[DK Goel] Q. 9 Financial Statements (with Adjustments) Solutions Class 11 CBSE (2025-26)

Solutions of Question number 9 of Chapter 20 Financial Statements (with Adjustments) DK Goel class 11 CBSE (2025-26)

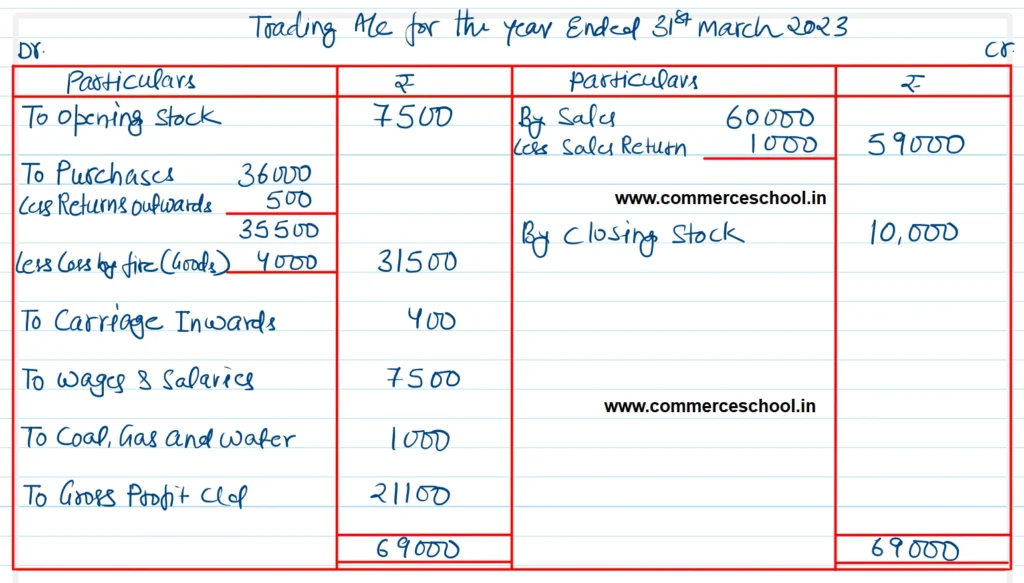

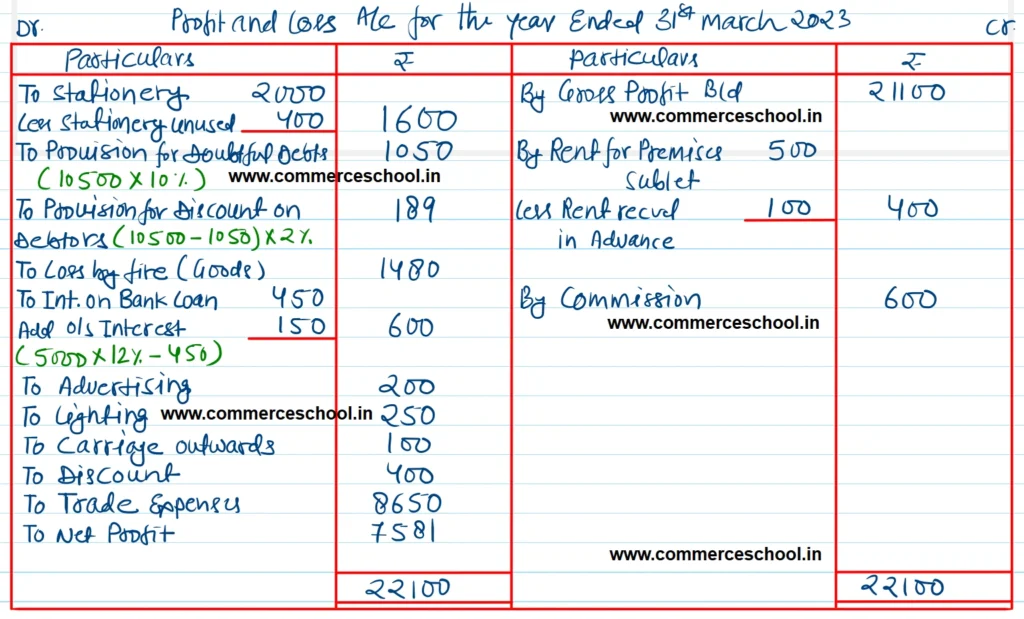

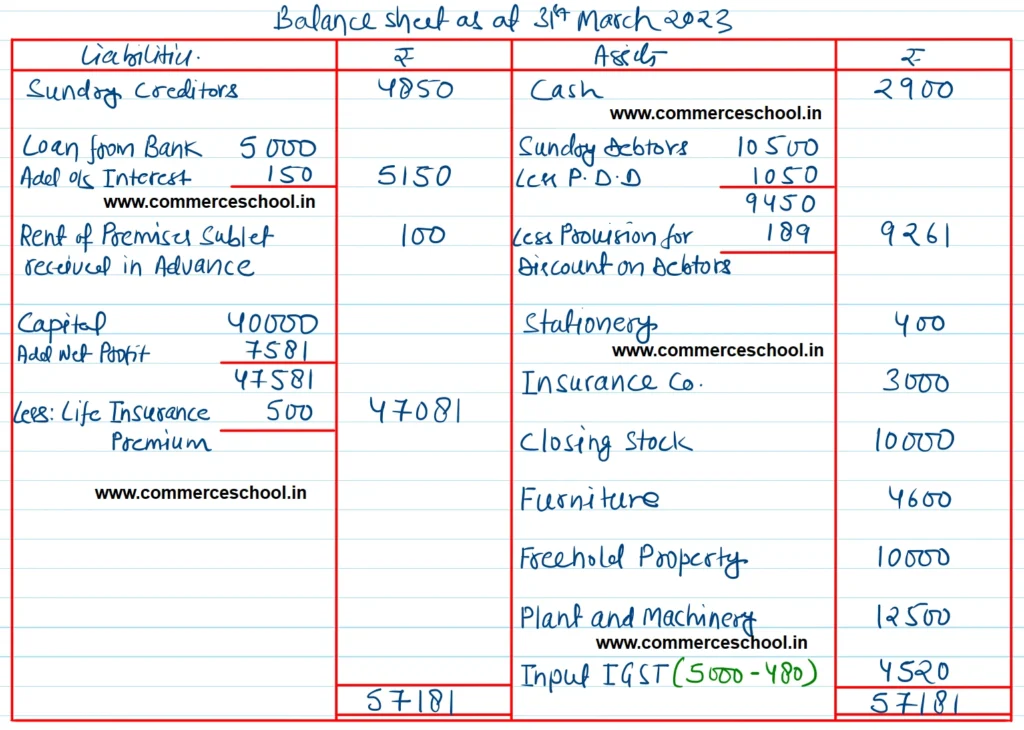

From the following balances, prepare Trading and Profit and Loss A/c for the year ended 31st March 2023 and a Balance Sheet as at that date:

| Particulars | ₹ | Particulars | ₹ |

| Life Insurance Premium (Self) | 500 | Capital | 40,000 |

| Opening Stock | 7,500 | Plant and Machinery | 12,500 |

| Returns Inward | 1,000 | Purchases | 36,000 |

| Furniture | 4,600 | Sundry Debtors | 10,500 |

| Freehold Property | 10,000 | Coal, Gas and Water | 1,000 |

| Carriage Inwards | 400 | Carriage Outwards | 100 |

| Advertising | 200 | Sales | 60,000 |

| Sundry Creditors | 4,850 | Discount (Dr.) | 400 |

| Returns Outwards | 500 | Rent for Premises Sublet | 500 |

| Commission (Cr.) | 600 | Trade Expenses | 8,650 |

| Lighting | 250 | Stationery | 2,000 |

| Loan from Bank | 5,000 | Interest Charged by Bank | 450 |

| Wages and Salaries | 7,500 | Cash | 2,900 |

| Input IGST | 5,000 |

Adjustments:-

(i) Stock on 31st March, 2023 was ₹ 10,000 and stationery unused at the end was ₹ 400.

(ii) Rent of Premises Sublet received in advance ₹ 100.

(iii) Provisoin for Doubtful Debts is to be created @ 10% on Debtors.

(iv) Provision for discount on Debtors is to be created @ 2%.

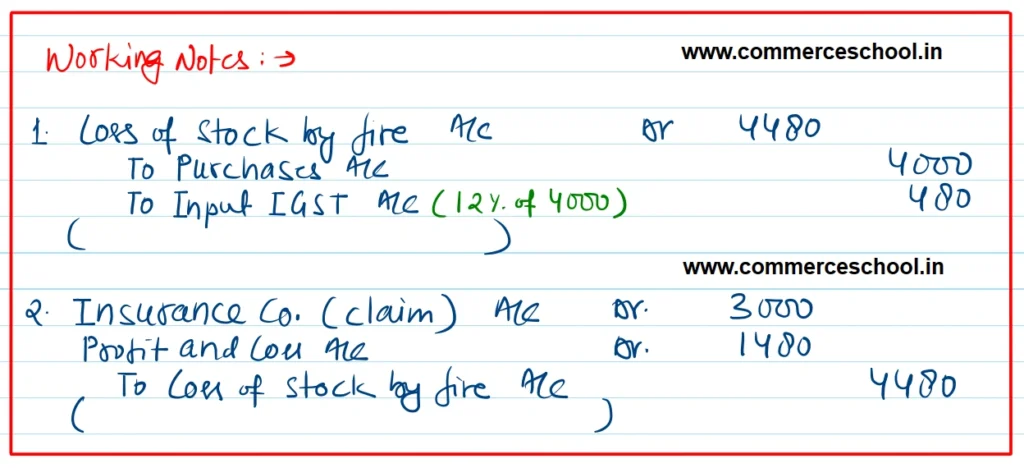

(v) Stock of the Value of ₹ 4,000 was destroyed by fire on 25th March, 2023. Stock was purchased paying IGST @ 12%. A Claim of ₹ 3,000 has been admitted by Insurance Co.

(vi) Bank Loan has been taken at 12% p.a. interest.

[Ans. G.P. ₹ 21,100; N.P. ₹ 7,581; B/S Total ₹ 57,181.]

Solution:-

Below is the list of all solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |