[ISC] Q. 16 Dissolution of Partnership Firm Solution TS Grewal Book Class 12 (2023-24)

Solution to Question number 16 of the Dissolution of Partnership Firm Chapter of TS Grewal Book 2023-24 Edition for the ISC Board?

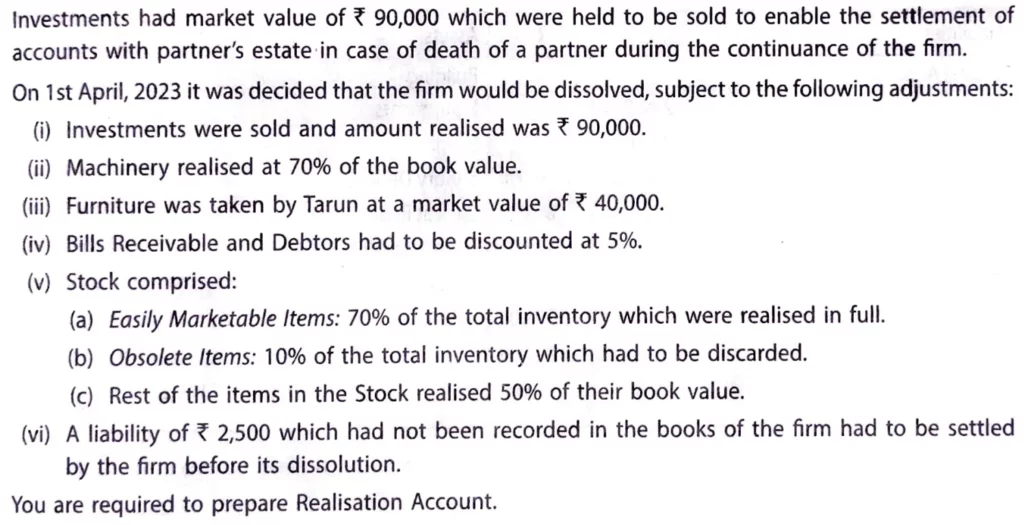

Harsh, Swarn and Tarun were in a partnership sharing profits and losses equally. Their Balance Sheet as at 31st March, 2022 was as under:

| Liabilities | ₹ | Assets | ₹ |

| Capital A/cs: Harsh Swarn Tarun Creditors Bills Payable | 1,00,000 1,00,000 1,00,000 90,000 10,000 | Machinery Furniture Debtors Investments Bills Receivable Stock Cash at Bank | 80,000 50,000 20,000 60,000 10,000 1,00,000 80,000 |

| 4,00,000 | 4,00,000 |

Investments had market value of ₹ 90,000 which were held to be sold to enable the settlement of accounts with partner’s estate in case of death of a partner the continuance of the firm.

On 1st April, 2022 It was decided that the firm would be dissolved, subject to the following adjustments:

(i) Investments were sold and amount realised was ₹ 90,000.

(ii) Machinery realised at 70% of the book value.

(iii) Furniture was taken by Tarun at a market value of ₹ 40,000.

(iv) Bills Receivable and Debtors had to be discounted at 5%.

(v) Stock comprised:

(a) Easily Marketable Items: 70% of the total inventory which were realised in full.

(b) Obsolete Items: 10% of the total inventory which had to be discarded.

(c) Rest of the items in the Stock realised 50% of their book value.

(vi) A liability of ₹ 2,500 which had not been recorded in the books of the firm had to be settled by the firm before its dissolution.

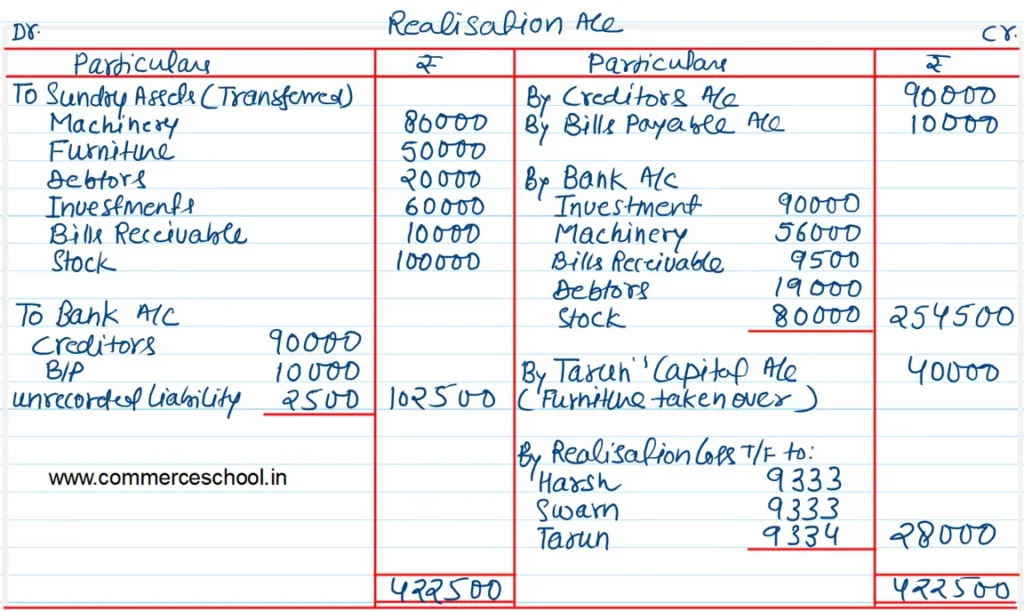

You are required to prepare Realisation Account.

Solution:-

Here is the list of solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |