[DK Goel] Q. 5, Q. 6 Bank Reconciliation Statements Solutions Class 11 CBSE (2025-26)

Solutions of Question number 5 and 6 of Chapter 16 Bank Reconciliation Statements DK Goel class 11 CBSE (2025-26)

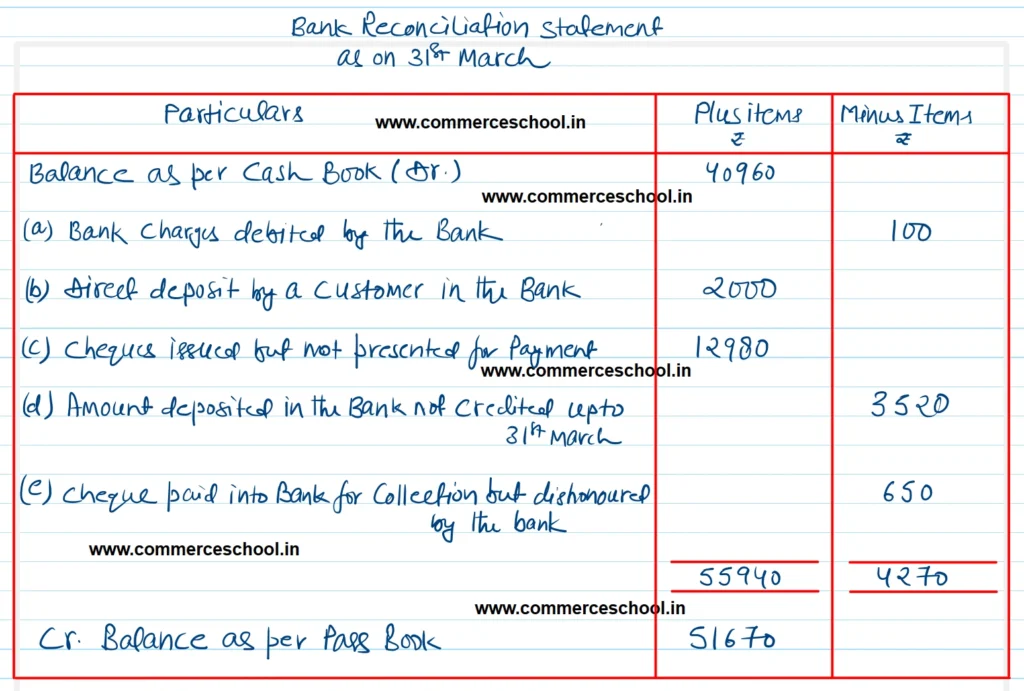

Q. 5. On comparing the Cash Book with Pass Book of Naman it is found that on March 31, 2023, bank balance of ₹ 40,960 showed by the Cash Book differs from the bank balance with regard to the following:

(a) Bank charges ₹ 100 on March, 31 2023, are not entered in the Cash Book.

(b) On March 21, 2023, a debtor paid ₹ 2,000 into the company’s bank in settlement of his account, but not entry was made in the Cash Book of the company in respect of this.

(c) Cheques totalling ₹ 12,980 were issued by the company and duly recorded in the Cash Book before March 31, 2023, but had not been presented at the bank for payment until after that date.

(d) ₹ 3,520 is entered in the Cash Book as paid into bank on March 31st 2023, but not credited by the bank until the following day.

(e) No entry has been made in the Cash Book to record the dishonour on March 15, 2023 of a cheque for ₹ 650 received from Bhanu.

Prepare a Bank Reconciliation Statement as on March 31, 2023.

[Ans. Balance as per Pass Book ₹ 51,670]

Solution:-

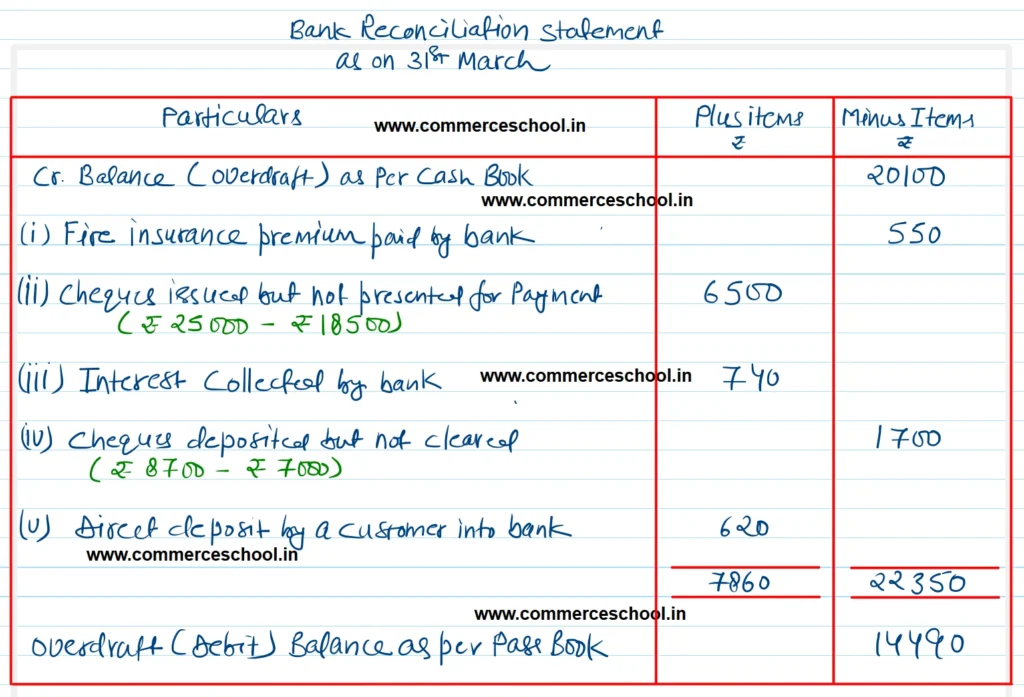

Q. 6. Prepare Bank Reconciliation Statement as on 31st January, 2017, if Cash Book of Mr. Sanjay showed a credit balance of ₹ 20,100.

(i) The bank had paid fire insurance premium of ₹ 550 which does not appear in the Cash Book.

(ii) Cheques for ₹ 25,000 issued during January, but cheques for only ₹ 18,500 were presented for payment.

(iii) Interest collected by bank ₹ 740.

(iv) Cheques of ₹ 8,700 were deposited into bank, but cheques for ₹ 7,000 were cleared till 31st January, 2017.

(v) A customer deposited $ 620 directly into bank without informing Mr. Sanjay.

[Ans. Overdraft (Debit) Balance as per Pass Book ₹ 14,490.]

Solution:-

Below is the list of all solutions

| S.N | Solutions |

| 1 | Question – 1, 2 |

| 2 | Question – 3, 4 |

| 3 | Question – 5, 6 |

| 4 | Question – 7, 8 |

| 5 | Question – 9, 10 |

| 6 | Question – 11, 12 |

| 7 | Question – 13, 14 |

| 8 | Question – 15, 16 |

| 9 | Question – 17, 18 |

| 10 | Question – 19, 20 |