[DK Goel] Q. 8 Accounting for Goods and Services Tax (GST) Solutions Class 11 CBSE (2025-26)

Solutions of Question number 8 of Chapter 10 Accounting for Goods and Services Tax (GST) DK Goel class 11 CBSE (2025-26)

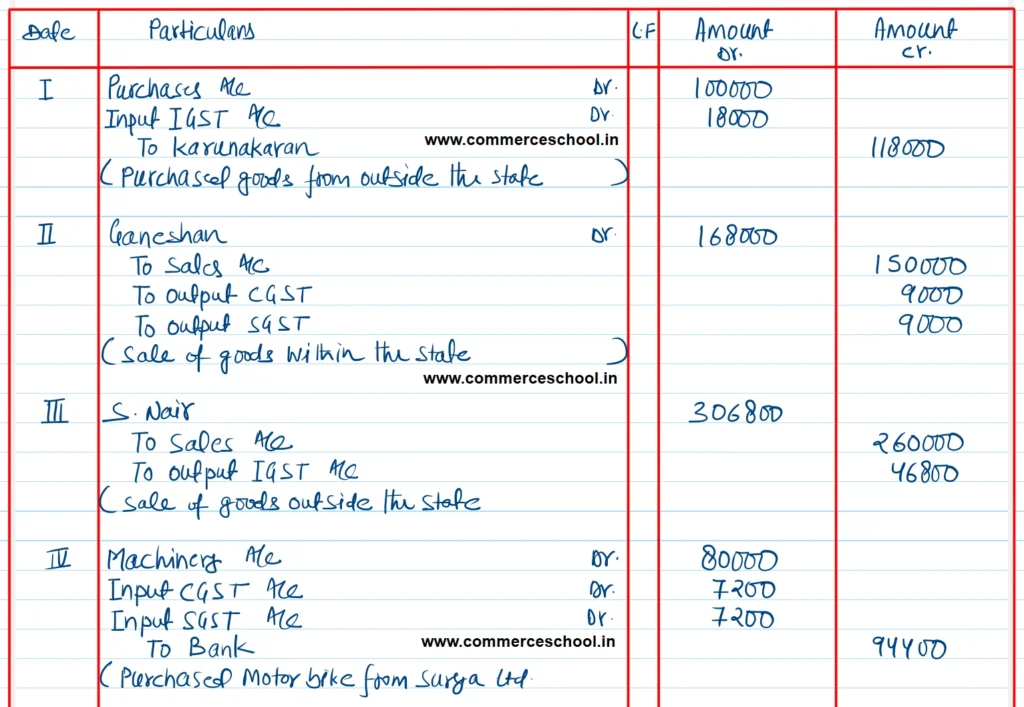

Pass entries in the books of Krishnan of Bengaluru (Karnataka) in the following cases:

| I | Purchased goods from Karunakaran of Chennai for ₹ 1,00,000. (IGST @ 18%) |

| II | Sold goods to Ganeshan of Bengaluru for ₹ 1,50,000. (CGST @ 6% and SGST @ 6%) |

| III | Sold goods to S.Nair of Kerala for ₹ 2,60,000. (IGST @ 18%) |

| IV | Purchased Machinery for ₹ 80,000 from Surya Ltd. against cheque. (CGST @ 9% and SGST 2 9%) |

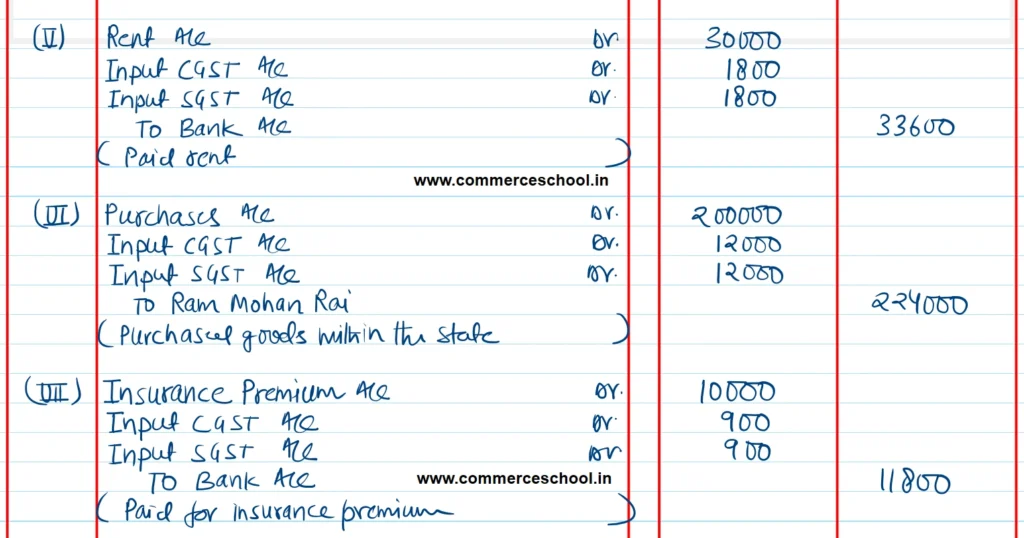

| V | Paid rent ₹ 30,000 by cheque (CGST @ 6% and SGST @ 6%) |

| VI | Purchased goods from Ram Mohan Rai of Bengaluru for ₹ 2,00,000. (CGST @ 6% and SGST @ 6%) |

| VII | Paid Insurance premium ₹ 10,000 by cheque. (CGST @ 9% and SGST @ 9%) |

| VIII | Received commission ₹ 20,000 by cheque which is deposited into bank. (CGST @ 9% and SGST @ 9%) |

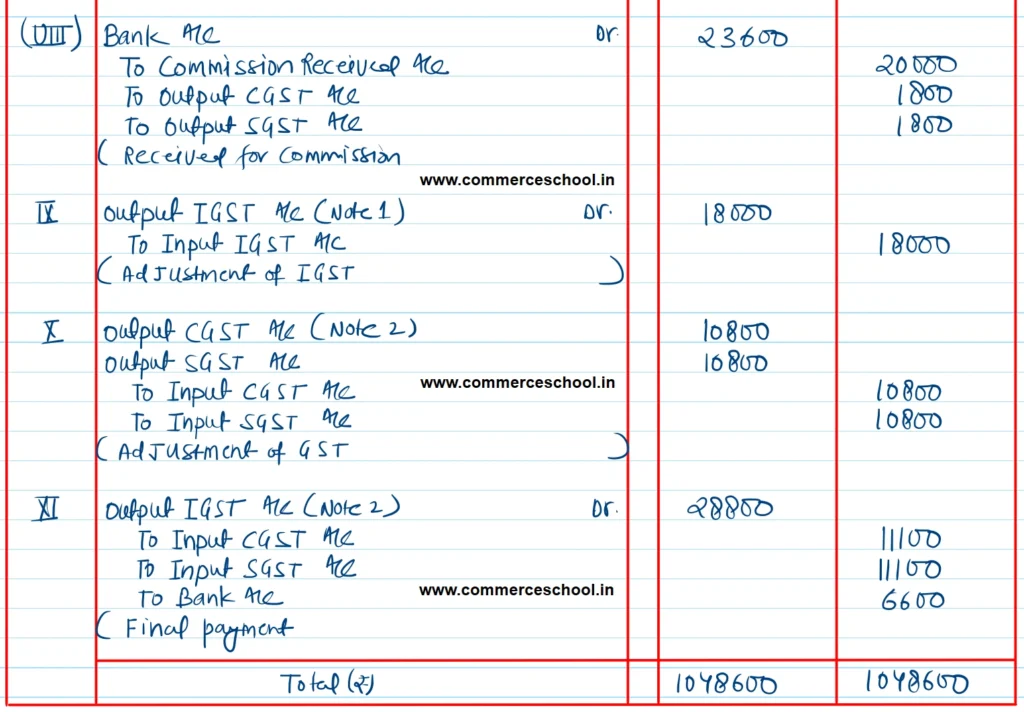

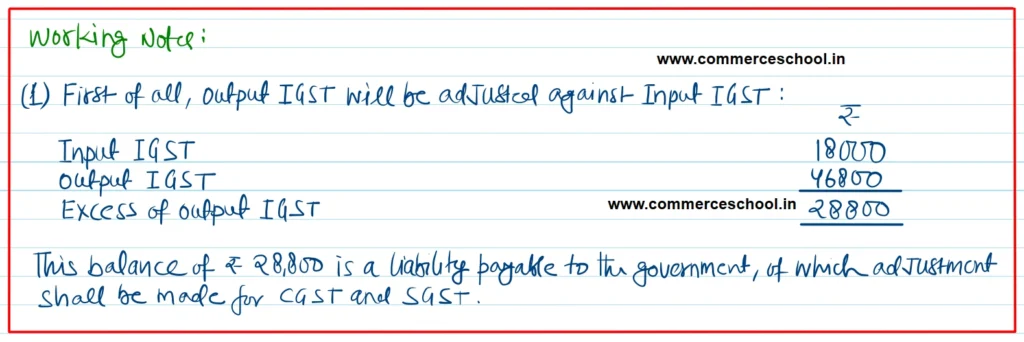

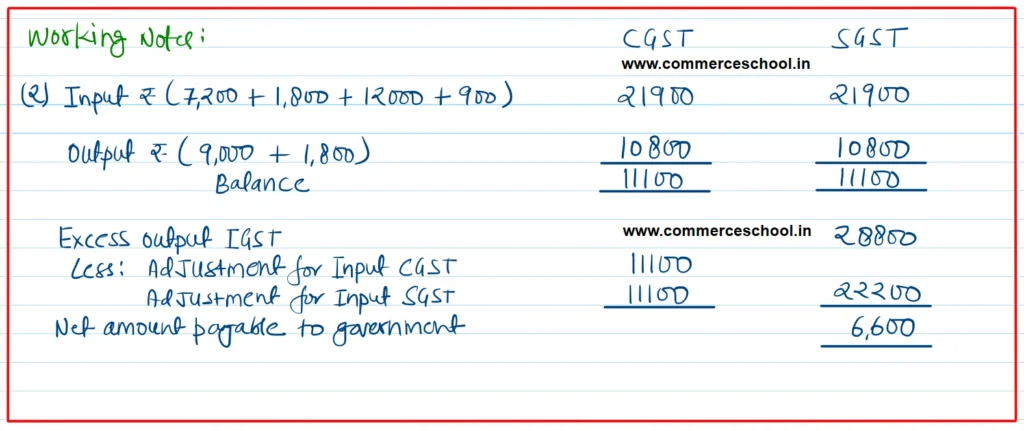

| IX | Payment made of balance amount of GST. |

[Ans. Total ₹ 10,48,600]

Solution:-

Below is the list of all solutions