[DK Goel] Q. 35 Depreciation Solutions Class 11 CBSE (2025-26)

Solutions of Question number 35 of the Depreciation chapter DK Goel class 11 CBSE (2025-26)

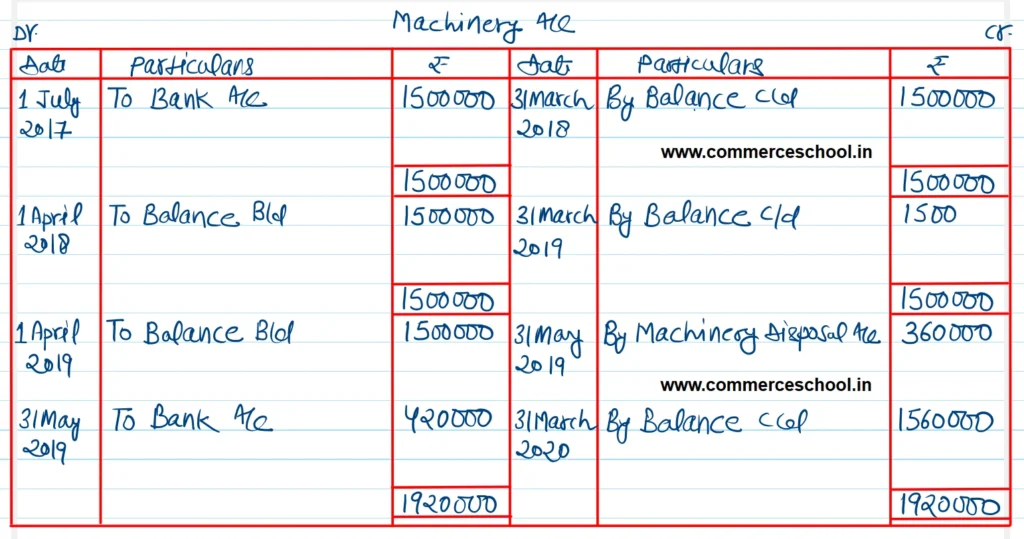

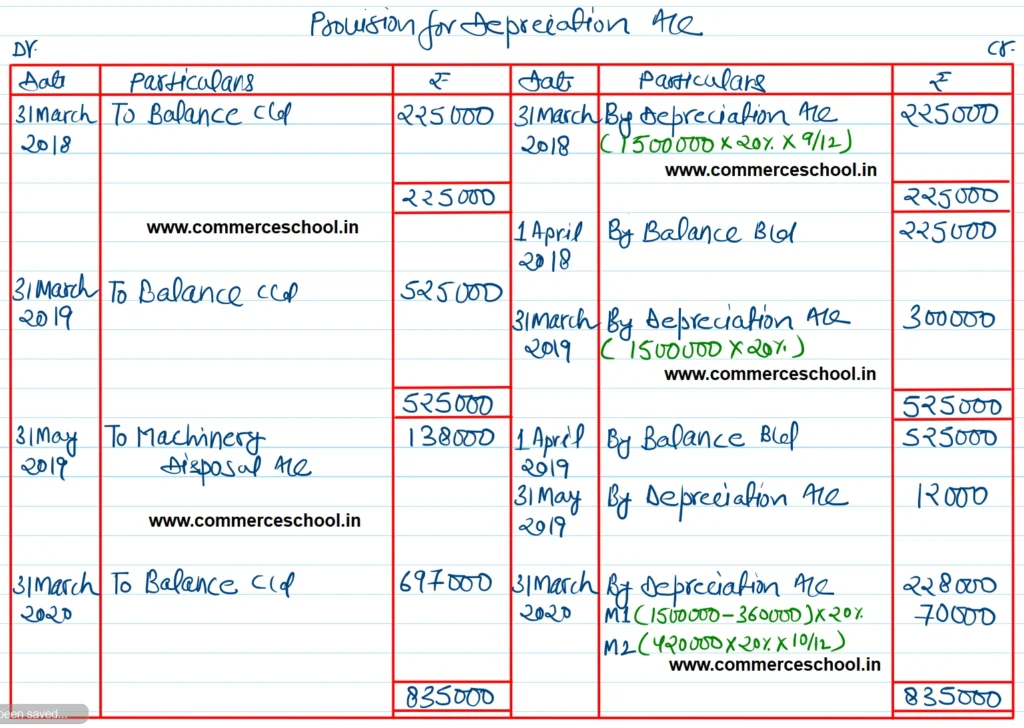

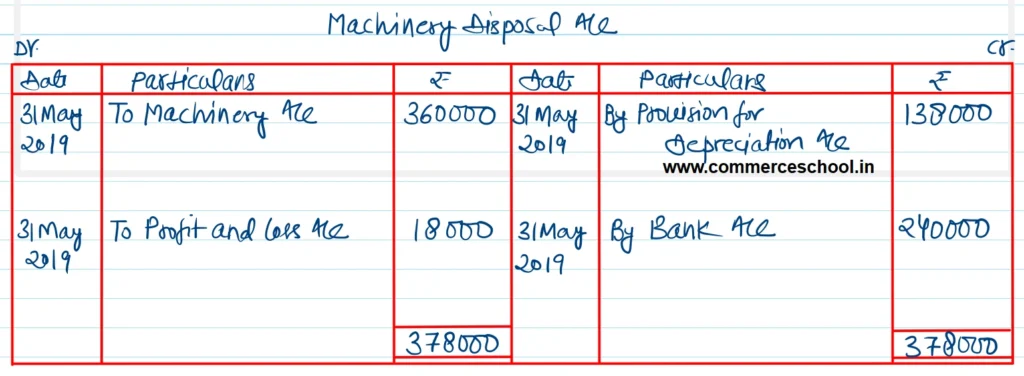

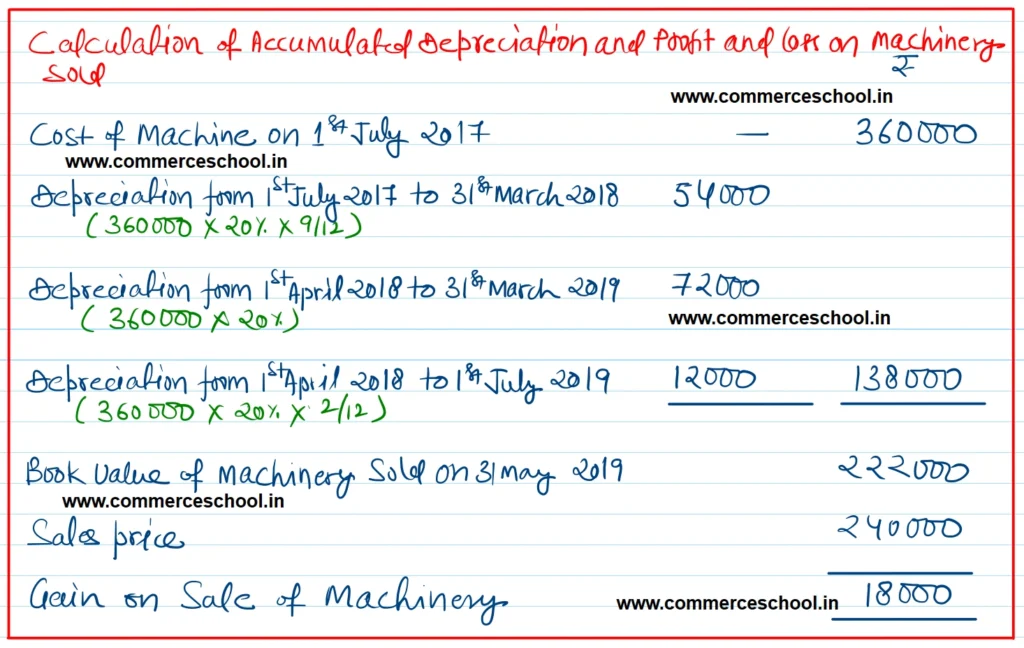

On 1st July, 2017, X Ltd. purchased a machinery for ₹ 15,00,00. Depreciation is provided @ 20% p.a. on the original cost of the machinery and books are closed on 31st March each year. On 31st May, 2019, a part of this machine purchased on 1st July 2017 for ₹ 3,60,000 was sold for ₹ 2,40,000 and on the same date new machinery was purchased for ₹ 4,20,000. You are required to prepare (a) Machinery Account, (b) Provision for Depreciation Account, and (c) Machinery Disposal Account.

[Ans. Balance of Machinery A/c on 31st March, 2020 ₹ 15,60,000; Balance of Provision for Dep. A/c on 31st March, 2020 ₹ 6,97,000; Gain on sale of Machinery ₹ 18,000.]

Solution:-

Below is the list of all solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |