[ISC] Q. 17 Death of Partner Solution TS Grewal Class 12 (2023-24)

Solution to Question number 17 of the Death of Partner Chapter of TS Grewal Book ISC Board 2023-24 Edition?

Munish, Bishan and Chahat were partners sharing profits in the ratio of 3 : 2 : 1. Balance Sheet of the firm is given below as at 31st March, 2023:

| Liabilities | ₹ | Assets | ₹ |

| Bills Payable Creditors Reserve Loans Capital A/cs: Munish Bishan Chahat | 2,000 5,000 6,000 7,100 22,750 15,250 12,000 | Cash at Bank Bills Receivable Stock Debtors Furniture Plant and Machinery Building | 5,800 800 9,000 16,000 2,000 6,500 30,000 |

| 70,100 | 70,100 |

Chahat died on 31st July, 2023. Partnership Deed provides that:

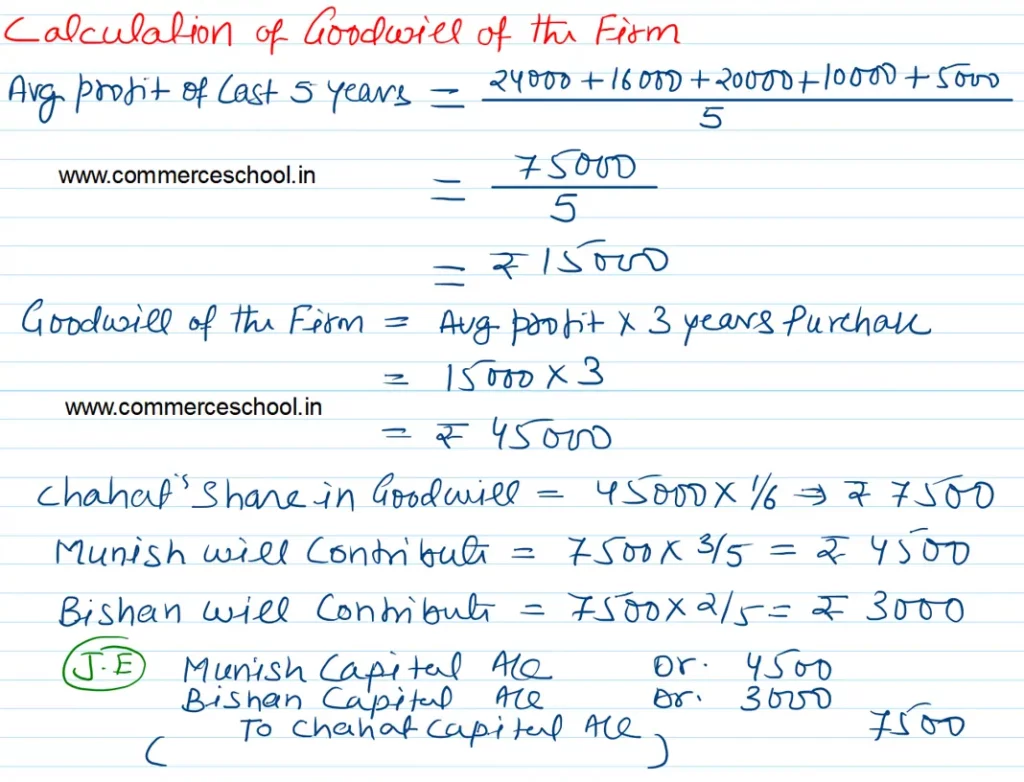

(i) Share of deceased partner’s Goodwill is to be valued on the basis of 3 year’s purchsae of last 5 years’ average profits.

Profits for the last 5 years (ended 31st March) were:

2023 – ₹ 24,000; 2022 – ₹ 16,000; 2021 – ₹ 20,000; 2020 – ₹ 10,000 and 2019 – ₹ 5,000.

(ii) Deceased partner to be given share of profits up to the date of death on the basis of profits for previous year.

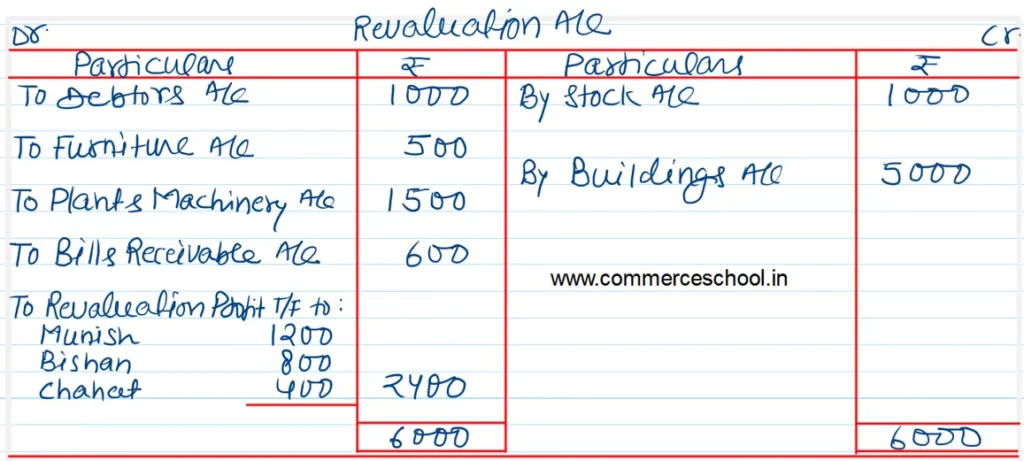

(iii) Assets have been revalued as: Stock ₹ 10,000; Debtors ₹ 15,000; Furniture ₹ 1,500; Plant and Machinery ₹ 5,000; Building ₹ 35,000. A Bill for ₹ 600 was valueless.

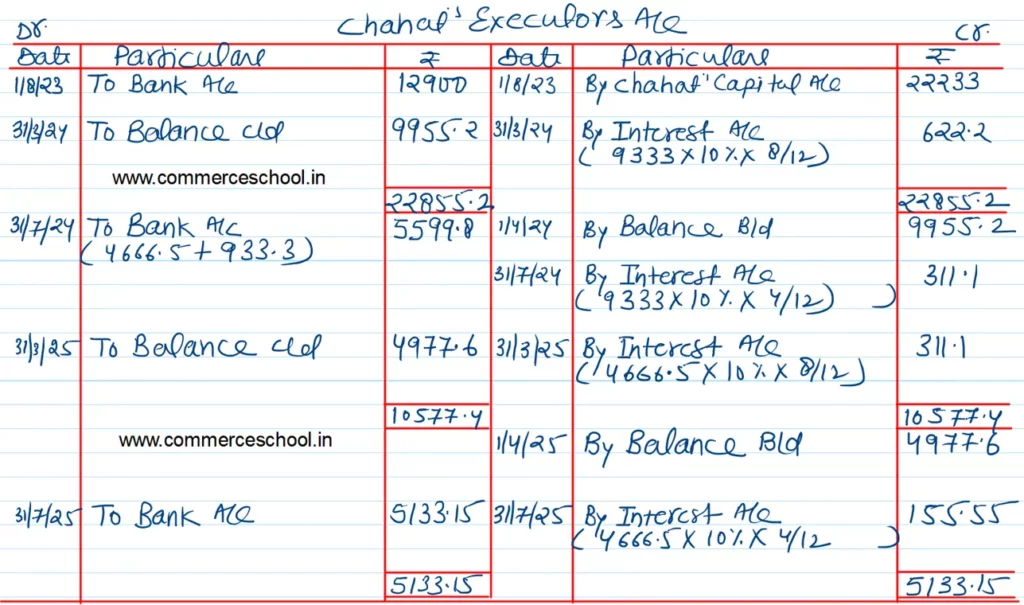

(iv) An amount of ₹ 12,900 was paid immediately to Chahat’s executors and the balance to be paid in two equal annual instalments together with interest @ 10% p.a. on the amount outstanding.

Give Journal entries and show Chahat’s Executors’ Account.

Solution:-