[ISC] Q. 14 Dissolution of Partnership Firm Solution TS Grewal Book Class 12 (2023-24)

Solution to Question number 14 of the Dissolution of Partnership Firm Chapter of TS Grewal Book 2023-24 Edition for the ISC Board?

Sunil, Pawan and Manish were equal partners. On 31st March, 2023, their Balance Sheet stood as follows:

| Liabilities | ₹ | Assets | ₹ |

| Creditors Reserve Sunil’s Capital A/c Pawan Capital A/c Manish’s Capital A/c | 50,400 12,000 30,000 25,000 15,000 | Cash Stock Debtors Investments Furniture Building | 3,700 20,100 62,600 16,000 6,500 23,500 |

| 1,32,400 | 1,32,400 |

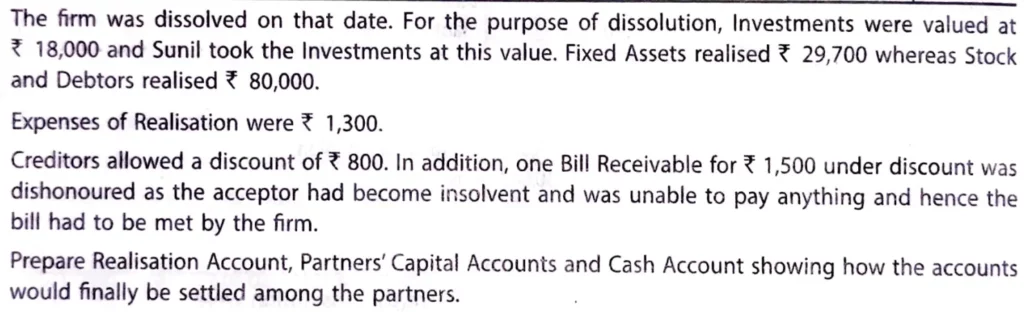

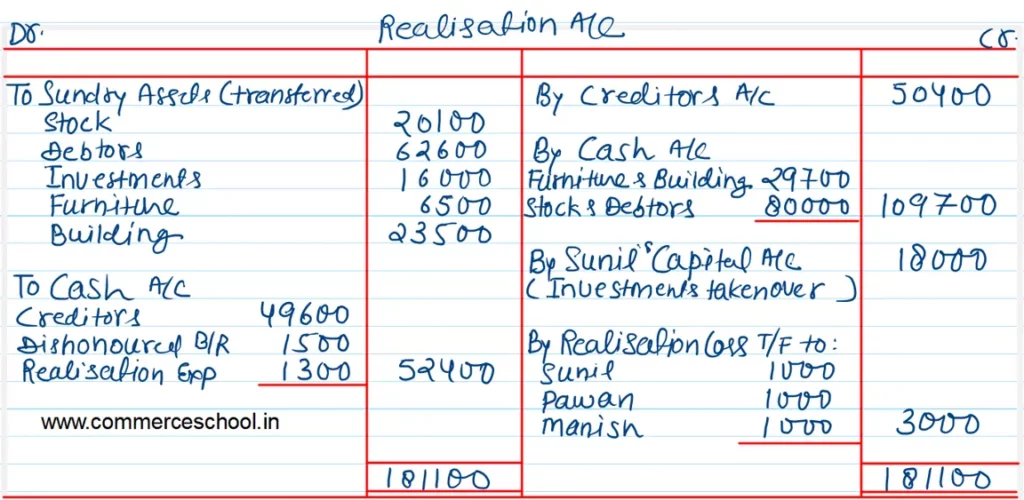

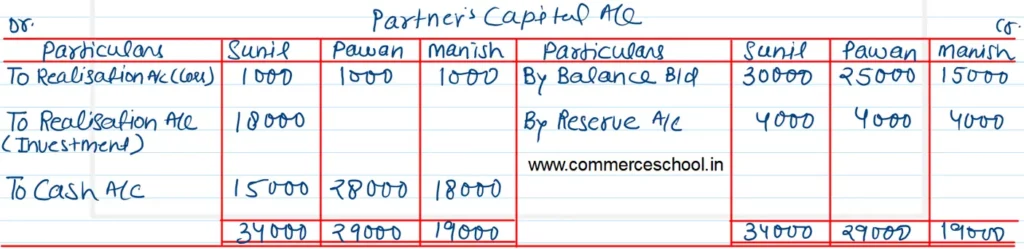

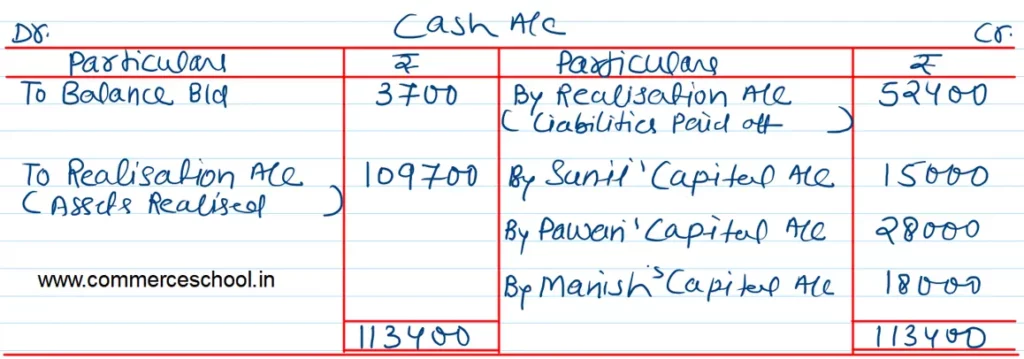

The firm was dissolved on that date. For the purpose of dissolution, investments were value at ₹ 18,000 and Sunil took the investments at this value, Fixed Assets realised ₹ 29,700 whereas Stock and Debtors realised ₹ 80,000.

Expenses of Realisation were ₹ 1,300.

Creditors allowed a discount of ₹ 800. In addition, one Bill Receivable for ₹ 1,500 under discount was dishonoured as the acceptor had become insolvent and was unable to pay anything and hence the bill had to be met by the firm.

Prepare Realisation Account, Partner’s Capital Accounts and Cash Account showing how the accounts would finally be settled among the partners.

Solution:-

Here is the list of solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |