[DK Goel] Q. 9 Accounts from Incomplete Records Solutions Class 11 CBSE (2025-26)

Solutions of Question number 9 of Chapter 22 Accounts from Incomplete Records DK Goel class 11 CBSE (2025-26)

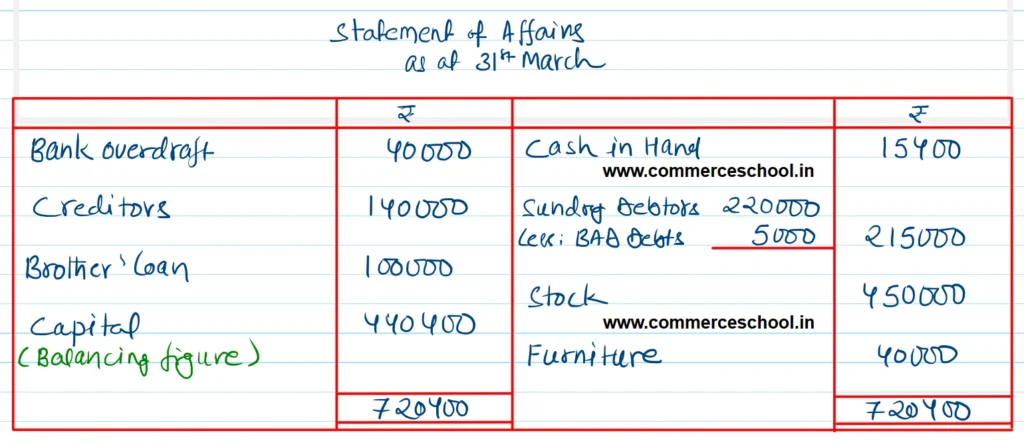

On 1st April 2019, Mr. Ghosh started business with a capital of ₹ 5,00,000. He kept his books on single entry basis. Soon after he purchased furniture for ₹ 40,000 and purchased goods for ₹ 3,00,000. During the year he borrowed ₹ 1,00,000 from his brother and introduced further capital of his own amounting to ₹ 80,000.

On 31st March, 2020, there were sundry debtors amounting to ₹ 2,20,000 and creditors amounted to ₹ 1,40,000. Stock was valued at ₹ 4,50,000. Cash in hand ₹ 15,400 and Bank Overdraft ₹ 40,000.

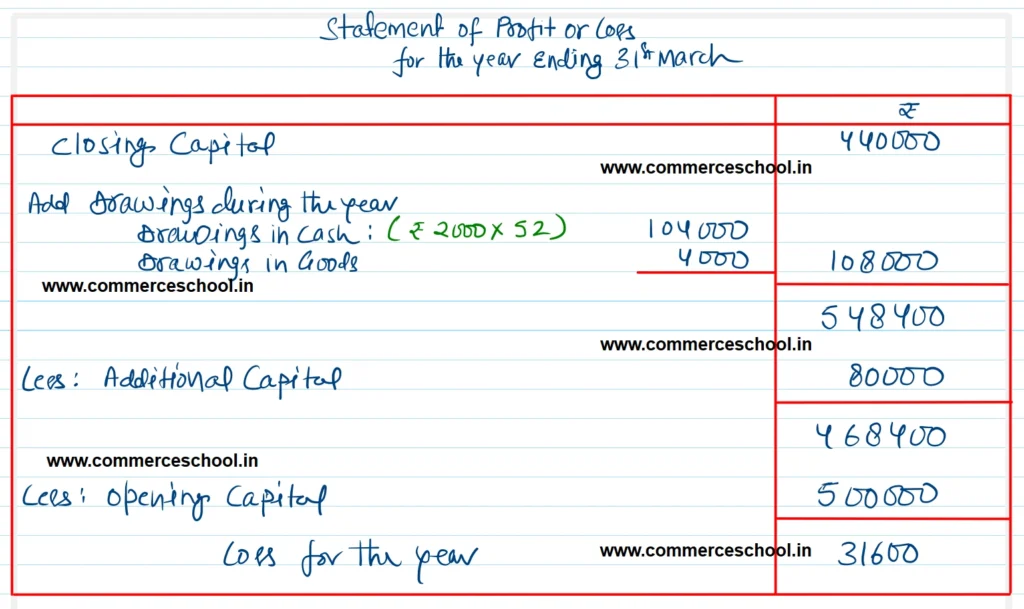

During the year Mr. Ghosh withdrew ₹ 2,000 per week for his family expenses. You are informed that included in sundry debtors is an irrecoverable amount of ₹ 5,000. He also took goods from the business for his personal use amounting to ₹ 4,000.

You are required to calculate his profit or loss during the year.

[Ans. Closing Capital ₹ 4,40,400; Loss ₹ 31,600.]

Solution:-

Below is the list of all solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |