[ISC] Q. 10 Dissolution of Partnership Firm Solution TS Grewal Book Class 12 (2023-24)

Solution to Question number 10 of the Dissolution of Partnership Firm Chapter of TS Grewal Book 2023-24 Edition for the ISC Board?

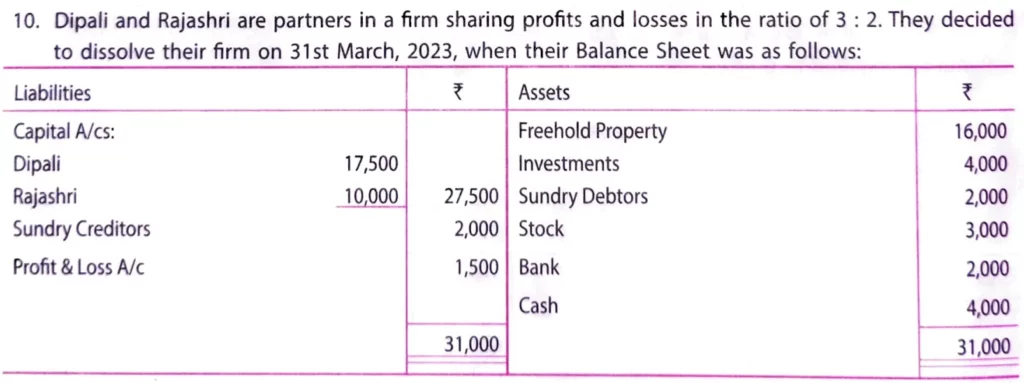

Dipali and Rajashri are partners in a firm sharing profits and losses in the ratio of 3 : 2. They decided to dissolve their firm on 31st March, 2023, when their Balance Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Capital A/cs: Dipali Rajashri Sundry Creditors Profit and Loss A/c | 17,500 10,000 2,000 1,500 | Freehold Property Investments Sundry Debtors Stock Bank Cash | 16,000 4,000 2,000 3,000 2,000 4,000 |

| 31,000 | 31,000 |

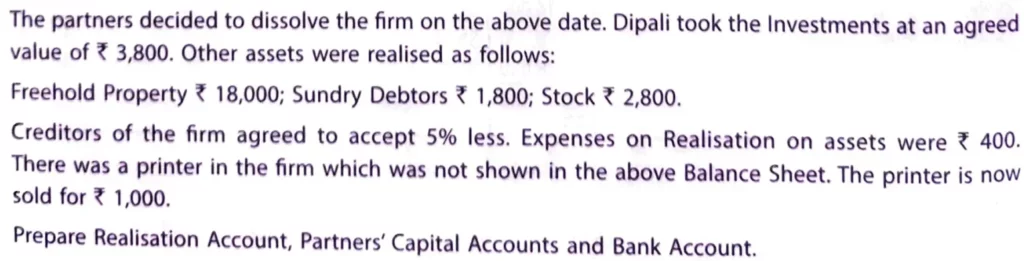

The partners decided to dissolve the firm on the above date. Dipali took the investments at an agreed value of ₹ 3,800. Other assets were realised as follows:

Freehold Property ₹ 18,000; Sundry Debtors ₹ 1,800; Stock ₹ 2,800.

Creditors of the firm agreed to accept 5% less. Expenses on Realisation on assets were ₹ 400. There was a printer in the firm which was not shown in the above Balance Sheet. The Printer is now sold for ₹ 1,000.

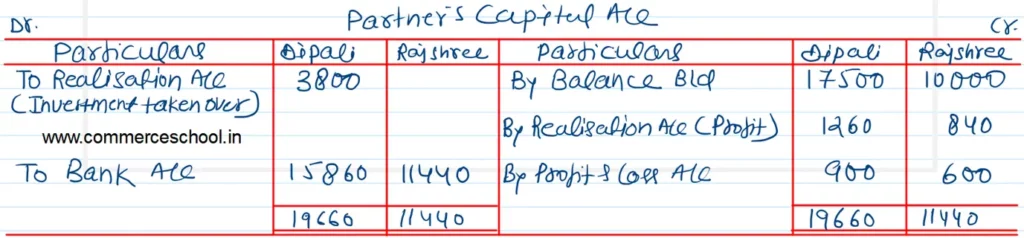

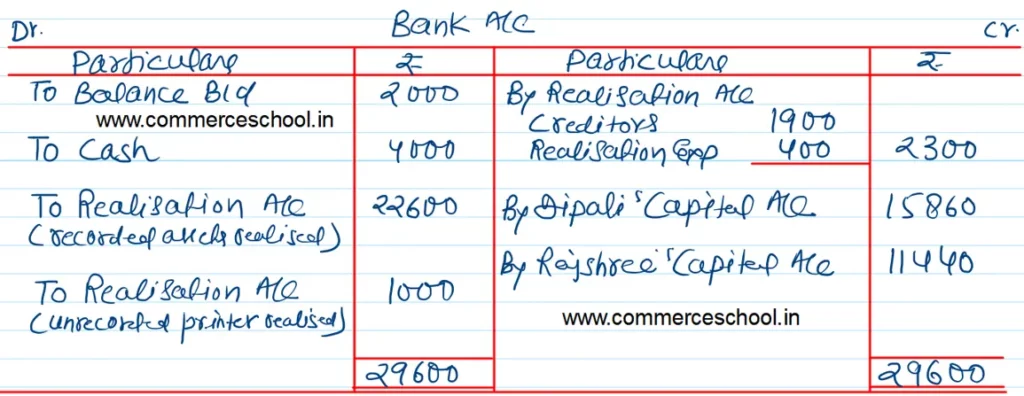

Prepare Realisation Account, Partner’s Capital Accounts and Bank Account.

Solution:-

Here is the list of solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |