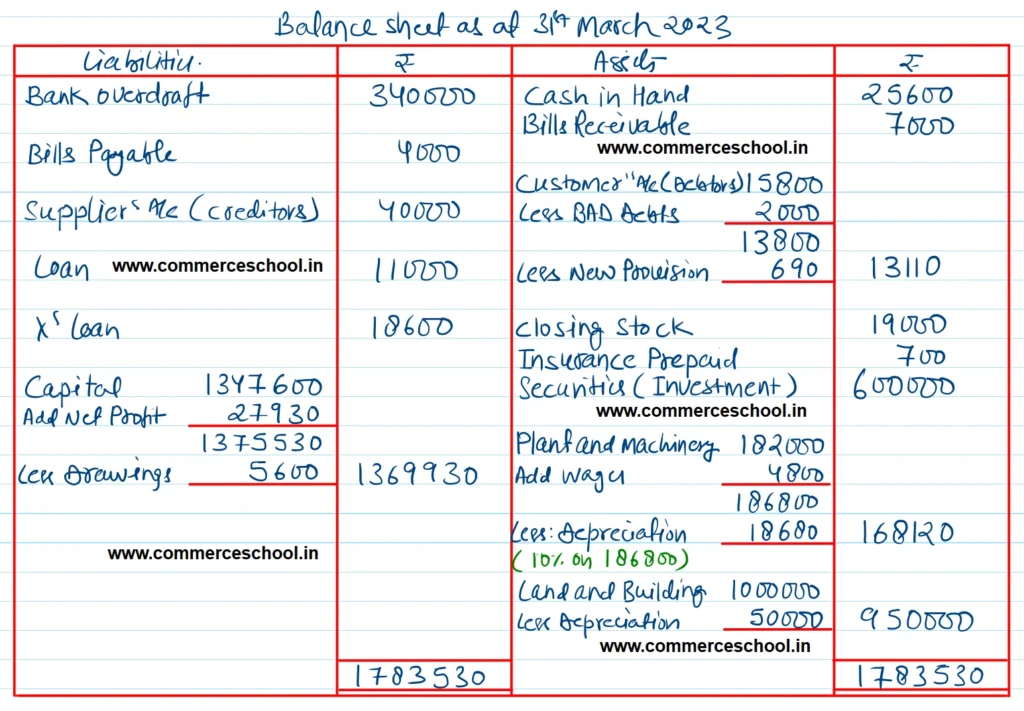

Prepare Trading and Profit & Loss Account for the year ended 31st March 2023 and Balance Sheet as at that date after taking into account the following adjustments:

(i) Closing Stock was valued at ₹ 19,000.

(ii) Depreciation to be provided on Land and Building @ 5% p.a. and on Plant & Machinery @ 10% p.a.

(iii) Write off ₹ 2,000 as Bad Debt.

(iv) Insurance was prepaid ₹ 700.

(v) Create provision for doubtful debts @ 5% on debtors.

(vi) Wages include ₹ 4,800 for installation of a new machinery.

[Ans. Gross Profit ₹ 1,06,980; Net Profit ₹ 27,930; Balance Sheet Total ₹ 17,83,530.]

Solution:-

Hints:

(i) Customer’s A/c means Debtors A/c

(ii) Supplier’s A/c means Creditors A/c

(iii) Repairs to Machinery will appear on Dr. side of P & L A/c

(iv) Securities means Investments. It will appear on the assets side of Balance Sheet.

(v) Interest on Securities will appear on the Cr. side of P & L A/c.

Below is the list of all solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |