[ISC] Q. 13 Death of Partner Solution TS Grewal Class 12 (2023-24)

Solution to Question number 13 of the Death of Partner Chapter of TS Grewal Book ISC Board 2023-24 Edition?

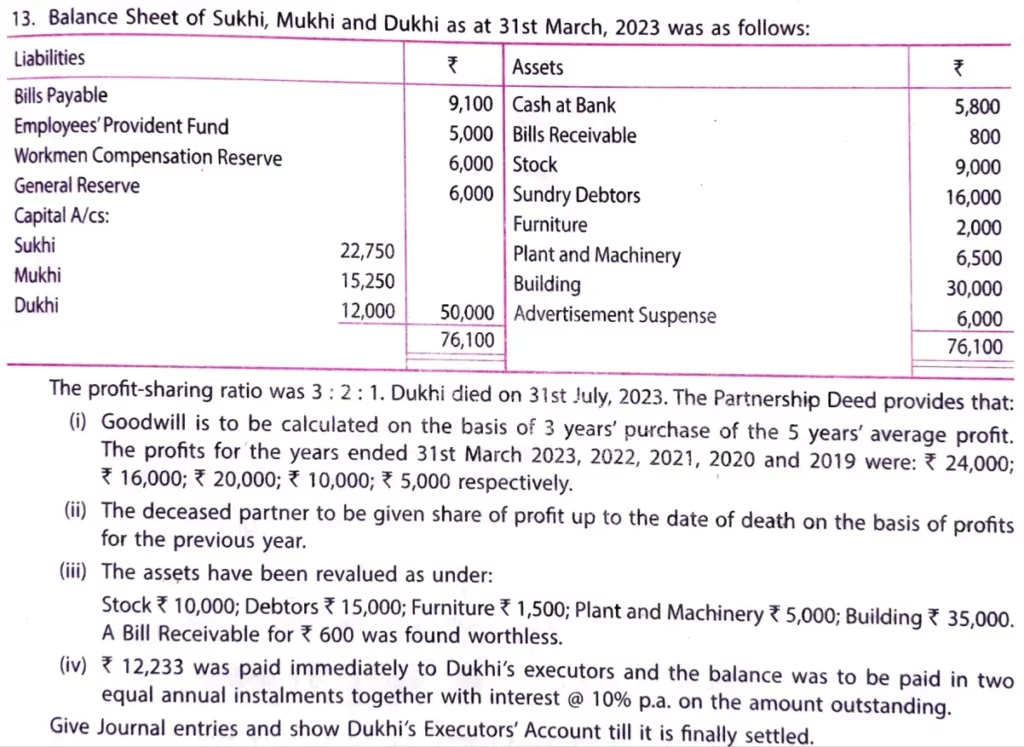

Balance Sheet of Sukhi, Mukhi and Dukhi as at 31st March, 2023 was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Bills Payable Employees’ Provident Fund Workmen Compensation Reserve General Reserve Capital A/cs: Sukhi Mukhi Dukhi | 9,100 5,000 6,000 6,000 22,750 15,250 12,000 | Cash at Bank Bills Receivable Stock Sundry Debtors Furniture Plant and Machinery Building Advertisement Suspense | 5,800 800 9,000 16,000 2,000 6,500 30,000 6,000 |

| 76,100 | 76,100 |

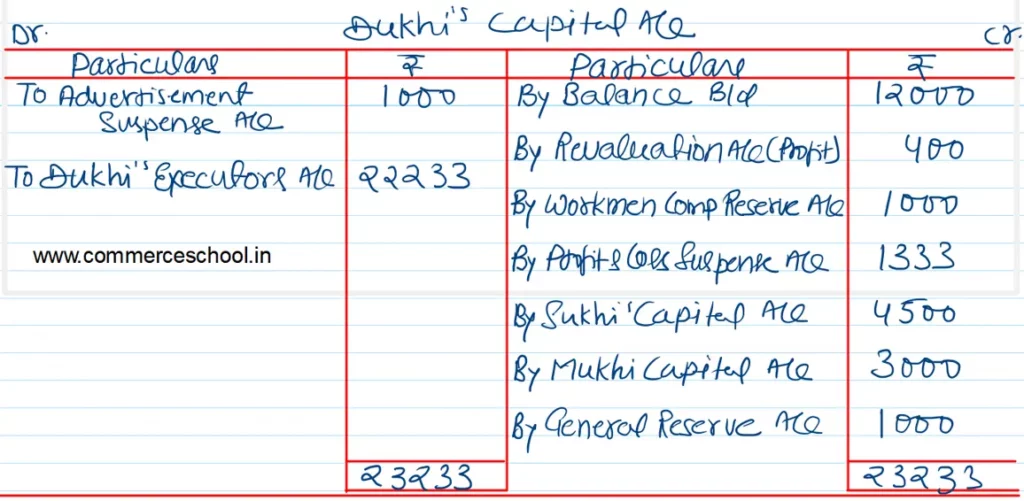

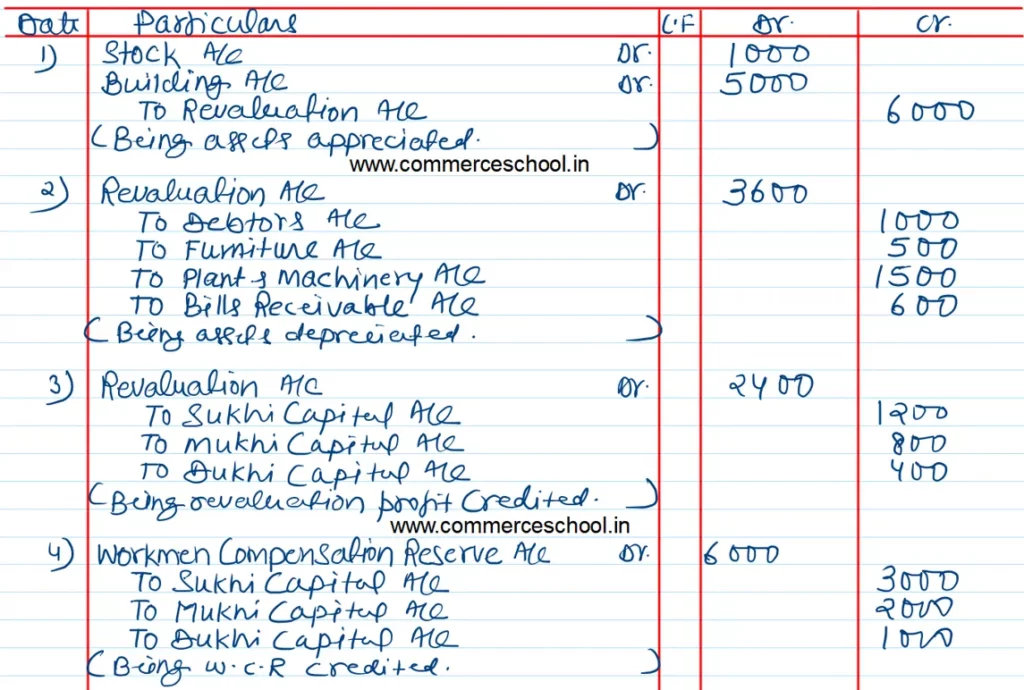

The profit-sharing ratio was 3 : 2 : 1. Dukhi died on 31st July, 2023. The partnership Deed provides that:

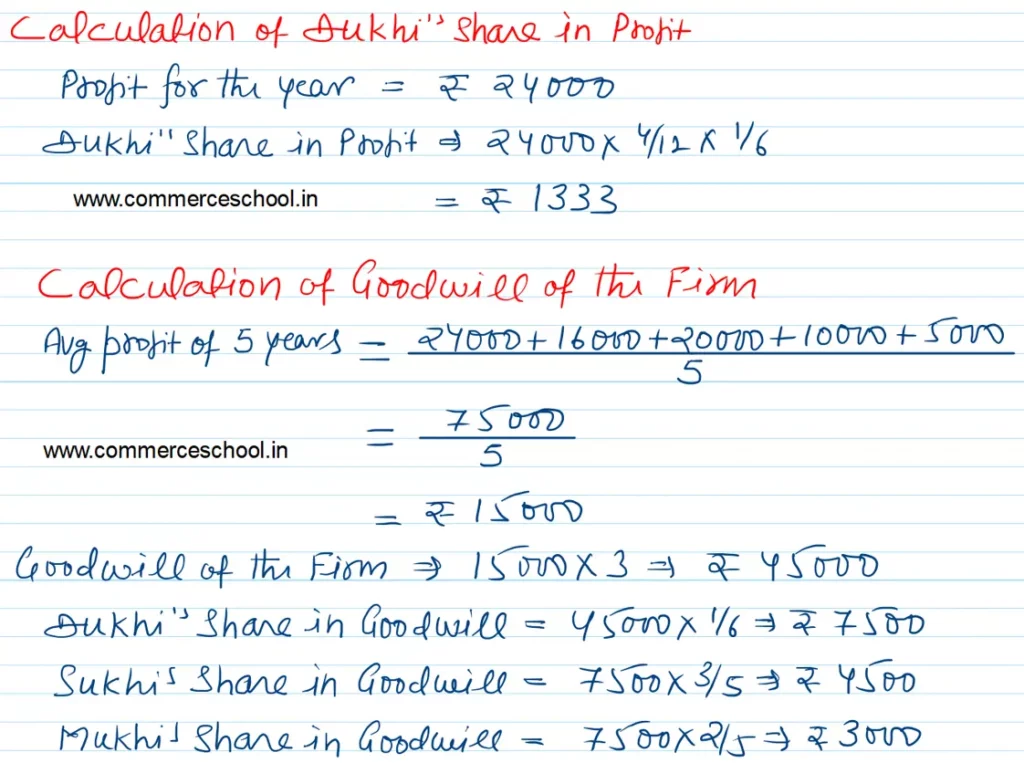

(i) Goodwill is to be calculated on the basis of 3 years’ purchase of the 5 years’ average profit. The profits for the years ended 31st March 2023, 2022, 2021, 2020 and 2019 were: ₹ 24,000; ₹ 16,000; ₹ 20,000; ₹ 10,000; ₹ 5,000 respectively.

(ii) The deceased partner to be given share of profit up to the date of death on the basis of profits for the previous year.

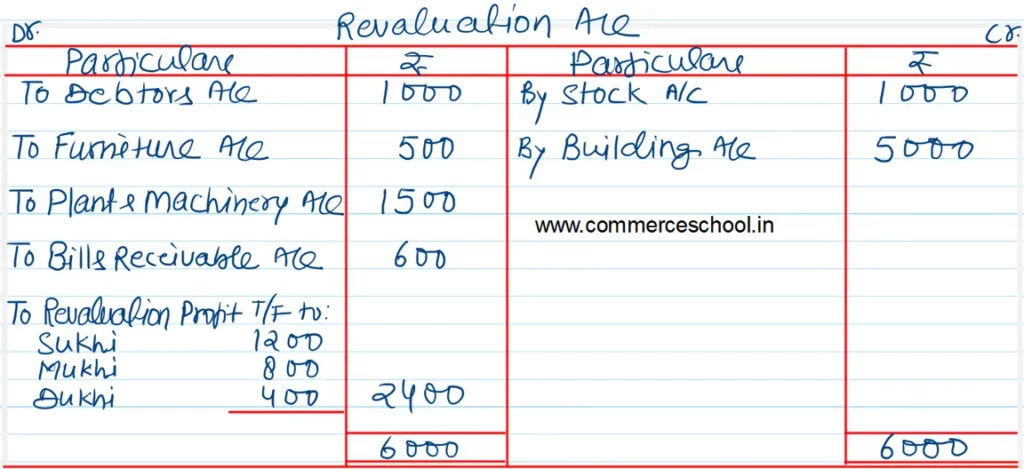

(iii) The assets have been revalued as under:

Stock ₹ 10,000; Debtors ₹ 15,000; Furniture ₹ 1,500; Plant and Machinery ₹ 5,000; Building ₹ 35,000. A Bill Receivable for ₹ 600 was found worthless.

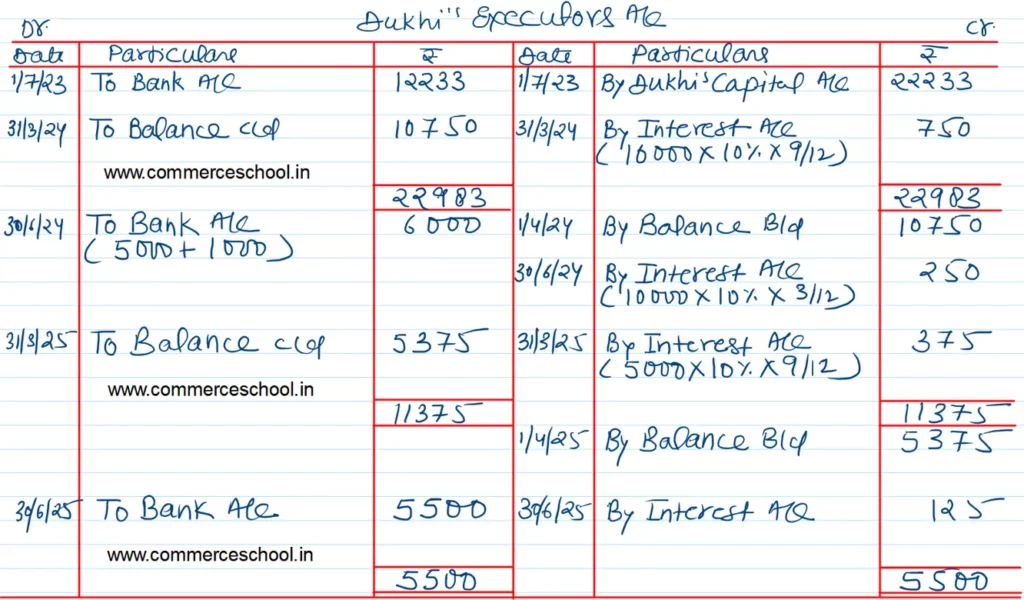

(iv) ₹ 12,233 was paid immediately to Dukhi’s executors and the balance was to be paid in two equal annual instalments together with interest @ 10% p.a. on the amount outstanding.

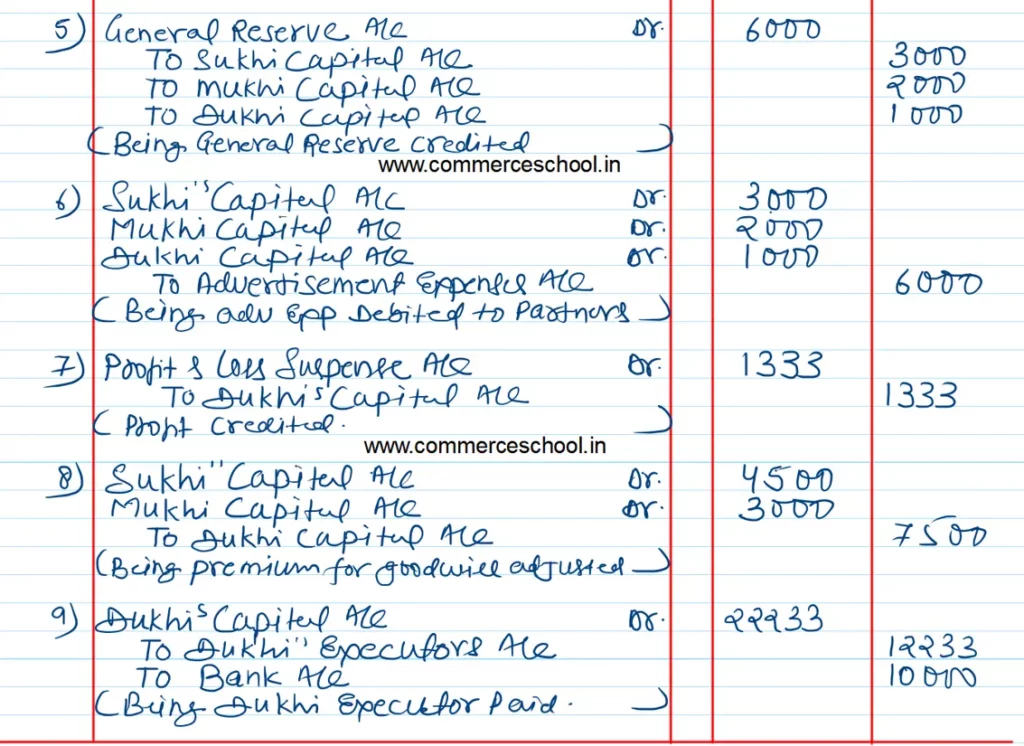

Give Journal entries and show Dukhi’s Executors Account till it is finally settled.

Solution:-