[DK Goel] Q. 8 Cash Book Solutions Class 11 CBSE (2025-26)

Solutions of Question number 8 Chapter 11 Books of Original Entry – Cash Book DK Goel class 11 CBSE (2025-26)

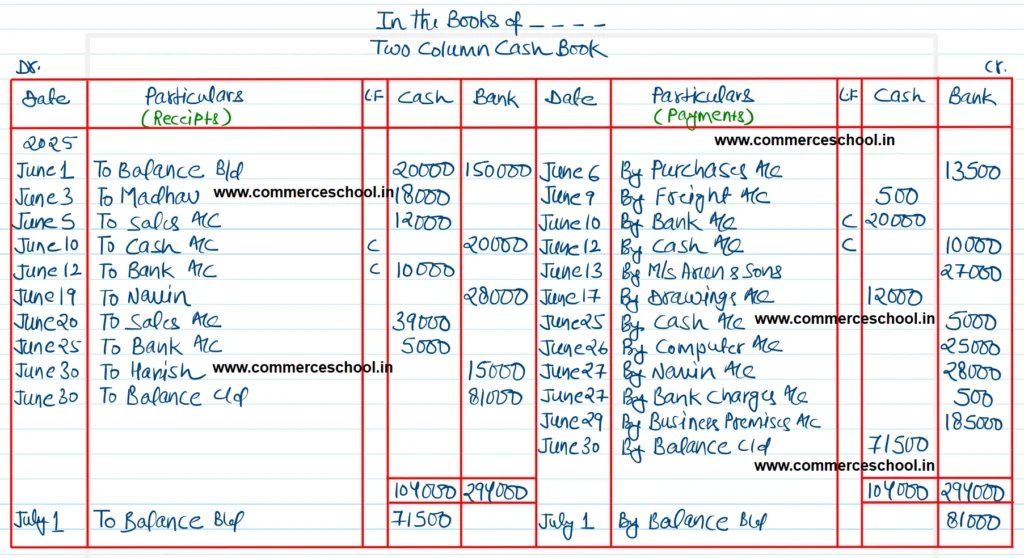

Q. 8 (A). Enter the following particulars in the Cash Book with Cash and Bank Column:-

| 2025 | ₹ | |

| June 1 | Balance of cash in hand ₹ 20,000 and at Bank ₹ 1,50,000 | |

| 3 | Received cash from Madhav | 18,000 |

| 5 | Cash Sales | 12,000 |

| 6 | Purchases by cheque | 13,500 |

| 9 | Paid cash for freight | 500 |

| 10 | Paid into Bank | 20,000 |

| 12 | Drew from Bank for office use | 10,000 |

| 13 | Issued a cheque in favour of M/s Arun & Sons | 27,000 |

| 17 | Drew cash for his son’s birthday party | 12,000 |

| 19 | Received a cheque from Navin for ₹ 28,000 and deposited it into bank on the same day | |

| 20 | Cash Sales | 39,000 |

| 25 | Drew from Bank for office use | 5,000 |

| 26 | Purchased computer for ₹ 25,000 and payment made by cheque | |

| 27 | Navin’s cheque dishonoured, Bank charges ₹ 500 | |

| 29 | Purchased business premises, payment made by cheque ₹ 1,85,000 | |

| 30 | Received cheque for ₹ 15,000 from Harish |

[Ans. Cash in hand ₹ 71,500; Bank Overdraft ₹ 81,000.]

Solution:-

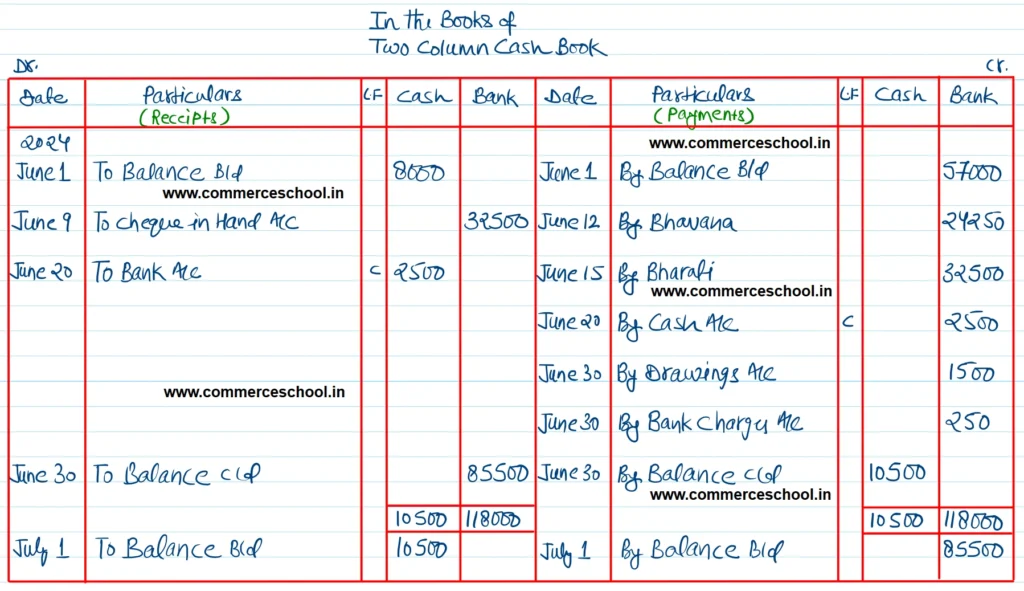

Q. 8 (B). Enter the following transactions in the Cash Book with Cash and Bank Columns:-

| 2024 | ||

| June 1 | Cash in hand Bank Overdraft | 8,000 57,000 |

| 7 | Received a cheque from Bharti | 32,500 |

| 9 | Deposited the above cheque into bank | |

| 12 | Paid to Bhavana by cheque | 24,250 |

| 15 | Bharti’s cheque returend dishonoured | |

| 20 | Withdrew from Bank for office use | 2,500 |

| 25 | Cheque received from Panna Lal and endorsed it in favour of Kamal on 28th June | 12,000 |

| 30 | Income Tax paid by cheque | 1,500 |

| 30 | Bank Charges | 250 |

[Ans. Cash in hand ₹ 10,500; Bank Overdraft ₹ 85,500.]

Solution:-

Hints:

(1) On June 7, Cheque received from Bharti will be recorded through Journal Proper:

Chques in Hand A/c Dr. 32,500

To Bharti 32,50

When the cheque is deposited into Bank on 9th June, it will be recorded in the Bank column of the Cash Book on Dr. side.

(2) Receipt and endorsement of Cheque will not be entered in Cash Book. It will be recorded through Journal Proper.

(3) June 30th : Income tax is the personal expenses of the proprietor. As such, it will be treated as Drawings.

Below is the list of all solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |