[DK Goel] Q. 28 Financial Statements (with Adjustments) Solutions Class 11 CBSE (2025-26)

Solutions of Question number 28 of Chapter 20 Financial Statements (with Adjustments) DK Goel class 11 CBSE (2025-26)

The following is the trial balance of Mr. Amar Chand as at 31st March, 2023:

| Dr. (₹) | Cr. (₹) | |

| Stock on 1st April, 2022 | 62,000 | |

| Purchases and Sales | 3,15,000 | 4,48,000 |

| Returns | 3,700 | 2,500 |

| Sundry Debtors and Creditors | 80,000 | 43,000 |

| Bills Receivable and Payable | 12,100 | 4,300 |

| Drawings and Capital | 30,000 | 2,00,000 |

| Cash in Hand | 24,800 | |

| Balance with Bank of Tokyo | 32,800 | |

| Discount | 2,600 | |

| Carriage on Purchases | 7,500 | |

| Carriage on Sales | 1,200 | |

| Bad-Debts | 2,400 | |

| Bad-Debts Provision | 3,000 | |

| Furniture on 1st April, 2022 | 10,000 | |

| New Furniture purchased on 1st January, 2023 | 6,000 | |

| Rent | 10,000 | |

| Salaries | 25,000 | |

| Commission | 2,400 | |

| Repairs | 2,300 | |

| Insurance (Annual Premium paid on 1st Jan, 2023) | 3,600 | |

| Salaries Outstanding | 5,000 | |

| Sales Van | 75,000 | |

| Sales Van Expenses | 6,000 | |

| 7,12,000 | 7,12,000 |

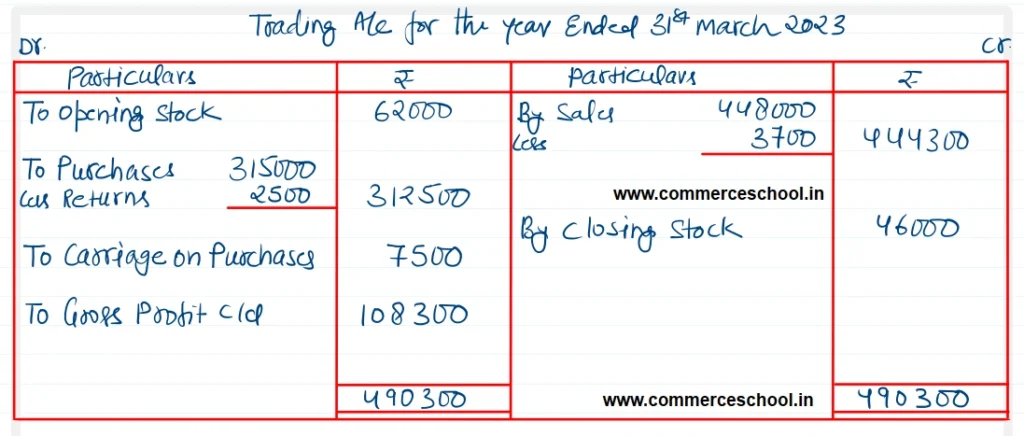

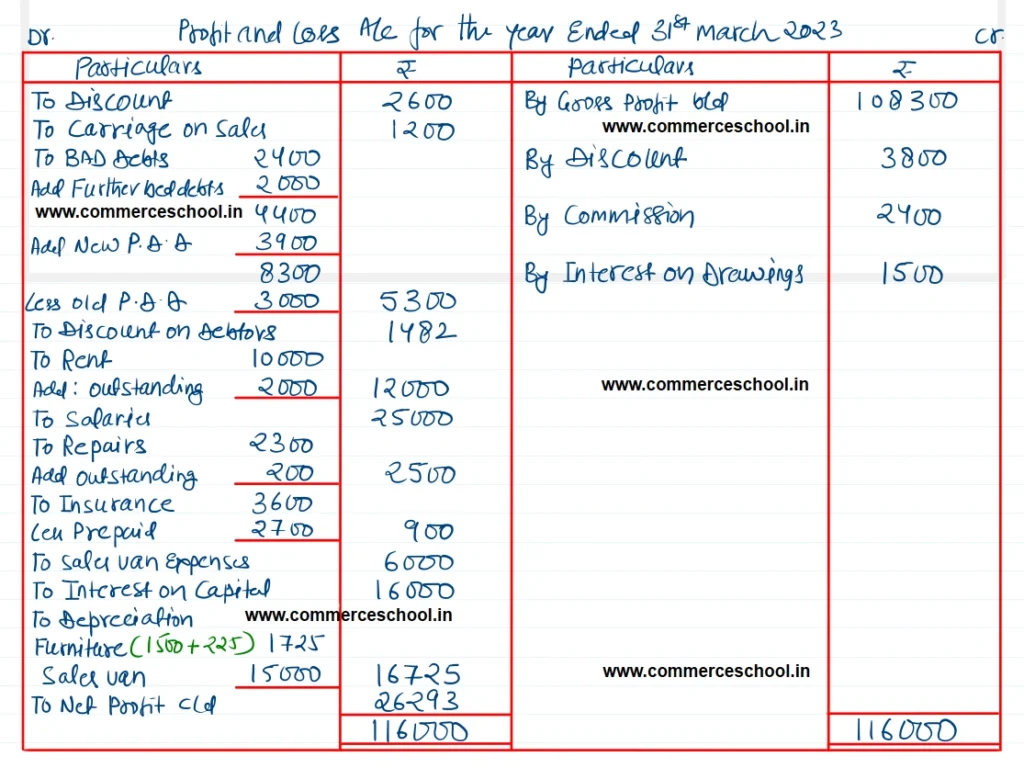

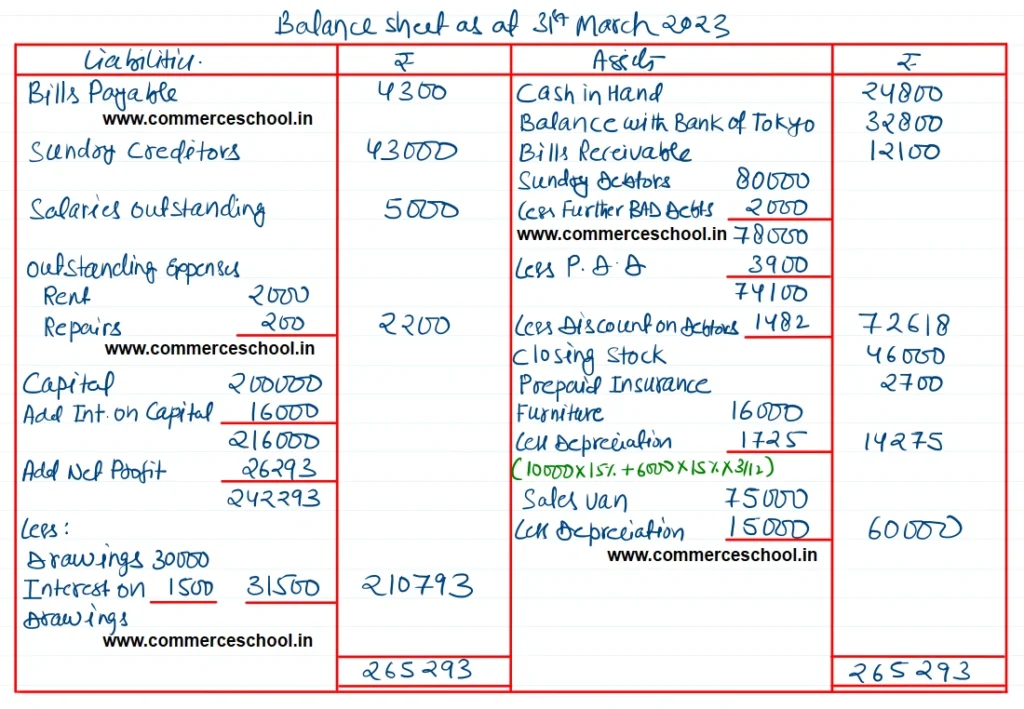

Taking into account the following adjustments, prepare Trading and Profit & Loss Account and the Balance Sheet as at 31st March, 2023:-

(1) Stock on 31st March, 2023 was valued at ₹ 46,000.

(2) Depreciate Furniture at 15% p.a. and Sales Van at 20% p.a.

(3) A sum of ₹ 200 is due for repairs.

(4) Write off ₹ 2,000 as further bad-debts and create a provision for doubtful debts @ 5% on Debtors. Also provide 2% for discount on Debtors.

(5) Rent is paid at the rate of ₹ 1,000 per month.

(6) Allow 8% interest on Capital and Charge ₹ 1,500 as interest on Drawings.

[Ans. Gross Profit ₹ 1,08,300; Net Profit ₹ 26,293; Balance Sheet Total ₹ 2,65,293.]

Solution:-

Below is the list of all solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |