[ISC] Q 11 Solution Final Accounts with adjustments TS Grewal Class 11 (2023-24)

Solution of Question number 11 solution of Final Accounts with adjustments TS Grewal class 11 Accountancy ISC Board 2023-24.

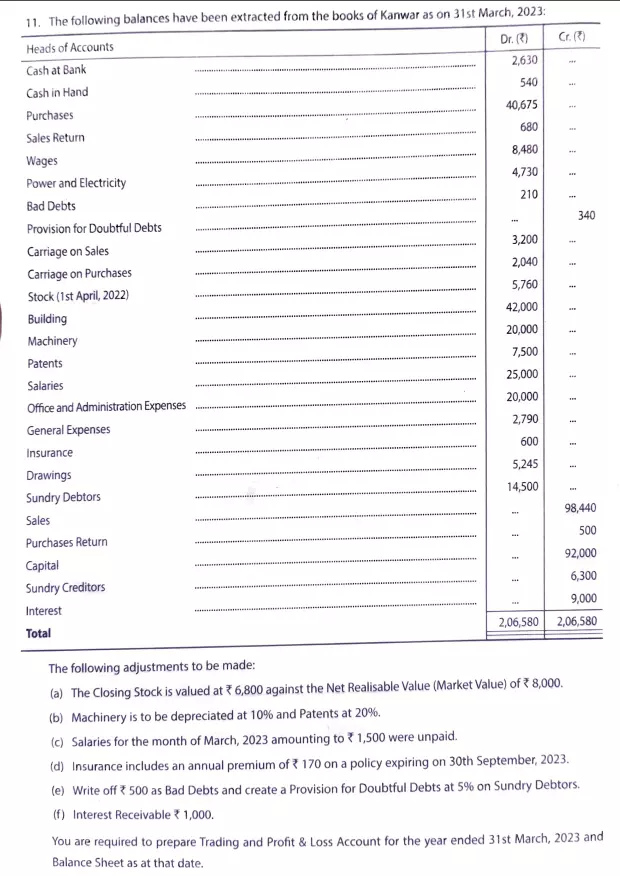

The following balances have been extracted from the books of Kanwar as on 31st March, 2023:

| Heads of Accounts | Dr. (₹) | Cr. (₹) |

| Cash at Bank Cash in Hand Purchases Sales Return Wages Power and Electricity Bad Debts Provision for Doubtful Debts Carriage on Sales Carriage on Purchases Stock (1st April, 2022) Building Machinery Patents Salaries Office and Administrative Expenses General Expenses Insurance Drawings Sundry Debtors Sales Purchases Return Capital Sundry Creditors Interest | 2,630 540 40,675 680 8,480 4,730 210 – 3,200 2,040 5,760 42,000 20,000 7,500 25,000 20,000 2,790 600 5,245 14,500 – – – – – | – – – – – – – 430 – – – – – – – – – – – – 98,440 500 92,000 6,300 9,000 |

| Total | 2,06,580 | 2,06,580 |

The following adjustments to be made:

(a) The Closing Stock is valued at ₹ 6,800 against the Net Realisable Value (Market Value) of ₹ 8,000.

(b) Machinery is to be depreciated at 10% and Patents at 20%.

(c) Salaries for the month of March, 2023 amounting to ₹ 1,500 were unpaid.

(d) Write off ₹ 500 as Bad Debts and create a Provision for Doubtful Debts at 5% on Sundry Debtors.

(f) Interest Receivable ₹ 1,000.

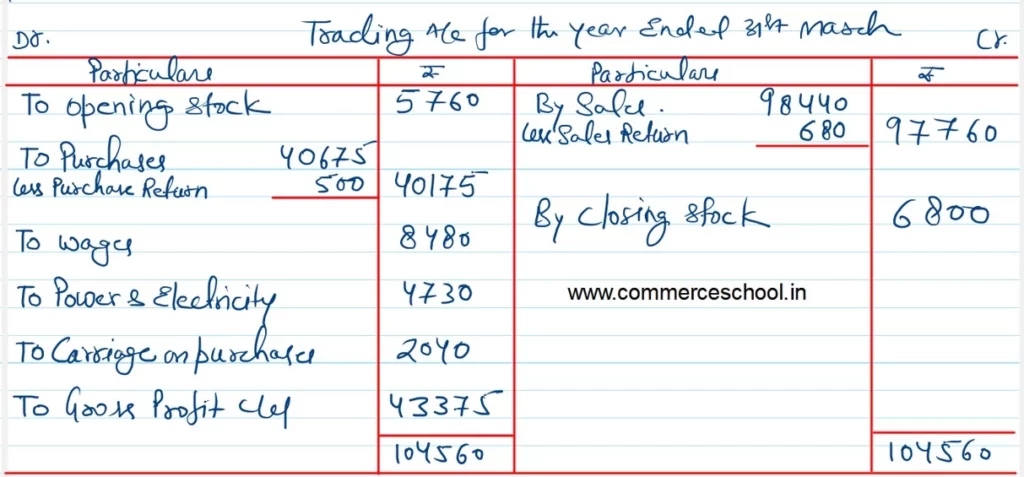

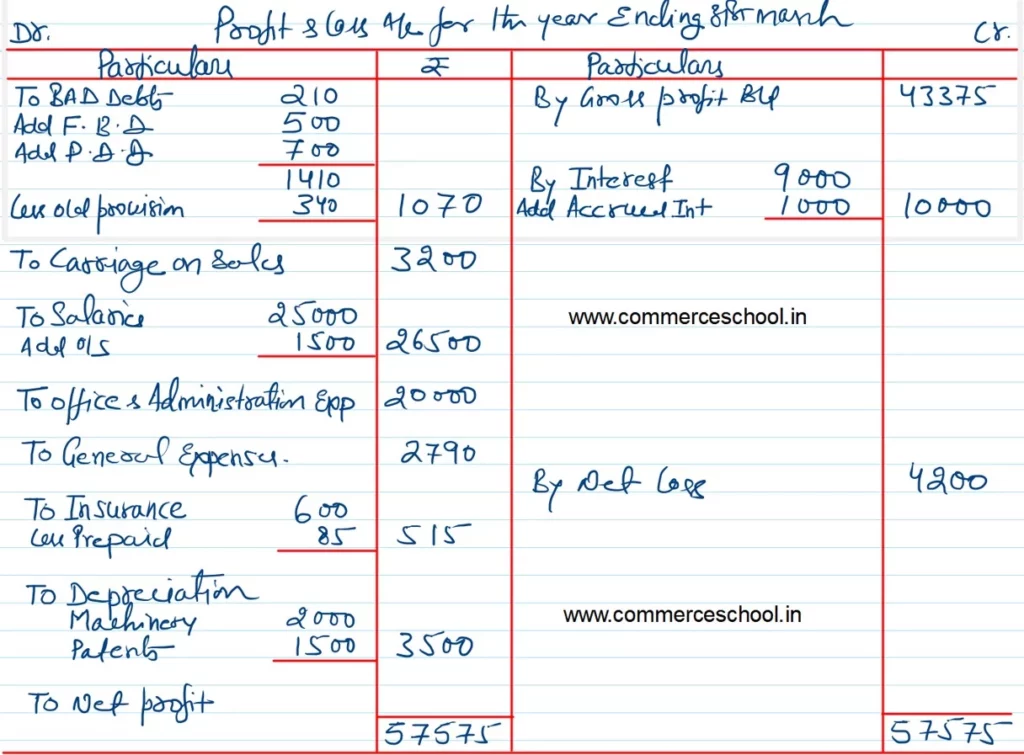

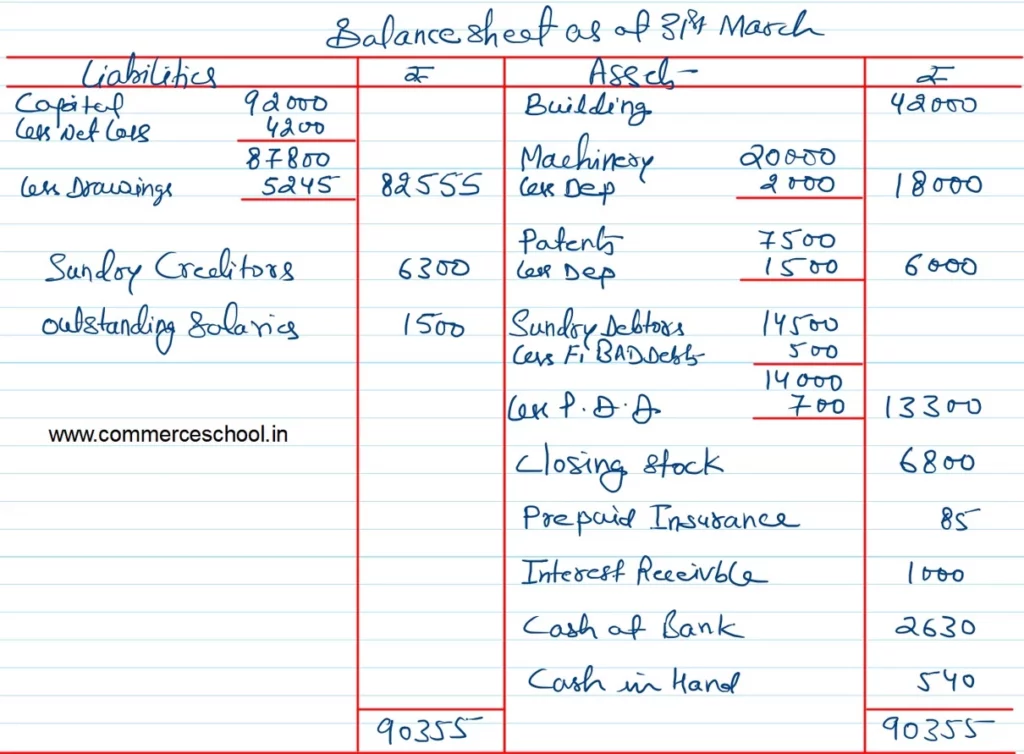

You are required to prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and Balance Sheet as at that date.

Solution:-

Here is the list of all solutions of Practical Problems below

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |