[DK Goel] Q. 4 Financial Statements (with Adjustments) Solutions Class 11 CBSE (2025-26)

Solutions of Question number 4 of Chapter 20 Financial Statements (with Adjustments) DK Goel class 11 CBSE (2025-26)

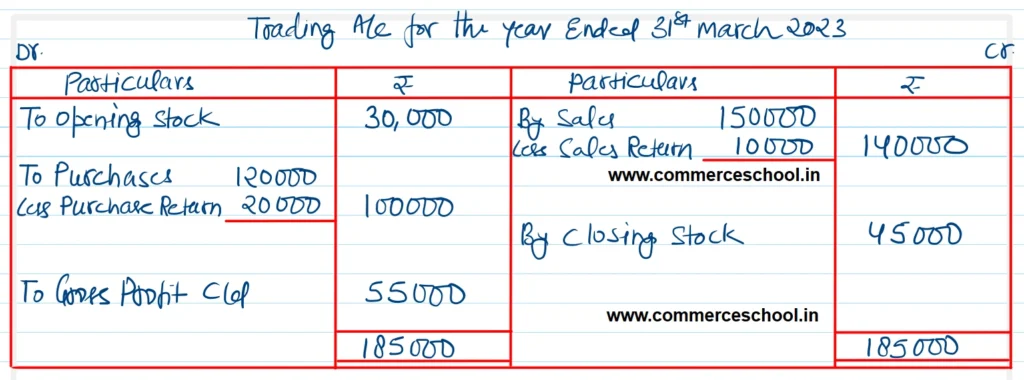

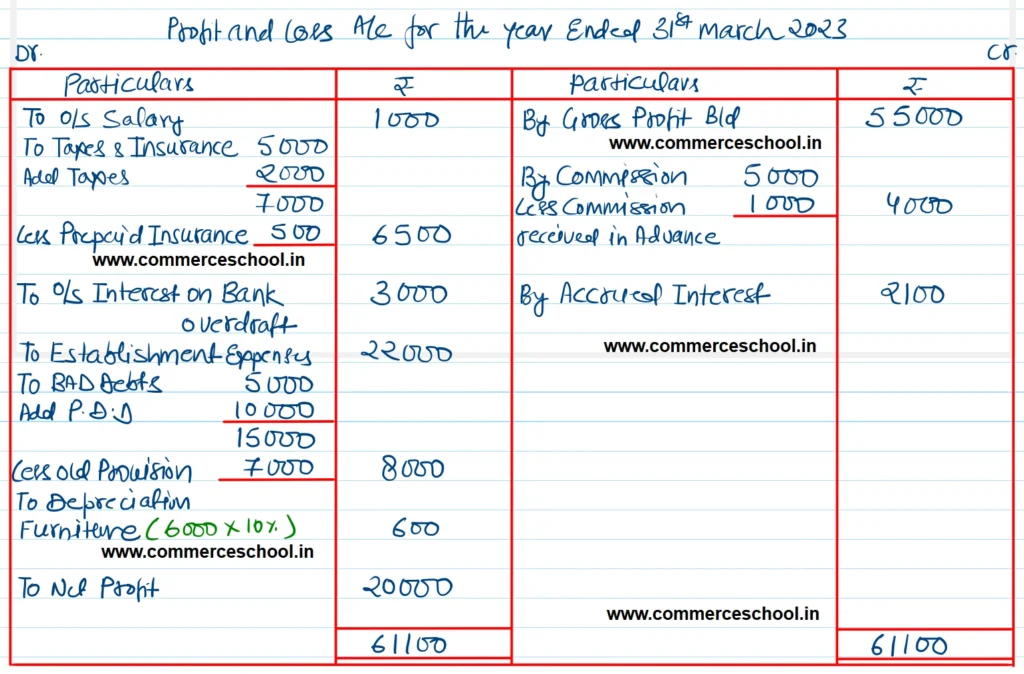

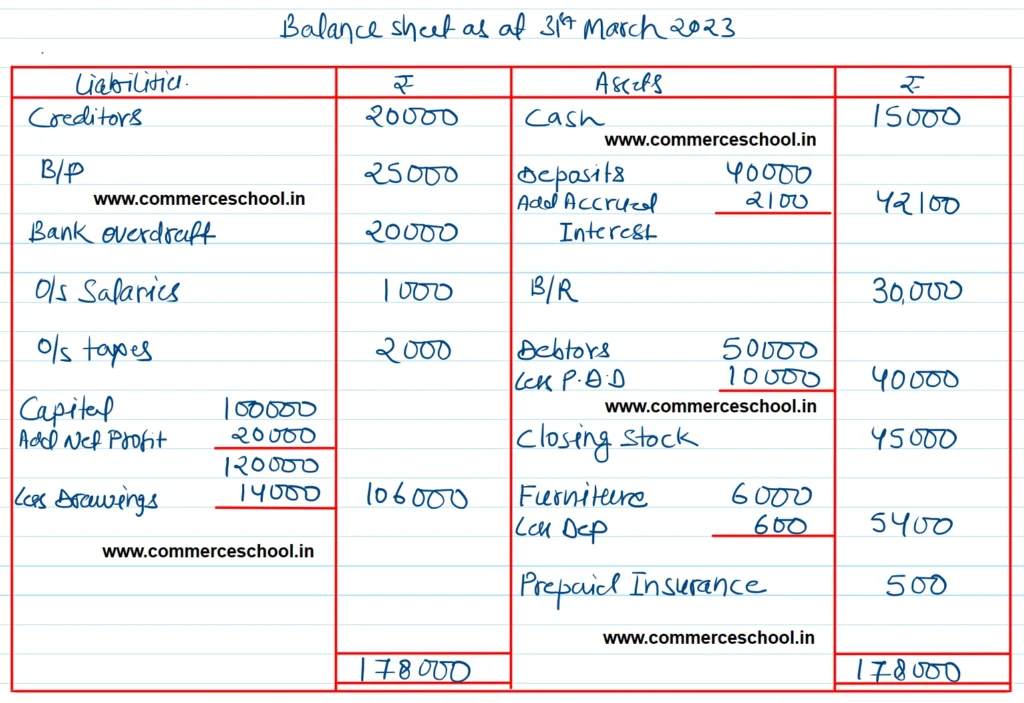

Prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and Balance Sheet as at that date from the following Trial Balance:-

| Particulars | Dr. (₹) | Cr. (₹) |

| Capital | 1,00,000 | |

| Cash | 15,000 | |

| Bank Overdraft | 20,000 | |

| Purchases and Sales | 1,20,000 | 1,50,000 |

| Returns | 10,000 | 20,000 |

| Establishment Expenses | 22,000 | |

| Taxes and Insurance | 5,000 | |

| Bad-debts and Bad-debt Provision | 5,000 | 7,000 |

| Debtors and Creditors | 50,000 | 20,000 |

| Commission | 5,000 | |

| Deposits | 40,000 | |

| Opening Stock | 30,000 | |

| Drawings | 14,000 | |

| Furniture | 6,000 | |

| B/R and B/P | 30,000 | 25,000 |

| 3,47,000 | 3,47,000 |

Adjustments:-

1. Salaries ₹ 1,000 and taxes ₹ 2,000 are outstanding but insurance ₹ 500 is prepaid.

2. Commission ₹ 1,000 is received in advance for next year.

3. Interest ₹ 2,100 is to be received on Deposits and Interest on Bank Overdraft ₹ 3,000 is to be paid.

4. Bad-debts provision is to be maintained at ₹ 10,000 on Debtors.

5. Depreciate Furniture by 10%.

6. Stock on 31st March, 2023 was valued at ₹ 45,000.

[Ans. G.P. ₹ 55,000; N.P. ₹ 20,000, and B/S Total ₹ 1,78,000.]

Solution:-

Hint: Interest receivable ₹ 2,100 will be shown on the Cr. side of P & L A/c and will also be added in the Deposits on the Assets side.

Hence the Deposits will be ₹ 40,000 + ₹ 2,100 = ₹ 42,100.

Below is the list of all solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |