[ISC] Q. 11 Death of Partner Solution TS Grewal Class 12 (2022-23)

Are you looking for the solution to Question number 11 of the Death of Partner Chapter of TS Grewal Book ISC Board 2022-23 Edition?

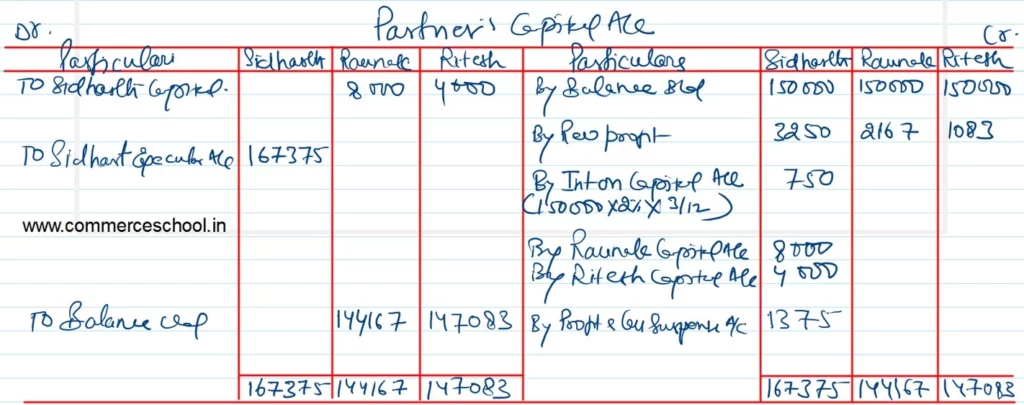

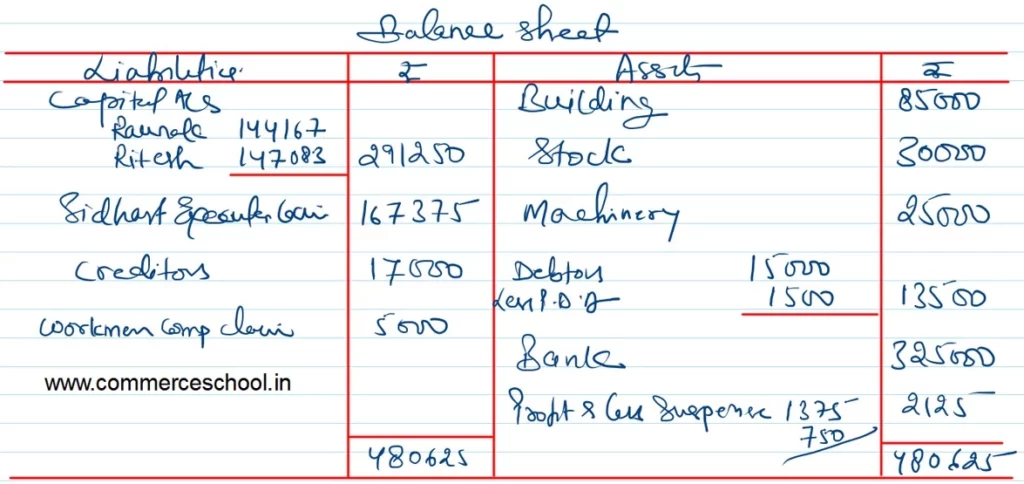

Sidharth, Raunak and Ritesh are partners sharing profits and losses in the ratio of 3 : 2 : 1 and their Balance sheet as at 31st March, 2022 stood as under:

| Liabilites | ₹ | Assets | ₹ |

| Sidharth’s Capital Raunak’s Capital Ritesh’s Capital Creditors | 1,50,000 1,50,000 1,50,000 17,000 | Building Machinery Stock Debtors Bank | 70,000 25,000 32,000 15,000 3,25,000 |

| 4,67,000 | 4,67,000 |

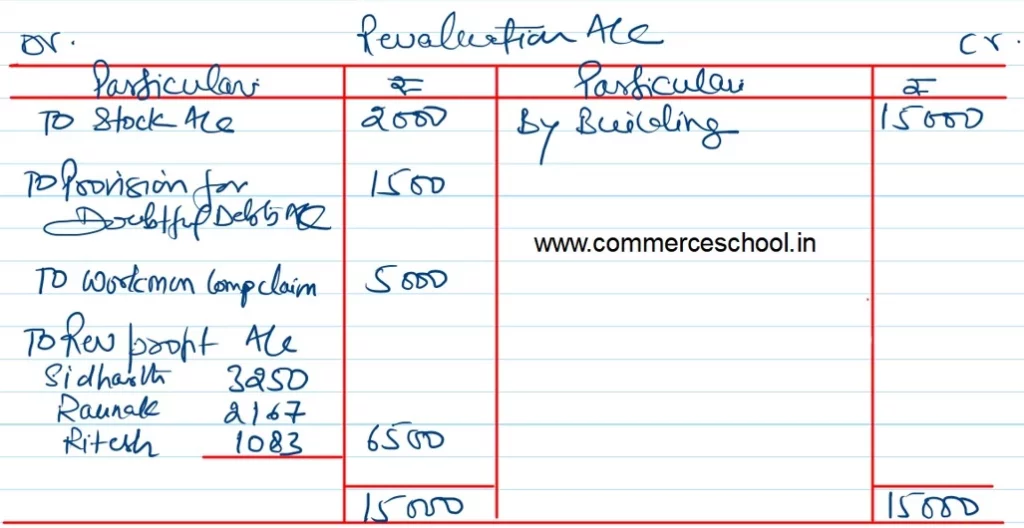

Sidharth died on 1st July, 2022 and the following decisions were taken by the surviving partners. According to the Partnership Deed, his executors were entitled to:

(i) The deceased partner’s capital as appearing in the last Balance Sheet and interest thereon @ 2% p.a. up to the date of death.

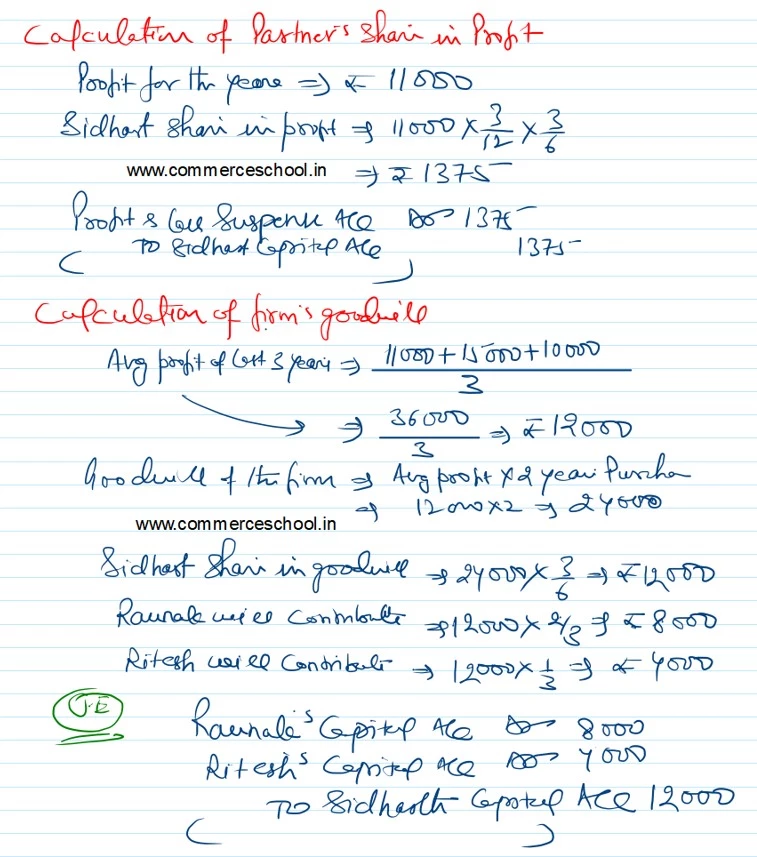

(ii) His share of profit for the period he was alive based on the profit for the year ended 31st March, 2022.

(iii) Goodwill of the firm was valued at 3 year’s purchase of the average profit of the last years.

The profits of the previous years were:

31st March 2022 – ₹ 11,000;

31st March 2021 – ₹ 15,000;

31st March 2020 – ₹ 10,000

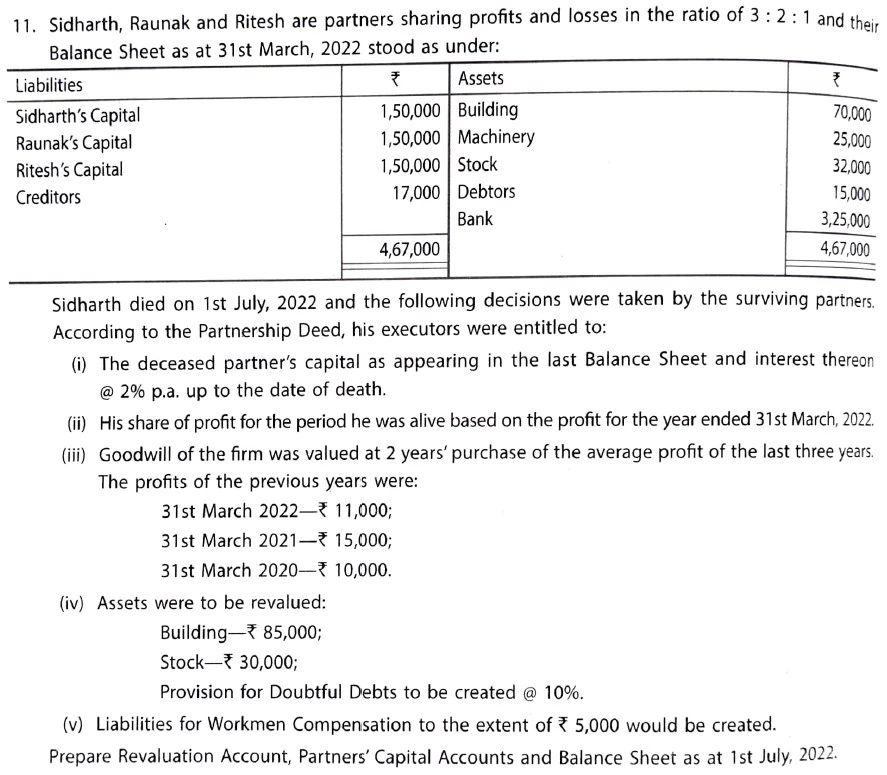

(iv) Assets were to be revalued:

Building – ₹ 85,000;

Stock – ₹ 30,000;

Provision for Doubtful Debts to be created @ 10%.

(v) Liabilities for Workmen Compensation to the extent of ₹ 5,000 would be created.

Prepare Revaluation Account, Partner’s Capital Accounts and Balance Sheet as at 1st July, 2022.

Solution:-

Here is the list of Solutions