[DK Goel] Q. 8 Financial Statements (with Adjustments) Solutions Class 11 CBSE (2025-26)

Solutions of Question number 8 of Chapter 20 Financial Statements (with Adjustments) DK Goel class 11 CBSE (2025-26)

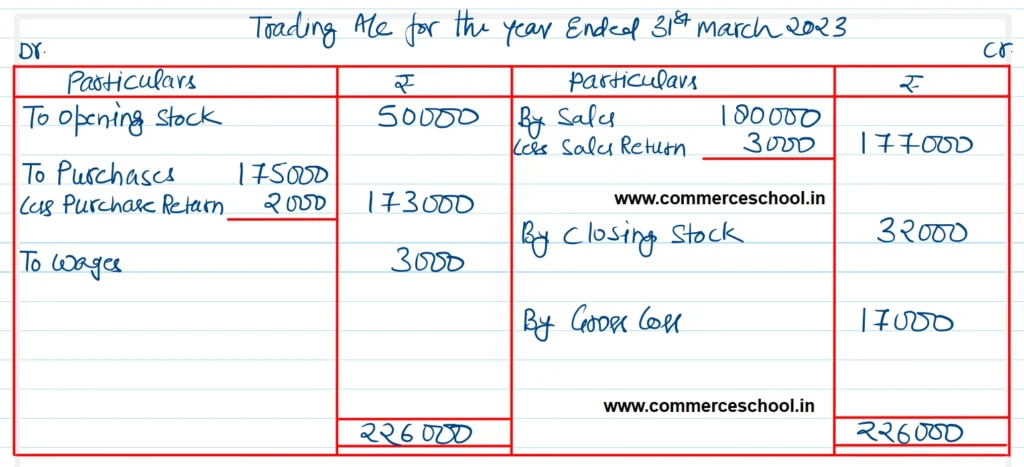

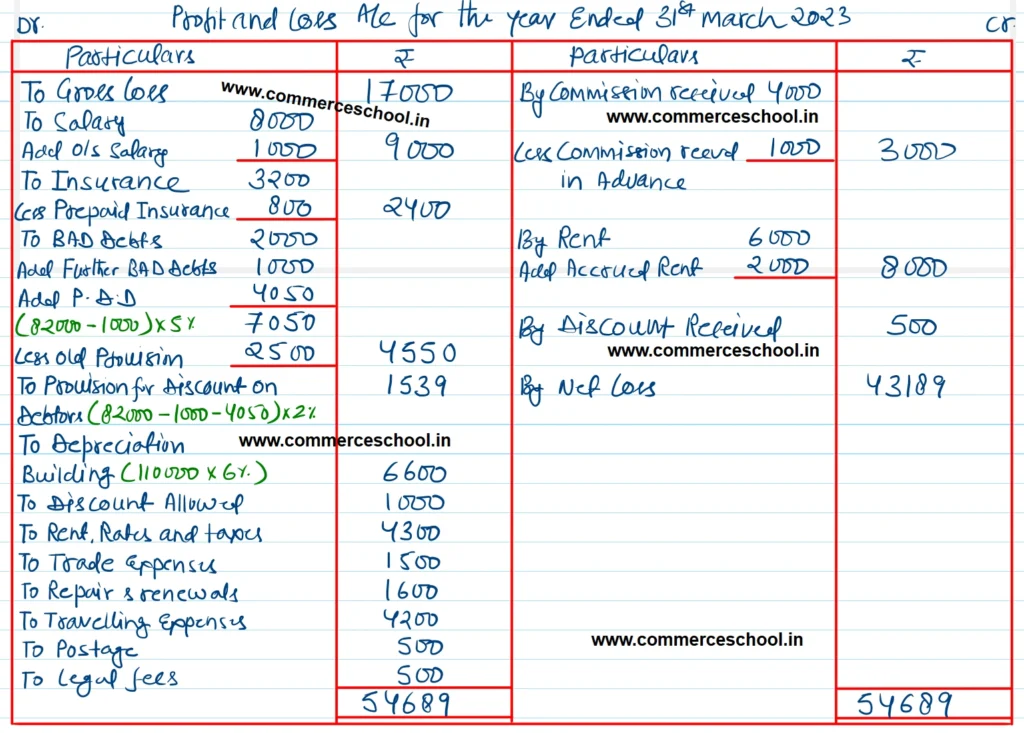

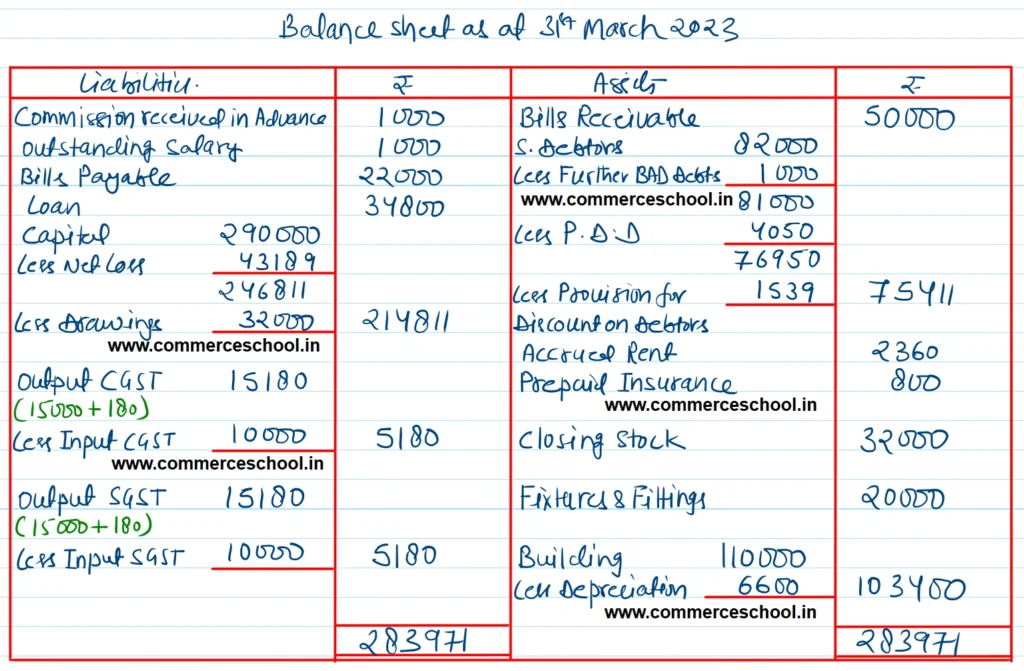

Prepare a Trading and Profit & Loss account for the year ending March 31, 2023, from the balances extracted of M/s Rahul Sons. Also prepare a balance sheet as at that date.

| Debit Balances | ₹ | Credit Balances | ₹ |

| Opening Stock | 50,000 | Sales | 1,80,000 |

| Wages | 3,000 | Purchase return | 2,000 |

| Salary | 8,000 | Discount received | 500 |

| Purchases | 1,75,000 | Provision for bad debts | 2,500 |

| Sales Return | 3,000 | Capital | 2,90,000 |

| S. Debtors | 82,000 | Bills Payable | 22,000 |

| Discount allowed | 1,000 | Commission received | 4,000 |

| Insurance | 3,200 | Rent | 6,000 |

| Rent, rates and taxes | 4,300 | Loan | 34,800 |

| Fixtures and fittings | 20,000 | Output CGST | 15,000 |

| Trade Expenses | 1,500 | Output SGST | 15,000 |

| Bad debts | 2,000 | ||

| Drawings | 32,000 | ||

| Repair and revewals | 1,600 | ||

| Travelling expenses | 4,200 | ||

| Postage | 500 | ||

| Legal fees | 500 | ||

| Bills Reveivable | 50,000 | ||

| Building | 1,10,000 | ||

| Input CGST | 10,000 | ||

| Input SGST | 10,000 | ||

| 5,71,800 | 5,71,800 |

Adjustments:-

(i) Commission received in advance ₹ 1,000.

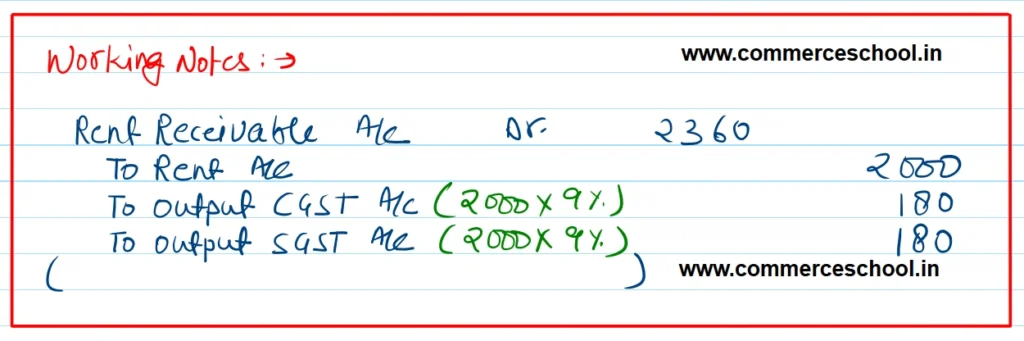

(ii) Rent receivable ₹ 2,000, subject to levy of CGST and SGST @ 9% each.

(iii) Salary outstanding ₹ 1,000 and insurance prepaid ₹ 800.

(iv) Further Bad-debts ₹ 1,000 and provision for Bad-debts @ 5% on debtors and provision for discount on debtors @ 2%.

(v) Closing Stock ₹ 32,000.

(vi) Depreciation on Building @ 6% p.a.

[Ans. Gross Loss ₹ 17,000; Net Loss ₹ 43,189 and Balance Sheet Total ₹ 2,83,971.]

Note: GST is not levied on Salary.

Solution:-

Below is the list of all solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |