[ISC] Q 1 Solution Accounting of Goods and Services Tax (GST) TS Grewal (2022-23)

Are you looking for the solution of Question number 1 of Accounting of Goods and Services Tax (GST) of TS Grewal class 11 ISC Board 2022-23 Session?

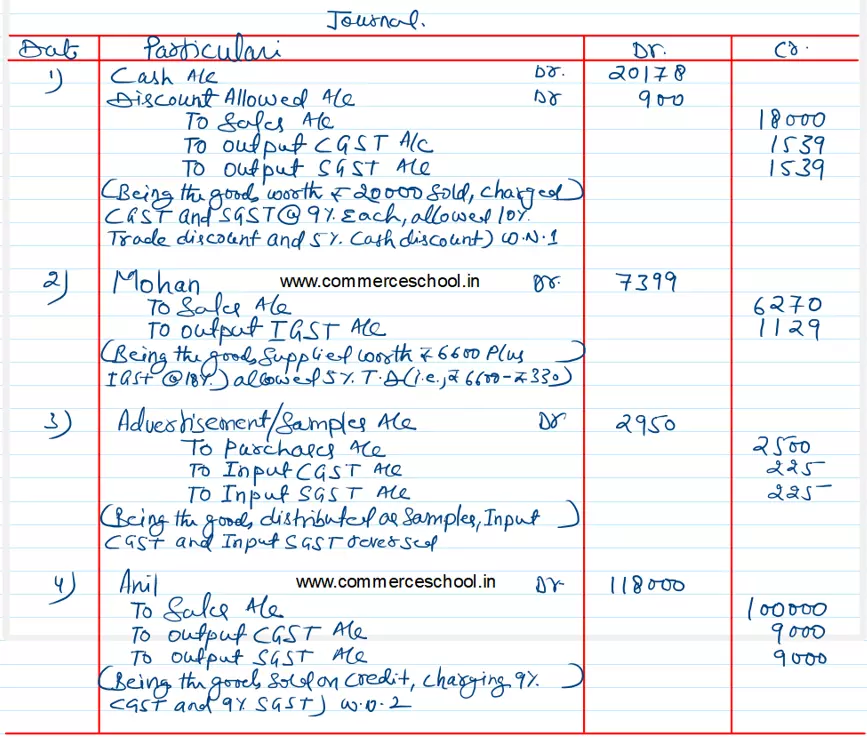

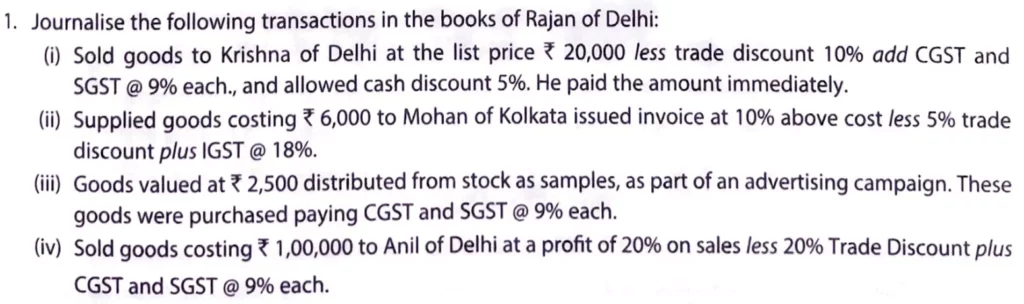

Journalise the following transactions in the books of Rajan of Delhi:

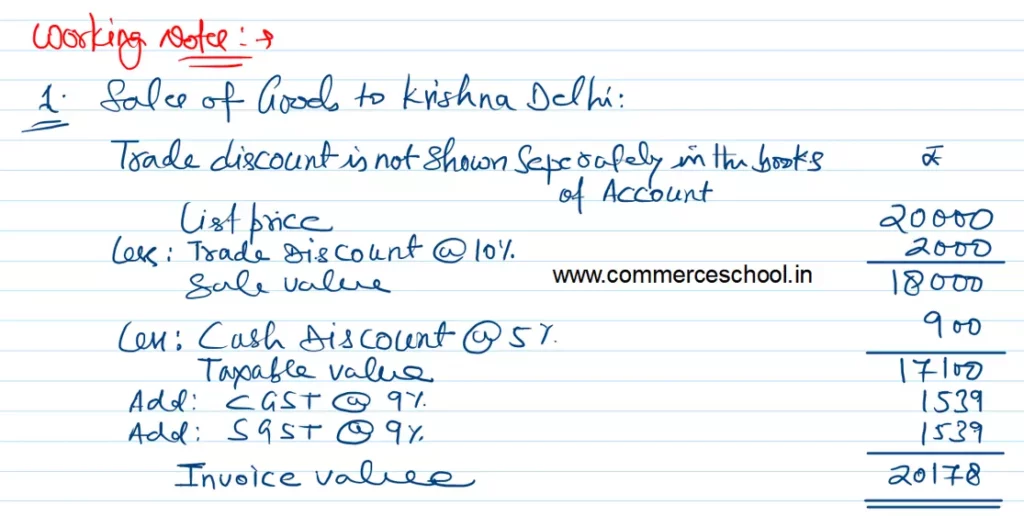

(i) Sold goods to Krishna of Delhi at the list price ₹ 20,000 less trade discount of 10% add CGST and SGST @ 9% each, and allowed cash discount 5%. He paid the amount immediately.

(ii) Supplied goods costing ₹ 6,000 to Mohan of Kolkata issued invoice at 10% above cost less 5% trade discount plus IGST @ 18%.

(iii) Goods valued at ₹ 2,500 distributed from stock as samples, as part of an advertising campaign. These goods were purchased paying CGST and SGST @ 9% each.

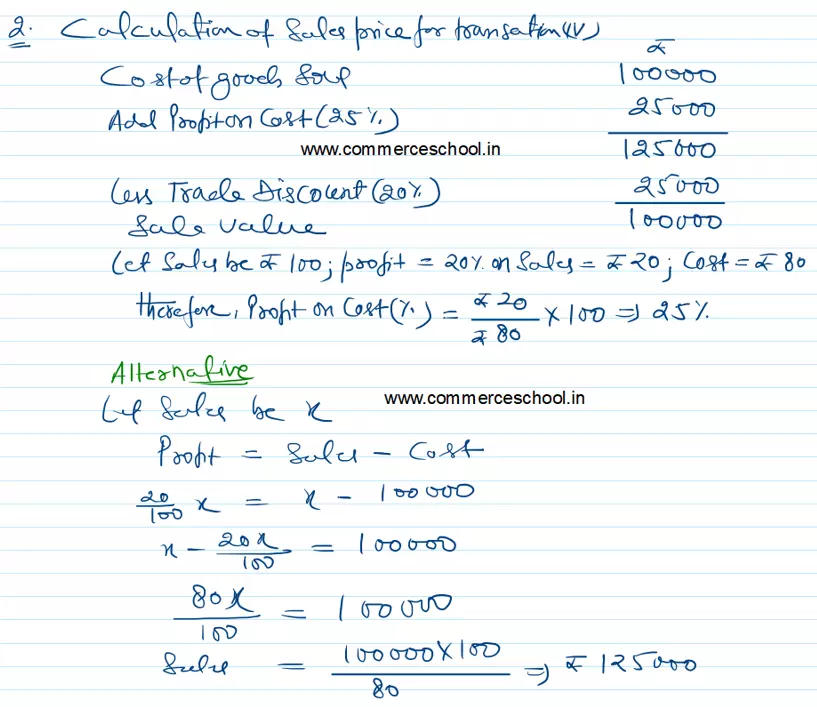

(iv) Sold goods costing ₹ 1,00,000 to Anil of Delhi at a profit of 20% on sales less 20% Trade Discount plus CGST and SGST @ 9% each.

Solution:-