[DK Goel] Q. 7 Accounting for Goods and Services Tax (GST) Solutions Class 11 CBSE (2025-26)

Solutions of Question number 7 of Chapter 10 Accounting for Goods and Services Tax (GST) DK Goel class 11 CBSE (2025-26)

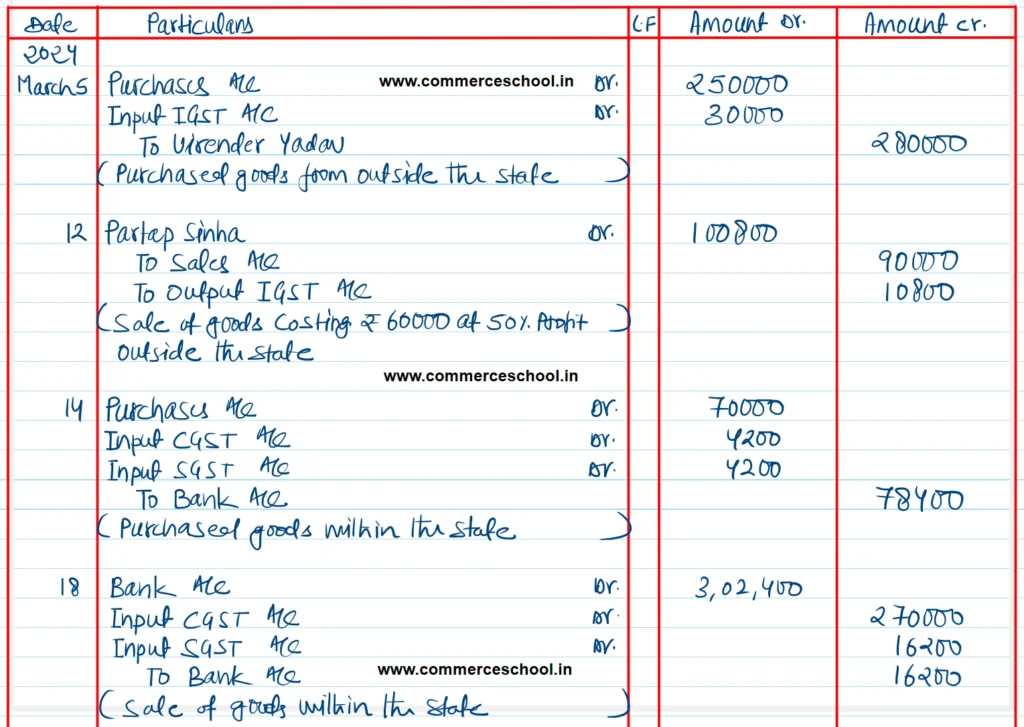

Pass entries in the books of Sh. Jagdish Mishra of Lucknow (U.P) assuming CGST @ 6% and SGST @ 6%:

| 2023 | |

| March 5 | Purchased goods for ₹ 2,50,000 from Virender Yadav of Patna (Bihar) |

| March 12 | Sold goods costing ₹ 60,000 at 50% profit to Partap Sinha of Ranchi (Jharkhand) |

| March 14 | Purchased goods for ₹ 70,000 from Ram Nath of Kanpur (U.P.) against cheque. |

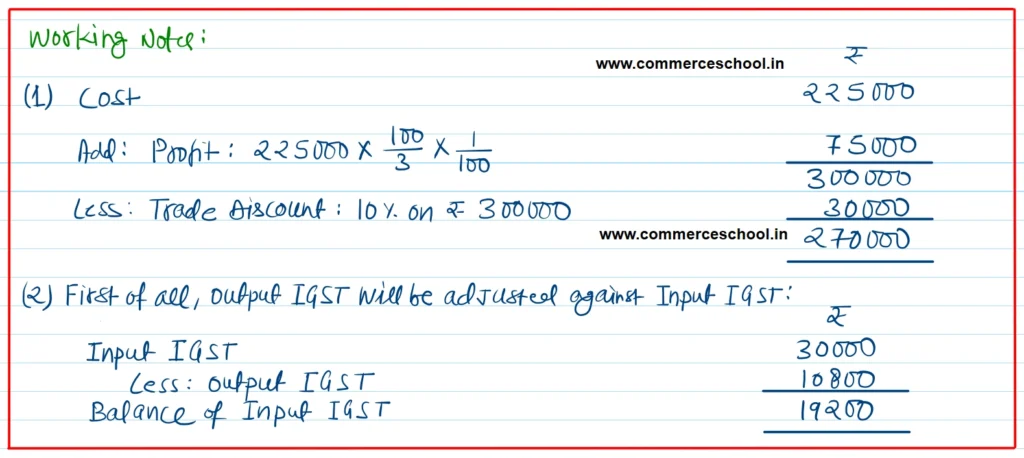

| March 18 | Sold good at Varanasi (U.P.) Costing ₹ 2,25,000 at 331/3% profit less trade discount 10% against cheque which was deposited into bank. |

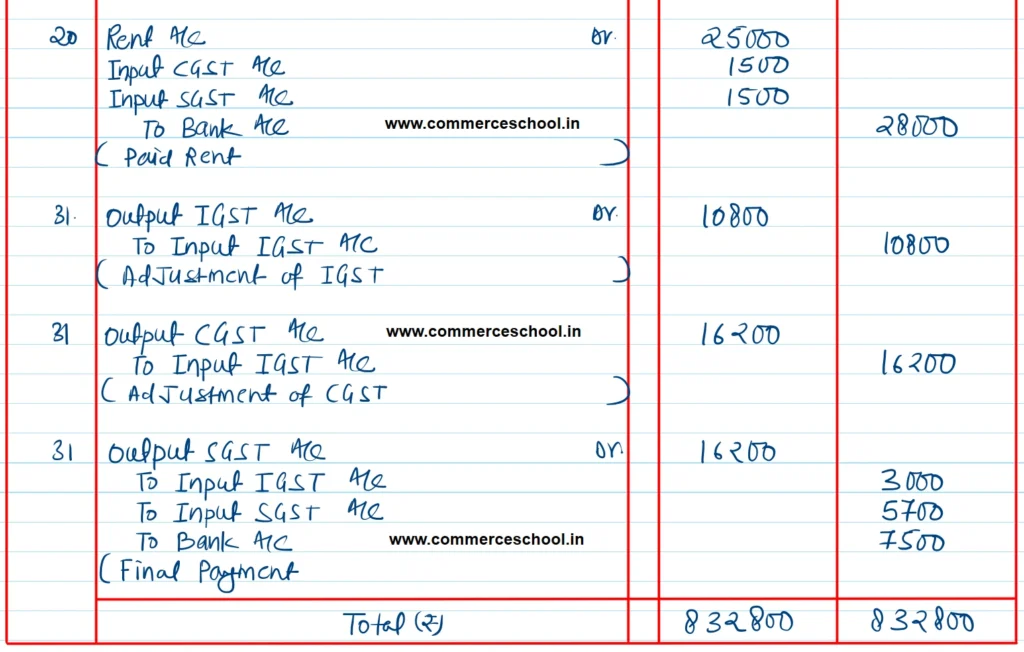

| March 20 | Paid rent ₹ 25,000 by cheque. |

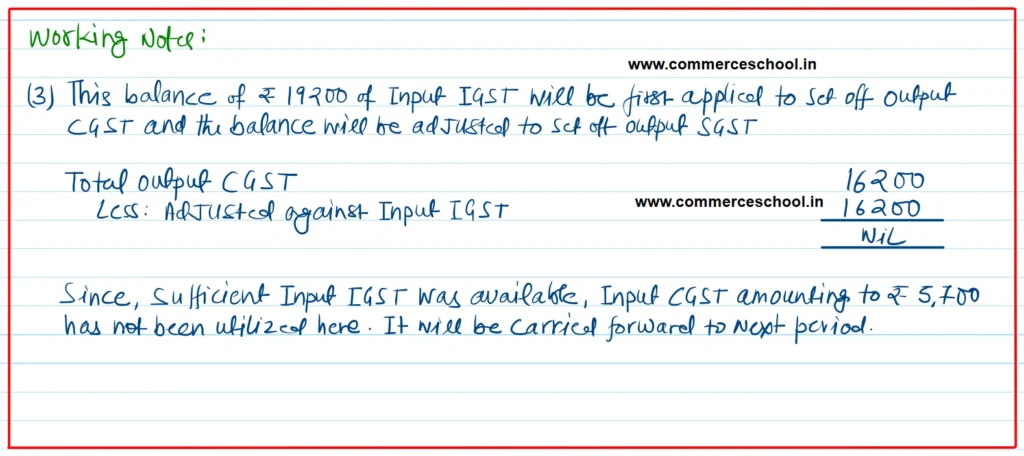

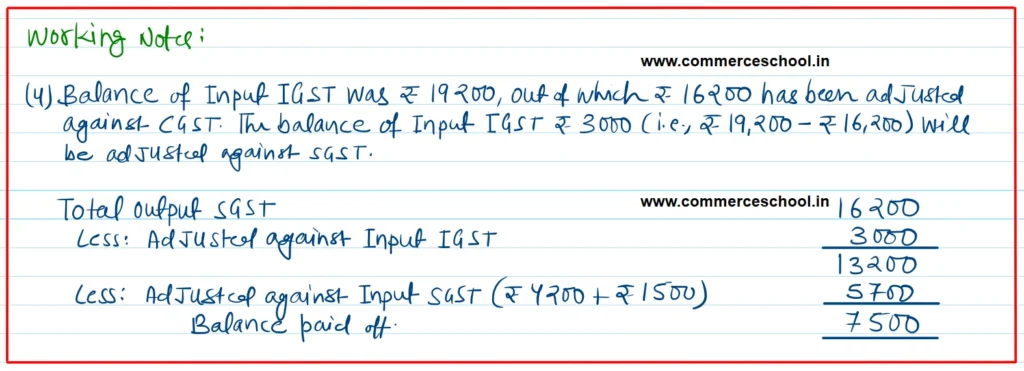

| March 31 | Payment made of balance amount of GST |

[Ans. Total ₹ 8,32,800]

Solution:-

Below is the list of all solutions