[DK Goel] Q. 4 Accounting for Goods and Services Tax (GST) Solutions Class 11 CBSE (2025-26)

Solutions of Question number 4 of Chapter 10 Accounting for Goods and Services Tax (GST) DK Goel class 11 CBSE (2025-26)

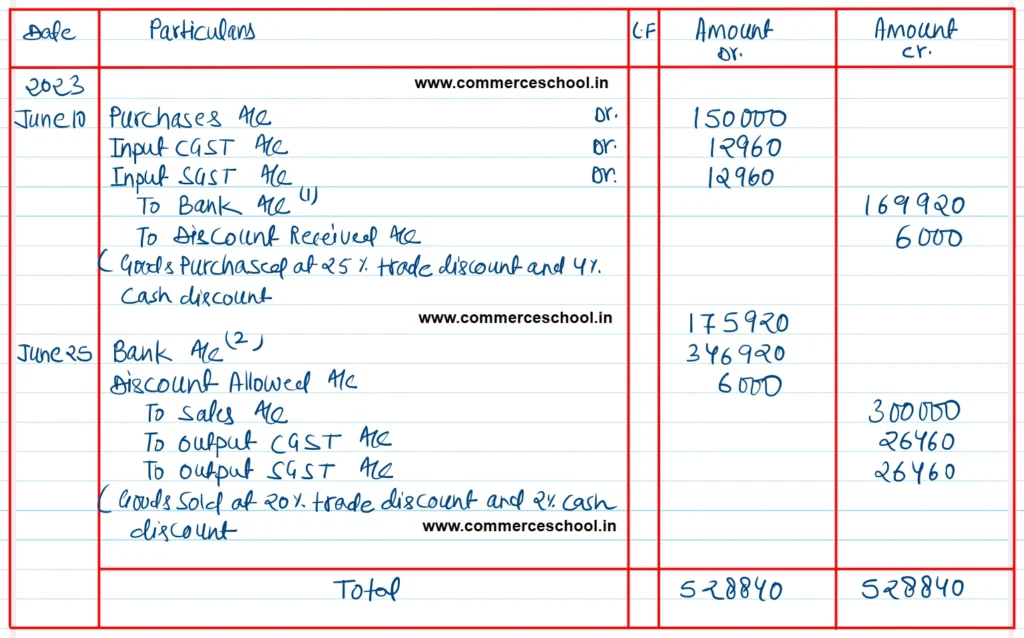

Pass entries for the following transactions in the books of M/s Karthikeyan & Co. of Chennai:

| 2022 | |

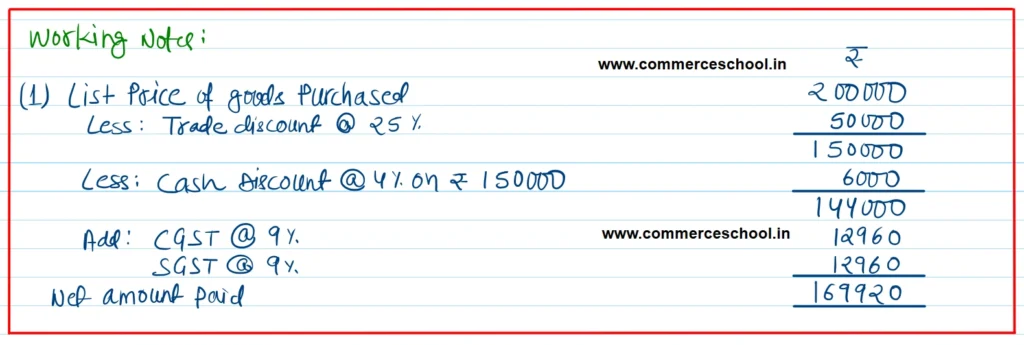

| June 10 | Purchased goods from Ravichandran of Madurai of the list price of ₹ 2,00,000 at 25% trade discount at 4% cash discount on purchase price of goods. Paid CGST and SGST @ 9% each. Paid the entire amount by cheque on the same date. |

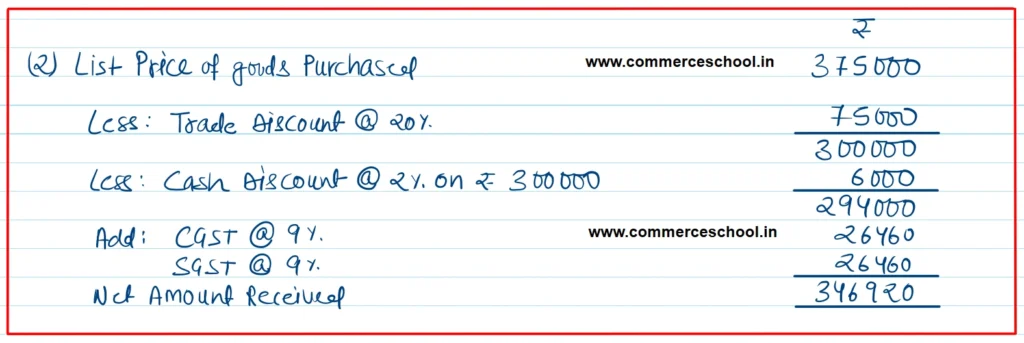

| June 25 | Sold goods to Ramalingam of Erode of the list price of $ 3,75,000 at 20% trade discount and 2% cash discount on sale price. Charged CGST and SGST @ 9% each. Full amount was received by cheque on the same date. |

Ignore adjustment and payment of GST.

[Ans. Total ₹ 5,28,840;

June 10: Net amount paid ₹ 1,69,920; Discount Received ₹ 6,000.

June 25: Net amount received ₹ 3,46,920; Discount allowed ₹ 6,000.]

Solution:-

Below is the list of all solutions