[DK Goel] Q. 39, Q. 40 Bank Reconciliation Statements Solutions Class 11 CBSE (2025-26)

Solutions of Question number 39 and 40 of Chapter 16 Bank Reconciliation Statements DK Goel class 11 CBSE (2025-26)

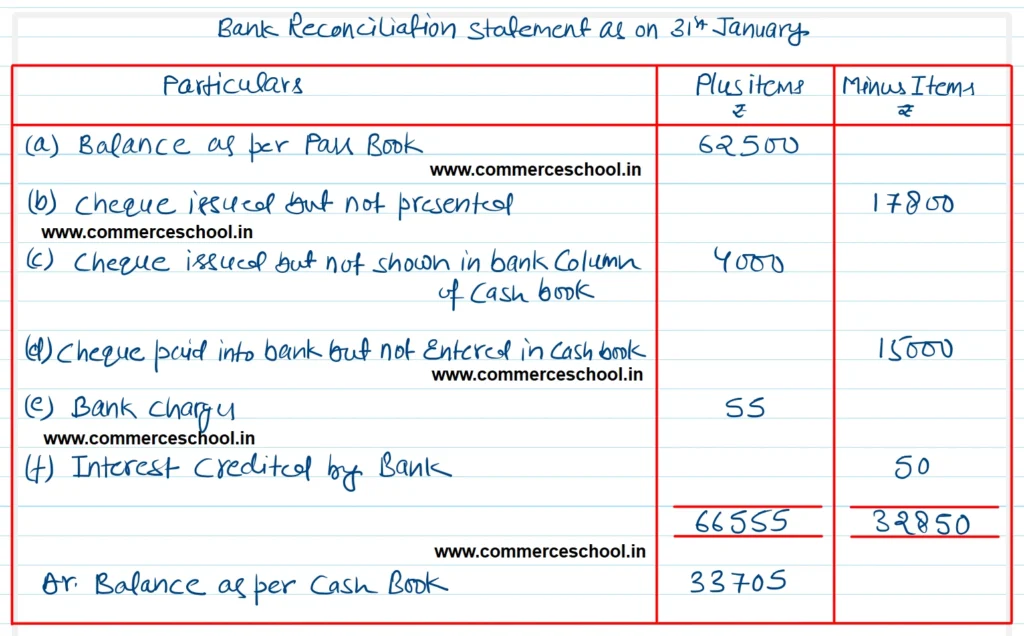

Q. 39. Prepare a Bank Reconciliation Statement in the books of Bharti as on 31st January 2023:

(a) Balance as per Pass Book as on 31st Janauary was ₹ 62,500.

(b) Cheque of ₹ 17,800 was issued by her on 28th January but this was not presented for payment till 31st January.

(c) A cheque of ₹ 4,000 issued to Mr. Rahim, was taken in the cash column.

(d) A cheque of ₹ 15,000 was paid into bank but was omitted to be entered in the cash book.

(e) The bank has charged ₹ 55 as its commission and has allowed interest ₹ 50.

[Ans. Dr. Balance as per Cash Book ₹ 33,705.]

Solution:-

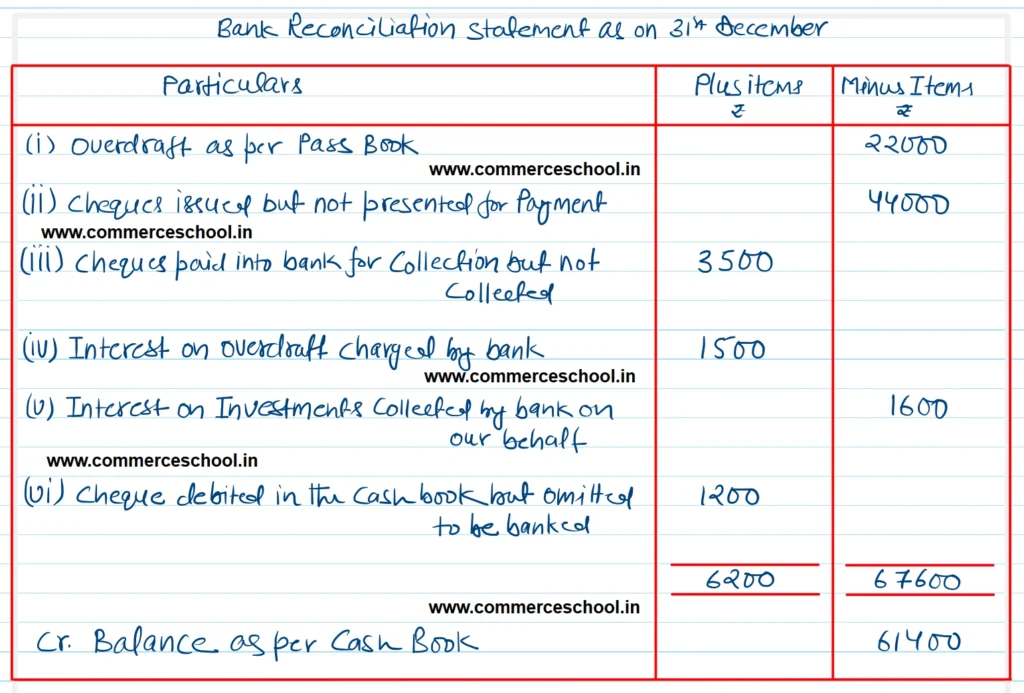

Q. 40. Prepare a Bank Reconciliation Statement as on 31st Dec., 2019 from the following transactions:

(i) Bank overdraft as per Pass Book ₹ 22,000 as on 31st Dec.

(ii) On 28th Dec., cheques had been issued for ₹ 50,000 of which cheques worth ₹ 6,000 only had been encashed upto 31st Dec.

(iii) Cheques amounted to ₹ 4,500 had been paid into the bank for collection but out of these only ₹ 1,000 had been credited in the Pass Book.

(iv) The bank has charged ₹ 1,500 as interest on overdraft and the intimation of which has not been received as yet.

(v) Bank has collected ₹ 1,600 directly in respect of interest on investment.

(vi) A cheque of ₹ 1,200 has been debited in bank column of Cash Book, but it was not sent to bank at all.

[Ans. Overdraft as per Cash Book ₹ 61,400.]

Solution:-

Below is the list of all solutions

| S.N | Solutions |

| 1 | Question – 1, 2 |

| 2 | Question – 3, 4 |

| 3 | Question – 5, 6 |

| 4 | Question – 7, 8 |

| 5 | Question – 9, 10 |

| 6 | Question – 11, 12 |

| 7 | Question – 13, 14 |

| 8 | Question – 15, 16 |

| 9 | Question – 17, 18 |

| 10 | Question – 19, 20 |