[DK Goel] Q. 37, Q. 38 Bank Reconciliation Statements Solutions Class 11 CBSE (2025-26)

Solutions of Question number 37 and 38 of Chapter 16 Bank Reconciliation Statements DK Goel class 11 CBSE (2025-26)

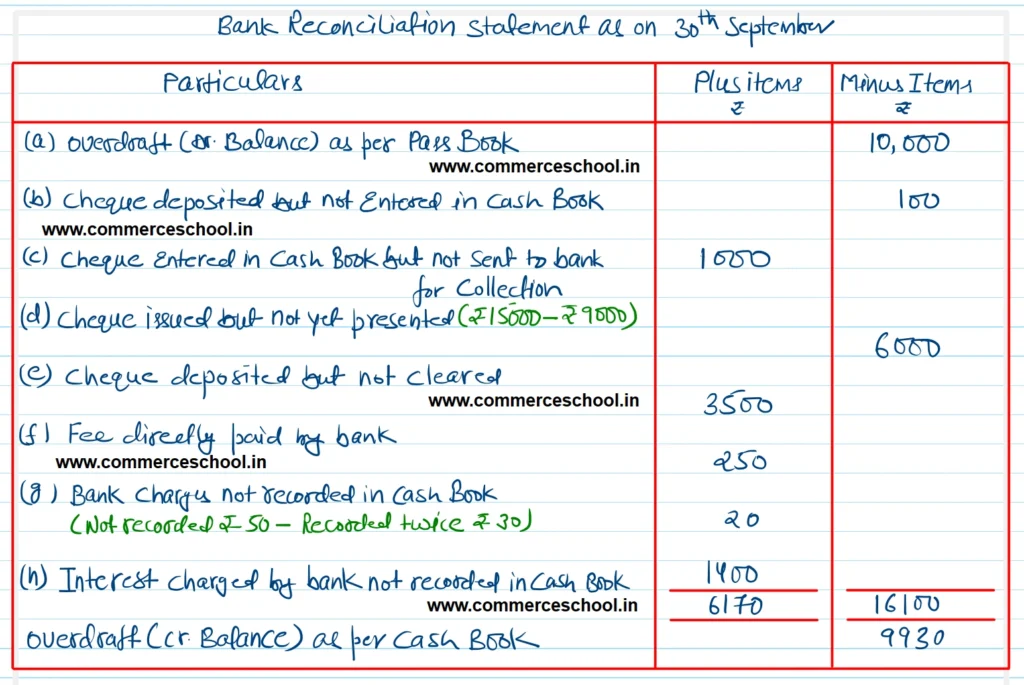

Q. 37. From the following particulars, prepare a Bank Reconciliation Statement of Alpha Electronic Motor Private Ltd. as on 30th September, 2024:

(a) Overdraft on 30th September 2024 as per Pass Book ₹ 10,000.

(b) Cheque deposited in the bank but not recorded in Cash Book ₹ 100.

(c) Cheque received and recorded in the Cash Book but not sent to bank for collection ₹ 1,000.

(d) Several cheques were drawn in the last week of September, totalling ₹ 15,000; of these cheques totalling only ₹ 9,000 were cashed before 30th September.

(e) Similarly, several cheques, totalling ₹ 9,000 were sent for collection; of these, cheques fo the value of ₹ 1,500 were credited on 5th October and ₹ 2,000 on 7th October, balance being credited before 30th September.

(f) Fees of ₹ 250 was pid directly by the bank but was not recorded in the Cash Book.

(g) In the Cash Book, a bank charge of ₹ 30 was recorded twice while another bank charge of ₹ 50 was not recorded at all.

(h) Interest of ₹ 1,400 was charged by the bank but was not recorded in the Cash Book.

[Ans. Overdraft as per Cash Book ₹ 9,930.]

Solution:-

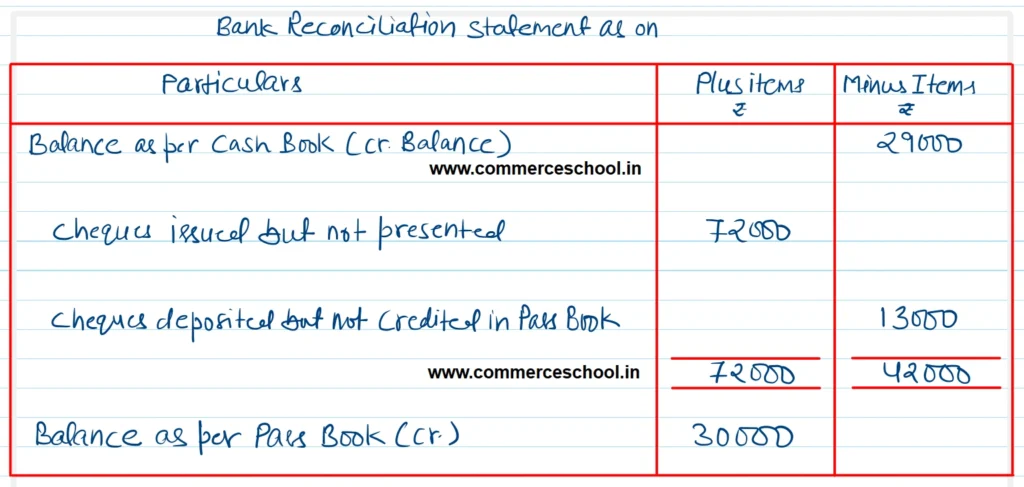

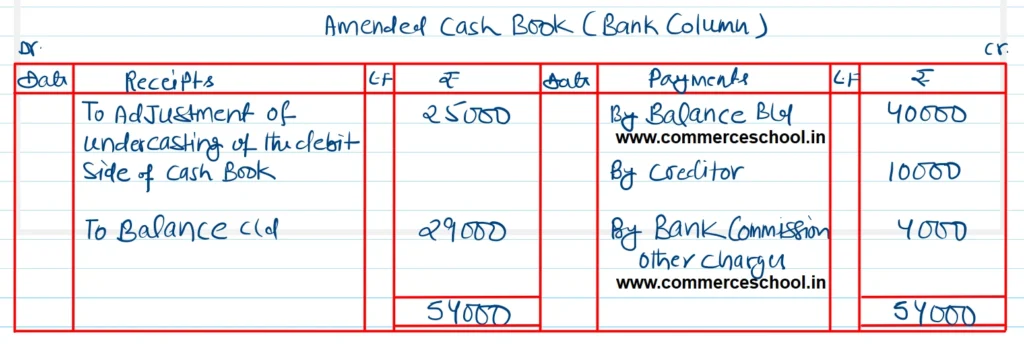

Q. 38. The following information relate to the business of Mohit Raina, who requests you to prepare his amended Cash Book and reconcile his Cash Book balance with his Pass Book balance:

| ₹ | |

| Balance as per Cash Book (Cr.) | 40,000 |

| Unpresented cheques | 72,000 |

| Uncredited cheques | 13,000 |

You have been given the following additional information:

(a) The debit side of the Cash Book (Bank Column) has been undercast by ₹ 25,000.

(b) A cheque for ₹ 10,000 paid to a creditor has been wrongly entered in the Cash Column.

(c) Bank commission and other charges ₹ 4,000 have not been recorded in the Cash Book.

[Ans. Adjusted balance as per cash Book (Cr. ) ₹ 29,000; Pass Book Cr. Balance ₹ 30,000.]

Solution:-

Below is the list of all solutions

| S.N | Solutions |

| 1 | Question – 1, 2 |

| 2 | Question – 3, 4 |

| 3 | Question – 5, 6 |

| 4 | Question – 7, 8 |

| 5 | Question – 9, 10 |

| 6 | Question – 11, 12 |

| 7 | Question – 13, 14 |

| 8 | Question – 15, 16 |

| 9 | Question – 17, 18 |

| 10 | Question – 19, 20 |