[ISC] Q. 14 Dissolution of Partnership Firm Solution TS Grewal Class 12 (2024-25)

Solution to Question number 14 of the Dissolution of Partnership Firm Chapter of TS Grewal Book 2024-25 Edition for the ISC Board.

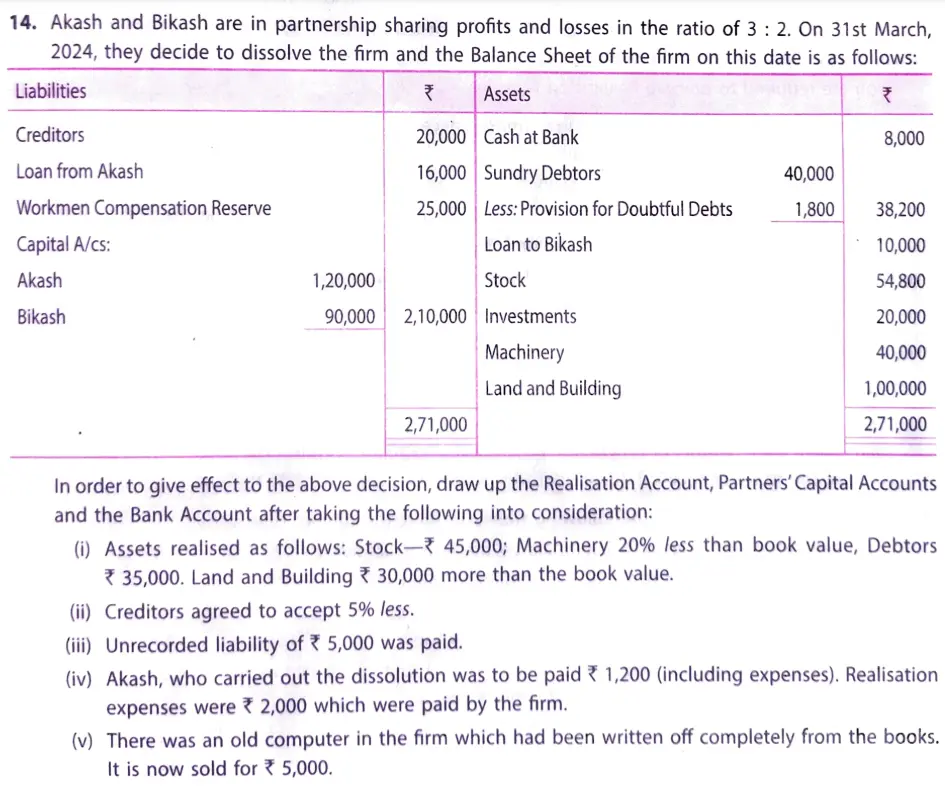

Akash and Bikash are in partnership sharing profits and losses in the ratio of 3 : 2. On 31st March, 2024, they decide to dissolve the firm and the Balance Sheet of the firm on this date is as follows:

| Liabilities | ₹ | Assets | ₹ | |

| Creditors Loan to Akash Workmen Compensation Reserve Capital A/cs: Akash Bikash | 20,000 16,000 25,000 1,20,000 90,000 | Cash at Bank Sundry Debtors Less: Provision for Doubtful Debts Loan to Bikash Stock Investments Machinery Land and Building | 40,000 1,800 | 8,000 38,200 10,000 54,800 20,000 40,000 1,00,000 |

| 2,71,000 | 2,71,000 |

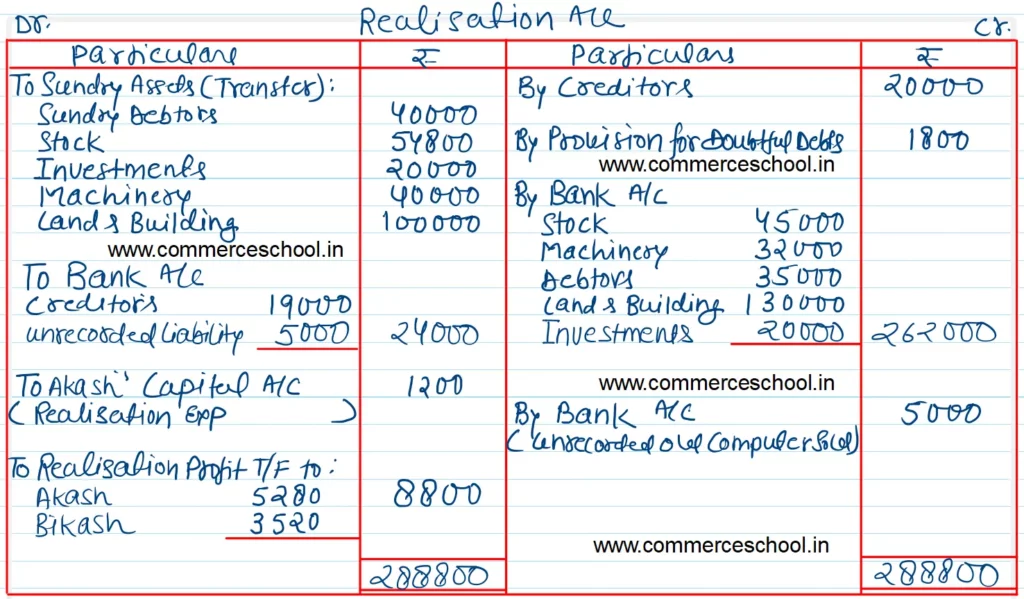

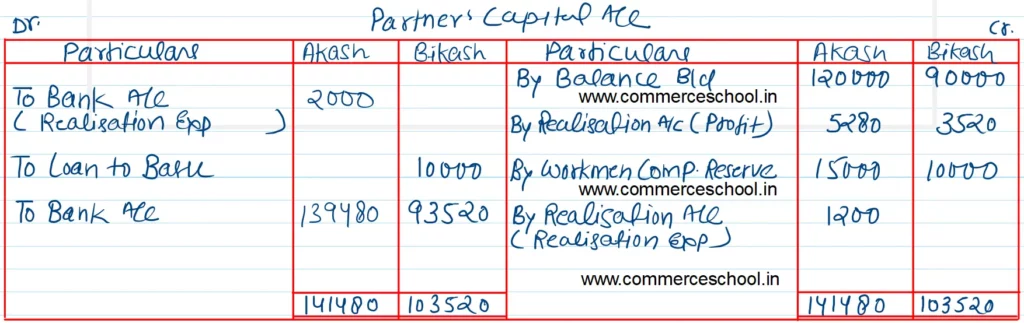

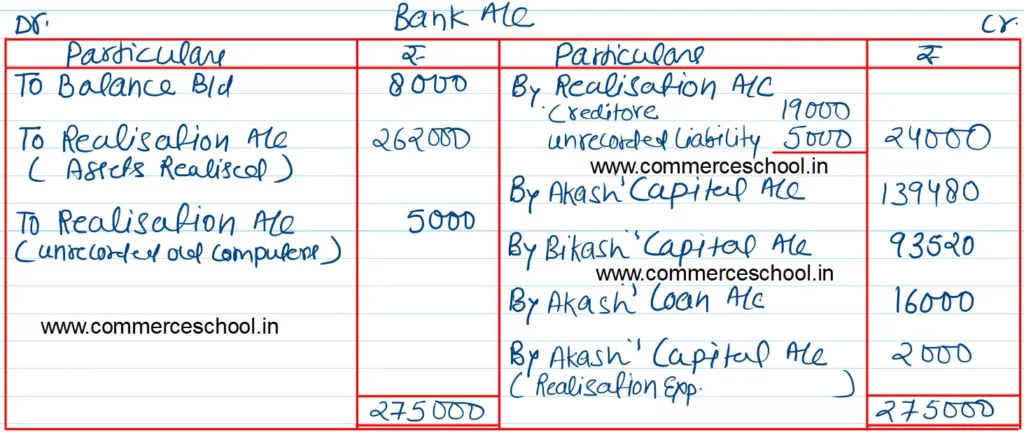

In order to give effect to the above decision, draw up the Realisation Account, Partner’s Capital Accounts and the Bank Account after taking the following into consideration:

(i) Assets realised as follows: Stock – ₹ 45,000; Machinery 20% less than book value, Debtors ₹ 35,000. Land and Building ₹ 30,000 more than the book value.

(ii) Creditors agreed to accept 5% less.

(iii) Unrecorded liability of ₹ 5,000 was paid.

(iv) Akash, who carried out the dissolution was to be paid ₹ 1,200 (including expenses). Realisation expenses were ₹ 2,000 which were paid by the firm.

(v) There was an old computer in the firm which had been written off completely from the books. It is now sold for ₹ 5,000.

Solution:-