[DK Goel] Q. 5 Financial Statements (with Adjustments) Solutions Class 11 CBSE (2025-26)

Solutions of Question number 5 of Chapter 20 Financial Statements (with Adjustments) DK Goel class 11 CBSE (2025-26)

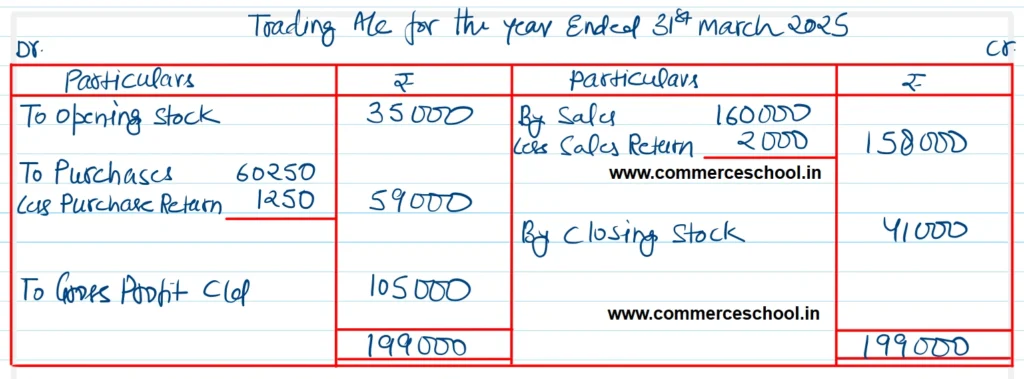

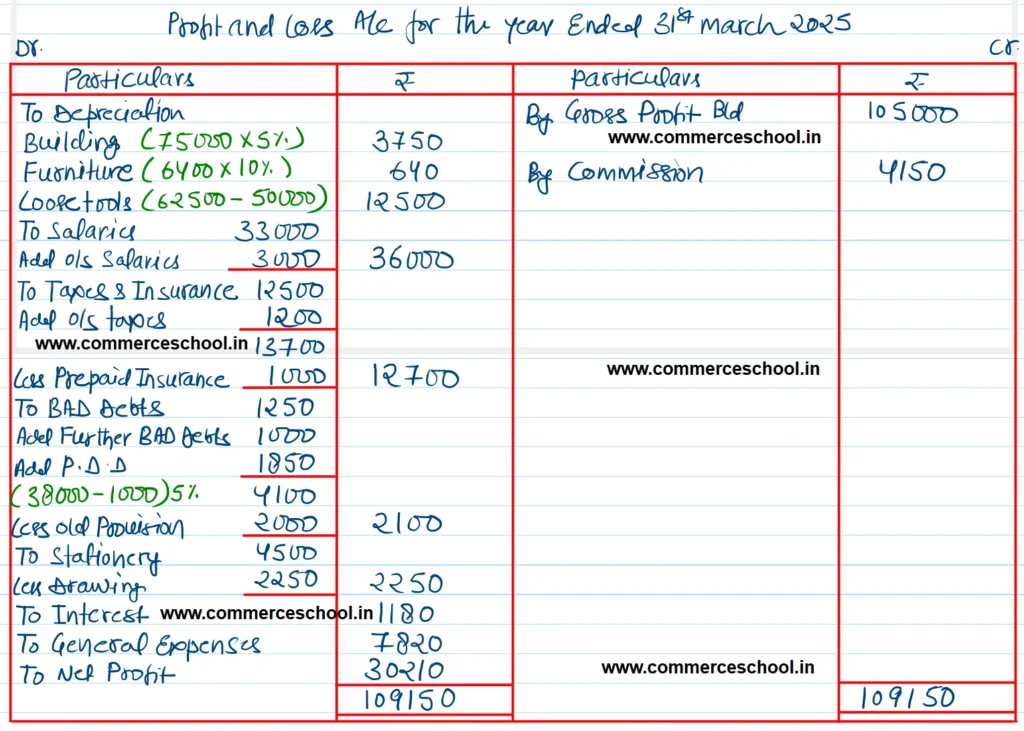

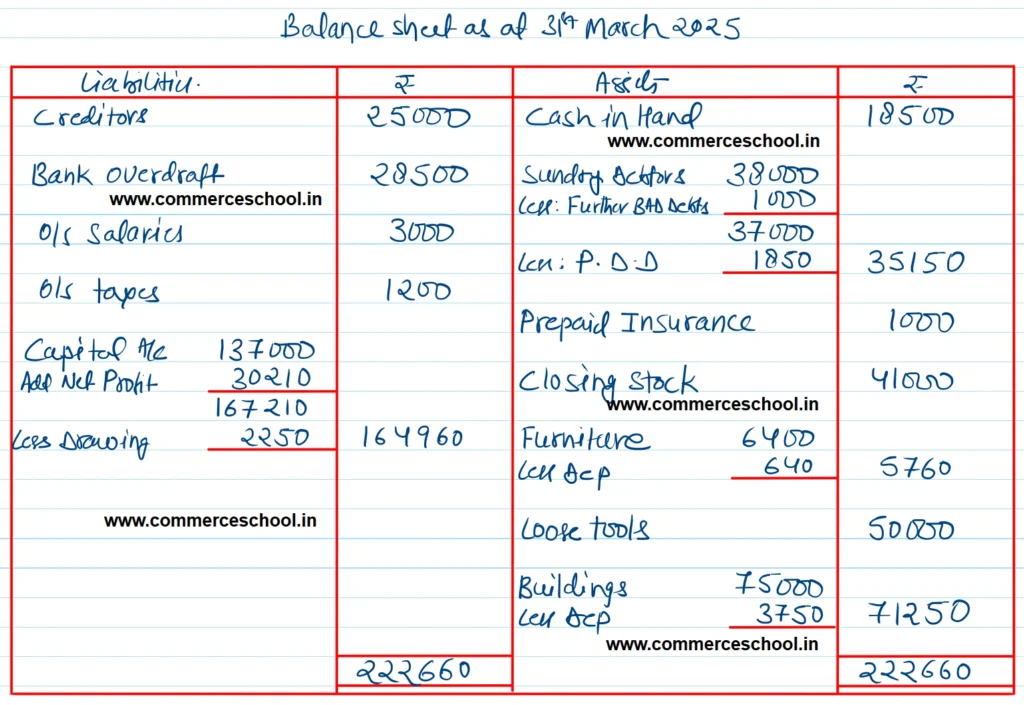

From the following Trial Balance extracted from the books of Joseph, prepare Trading and Profit & Loss Account for the year ending 31st March, 2025 and a Balance Sheet as at that date:-

| Particulars | Dr. (₹) | Cr. (₹) |

| Capital Account | 1,37,000 | |

| Bad-debts | 1,250 | |

| Provision for Bad-debts | 2,000 | |

| Sundry Debtors and Creditors | 38,000 | 25,000 |

| Stock on 1st April, 2022 | 35,000 | |

| Purchases and Sales | 60,250 | 1,60,000 |

| Bank Overdraft | 28,500 | |

| Sales Return and Purchases Return | 2,000 | 1,250 |

| Stationery | 4,500 | |

| Interest Account | 1,180 | |

| Commission | 4,150 | |

| Cash in Hand | 18,500 | |

| Taxes and Insurance | 12,500 | |

| General Expenses | 7,820 | |

| Salaries | 33,000 | |

| Furniture | 6,400 | |

| Loose Tools | 62,500 | |

| Buildings | 75,000 | |

| 3,57,900 | 3,57,900 |

The following adjustments are to be made:

(i) Depreciate Buildings at 5% and Furniture at 10%. Loose Tools are revalued at ₹ 50,000 at the end of the year.

(ii) Salaries ₹ 3,000 and taxes ₹ 1,200 are outstanding.

(iii) Insurance amounting to ₹ 1,000 is prepaid.

(iv) Write off a further ₹ 1,000 as Bad-Debts and provision for Doubtful Debts is to be made equal to 5% on Sundry Debtors.

(v) Half of the stationery was used by the proprietor for his personal purposes.

(vi) Stock in hand on 31st March, 2025 was ₹ 41,000.

[Ans. G.P. ₹ 1,05,000; N.P. ₹ 30,210 and B/S Total ₹ 2,22,660.]

Hint:- Depreciation on Loose Tools will be ₹ 62,500 – ₹ 50,000 = ₹ 12,500.

Solution:-

Below is the list of all solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |