[ISC] Q. 13 Dissolution of Partnership Firm Solution TS Grewal Book Class 12 (2023-24)

Solution to Question number 13 of the Dissolution of Partnership Firm Chapter of TS Grewal Book 2023-24 Edition for the ISC Board?

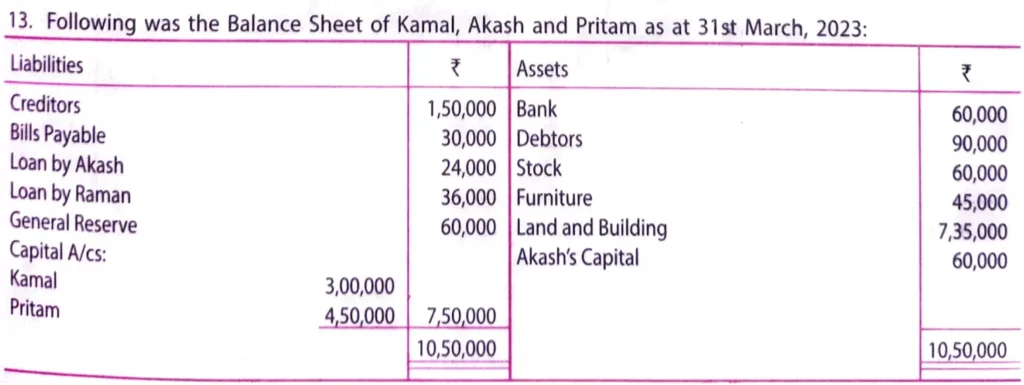

Following was the Balance Sheet of Kamal, Akash and Pritam as at 31st March, 2023:

| Liabilities | ₹ | Assets | ₹ |

| Creditors Bills Payable Loan by Akash Loan by Raman General Reserve Capital A/cs: Kamal Pritam | 1,50,000 30,000 24,000 36,000 60,000 3,00,000 4,50,000 | Bank Debtors Stock Furniture Land and Building Akash’s Capital | 60,000 90,000 60,000 45,000 7,35,000 60,000 |

| 10,50,000 | 10,50,000 |

The firm was dissolved on the above date on the following terms:

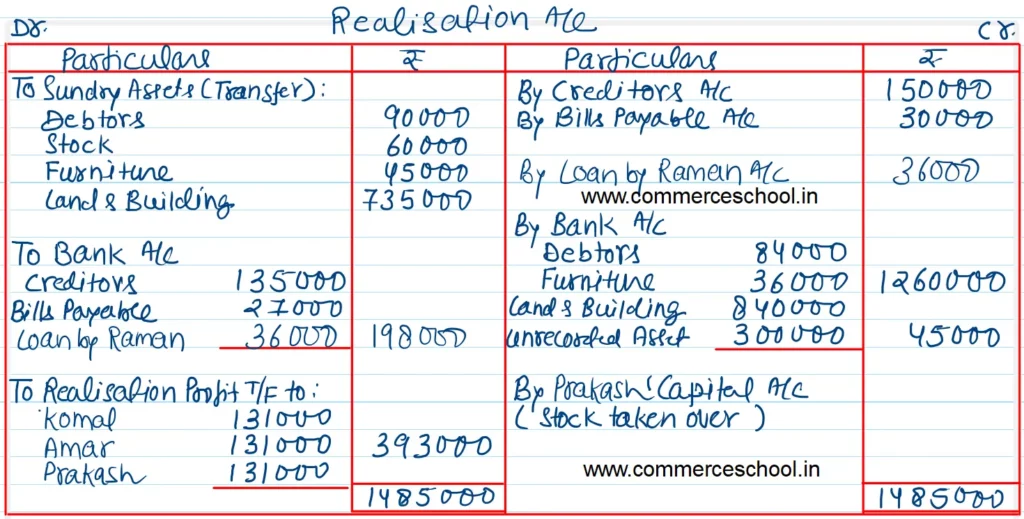

(i) Debtors realised ₹ 84,000; Creditors and Bills Payable were paid at a discount of 10%.

(ii) Stock was taken by Pritam for ₹ 45,000 and Furniture was sold to Ramesh by Cheque 20% less than its book value.

(iii) Land and Building were sold for ₹ 8,40,000.

(iv) Firm had an unrecorded asset which realised ₹ 3,00,000.

(v) Kamal carried out dissolution. He was to bear the realisation expenses. He paid realisation expenses of ₹ 5,000.

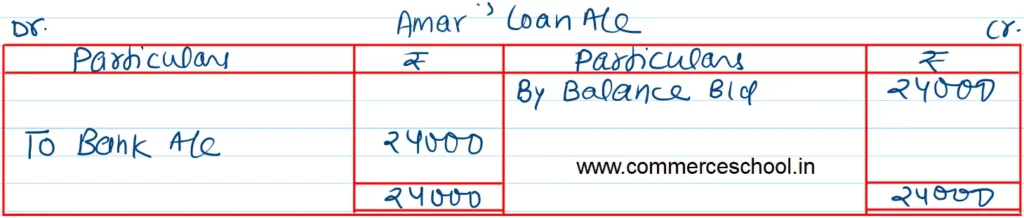

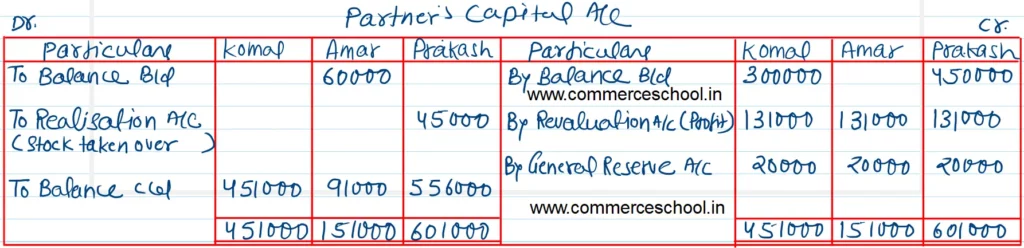

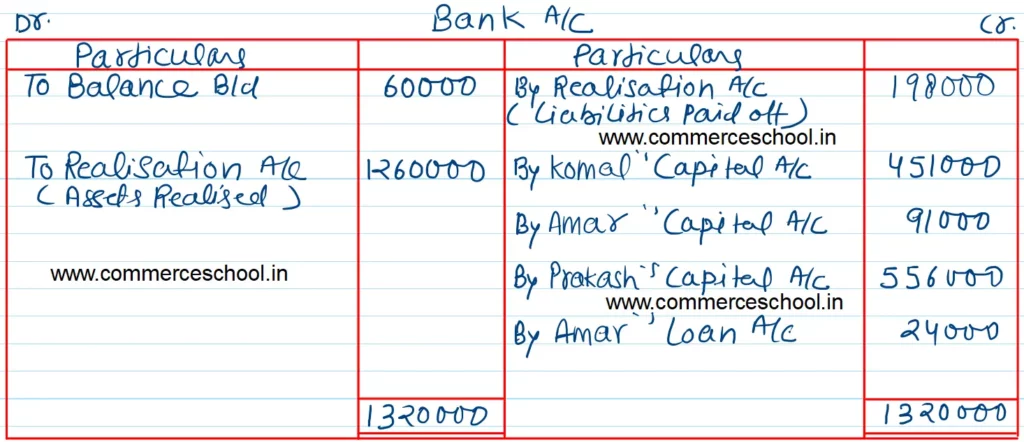

Prepare Realisation Account, Capital Accounts of Kamal, Akash and Pritam and Bank Account.

Solution:-

Here is the list of solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |